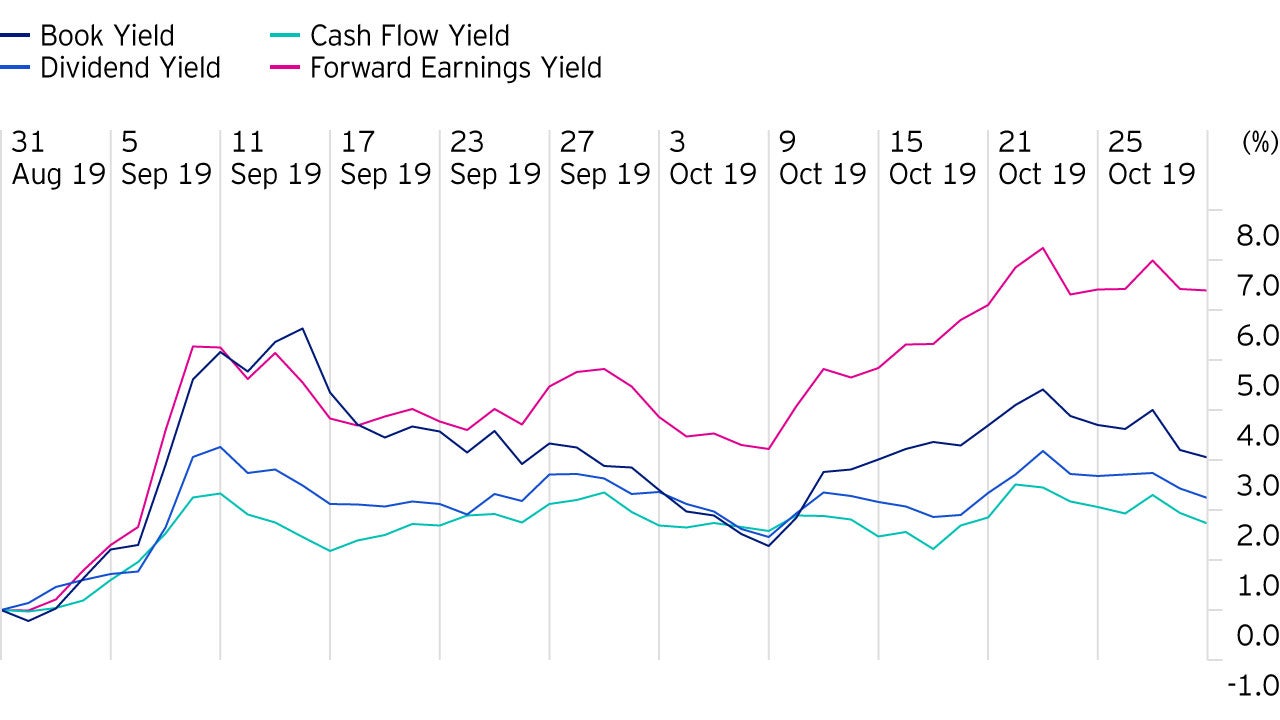

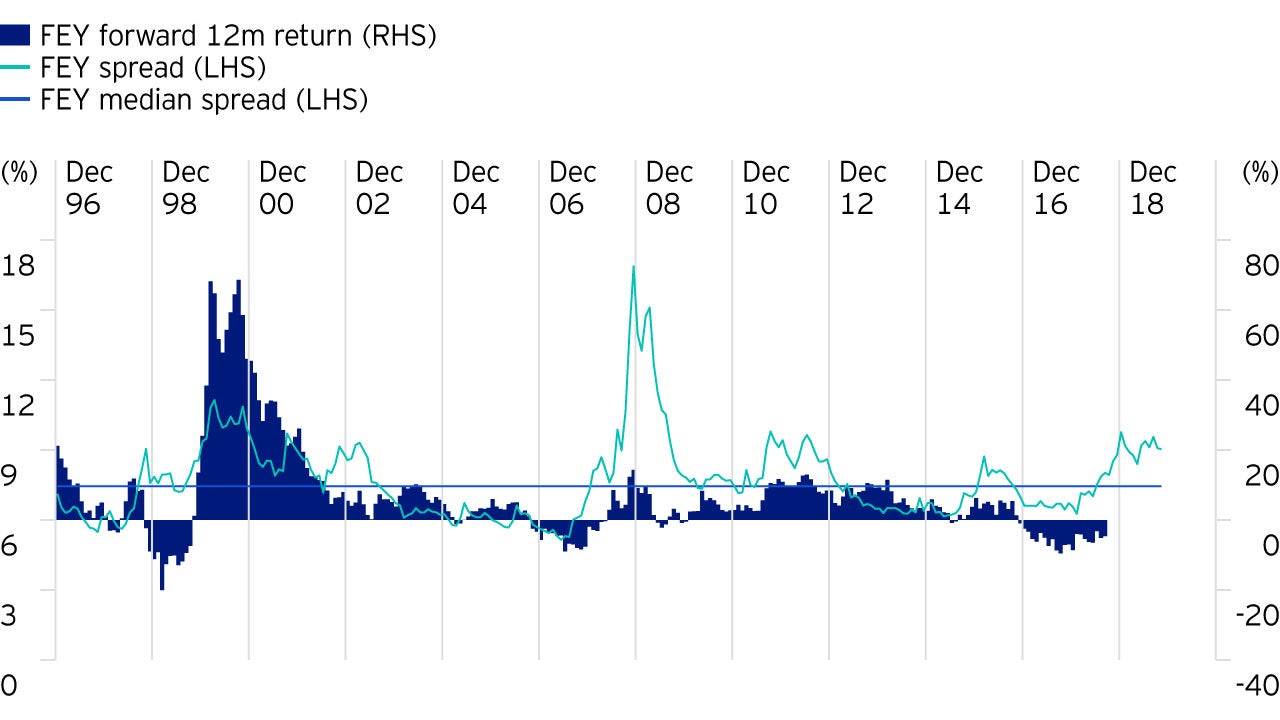

Furthermore, the lightly shaded blue bars in the same chart represent the returns of a forward earnings yield factor over the following 12 months. We can see that value has historically performed best when it was particularly cheap.

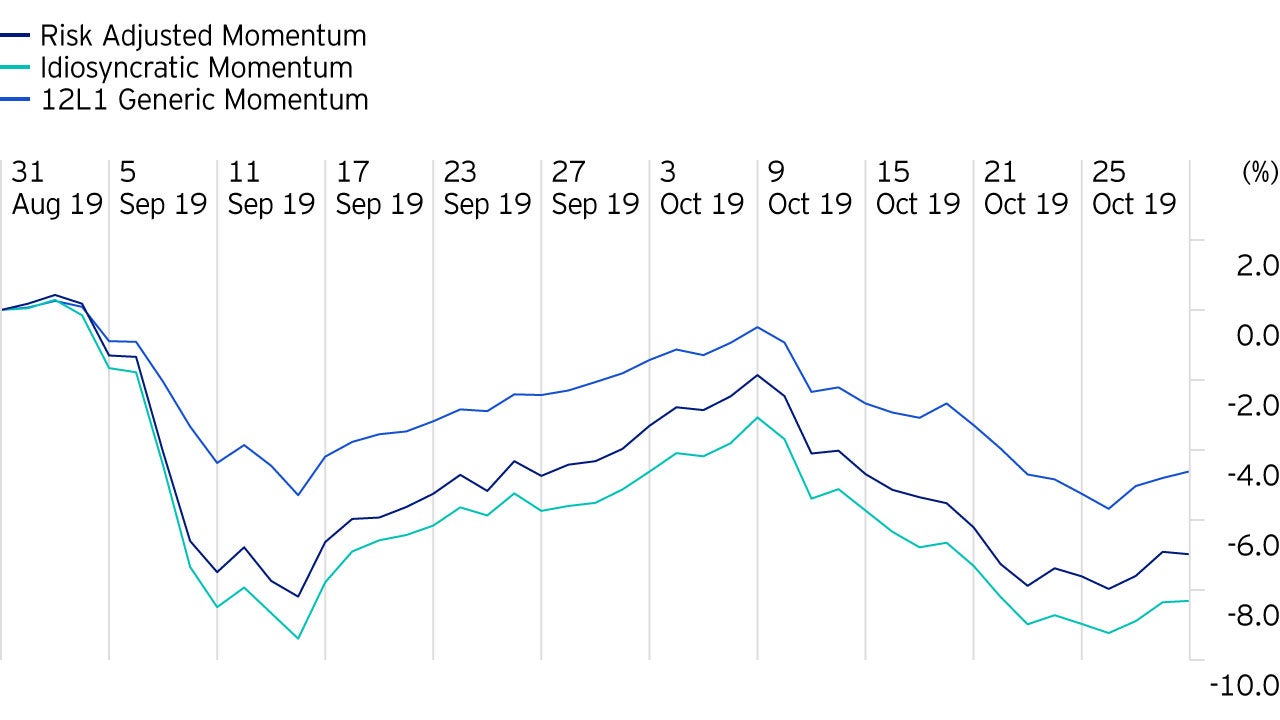

Apart from value spreads, economic developments remain an important consideration. In particular, cyclical value signals favour a healthy economic environment. If trade uncertainties and recession fears continue to alleviate, investors’ preference for value stocks may continue further.

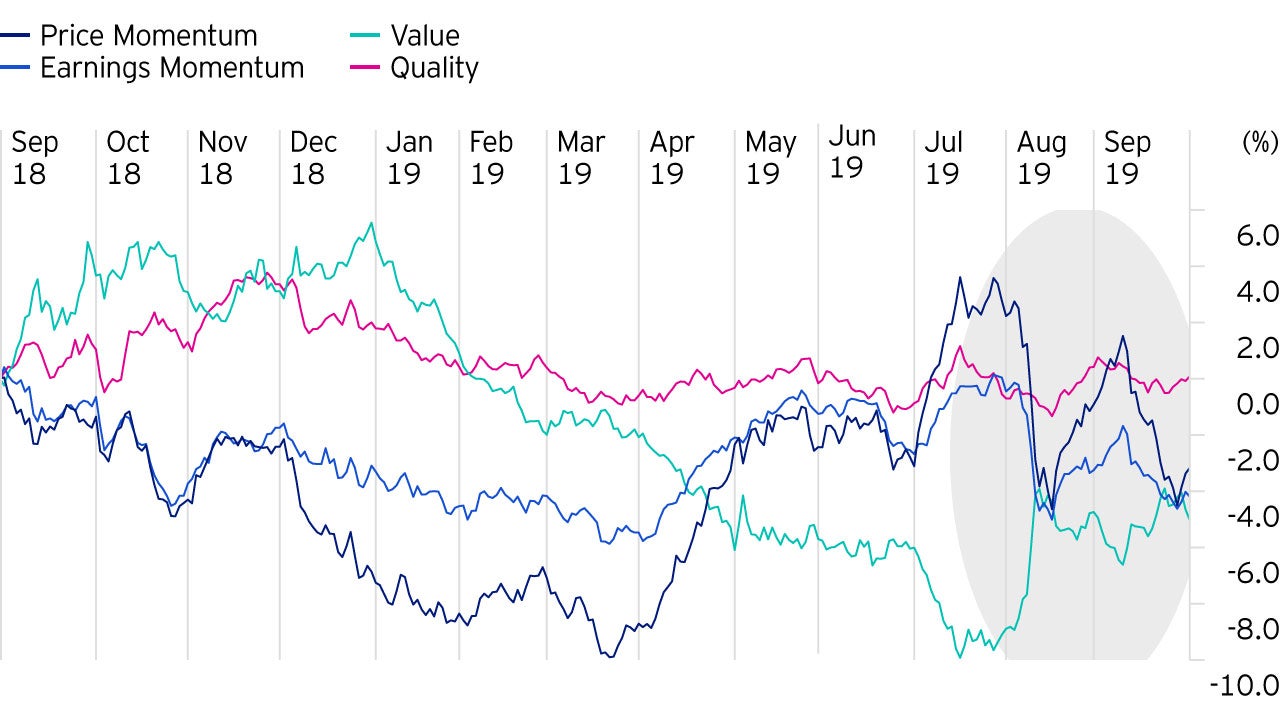

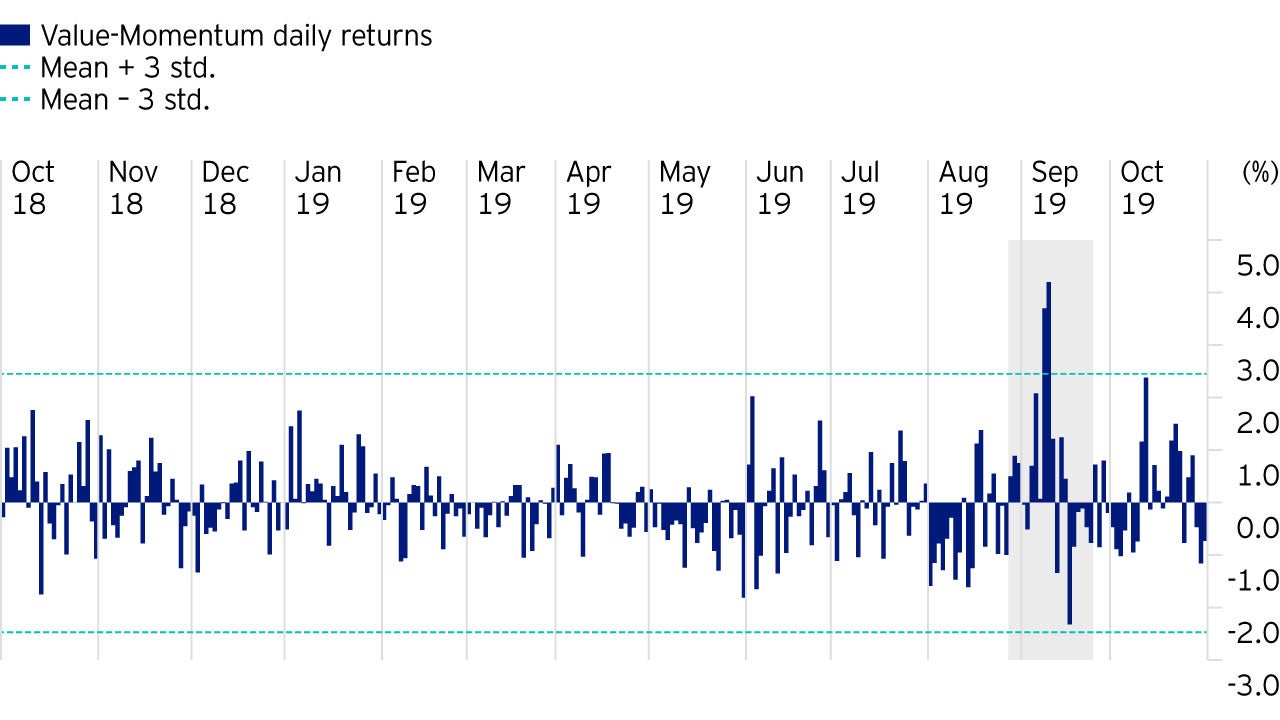

Still, whether this will become the start of more significant change of factor dynamic is impossible to predict and remains to be seen. We therefore believe that a cautious stance with balanced exposure to key factors, momentum, quality and value will remain crucial in these volatile periods.