Transcript

Navigating markets effectively is paramount for long term success. A dynamic approach may help meet desired investment goals across ever changing market environments. Of course, as with all approaches, there's no guarantee of profit or complete elimination of the risk of loss. By combining stocks, bonds and cash and targeting a specific volatility level. The Invesco Dynamic Growth Index seeks to deliver stable returns across different market landscapes.

We built the index on a foundation that adjusts to the current economic environment by selecting companies with qualities suited for potential outperformance under those conditions. The qualities emphasized, like value and quality, align with decades of academic research showing their historical ability to outperform using a disciplined approach to determine the current economic regime. Exposure is increased to stocks with characteristics that tend to be rewarded in this environment, while exposure is decreased to those that tend not to be.

In order to seek to deliver better returns than generic stock market exposure. While stocks are the main driver of growth, they also have the potential for higher volatility. The index offsets this risk by also holding bonds backed by the US government cash, or a combination of both. While the index typically prefers bonds to cash, when bond prices are falling more than usual, bond exposure is reduced and cash exposure is increased.

To seek to help to offer protection from the negative effects of rising interest rates. Compared to stocks, bonds tend to offer complementary returns and more stability. So when stocks become riskier, the index allocates more to bonds and vice versa. That way, no matter where we are in the cycle, the index can make the necessary adjustments to deliver a stable return profile to maintain stability.

The safety of cash may be used to adjust the volatility of the index, helping to weather times of heightened risk by adding more when stocks and bonds become riskier and then decreasing when risk subsides. Further intraday stock market moves are used to adjust the return profile of the index in an attempt to mitigate rapid drawdown risk. The Invesco Dynamic Growth Index, rising to the challenge of ever changing markets through responsive allocations to stocks, bonds and cash.

Learn more at InvescoDynamicGrowthIndex.com

About Invesco Dynamic Growth Index

Stock market exposure built from a dynamic multi-factor approach. Bond exposure that responds to changes in market conditions. Daily, adaptive allocations seek to mitigate wild swings in the market. All delivered in a single, comprehensive package.

How it works

Dynamic multifactor strategy seeks to take advantage of changing market environments using a disciplined approach to determine the current economic regime and then increase exposure to factors that tend to be rewarded in that climate while decreasing exposure to those that do not, in order to seek to deliver better returns than generic stock market exposure:

Macro Regimes Framework

Emphasis on each factor is determined by the current environment.

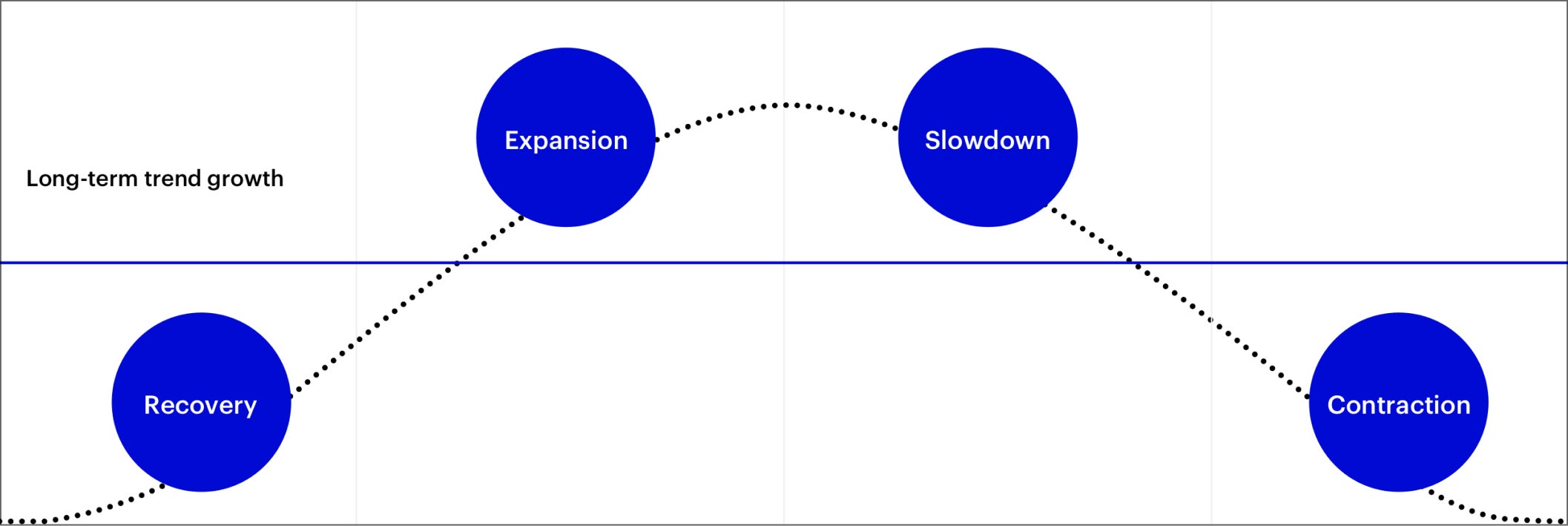

This diagram shows the four distinct regime periods of recovery, expansion, slowdown, and contraction and which factor tilts correspond with each regime.

| Recovery | Expansion | Slowdown | Contraction | |

|---|---|---|---|---|

| Long-term economic growth trend | Growth is below trend and accelerating | Growth is above trend and accelerating | Growth is above trend and decelerating | Growth is below trend and decelerating |

| Size | X | X | ||

| Value | X | X | ||

| Momentum | X | X | ||

| Low volatility | X | X | ||

| Quality | X | X |

Uses a rules-based approach that assigns securities a score for each investment style: Value, Momentum, Quality, Low Volatility and Size. Security weights are then tilted in a rules-based manner based on the factors most relevant to the current economic regime. For illustrative purposes only.

In addition to multi-factor equity, the Invesco Dynamic Growth Index also provides exposure to bonds when conditions warrant as an additional and complementary source of returns. Beneficially, bonds – and, in particular, US Treasury bonds – quite often experience less dramatic swings in returns relative to stocks.1

In most market environments, bond exposure in the index comes from exposure to 10-year Treasury bonds, which, historically, have delivered stronger returns than cash.2

However, a drop in price coupled with higher volatility in 10-year Treasuries often signals a rise in interest rates. When this happens, the index allocates a portion of the bond exposure away from 10-year Treasuries and into cash, potentially offering more price stability under these conditions. The goal is to provide more defensive exposure and help cushion the impact of declining bond prices.

Exposure to stocks, bonds, and cash are adjusted daily seeking to deliver a smoother performance profile for the Invesco Dynamic Growth Index over time.

For instance, when the riskiness of stock holdings rises, the index will shift away from stocks and into bonds, into cash or into a combination of bonds and cash.

On the other hand, as the riskiness of stock holdings decreases, the index will shift away from bonds or cash and into stocks.

Additionally, as the riskiness of the combined allocation of stocks and bonds rises and falls, the index allocates more and less, respectively, to cash.

In periods of high volatility, it may be possible for the index to be comprised heavily or fully of bonds and / or cash, which may persist as volatility is elevated. Due to excess return index construction, cash allocations in the index are non-remunerated.4

Why factors work

The centerpiece of the Invesco Dynamic Growth Index is a dynamic multi-factor approach. Value, Momentum, Quality, Low Volatility and Size are stock characteristics, or factors, shown by academics and practitioners to deliver more attractive returns historically than the broad market:3

Resources

Brochure

An overview of the index complete with strategy highlights and performance information

Transcript

Methodology

Rules and guidelines followed to build and maintain the index

Transcript

Factsheet

Information on the Invesco Dynamic Growth Index

Transcript

EU BMR ESG Disclosures

The purpose of this document is to outline the information required in Article 27 of the EU regulation on indices used as financial benchmarks (“BMR”) and Commission Delegated Regulation (EU) 2018/1643.

Transcript

NA4046221

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions. There can be no assurance that actual results will not differ materially from expectations.

Diversification/Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns and does not assure a profit or protect against loss.

Factor investing is an investment strategy in which securities are chosen based on certain characteristics and attributes that may explain differences in returns. Factor investing represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, both in active or passive vehicles. There can be no assurance that performance will be enhanced or risk will be reduced for strategies that seek to provide exposure to certain factors. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Factor investing may underperform cap-weighted benchmarks and increase portfolio risk. There is no assurance that the index discussed in this material will achieve their investment objectives.

Holding cash or cash equivalents may negatively affect performance.

Although bonds generally present less short-term risk and volatility than stocks, the bond market is volatile and investing in bonds involves interest rate risk; as interest rates rise, bond prices usually fall, and vice versa. Bonds also entail issuer and counterparty credit risk, and the risk of default. Additionally, bonds generally involve greater inflation risk than stocks.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Invesco Indexing LLC is an indirect, wholly owned subsidiary of Invesco Ltd. The group is legally, technologically and physically separate from other business units of Invesco, including the various global investment centers. NA2107793