Global Fixed Income Strategy Monthly Report

In our regularly updated macroeconomic analysis we offer an outlook for interest rates and currencies – and look at which fixed income assets are favoured across a range of market environments.

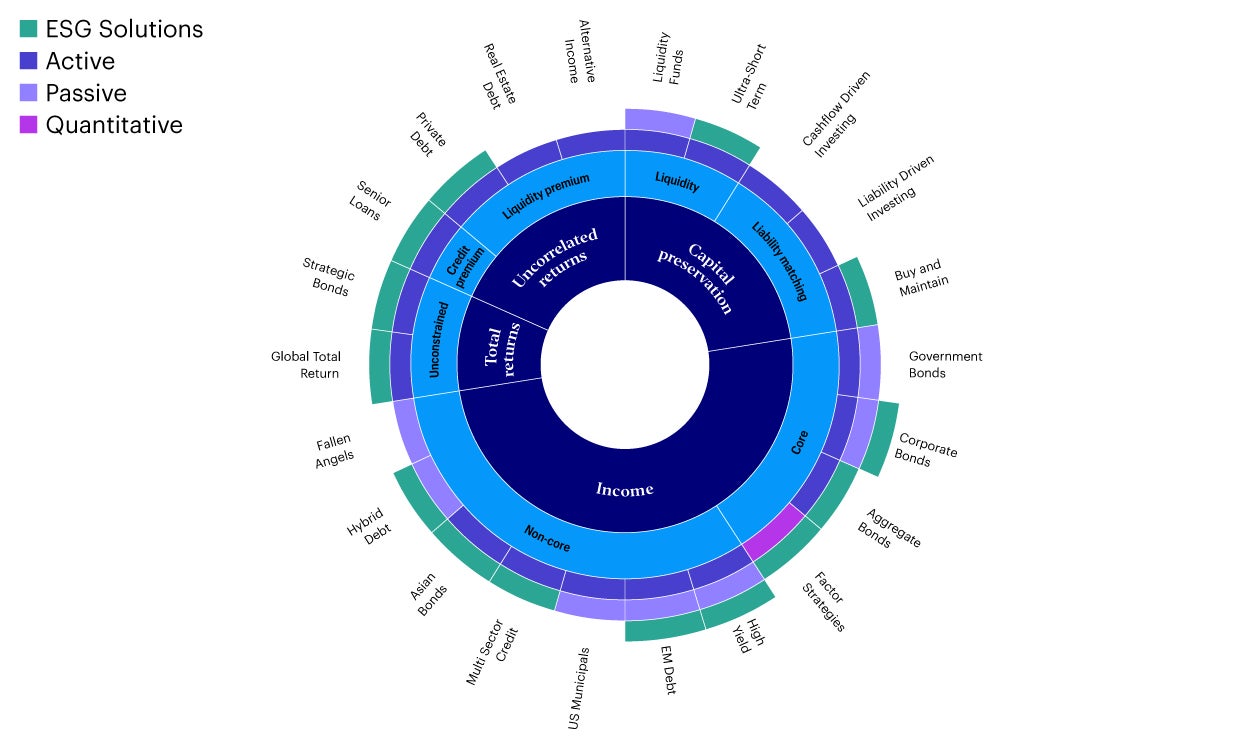

At Invesco, flexibility is key. Our broad range of fixed income capabilities allows investors to switch their preferences as markets evolve.

Whether you’re positioning for persistent inflation or disinflation, our insights and case studies can help guide your asset allocation decisions. We focus on key areas of the fixed income universe.

Let us know your preferences to receive insights and ideas on the themes, strategies and products of most interest to you.

Today, we manage over USD313.72 billion in fixed income assets for a diverse range of clients across the globe. Our products are designed with investor outcomes in mind – from unconstrained bond funds that look to achieve total returns, to liquidity funds that aim to preserve capital.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date.

All data is provided as at 31 December 2023, sourced from Invesco unless otherwise stated.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.

EMEA 2736500 (2023)