Inflation, remember me?

Inflation is on the rise in Australia, with interest rates likely to follow.

Where have we seen this before?

It’s been a long time since rising inflation and rising rates were front-of-mind for Australian investors. The most recent period to resemble the present was that of the global “energy crisis” of 2007/08 – which was a period of stepped-up Chinese demand for Australian resources and also the last high-point of Chinese economic growth1. By the end of that period, Australian CPI had peaked at 5% in September 2008 (up from 2% a year earlier) and interest rates had peaked at 7.25% (up from 6.5% a year earlier). What can we learn from this period about the likely performance of the Australian equity market in the present and near future?

History doesn’t repeat, but it rhymes: 2007/08 and 2021/22

The “energy crisis” period saw oil spike from around US $60 a barrel in 2007 to over US $130 a barrel in mid-2008 due to geopolitics (middle-east conflict) and supply-chain bottlenecks (Hurricane Katrina). A rise similar in dollar terms to the 2021/22 rises, which were also triggered by geopolitics (Russian sanctions) and supply-chain bottlenecks (COVID reopening, environmental policies). Both periods can be defined as cost-push inflationary.

In terms of resources (ex-energy), there was divergence in the ‘flavours’ of inflation between the two periods in Australia. Demand-pull inflation (China) defined the 2007/08 period, whereas cost-push inflation (supply-chain bottlenecks and Russia sanctions) define the current 2021/22 period. Also, the ‘flavour’ of GDP growth in Australia differed between the periods; 2007/08 was ‘strong’ off a ‘medium’ base rather than ‘medium’ off a ‘weak’ base as we observe today. In short, the two periods rhyme rather than repeat on resources and GDP growth.

Though the inflation/rate-rise period of 2007/08 was not sustained (the GFC enveloped the macroeconomic status quo like an enormous black hole) it was sustained enough to learn from our investment model’s simulated returns over the period, and to point to signal and factor trends which can illuminate the near future, as will be explored in this paper.

The Factors in 2007/08

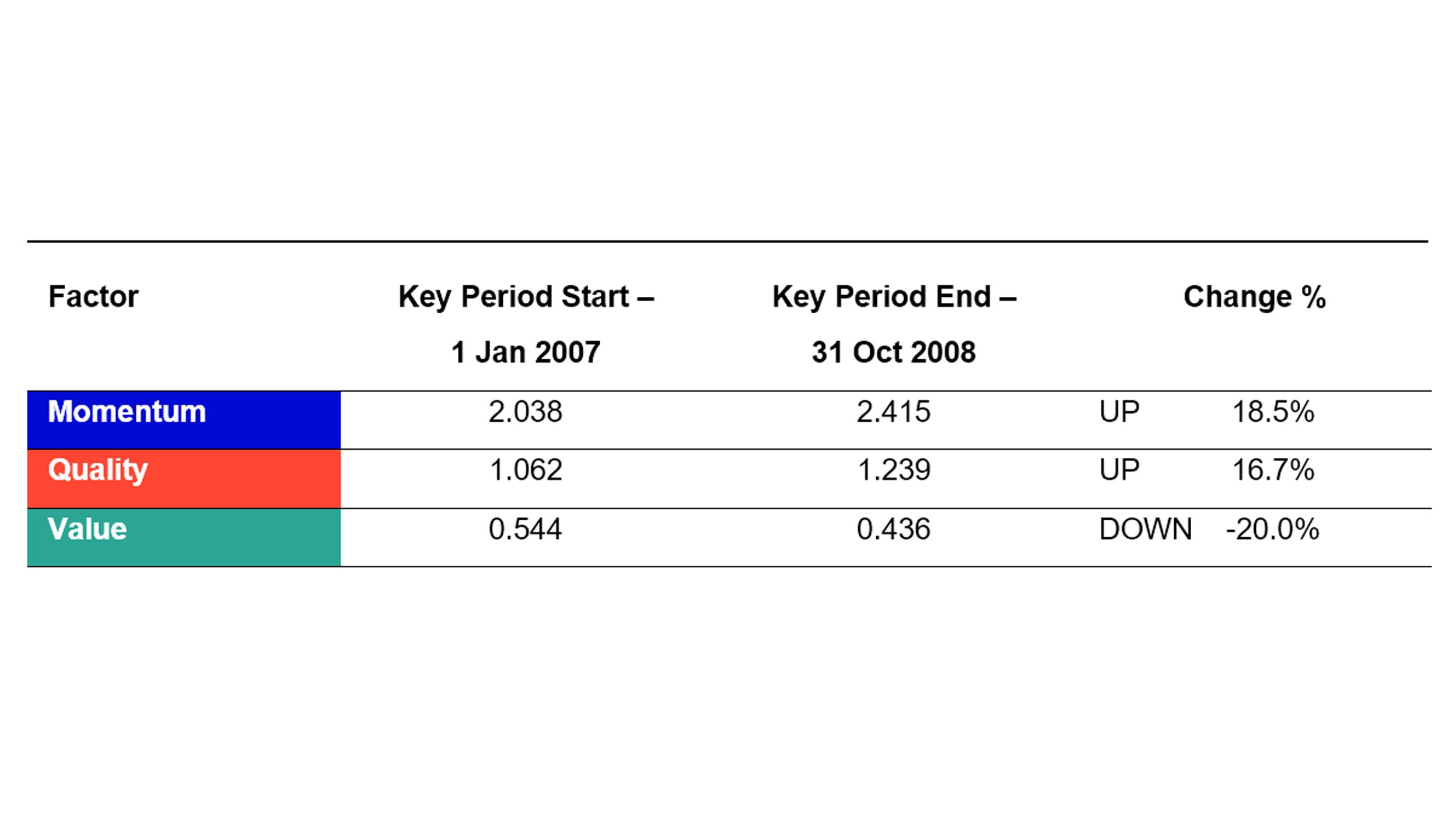

In the 2007/08 pre-GFC “energy crisis” period as interest rates and inflation rose the Momentum factor performed most strongly, followed by Quality. Value down for the period from a low base of cumulative performance (Figure 1).

Source: Invesco – 1st Jan 2007 – 31st Oct 2008. Simulated returns from Invesco Quantitative Strategies investment model as at 17th Mar 2022; cumulative factor returns from multivariate cross-sectional regression of factor exposures against stock returns for Australian stocks. Factors are composite exposures based on several underlying measures for each factor.

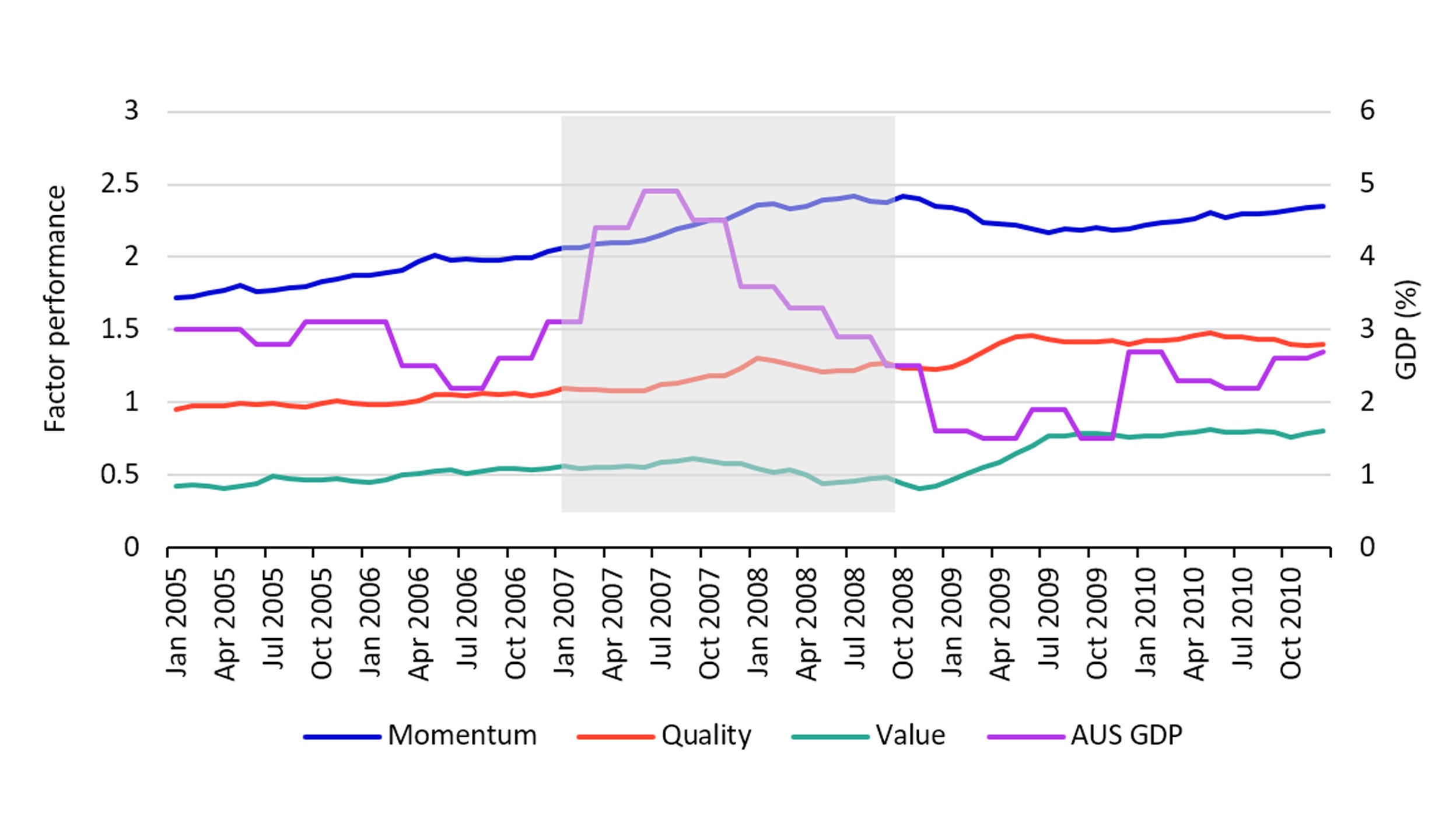

The Momentum Factor performs well during periods of extended growth, as it is good at picking up extended themes. Despite GDP peaking in 2007, the commodity theme persisted into 2008 with strong resource stock performance in Australia driving momentum returns (Figure 2).

Source: Invesco – 1st Jan 2005 – 31st Dec 2010. Simulated returns from Invesco Quantitative Strategies investment model as at 17th Mar 2022; cumulative factor returns from multivariate cross-sectional regression of factor exposures against stock returns for Australian stocks. Factors are composite exposures based on several underlying measures for each factor. FactSet: AUS GDP.

The Quality Factor identifies those companies with well managed balance sheets, by way of the Liability Payback Horizon and Net External Financing signals, amongst others. Quality tends to perform well when rate rises begin to hurt growth expectations and markets decline. Certainly, growth expectations declined from late 2007 as GDP growth began a -1.5% retreat over 2008 (figure 2)

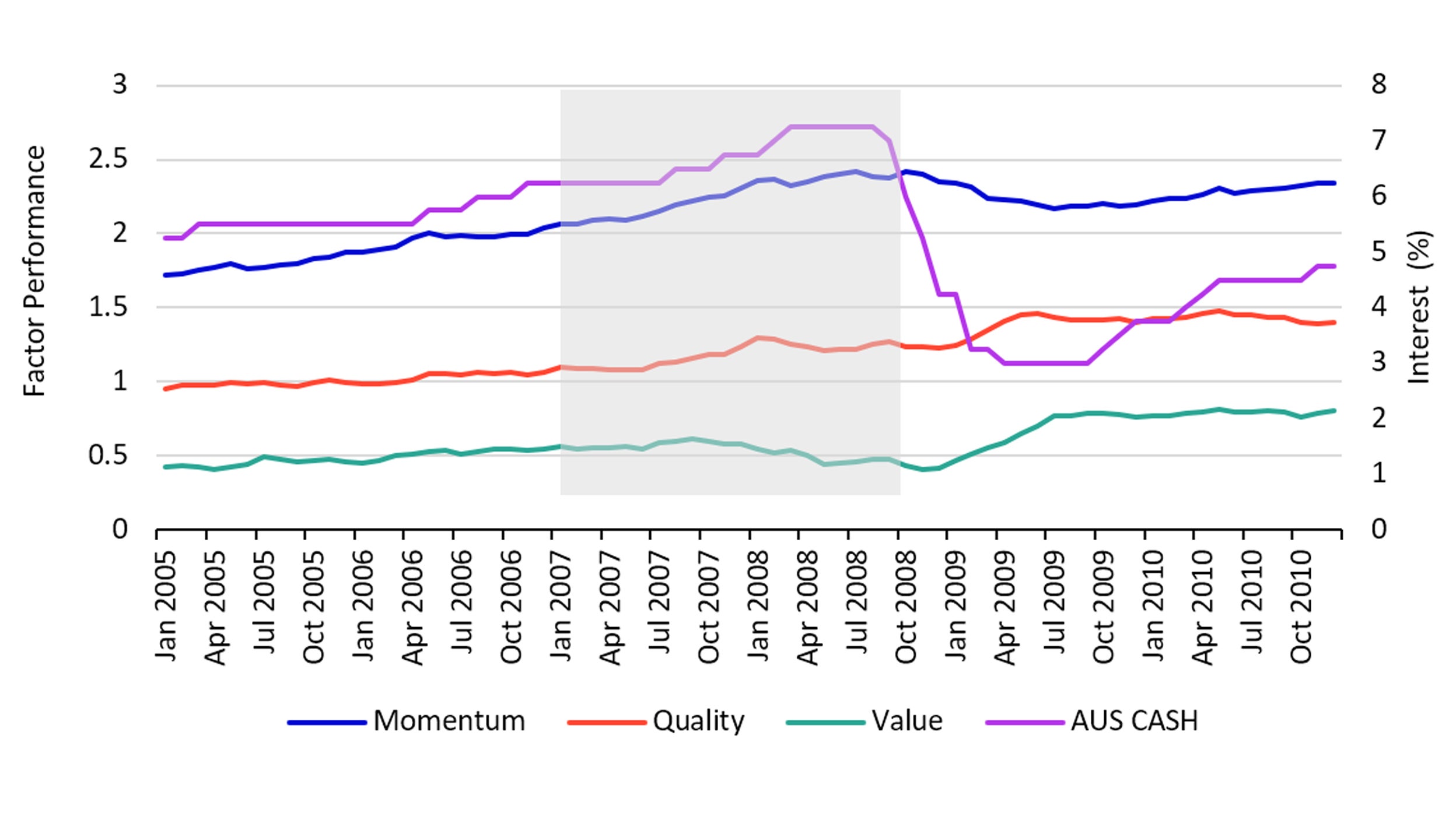

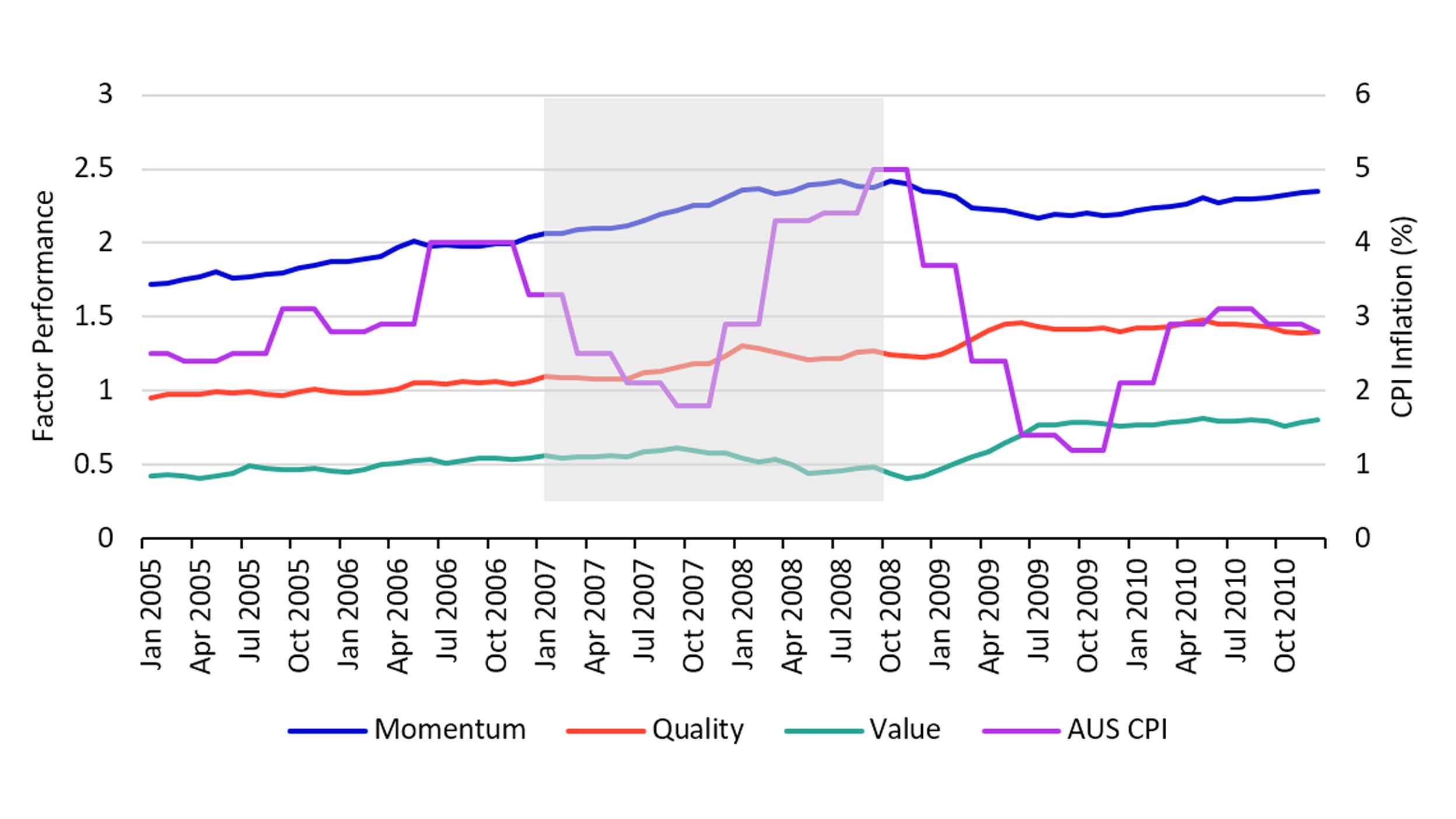

Part of the reason that Quality can be rewarded in these periods is that high quality company management (who manage high quality balance sheets) are likely to better navigate and accommodate the impact of interest rate rises (Figure 3), as well as inflation (Figure 4).

Source: Invesco – 1st Jan 2005 – 31st Dec 2010. Simulated returns from Invesco Quantitative Strategies investment model as at 17th Mar 2022; cumulative factor returns from multivariate cross-sectional regression of factor exposures against stock returns for Australian stocks. Factors are composite exposures based on several underlying measures for each factor. FactSet: AUS CASH.

The slightly lower returns for the concentrated portfolio is in line with the lower active risk for the concentrated benchmark (less risk / less return); there is less room to move with the concentrated benchmark weightings. However the differences are not particularly significant.

Source: Invesco – 1st Jan 2005 – 31st Dec 2010. Simulated returns from Invesco Quantitative Strategies investment model as at 17th Mar 2022; cumulative factor returns from multivariate cross-sectional regression of factor exposures against stock returns for Australian stocks. Factors are composite exposures based on several underlying measures for each factor. FactSet: AUS CPI.

The Value Factor performs in the early part of the growth cycle but tends to struggle when inflation, and consequent rate rises, create expectations of economic growth easing. Value Factor performance is quite flat and then dips in the later part of the period we are focusing on, 2007/08. A relationship with declining GDP can be perceived in Figure 2, as the 2007 commodities boom gave way to the rising inflation and rates of 2008.

Back to the future: 2008 and 2022

If the current period of rising rate expectations proceeds to actual rate rises, in response to the current inflation sticking, then we can expect a similar dampening effect on Australian GDP as seen in the 2008 period.

It is reasonable to expect that our propriety investment model will behave broadly in line with our simulated investment model performance over 2008, with Momentum and Quality rewarded, while Value is flat or even detracts.

So then why keep invested in Value? Simply, our investment philosophy is one of balanced factor investing, and we find that combining factors gives synergies beyond their standalone contributions. Value in particular acts as a guardrail against the excesses of Momentum – and the coming period could well be heavily Momentum driven.