What has been the strategy performance?

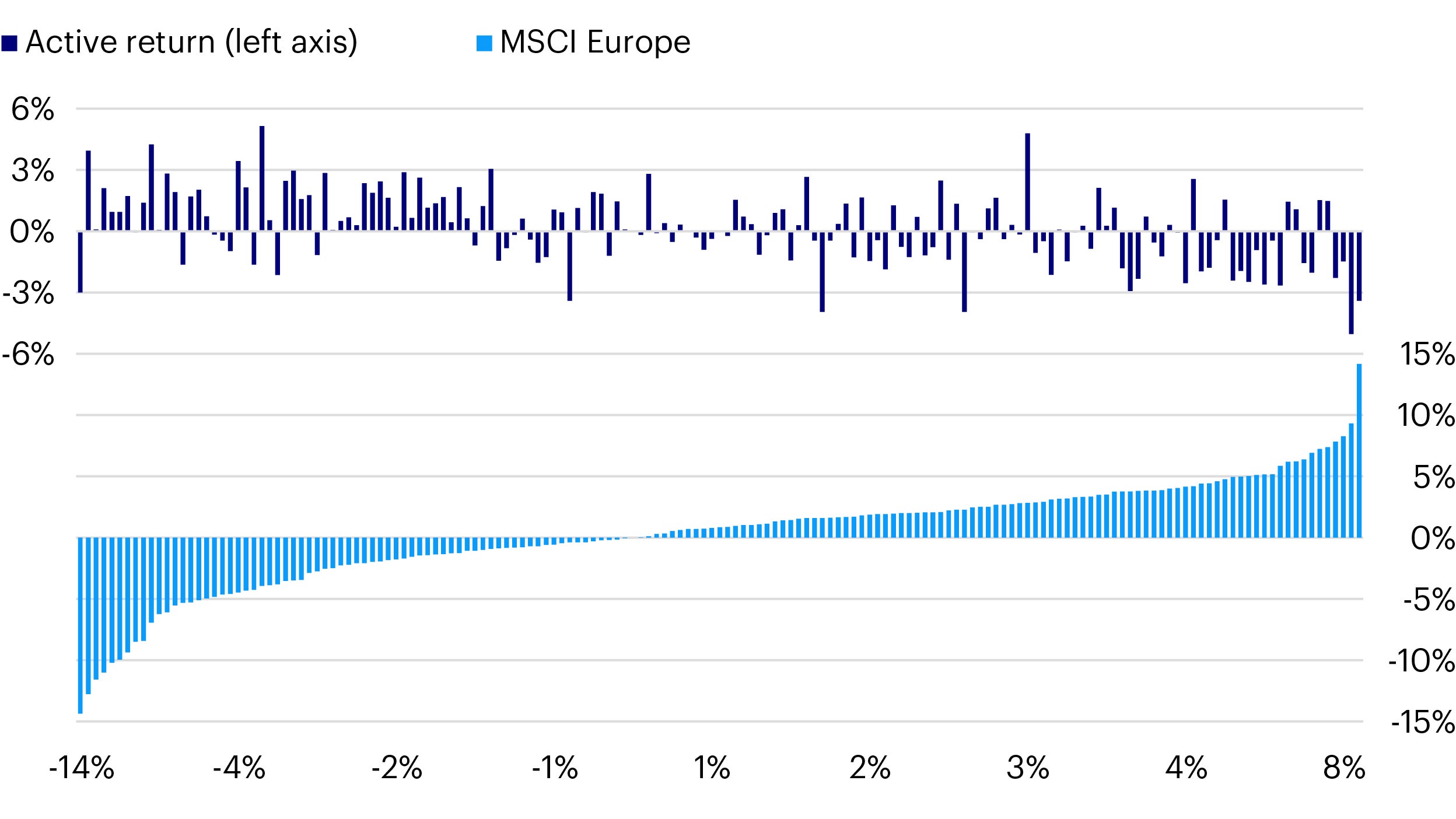

The strategy has been able to deliver attractive returns at a reduced risk level benefiting from both the multi-factor approach and its low volatility focus. Figure 3 shows the monthly returns of the MSCI Europe at the bottom and at the top of the chart, the strategy’s active returns of the corresponding month.

In negative months, when markets declined by 3% or more, the strategy achieved an average monthly outperformance of 1.1%, highlighting its defensive nature. In “normal” market periods, the strategy benefited from its multi-factor approach adding 30 bps to the benchmark return on average. Alternatively, in rising markets, the strategy’s defensive nature capped the upside participation to some extend (average by 0.9%).

While the strategy captured approx. 93% of the market upside moves, it only participated on 75% of the downside returns, leading to a significant excess return against the MSCI Europe Index since inception in 2006. The historical average beta has been 0.85. In aggregate this approach results in a style neutral large cap equity portfolio that many of our investors use as a core equity holding.

Outlook

We believe, the combination of superior ESG characteristics, downside protection and extra return potential of equity factors is very appealing to investors. ESG investing will be an essential part of the solution to a sustainable future. As a quantitative investor, IQS can merge the ESG focus with its proven multi factor approach while maintaining its targeted factor characteristics and deliver positive active returns over the long-term.

As our intended factors have added value over full economic cycles, the rationale supporting them remains intact, and we continue to be optimistic about the future. A defensive low volatility strategy serves as a valuable building block for a portfolio, allowing investors to participate in the conversion towards a more sustainable future while being well positioned to weather potential market setbacks.