Aligning Investors with their values

Each investor may have different goals for their portfolio. You may want more income, less risk or greater diversification. To meet these investment objectives, you can potentially benefit from shifting the mindset of investing to a responsible investing strategy. Various types of responsible investing, have been around for decades, but interest in these strategies has come to the fore front of the market news in recent years, spurred by shifting demographics, concerns about climate change, resource risks and regulatory changes. As investor interest has increased, the environmental, social, and governance (ESG) industry has responded with improved research capabilities which have thereby led to better products. With this in mind, Invesco has created a new portfolio, the ESG Opportunity Portfolio , to focus on this growing segment of the market.

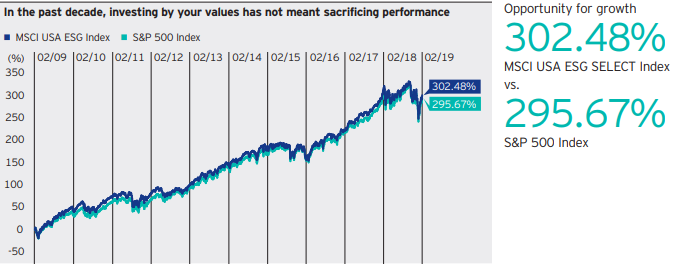

Source: Bloomberg L. P., January 2019.

The above chart and the accompanying highlighted performance data are presented for the purpose

of illustrating the outperformance of the MSCI USA ESG SELECT Index relative to the S&P 500 Index over

the last 10 years. The data is cumulative total return over the 10-year period. This performance is not

indicative of how any series of the ESG Opportunity Portfolio will perform. Past performance is not

indicative of future results. An investment cannot be made directly into an index.

Ready to learn more? Contact your Invesco representative or financial advisor for more on how Invesco can may help with your investment needs.

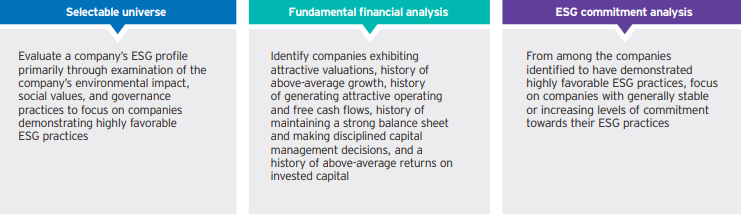

ESG Opportunity - Selection process

Before investing, investors should carefully read the prospectus and consider the investment objectives, risks, charges and expenses. For this and more complete information about the trust, investors should ask their advisor(s) for a prospectus or download one at invesco.com/uit.

About risk

There is no assurance that a series of a trust will achieve its investment objective. An investment in any series of a unit investment trust is subject to market risk, which is the possibility that the market values of securities owned by a trust will decline and that the value of trust units may therefore be less than what investors paid for them. A trust is unmanaged and its portfolio is not intended to change during the trust's life except in limited circumstances. Accordingly, investors can lose money investing in a trust. A trust should be considered as a part of a long-term investment strategy and investors should consider their ability to pursue it by investing in successive trusts, if available. Investors will realize tax consequences associated with investing from one series to the next.

Common stocks do not assure dividend payments. Dividends are paid only when declared by an issuer's board of directors and the amount of any dividend may vary over time. There can be no guarantee or assurance that companies will declare dividends in the future or that if declared, they will remain at current levels or increase over time.

A particular series of the trust may be concentrated in certain sectors or geographic regions, and to the extent that it is, your investment in units of a trust series would be subject to the risks associated with such concentrations. Please refer to the prospectus associated with the applicable trust.

Investing in foreign securities involves certain risks not typically associated with investing solely in the United States. This may magnify volatility due to changes in foreign exchange rates, the political and economic uncertainties in foreign countries, and the potential lack of liquidity, government supervision and regulation. The financial condition of an issuer may worsen or its credit ratings may drop, resulting in a reduction in the value of your Units. This may occur at any point in time, including during the initial offering period.

You could experience dilution of your investment if the size of the Portfolio is increased as Units are sold. There is no assurance that your investment will maintain its proportionate share in the Portfolio's profits and losses.

The Portfolio invests in securities of companies demonstrating favorable ESG practices. The companies may not have applied favorable ESG practices in the past and there is no guarantee that the companies will continue to apply favorable ESG practices over the life of the Portfolio.

The MSCI USA ESG Index is a broadly diversified global index that includes large and mid-capitalization companies with high ESG ratings relative to their sector peers. The S&P 500 Index is an unmanaged index considered representative of the US stock market.