ESG

Climate investing: mitigation and adaptation

Climate change is challenging societies and to address the risks it’s essential we invest in mitigation and adaptation strategies. Find out more.

Insights, education and ideas to help you express values, drive change for good and help build a sustainable future.

Sign upFrom balancing net profit with net zero, to any other ESG investing outcome – the numbers that matter to you, matter to us.

Investing now goes beyond a financial return and the way we understand and deliver value is constantly evolving.

At Invesco, we want to help you navigate the ESG landscape and realise your responsible investment goals.

This video is exclusively for use by Professional Clients, Financial Advisers and Qualified Clients/Sophisticated Investors. This is not for consumer use, please do not redistribute.

Governments around the globe, including major economies like the US and China, are setting ambitious targets to reduce their carbon emissions and transition to net zero. Underpinning many of these targets is the 2015 Paris Agreement and its goal to limit global warming.

Keep rise in mean global temperature to below 2°C above pre-industrial levels.

But this shift is a monumental task, requiring massive changes to infrastructure and regulations. The good news is that clean energy costs have declined substantially over the last 10 years.

The private sector will continue to be the major source of investment in these technologies, and there are many areas being developed where investors could see potential returns.

US$1.8 trillion invested in renewable energy between 2013 and 2018.²

Let’s start with energy storage. When the wind drops and the sun goes down, storing clean energy to ensure a constant supply is essential. In 2021, Moss Landing Power Plant, built in California in 1950, was reborn as the world’s largest battery energy storage system, feeding electricity back to the grid when energy isn’t being produced. Other countries are now following suit.

US$964 billion projected investment in global energy storage between 2020 and 2050.³

But batteries are not without their problems. Lithium is a finite natural resource, and mining it is an energy-intensive process that harms the environment too, using water and chemicals and leading to loss of biodiversity. Lithium can be recycled, but that’s not easy either, so governments are laying out recycling policies and encouraging research in this area.

Gravity can also be used to store and release energy, from traditional methods like pumped-storage hydroelectricity to more radical solutions involving huge multi-tonne blocks that are lifted and dropped by cranes. Innovators in this space make it ripe for possible investment.

There are some sectors where the use of clean energy and large batteries may be impractical, including heavy industry and the transportation sector.

Hydrogen is one solution, but it still relies predominantly on fossil fuels for its production. It can be made in other ways, however, such as by electrolysis, and if renewable energy sources are used, it essentially becomes ‘green hydrogen’. With the growth in renewable energy this is becoming an ever more viable option.

US$165 billion projected European investment in green hydrogen by 2030.⁴

Wherever our energy comes from in the future, it’s going to need an upgraded power grid to avoid bottlenecks in supply as populations and demand grow. But what if these grids were all connected too, like a ‘global energy grid’? Countries that produce excess energy from renewable sources could export it to others that don’t, providing big opportunities for developing economies.

US$14 trillion projected investment in global grid between 2020 and 2050.⁵

Whatever we do to reduce our carbon emissions, we will still be emitting millions of tonnes of it into the atmosphere every year for decades to come. That’s why carbon capture is another key part of reducing climate change.

Direct Air Capture devices pull in atmospheric air and extract the carbon dioxide, returning the remaining air to the environment – replicating what plants do but much faster. However, it’s energy intensive and a lot of renewable energy needs to be consumed for the process to be truly ‘carbon free’. The race is on to find ways to store or use this carbon without harming the planet.

40 million tonnes of carbon dioxide can currently be captured each year.⁶

A small company in Switzerland has developed technology that extracts carbon dioxide from the air and stores it underground using a mineralization process developed in Iceland. They are essentially transforming carbon into stone, which can remain stable for thousands of years.

No one knows which technologies will become the new standards for clean energy production. But we do know that this sector offers huge growth potential, and many opportunities will open up for investors.

We’re excited about exploring these new possibilities and are ready to be your partner on the journey towards net zero.

¹ Source: IRENA, 2019. Period covered: 2010-2019.

² Source: IRENA, Global landscape of renewable energy finance 2020.

³ Bloomberg NEF as at 14 December 2020.

⁴ Source: IHS Markit as at 4 June 2021.

⁵ Source: Bloomberg NEF, Power Grid Long-Term Outlook 2021.

⁶ Source: IEA, CCUS in clean energy transitions.

Risk warnings

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This marketing communication is exclusively for use by Professional Clients and Financial Advisers in Continental Europe as defined below, Qualified Clients/Sophisticated Investors in Israel and Professional Clients in Dubai, Ireland, Isle of Man, Jersey, Guernsey and the UK. It is not intended for and should not be distributed to, or relied upon, by the public. By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.

For the distribution of this communication, Continental Europe is defined as Austria, Belgium, Bulgaria, Croatia, Czech Republic, Finland, France, Germany, Hungary, Italy, Kosovo, Liechtenstein, Luxembourg, The Netherlands, North Macedonia, Norway, Romania, Spain, Sweden and Switzerland.

Issued by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg; Invesco Asset Management, (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland; Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority; Invesco Asset Management Deutschland GmbH, An der Welle 5, 60322 Frankfurt am Main, Germany.

Israel: This communication may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this communication should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licensed investment advisor prior to making any investment. Neither Invesco Ltd. Nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder.

The decarbonisation of energy production is creating big ideas and innovative solutions for the future.

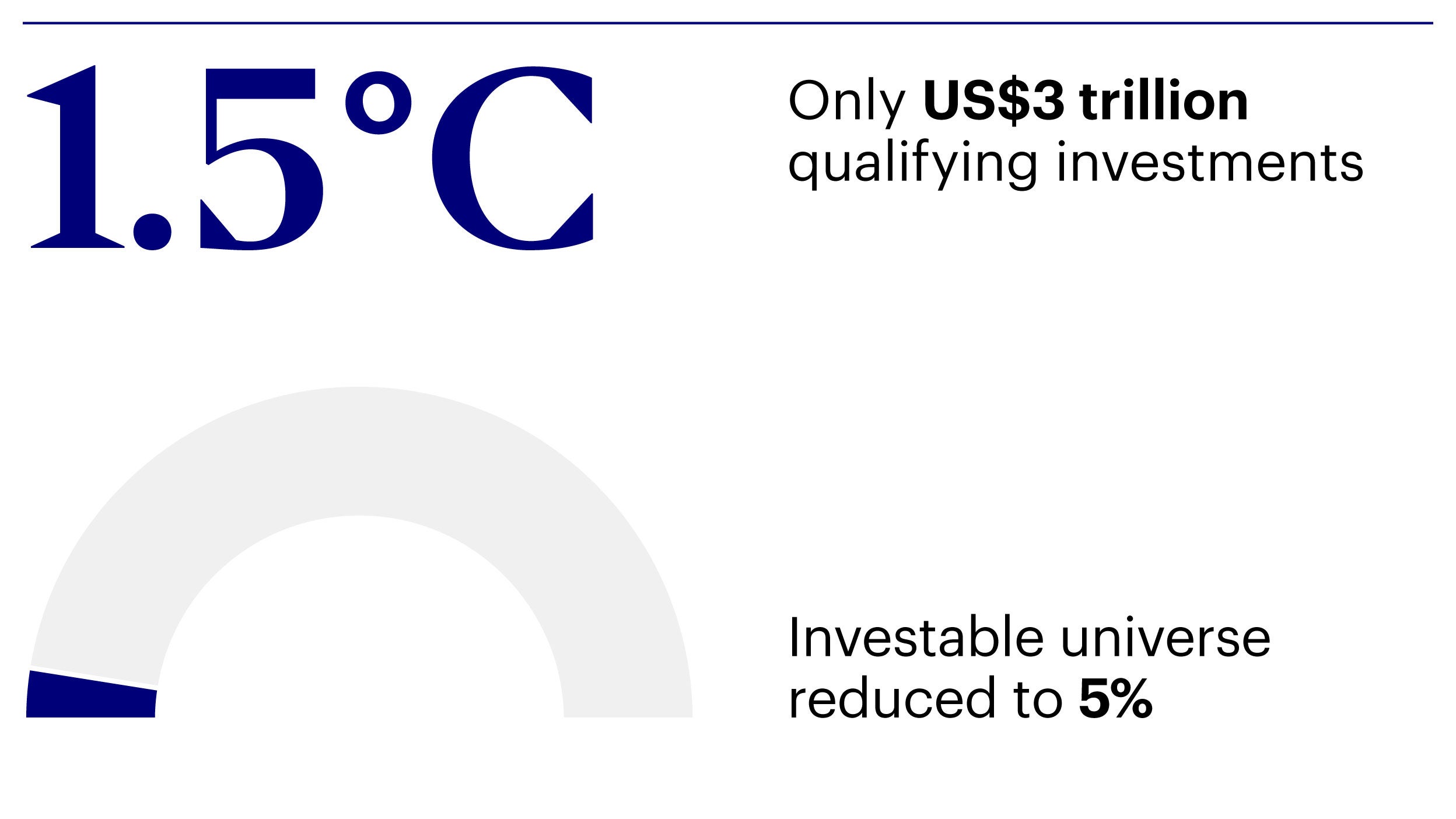

Although current global government policies put the world on track for a 3°C temperature increase by 21001, many investors believe this is not sufficient for their ESG investment targets. Many ESG investors would prefer to align themselves to investments that would limit the increase to 1.5°C. However, to do so would mean decreasing your investible universe to 5%. Should those focused on responsible investing accept missing out on a broader investment set, or will the pressure start mounting on those not compliant?

Sign up to access our handy environmental, social and governance (ESG) training and to receive other ESG-related content that will help you achieve your financial goals.

There is clear progress in the environmental, social and governance (ESG) space. ESG is everywhere. It features in daily discussions with fund managers on their investment process; in conversations with the globe’s smallest and largest corporates; and in Invesco’s suite of European funds that promote ESG characteristics — all in the context of the real commitments and show of financial muscle on the sidelines of Cop26. Ahead of Cop27, more momentum is expected to build on the environmental side of ESG. Key climate-related themes are increasingly appearing in company transcripts, including biodiversity, biofuel, carbon capture, carbon offset, decarbonisation, net zero, electric vehicles, the green deal and the EU taxonomy.

The Covid-19 pandemic has highlighted the need for more work to be done in the social and governance space too. The same analysis of company transcripts show the increasing interest in themes such as employee welfare and digital tax. This comes amid a backdrop of increasing global ESG assets under management and more sustainable fund launches across the world.

To fulfil the goals of the Paris Agreement, countries, corporates and consumers will have to take steps to reduce their carbon footprints. The switch from a carbon-intensive economy will require huge public and private sector investment in innovative technology and green infrastructure. Meanwhile, any delay in the transition to net zero could exacerbate the climate crisis and pose risks to portfolios and assets. Investment portfolios and asset allocation will increasingly reflect the realities of the transition to net zero. Shareholders are also increasingly focused on good governance and sound social policies.

Socially responsible investing (SRI) is one component of conscious investing, and includes any investment strategy that aims to consider financial return and social and/or environmental good to bring about social change.

While there’s evidence to suggest ESG-focused funds do outperform, there are several factors to consider. These include the strategy applied to portfolio, its allocation and how stocks in the portfolio are selected (i.e., using their ESG score). In Responsible investing: common myths debunked; we explore ESG outperformance in more detail.

There’s no one-size-fits-all approach for measuring ESG, which makes standardisation difficult. Investors can’t easily compare ESG funds – and while there are now different agencies, covering varying numbers of businesses, each uses a different ESG ratings scale.

In ‘More than numbers: Meaningful measuring and reporting in an ESG landscape’, we explore the complexities – and potential solutions in more detail. Standardisation is imperative but it’s also important to define the different elements of measurement. There’s a distinction between measuring ESG implementation and ESG impact; as well as between fund-level and entity-level ESG scoring.

Fund categorisation based on the specific area of ESG each fund targets is one way to help, allowing investors to align their decisions with their non-financial objectives – or their desire to ‘do good’. There are three main components:

As ESG continues to grow globally, different regions have made efforts to introduce regulatory standards. Regulation will be a key factor in ensuring that efforts to integrate ESG have a tangible impact. It’ll also help to drive the standardisation of measuring and reporting.

The EU has introduced green taxonomy, Sustainable Finance Disclosure Regulation (SFDR) and most recently, the Sustainable Finance Strategy to provide rules and structure to the way businesses report on their ESG activities. You can read more about this in our A-Z guide.

Greenwashing is when companies portray a public image of sustainability but aren’t taking sufficient or tangible action behind the scenes or undertake other questionable business activities. It could be a global drinks company committing to using 100% recycled plastic but setting no actual target, or a fast fashion brand using sustainable materials but with questionable manufacturing processes.

In the investment industry, it could be excluding obvious companies like tobacco manufacturers from a portfolio but not applying ESG analysis to the rest of it. Greater regulation and efforts to standardise measuring and reporting should help reduce the effects of greenwashing, as well as wider education. Our ESG@Invesco series features a wealth of content and discussions on the importance of meaningful ESG implementation. A key part of this will be net zero implementation, which will include decarbonisation; company-level assessments of alignment to green targets; and further engagement on reducing carbon footprints.

Growing concerns over climate change mean it’s often considered the leading ESG issue. Climate data is already playing an important role in investment strategies and in investors’ decision-making, putting business practices and disclosures under increasing scrutiny. Global initiatives like the Paris Agreement, the Task Force on Climate-Related Financial Disclosures and COP26 aim to address climate change at a sovereign and institutional level – with the goal of limiting global warming to 1.5°C degrees Celsius, compared with pre-industrial levels.

In the investment industry, the Principles for Responsible Investment (PRI) supports its signatories by setting out six guiding principles to help understand and integrate ESG into their investment decisions. They view education as key and there are several resources available. The objectives include using analysis as a tool to create climate-friendly investment strategies. This could be investing in areas that specifically target climate change, like renewables, to investing in businesses operating sustainable practices, like better energy efficiency.

Climate investing: mitigation and adaptation

Climate change is challenging societies and to address the risks it’s essential we invest in mitigation and adaptation strategies. Find out more.

2022 Global TCFD Report

Our fourth annual TCFD Report provides a comparable, investor-relevant disclosure on our activities and capabilities in climate-aware investing. Find out more.

Invesco’s evolving fund range for sustainable investing – Article 8 and 9 funds

An Article 6, 8 and 9 fund classification help make investors aware about a fund’s sustainable characteristics. Learn more about Invesco’s Article 8 and 9 fund range.

Discover our ESG investment ideas and funds.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.