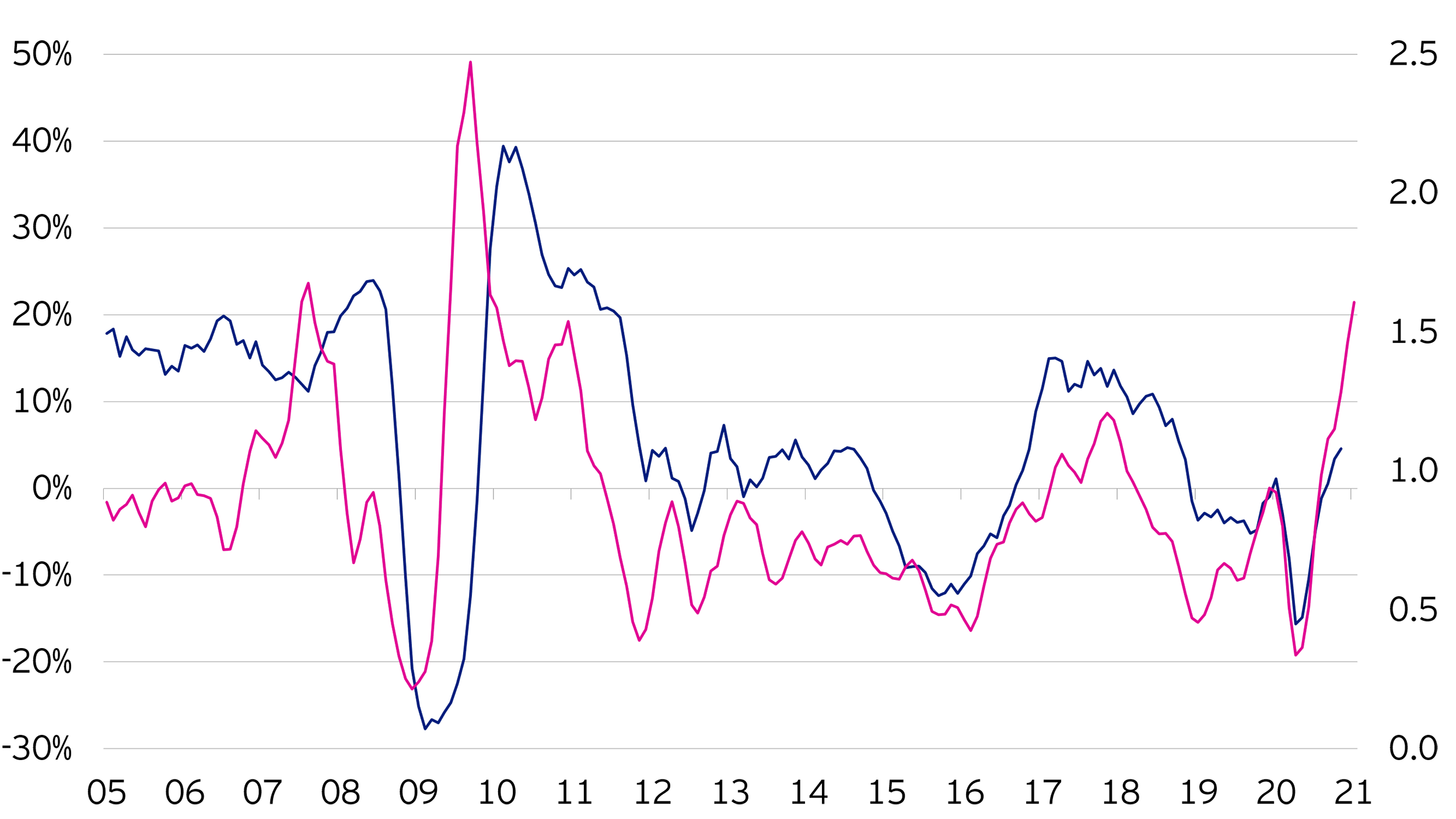

The strong recovery we are seeing in demand is also leading to a broadening in the earnings recovery, with industrial supply struggling to keep up with global demand. In Asia, 13 out of 16 sectors are currently experiencing upgrades in earnings revisions, compared to the average of 7 for historic earnings upturns. Once normality has returned, however, governments in developed markets will be forced to begin to chart a course back to policy orthodoxy, in our view. This is likely to be a riskier point for markets.

In recent weeks, the markets have come back. Growing expectations that a strong cyclical recovery in the US would result in inflationary pressures led to a spike in US treasury yields. Whilst a rising yield environment has historically been tough for Asian and emerging markets performance, we remain calm as, in our view, concerns about inflationary pressures in this part of the world are premature. Although stimulus measures may see some increase in demand for goods manufactured in Asia, the next leg of the recovery is much more likely to see pent up demand for service sectors such as leisure and hospitality, which have been most affected by social distancing.

Overall, we expect that conditions will remain accommodative at this stage in the recovery. Most Asian countries went into the Covid-19 crisis with relatively low levels of government debt, which has enabled them to loosen fiscal policy and means they may not need to revert to austerity once the crisis is over. Furthermore, economic growth in China is recovering without the authorities having to rely on the sort of fiscal impulse manufactured in developed economies.

Although the market currently has policy and vaccine tailwinds behind it, we feel it important not to exaggerate the likely positive impact of economic normalisation on equity valuations. At least on a historic basis, markets appear up with events but we believe there are still plenty of opportunities for bottom-up stock pickers given the wide valuation discrepancies that exist between sectors. In our view, these discrepancies are no longer justifiable given the breadth of earnings recovery now being seen.