About Invesco Global Economic Pulse EUR VT10 Index

Stock market exposure built from a dynamic global multi-factor approach. A target volatility control that responds to changes in market conditions. Daily, adaptive allocations seek to mitigate wild swings in the market. All delivered in a single, comprehensive package.

How it works

Dynamic multi-factor strategy seeks to take advantage of changing market environments using a disciplined approach to determine the current economic regime and then increase exposure to factors that tend to be rewarded in that climate while decreasing exposure to those that do not, in order to seek to deliver better returns than generic stock market exposure:

Macro Regimes Framework

Emphasis on each factor is determined by the current environment

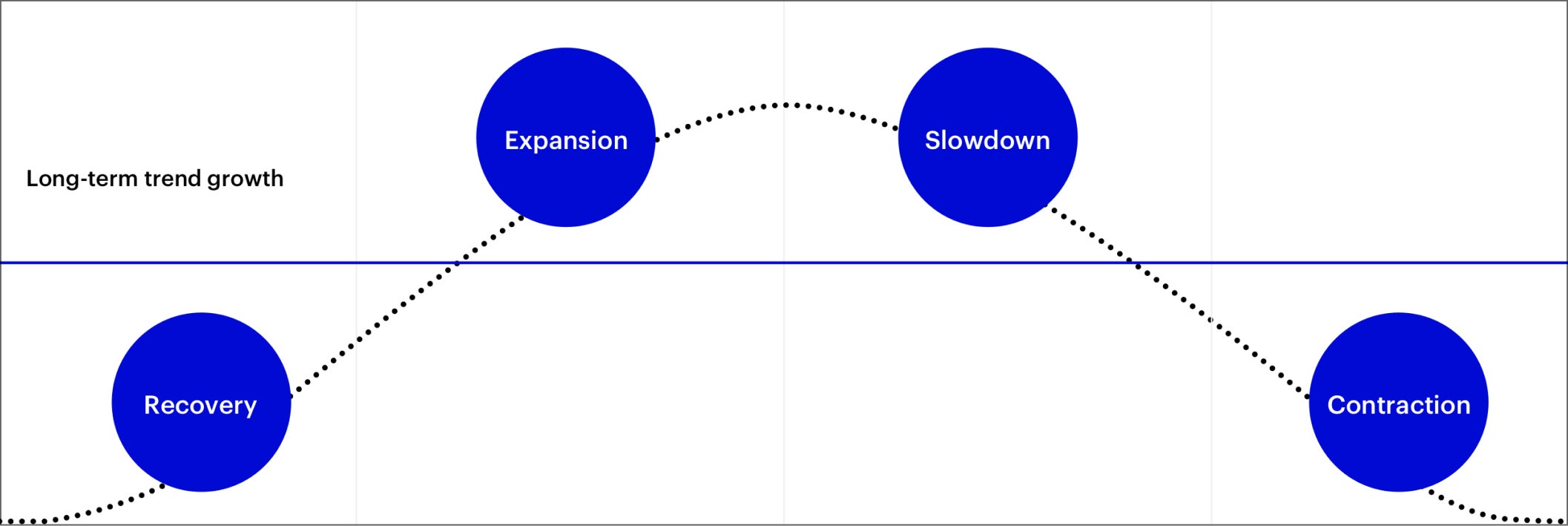

This diagram shows the four distinct regime periods of recovery, expansion, slowdown, and contraction and which factor tilts correspond with each regime.

| Recovery | Expansion | Slowdown | Contraction | |

|---|---|---|---|---|

| Long-term economic growth trend | Growth is below trend and accelerating | Growth is above trend and accelerating | Growth is above trend and decelerating | Growth is below trend and decelerating |

| Size | X | X | ||

| Value | X | X | ||

| Momentum | X | X | ||

| Low volatility | X | X | ||

| Quality | X | X |

Uses a rules-based approach that assigns securities a score for each investment style: Value, Momentum, Quality, Low Volatility and Size. Security weights are then tilted in a rules-based manner based on the factors most relevant to the current economic regime. For illustrative purposes only.

Why factors work

The centerpiece of the Invesco Global Economic Pulse EUR VT10 Index is a global dynamic multi-factor approach. Value, Momentum, Quality, Low Volatility and Size are stock characteristics, or factors, shown by academics and practitioners to deliver more attractive returns historically than the broad market:1

Resources

Methodology

Rules and guidelines followed to build and maintain the Index

Transcript

EU BMR ESG Disclosures

The purpose of this document is to outline the information required in Article 27 of the EU regulation on indices used as financial benchmarks (“BMR”) and Commission Delegated Regulation (EU) 2018/1643.

Transcript

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions. There can be no assurance that actual results will not differ materially from expectations.

Diversification/Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns and does not assure a profit or protect against loss.

Factor investing is an investment strategy in which securities are chosen based on certain characteristics and attributes that may explain differences in returns. Factor investing represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, both in active or passive vehicles. There can be no assurance that performance will be enhanced or risk will be reduced for strategies that seek to provide exposure to certain factors. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Factor investing may underperform cap-weighted benchmarks and increase portfolio risk. There is no assurance that the index discussed in this material will achieve their investment objectives. Holding cash or cash equivalents may negatively affect performance.

Although bonds generally present less short-term risk and volatility than stocks, the bond market is volatile and investing in bonds involves interest rate risk; as interest rates rise, bond prices usually fall, and vice versa. Bonds also entail issuer and counterparty credit risk, and the risk of default. Additionally, bonds generally involve greater inflation risk than stocks.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Invesco Indexing LLC is an indirect, wholly owned subsidiary of Invesco Ltd. The group is legally, technologically and physically separate from other business units of Invesco, including the various global investment centers.

EU Benchmark Regulation:

Invesco Indexing Limited Liability Corporation (IILLC) is recognised as a third country benchmark administrator under the EU Benchmark Regulation. Invesco Investment Management Limited is the legal representative of IILLC in the EU. Invesco Investment Management Limited, Ground Floor, 2 Cumberland Place, Fenian Street, Dublin 2, Ireland., is authorised and regulated in Ireland by the Central Bank of Ireland.

Issued by: Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg

GL4199282