Private credit Why CLO equity now

Collateralised loan obligation (CLO) equity can be a compelling diversifier and has the potential for attractive absolute and risk-adjusted returns.

As a team we describe valuation as the core of our process. We care about the price we pay for assets, for the simple reason that we believe the best long-term returns come from buying when stocks are cheap and selling as they become fair valued.

To be very clear; we do not buy stocks because they are cheap. Instead, being cheap piques our interest and that is when our fundamental analysis begins. Our process requires us to understand why the stock is cheap and, more importantly, what will stop it being so. Our analysis involves thinking about multiple facets, including but not exclusively: market positioning, sector dynamics, existing returns, earnings, marginal returns, operational momentum, free cash flow, balance sheet…the list goes on.

We work through these elements and as the process concludes, we come up with a range of share price outcomes and balance the upside against the risks and then we compare the new idea to our existing portfolio of ideas. Typically, as a team, we are fully invested. Our philosophy being, clients have allocated to us to get exposure to European equities, not for us to hold cash. Being fully invested means that for us to add a new idea to our funds, we typically need to sell something. A new investment needs to earn the right to get into the fund: more upside for the same risk, similar upside with less risk, upside with a different risk. New ideas need to add something we do not currently have and if they do shift the overall balance of the portfolio, it must be in the direction we want to take it.

All of which explains why our funds today look the way they do: namely ‘Value’ biased.

We never had a team meeting where a strategic top-down decision to lean towards ‘Value’ was taken: nothing could be further from the way we work as a team. Not least because we think Factor investing has got a lot to answer for: by compartmentalising the market, it can inappropriately pigeonhole companies.

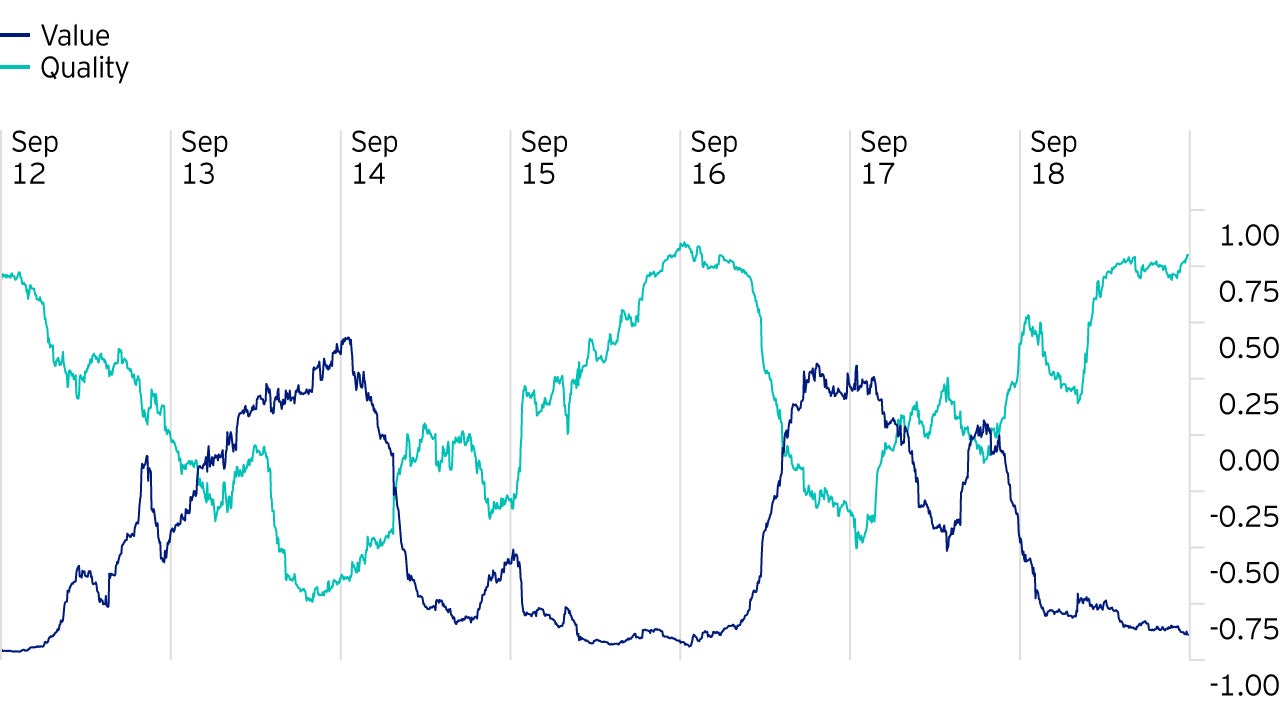

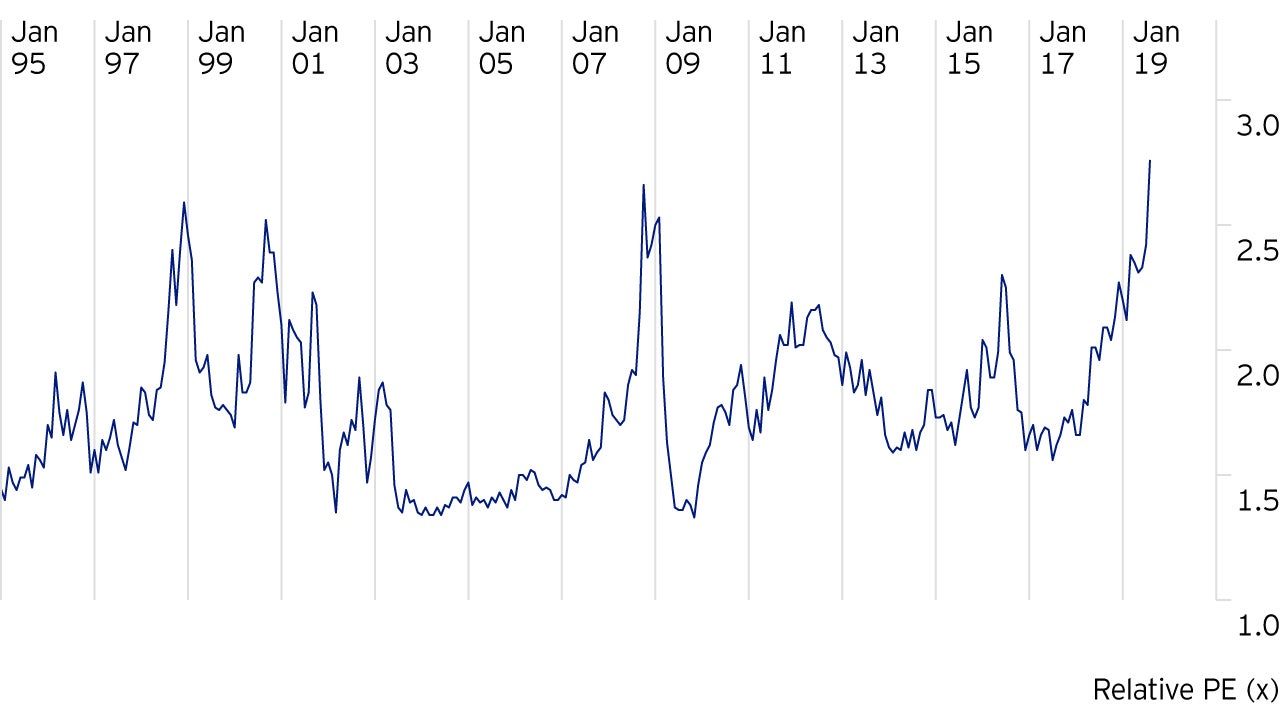

We found ourselves spoilt for choice at the ‘Value’ end of the market and as we carried out our analysis, we found that area of the market to be populated by companies with great business models, strong balance sheets, improving earnings, healthy and sustainable shareholder returns and, crucially, shares trading at silly prices. When we looked to find room for these ideas in the funds, the casualties were stocks that had become highly rated: ‘Quality’ stocks in the portfolios. The companies we sold may have had strong franchises, solid earnings potential and strong returns, but they also had high valuations, a function of their being consensually liked. Indeed, there was a high correlation between the Quality and Momentum factors. All sources of risk and downside.

The result, over time, was evident to see, that as the valuation of ‘Value’ fell, so our exposure increased. The corollary, of course, being that the exposure to ‘Quality’ fell as it became more expensive. The driver was a combination of market opportunities, a function of positioning, and our process, but it meant that ‘Value’ found us…we never knowingly went looking for ‘Value’.

Whilst it is a fact that ‘Value’ found us and we were not taking a top down view, it is also true to say it did not arrive unnoticed or unchallenged. We challenged each idea individually and the overall portfolio bias, but each time the conclusion was the same: we are happy to be a ‘Value’ fund today.

We believe the lack of interest in large swathes of the market means our hunting ground is rich in inefficient prices; we believe exposure to domestic EU cyclicality is not foolhardy; we believe the relative valuation differential between factors is unsustainable; we believe it is wrong to believe in monetary policy and nothing else; we believe recession risk is priced into the cyclical areas of the market and not others; we believe our exposures offers our unit holders uncorrelated returns to bonds.

To conclude, ‘Value’ found us because of our tried and trusted investment process. We have gone where the most attractive valuations have taken us – not without giving thought to the kind of portfolios being constructed, but rather above all because we have striven to create something which is aligned with our clients’ best interests. Valuation is far more than just an investment tool: it is the ultimate sanity check.

Collateralised loan obligation (CLO) equity can be a compelling diversifier and has the potential for attractive absolute and risk-adjusted returns.

April's fixed income markets saw mixed performance and volatility. Read our latest thoughts on how fixed income markets fared during the month and what we think you should be looking out for in the near term.

We cover a wealth of recent data reports and explore what they could mean for the path of growth going forward.