Innovation Suite

Explore the Innovation Suite to discover the variety of ways you can easily access innovation. Choose from large-cap, mid-cap, and ESG-focused ETFs.

Invesco QQQ is an exchange-traded fund (ETF) that features Apple, Google, Microsoft, and more.

Invesco QQQ ETF tracks the Nasdaq-100® Index — giving you access to the performance of the 100 largest non-financial companies listed on the Nasdaq. The fund and the index are rebalanced quarterly and reconstituted annually.

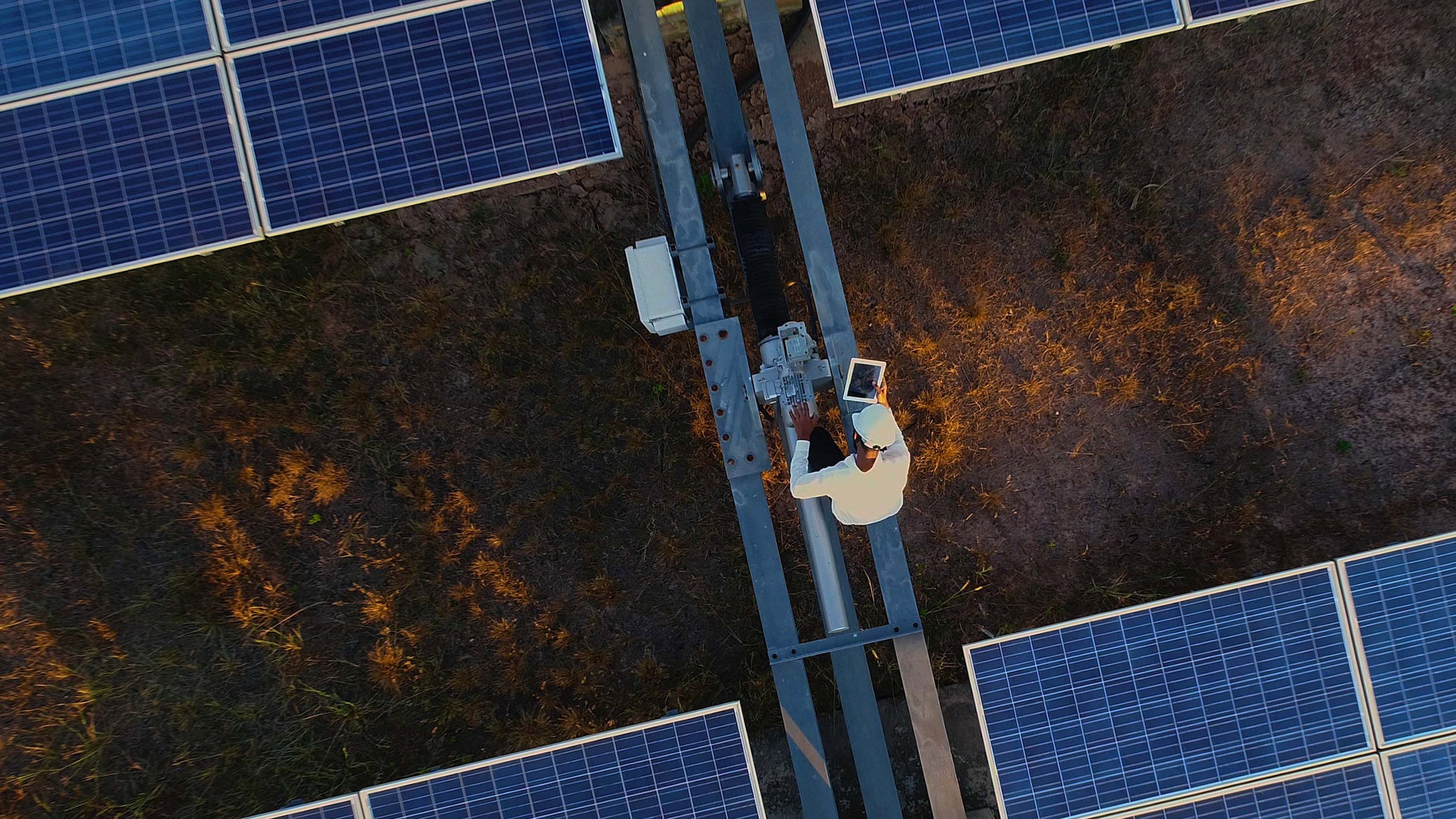

QQQ delivers exposure to companies that are at the forefront of transformative, long-term themes such as Augmented Reality, Cloud Computing, Big Data, Mobile Payments, Streaming Services, Electric Vehicles, and more.

Invesco QQQ holdings as of {date}. Fund holdings are subject to change.

More than just a tech fund, Invesco QQQ ETF showcases underlying holdings from multiple sectors and industries.

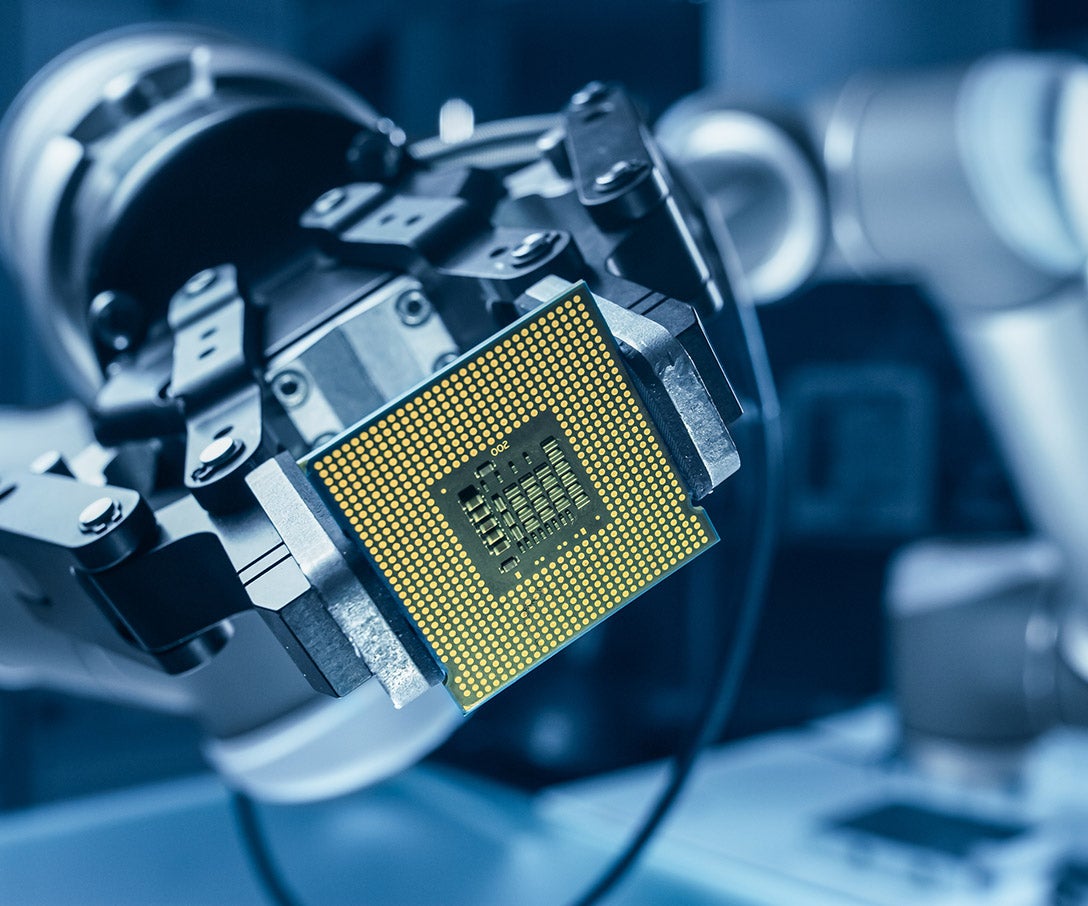

Companies in this sector are involved in the research, development and distribution of technologically focused products and services. This includes the creation of hardware like computers and smartphones, the components that make them tick and the software they run on. Others in the sector build digital enterprise systems for businesses.

This sector includes companies providing the non-essential goods and services that people enjoy when they have income to spare. Invesco QQQ features some of the most prominent and boundary-pushing companies in the sector, across categories like clothing, entertainment, automobiles, hotels, restaurants and more. It also includes some of the biggest online retail companies.

Companies in this sector provide some of the major services and products that keep the health care industry running. They touch many aspects of patient care — including medical equipment, pharmaceuticals, research and facilities. Everyone needs care throughout their lives — and the companies within Invesco QQQ are striving for breakthroughs in how that care is delivered.

Companies within the industrials sector deliver products, machinery, services, equipment and supplies to end users. These companies find ways to efficiently distribute energy, lower consumer prices through supply chain enhancement, and transport goods around the country.

Established in 2018, this new sector covers the telecommunications, entertainment and network services industries. These companies are changing the way we find information, consume content and connect to each other.

Consumer staples are the essential, must-have products that people use in their daily lives, like food, beverages and household items. They are the goods that people are unlikely to cut out of their budgets, and are in steady demand. Stocks within Invesco QQQ include both the makers of those products, and the retailing companies that have the scale and reach to move the entire industry forward.

Ready to rethink what’s possible?

To invest today, select the option that best describes you:

Sign up to learn more about Invesco QQQ. You’ll receive regular performance updates and insights.

|

Company

|

|---|

The Nasdaq-100 Index comprises the 100 largest non-financial companies traded on the Nasdaq.

ETFs disclose their holdings daily and are subject to change and should not be considered buy/sell recommendations.

The Index and Fund use the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.