The small cap space is also an incredibly opaque and inefficient market. These are all private companies without listed financials. You need to sign confidentiality agreements to access company information. Also, small cap companies are not widely followed allowing us to buy into these capital structures at attractive prices.

Q: To address the elephant in the room of a potential recession, if we agree there will be one, how do you go out and source these opportunities?

A: Due our preferred small cap habitat, we're a bit indifferent as to whether a recession occurs or not. We're obviously baking a recession into our base case and that's very important in terms of underwriting new opportunities. However, we think it is more important to consider what will happen with the rate environment. We believe as long as rates remain elevated, companies that have upcoming maturities are going to have a very difficult time refinancing.

We believe these issues may materialise across all industries. Interestingly, almost half of the senior loans and high yield bonds maturing over the next 36 months are split B-rated, potentially also increasing the number of company issuers experiencing distress and/or downgrades in a challenged economic environment. Importantly for us, over 40% of these businesses have less than US $500 million in debt outstanding – meaning they fall well within our small capitalisation target zone. In addition, significant percentages (30-40%) of recent new issuance across these markets are similarly situated – being B3/B- or unrated as well as issued by smaller companies. A period of significant downgrades could result in selling pressure for many original or “par” holders of this debt, particularly CLOs, who represent approximately 70% of the leveraged loan market1 and are limited in the amount of CCC-rated debt they can hold.

Q: Could you compare the distressed opportunities today versus what you've seen in past cycles?

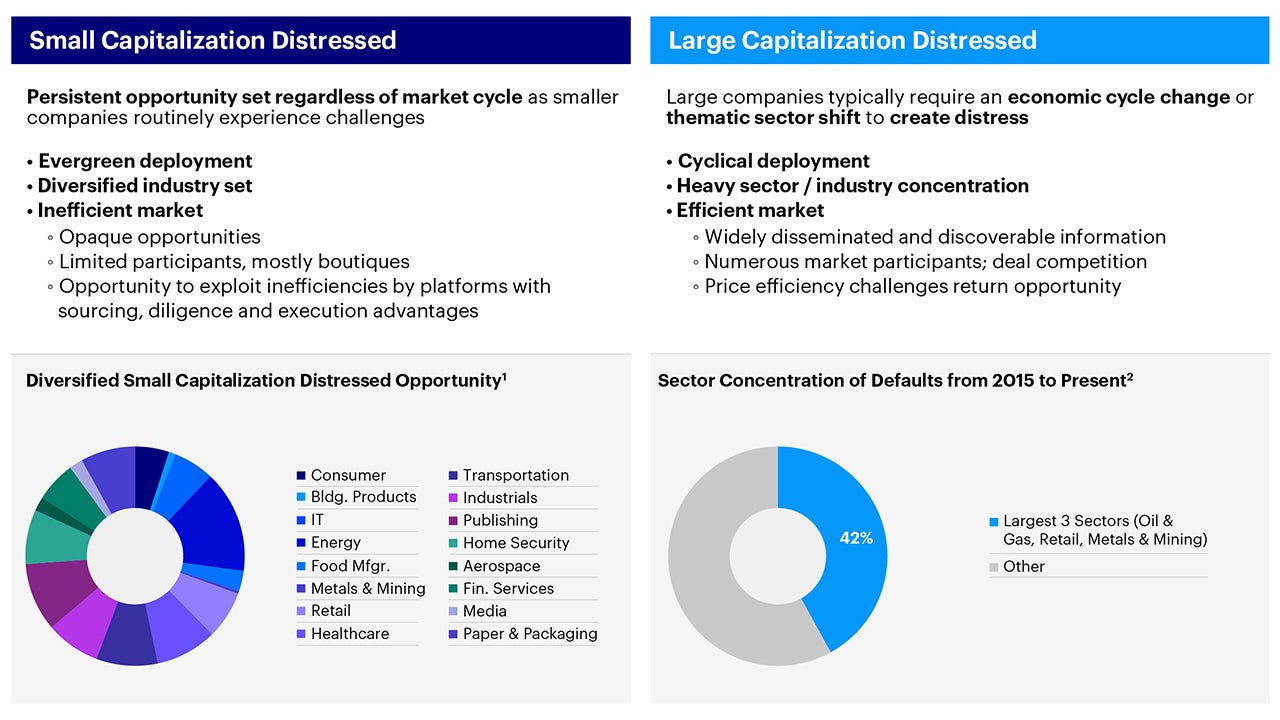

A: Today’s environment is very different than anything this asset class has ever seen. If you think about the cycles we’ve seen in the past 20+ years, they have mostly been very industry driven. The 2001 recession was tech, telecom and broadband-based. Then if you look in 2005 and 2006, we had an auto cycle in Europe. The GFC was also obviously very industry specific: financials, mortgages, home builders, building products; while 2015’s cycle was energy focused. Further, the last 10 to 15 years have seen issues in the retail sector as an e-commerce giant has disintermediated every non-experiential retailer in the market. Most recently, the COVID pandemic created an artificial economic cycle in that we slammed the door on the economy and then two and a half years later reopened it. This meant certain industries were more impacted than others such as travel, quick service restaurants, cinemas, etcetera.

In contrast, the opportunity set we're seeing today is much more broad-based. There's no one industry that's being impacted to a significant degree more than others. As distressed investors, we want to focus on the most compelling investments in robust companies and industries. Interestingly, and maybe more so than ever in the past, our opportunity set is less comprised of companies experiencing operational issues. This means we can spend more of our time investing in strong businesses and focusing on right-sizing company balance sheets or liquidity issues. As a result, the next couple of years look far less risky in terms of the market environment on a risk adjusted basis than what we've seen in prior vintages of distress.