Invesco Investment Solutions is proud to present our 2022 Capital Market Assumptions (CMAs). We hope the insights and data presented in this publication assist in your asset allocation process as you begin to rebalance portfolios in the coming months.

We have made significant enhancements this year for our CMAs including the launch of custom client CMAs and an industry benchmarking process within our analytics platform, Vision. We have expanded our coverage to include APAC direct real estate CMAs, taxable US municipal bonds, improved our modeling of private infrastructure equity, US TIPS and inflation in developed markets, and carried out additional COVID-19 fundamental adjustments on our earnings growth expectations.

Overall, we are covering over 170 assets in nearly 20 currencies across public and private markets to aid our clients globally in assessing their investment opportunities.

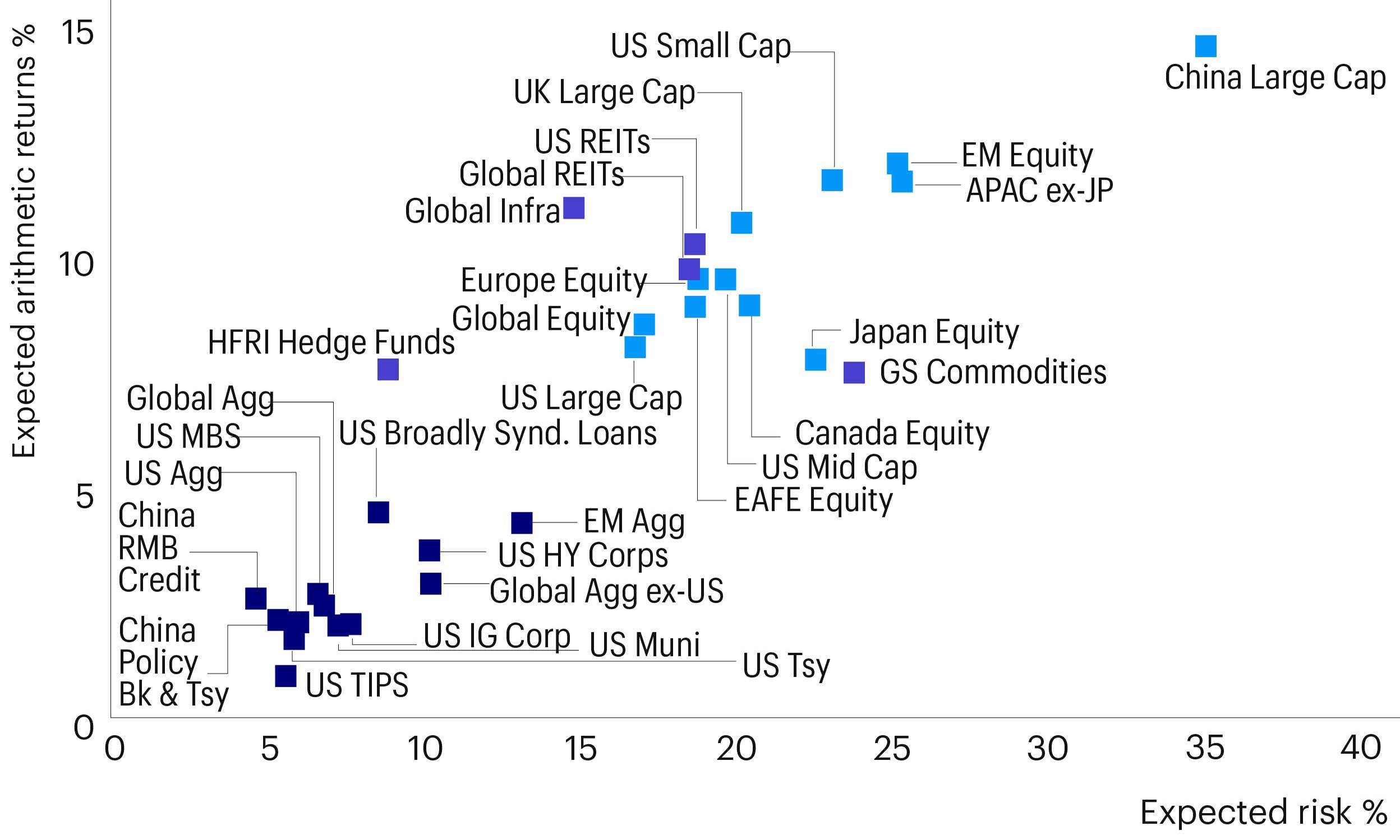

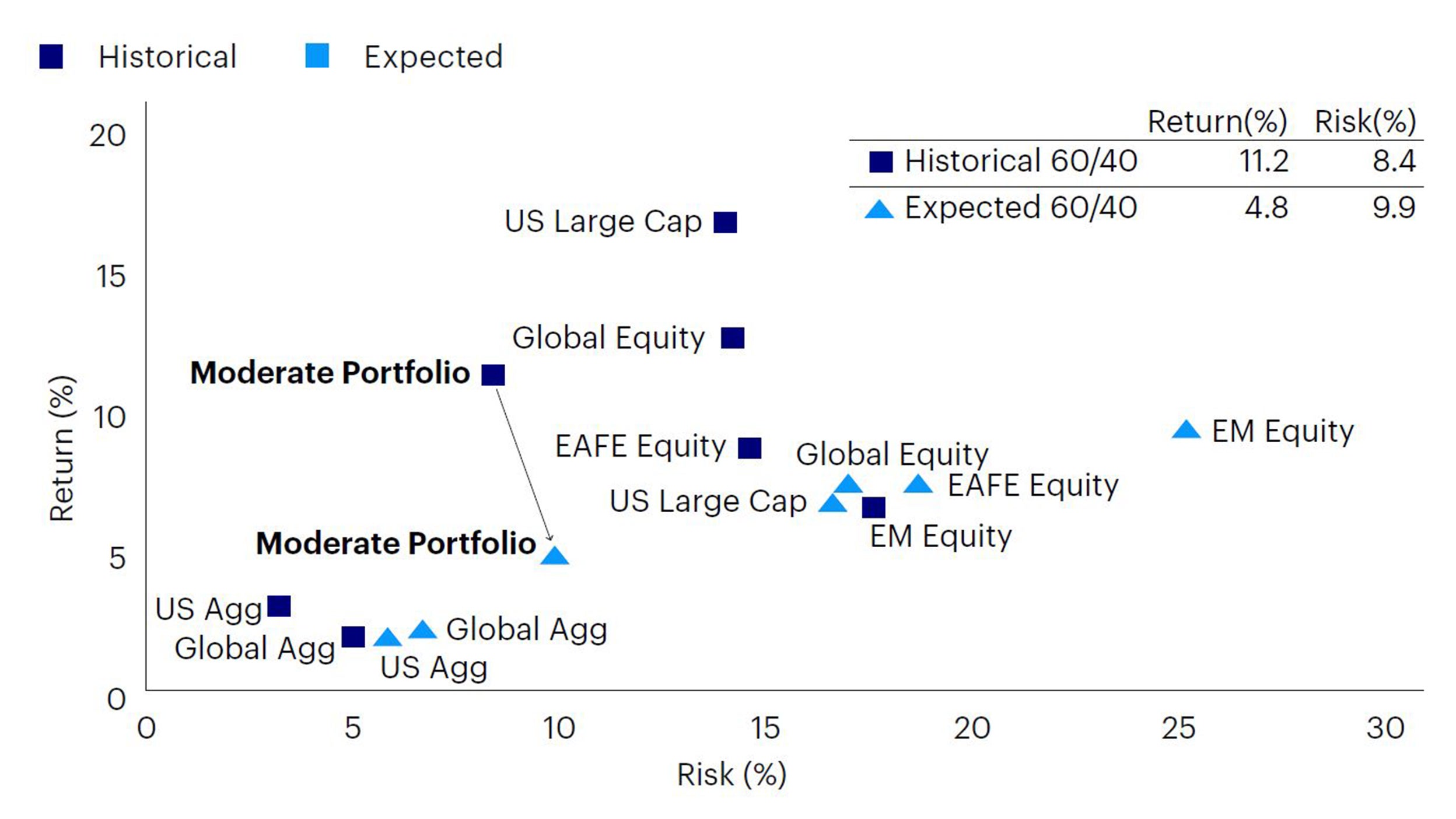

10-year Capital Market Assumptions

Expectations relative to historical average (USD)

Strategic Perspective

Many of the risks that existed before the pandemic are still relevant today; elevated valuations in developed economies will likely detract from prices, and some of the largest bubbles exist outside of equities, within the fixed income market, centered on duration and inflation risks as rates are low and rising, with spreads on most credit assets back to pre-pandemic tights.

Tactical view

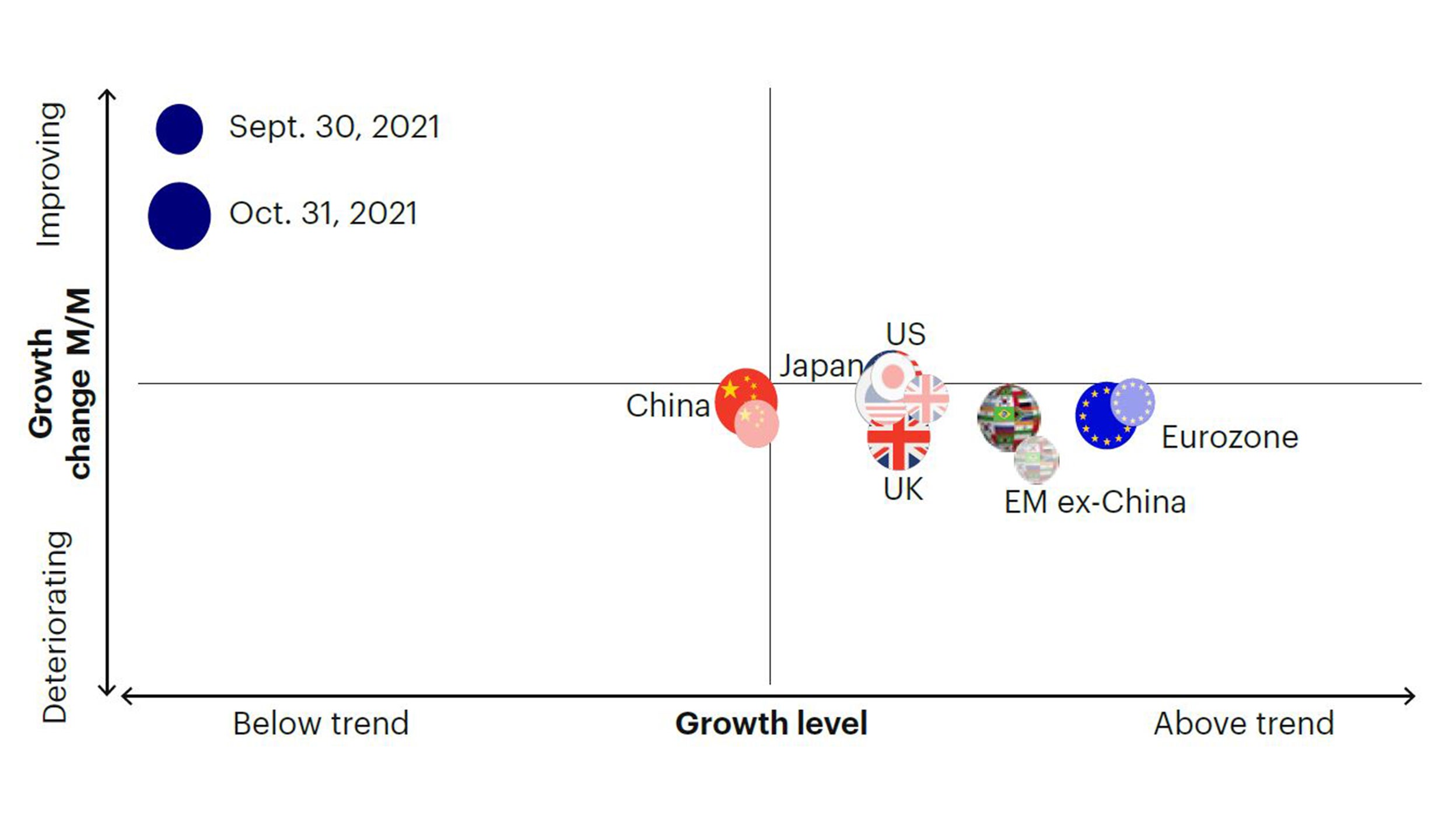

Our framework still points toward an expansionary regime. However, hawkish monetary policy repricing and flattening of global yield curves is a reminder of rising slowdown risks into 2022. We maintain a higher risk posture than our benchmark1, favoring equities, credit, cyclical factors/sectors, and emerging markets. We have further reduced our exposure to foreign currencies, given negative growth surprises outside the US.

Global Market Outlook

As we look ahead, we expect an improving economic environment in the fourth quarter, largely driven by the US. The US is benefiting from a drop in COVID-19 cases, helped by a modest increase in vaccination levels, which should result in an acceleration in economic growth. However, we expect a moderation in economic growth towards longer-term trend rates in 2022 as fiscal stimulus declines and the economy normalises.

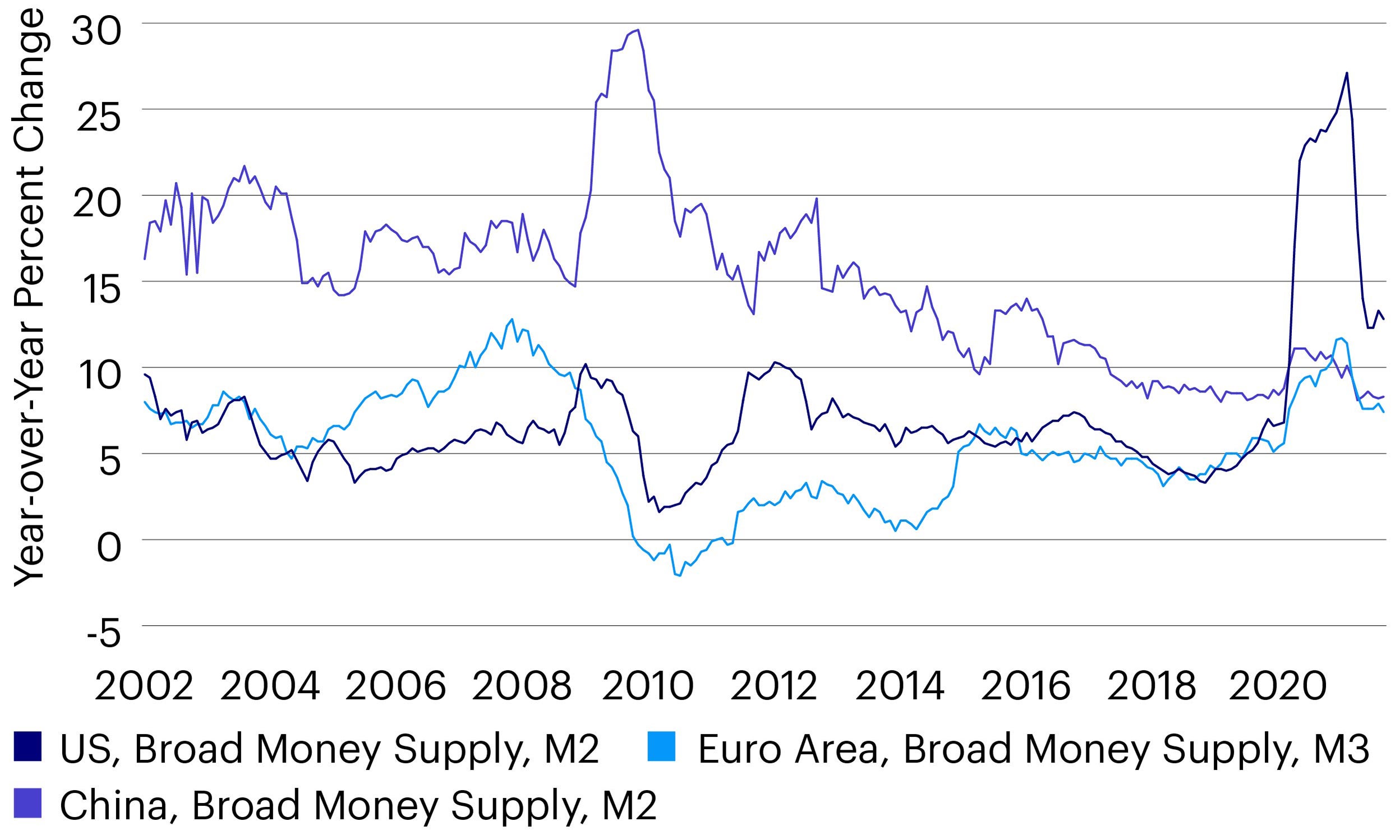

Inflation remains a significant tail risk. As economies continue to reopen and spending increases, inflation should remain elevated, but we believe this is unlikely to cause the Federal Reserve (Fed) to hasten tightening. The Fed continues to maintain a patiently accommodative stance and appears to have learned its lessons from 2013; it is moving gingerly in terms of normalising monetary policy. It has greater flexibility to do that given its adoption of a flexible average inflation targeting (FAIT) policy last year. Furthermore, we expect inflation to peak by mid-2022 as supply chain issues improve and pent-up demand fades. Over the longer term, we expect demographics and innovation to place downward pressure on inflation.