NA3557569

Learn more about the MMI/Barron’s Industry Awards here. You are leaving for another site that is not affiliated with Invesco. This site is for informational purposes only. Invesco does not guarantee nor take any responsibility for the content.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Past performance does not guarantee future results. An investment cannot be made directly into an index.

All investing involves risk, including the risk of loss.

Some products are offered through affiliates of Invesco Distributors, Inc.

The opinions referenced above are those of the author as of March 2024. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

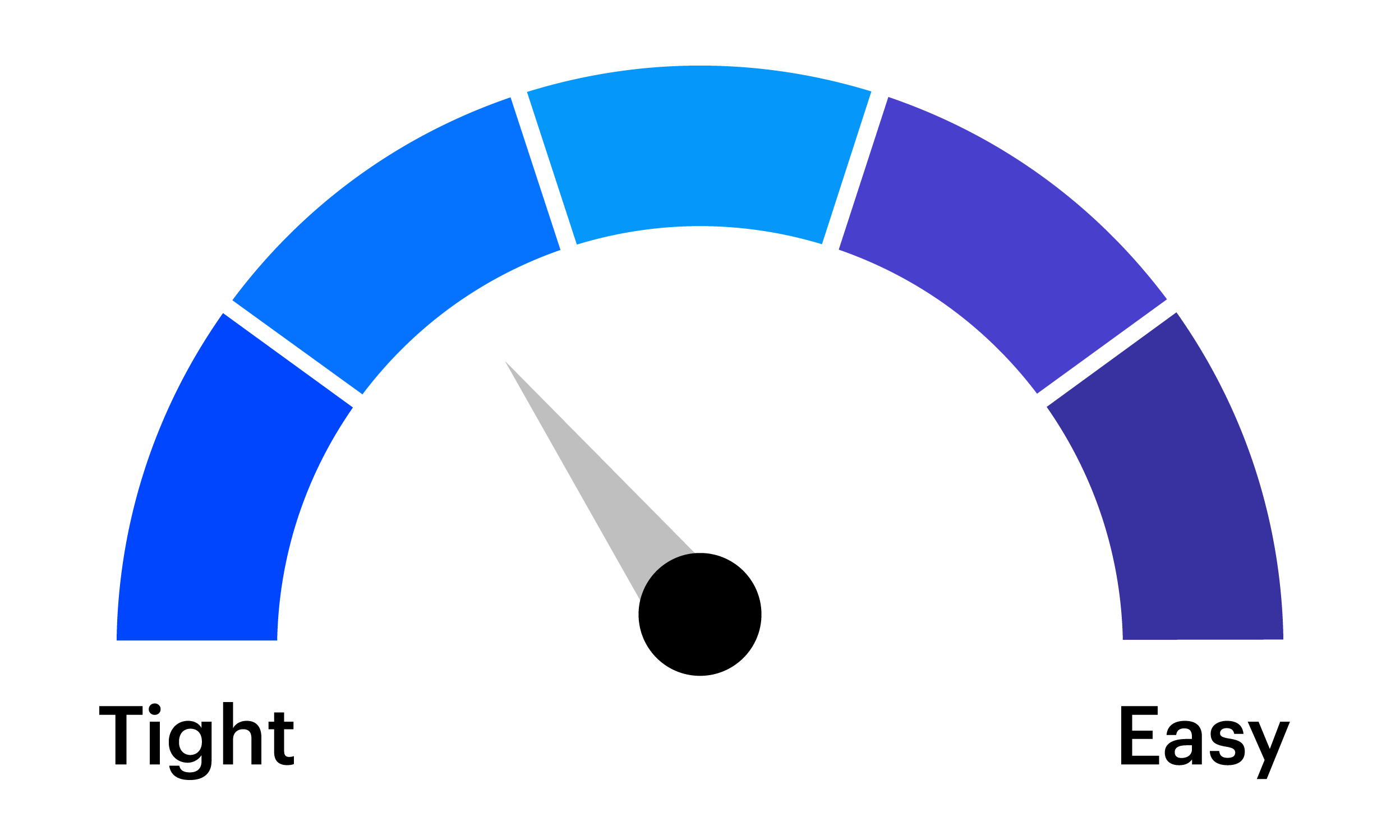

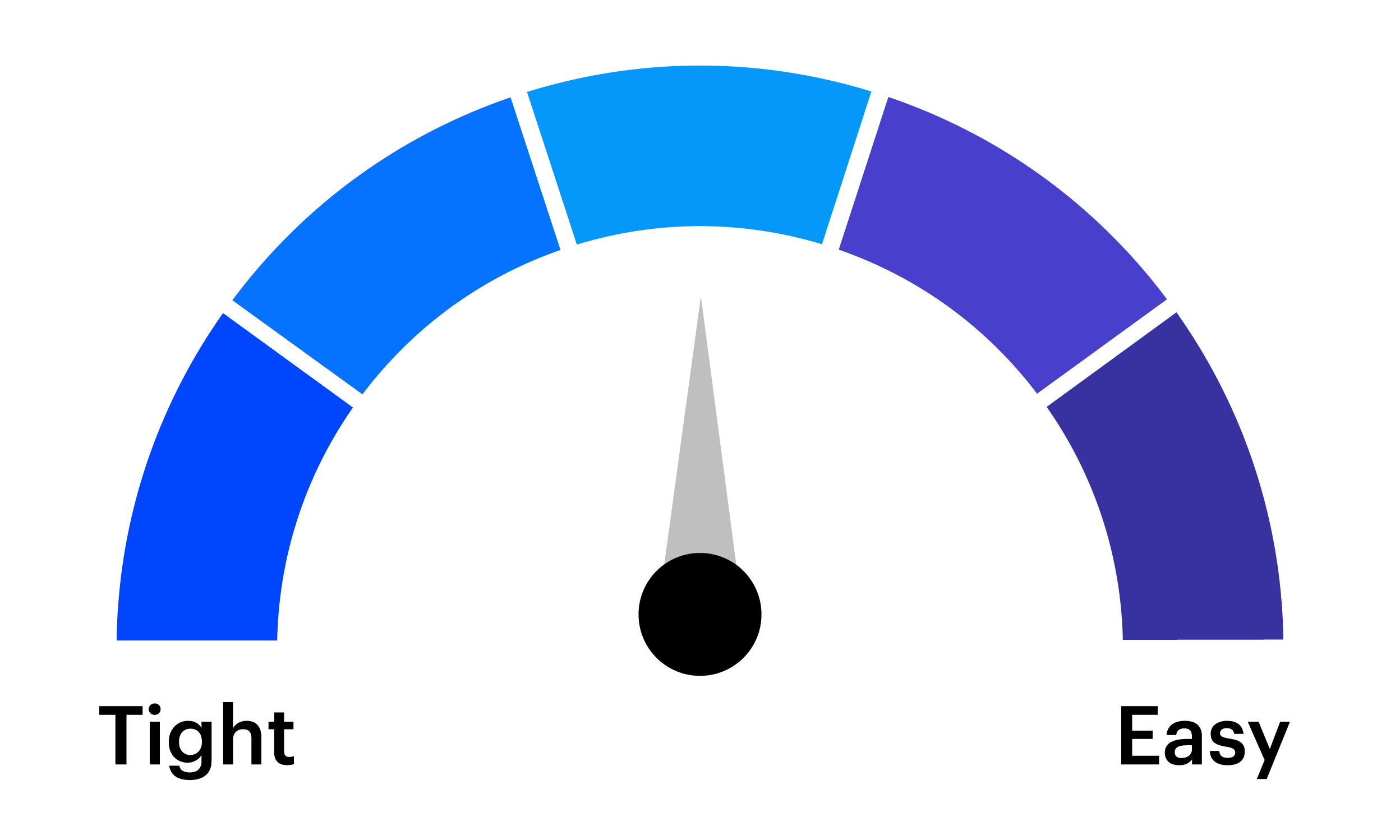

Tightening is a monetary policy used by central banks to normalize balance sheets.

There are risks involved with investing in ETFs, including possible loss of money. Index-based ETFs are not actively managed. Actively managed ETFs do not necessarily seek to replicate the performance of a specified index. Both index-based and actively managed ETFs are subject to risks similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply. The Fund's return may not match the return of the Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.

Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Stocks of small and mid-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Alternative products typically hold more non-traditional investments and employ more complex trading strategies, including hedging and leveraging through derivatives, short selling and opportunistic strategies that change with market conditions. Investors considering alternatives should be aware of their unique characteristics and additional risks from the strategies they use. Like all investments, performance will fluctuate. You can lose money.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

High yield bonds, or "junk bonds," involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

Municipal securities are subject to the risk that legislative or economic conditions could affect an issuer’s ability to make payments of principal and/ or interest.

In general, equity values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

An investment in emerging market countries carries greater risks compared to more developed economies.

A yield curve plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates.

BTCO Risks

See the prospectus for more information.

The Fund is speculative and involves a high degree of risk. An investor may lose all or substantially all of an investment in the Fund.

The Fund is not a mutual fund or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

Shares in the Fund are not FDIC insured, may lose value and have no bank guarantee.

This material must be accompanied or preceded by a prospectus. Please read the prospectus carefully before investing.

The Fund currently intends to effect creations and redemptions principally for cash, rather than principally in-kind because of the nature of the Fund's investments. As such, investments in the Fund may be less tax efficient than investments in ETFs that create and redeem in-kind.

Bitcoin has historically exhibited high price volatility relative to more traditional asset classes, which may be due to speculation regarding potential future appreciation in value. The value of the Trust’s investments in bitcoin could decline rapidly, including to zero.

The further development and acceptance of the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development or acceptance of the network may adversely affect the price of bitcoin and therefore an investment in the Shares.

Currently, there is relatively limited use of bitcoin in the retail and commercial marketplace in comparison to relatively extensive use as a store of value, contributing to price volatility that could adversely affect an investment in the Shares.

Regulatory changes or actions may alter the nature of an investment in bitcoin or restrict the use of bitcoin or the operations of the Bitcoin network or venues on which bitcoin trades. For example, it may become difficult or illegal to acquire, hold, sell or use bitcoin in one or more countries, which could adversely impact the price of bitcoin.

Option-adjusted spread (OAS) is the yield spread which must be added to a benchmark yield curve to discount a security’s payments to match its market price, using a dynamic pricing model that accounts for embedded options.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The Bloomberg US Aggregate Bond Index is an unmanaged index considered representative of the US investment-grade, fixed-rate bond market.

The Russell 1000® Value Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap value stocks. The Russell 1000 Value Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. An investment cannot be made directly in an index.

The Russell 1000® Growth Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap growth stocks.

The S&P 500® Low Volatility Index consists of the 100 stocks from the S&P 500® Index with the lowest realized volatility over the past 12 months.

The Russell 1000® Value Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap value stocks. The Russell 1000 Value Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. An investment cannot be made directly in an index.

The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

The Russell 1000 Quality Factor Index is comprised of securities within the Russell 1000 Index and tracks the performance of the ‘quality factor’. The quality factor is a recognized factor return premia supported by academic research that shows high-quality companies tend to outperform low-quality companies over the long-term.

The Russell 1000 Size Factor Index is comprised of securities within the Russell 1000 Index and tracks the performance of the ‘size factor’. The size factor is a recognized factor return premia supported by academic research that shows smaller companies tend to outperform larger companies over the long-term.

MSCI Emerging Markets TR Index: The MSCI Emerging Markets Index captures large and mid-cap representation across 24 Emerging Markets (EM) countries. With 1,375 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI World TR Index: The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries. With 1,465 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.