Investment outlook Asia/Emerging markets - 2020 outlook

2020 promises to be a challenging environment, but Ian Hargreaves and William Lam believe Asia and emerging markets can offer opportunities.

The coronavirus outbreak which originated in China has brought to a halt the positive market momentum we were seeing going into 2020. This outbreak is obviously concerning, reminiscent of SARS in 2002/03 and MERS in 2015, but this time the Chinese authorities have been swifter and more proactive in their response, even declaring the sort of quarantine only China can realistically engineer.

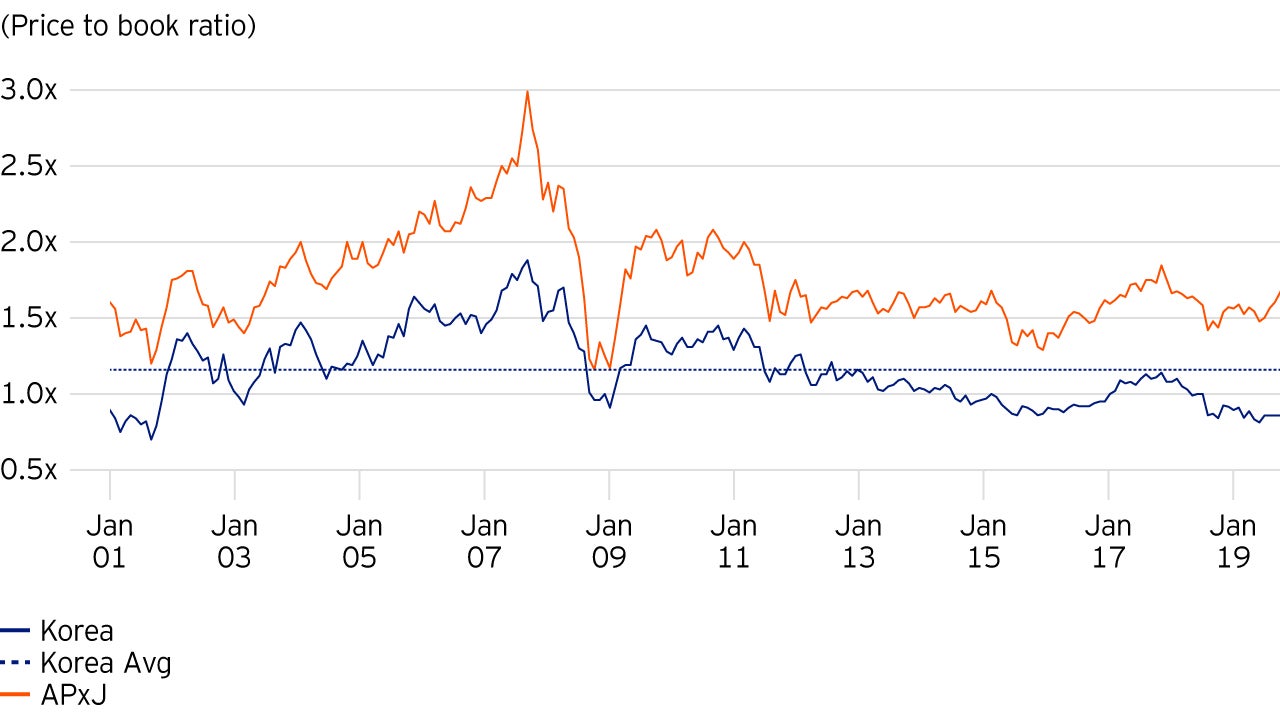

We wouldn’t hazard a guess on the duration or wider economic impact but it would not be unusual for markets to overreact. We will keep a close eye on developments and will report any decisions made in our funds to this effect. Naturally, tourism, transport and real estate are the most negatively affected industries so far whilst healthcare and utilities have been more resilient. Our exposure to any of these is relatively small. In the meantime, one of the major characteristics of our portfolios is the high exposure to strong balance sheets, which should offer some support should the outbreak worsen materially. Also, it is worth bearing in mind that our portfolios are significantly cheaper than the index, and starting valuations matter to subsequent long term returns.

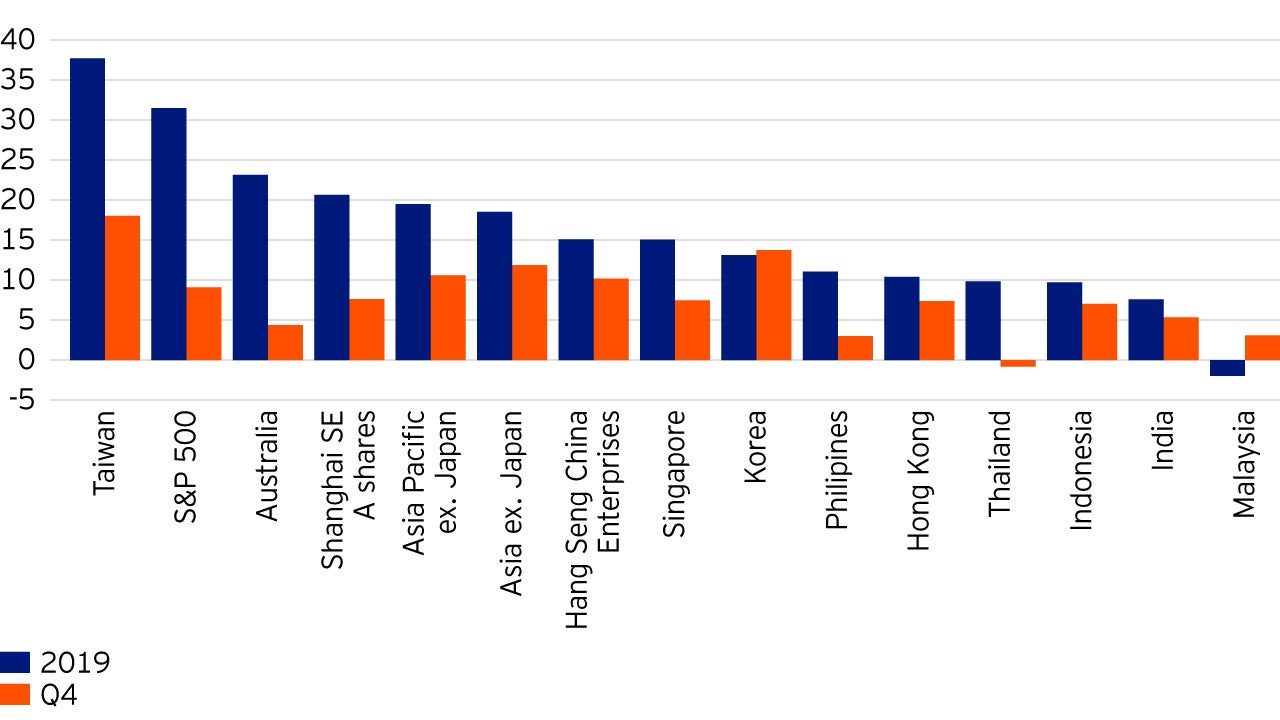

Looking back at 2019, Asian markets ended the year on a high note, returning +11.8% in Q4, and +18.5% for the full year (MSCI Asia ex. Japan Index , US$, Total Return).

A few key areas that stood out in 2019:

The strong narrative for Asia and EM equities going into 2020 includes a dialling down of US-China tensions; central bank easing; fiscal easing; a mild China stimulus; a more stable US$, and more importantly a global manufacturing cycle bottoming out especially in semiconductors and autos, with inventories having troughed.

The important question is whether the spread of this new virus is significant enough to turn the tide of the cyclical recovery under way. If not, we may view any further weakness as an opportunity to invest.