China’s May PMI & COVID Update – Is the Worst Over?

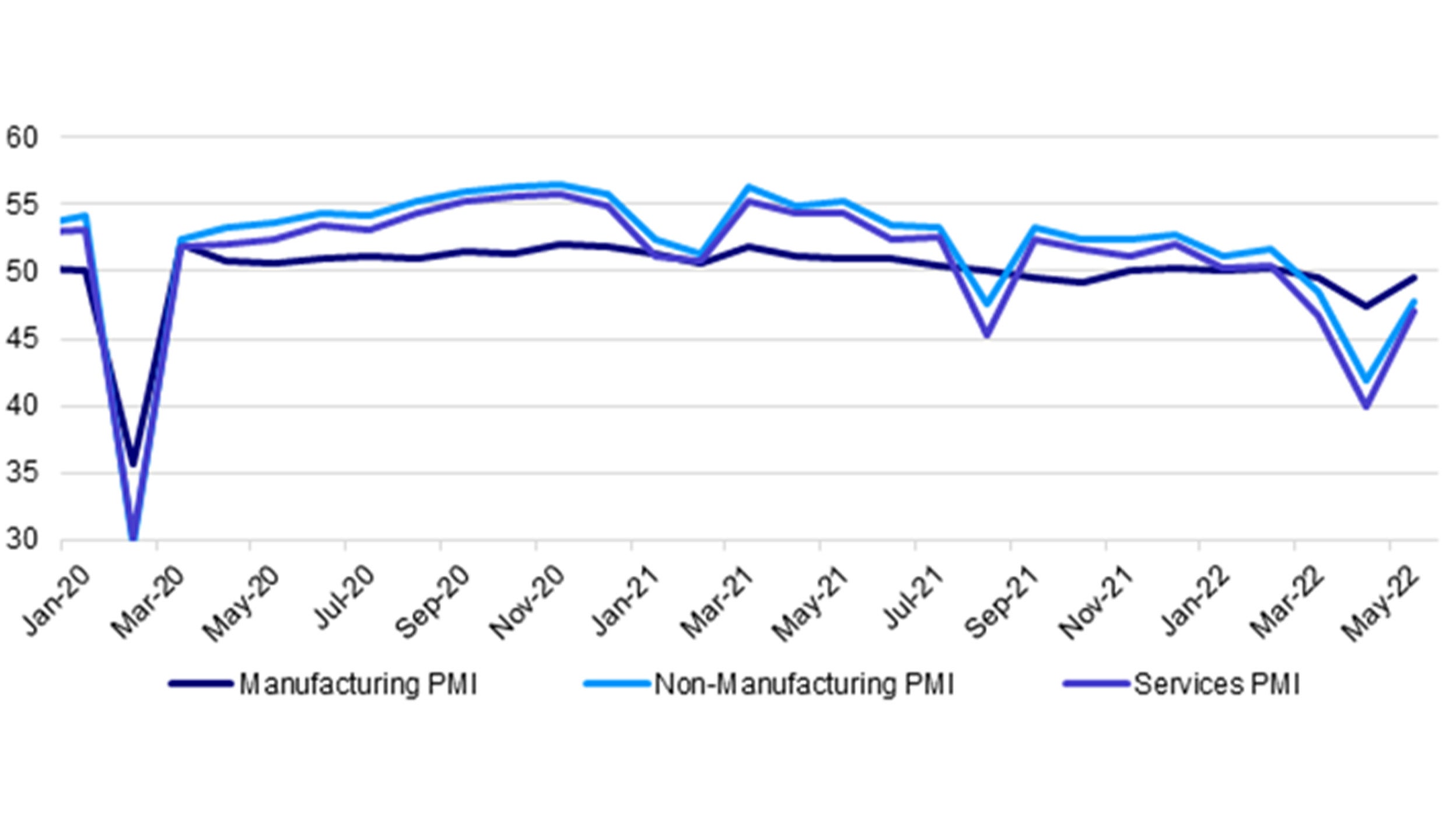

China’s May composite PMI rebounded to 48.4 from 42.7 in the prior month, driven mostly by the recovery from the services sector.1

Even though any reading under 50 reflects a contraction in activity, it’s still a welcomed sign that things aren’t getting worse in China and that conditions may be improving due to loosening COVID restrictions.

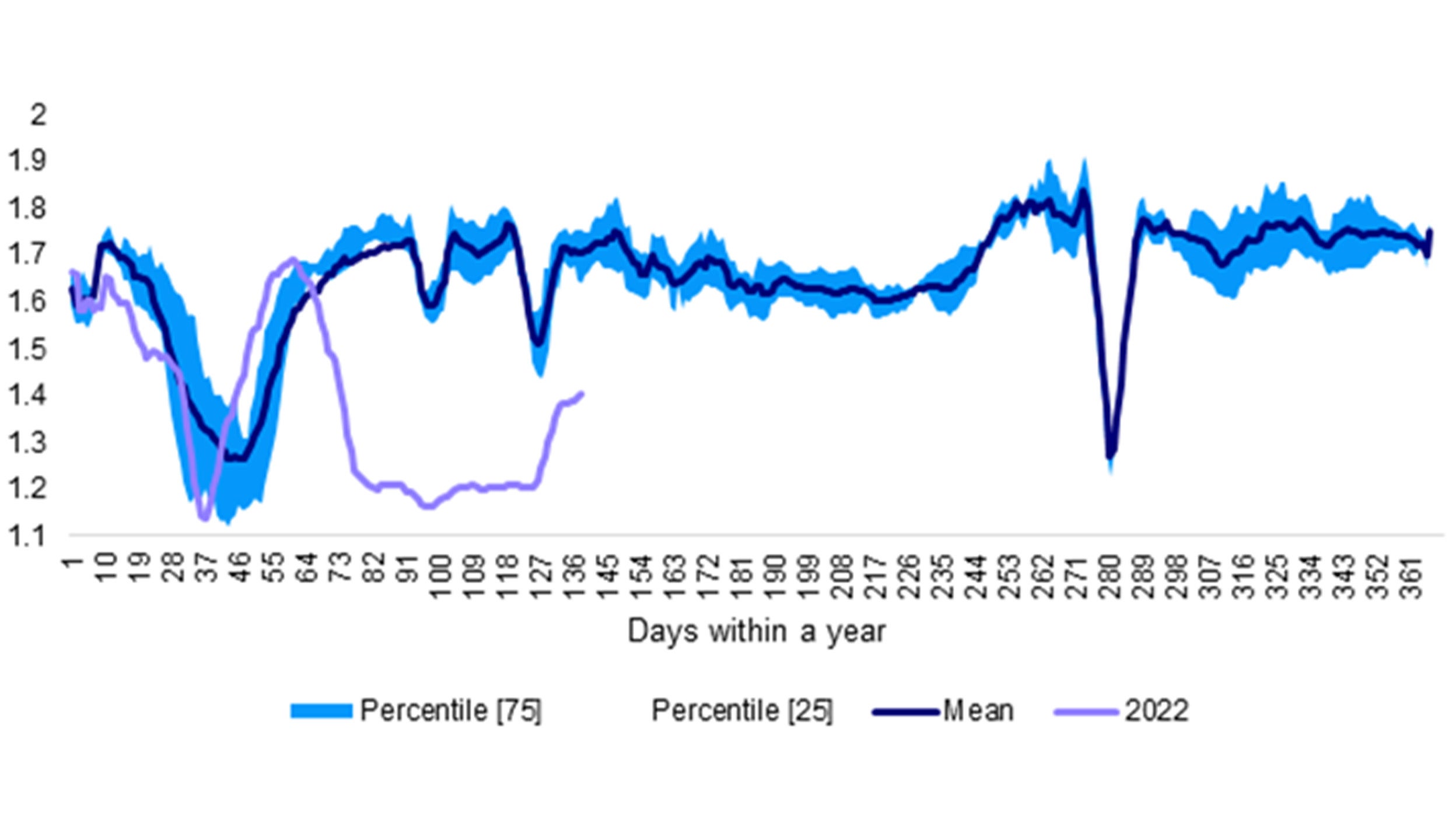

More importantly, I expect the coming few months’ PMI and monthly economic data to improve, especially in June since most restrictions in Shanghai were relaxed after the May month’s survey. Already, mobility indexes show a pick-up in consumer activity over the past few weeks.

Source: China Ministry of Transport. Data as of 18 May 2022.

China’s manufacturing PMI for the month of May recovered slightly to 49.6 - beating consensus expectations of 49.0 – and up from 47.4 in the prior month.1 It could be a matter of months before the manufacturing PMI survey marches firmly into the expansionary phase.

In addition to the pandemic lockdowns to worry about, business managers continue to struggle with supply chain disruptions. The survey shows that delivery times have lengthened even further and firms continue to draw down on their raw materials inventory, although less than previous months.

Furthermore, the most recent unemployment data shows continued weakness in the labor market.

Source: China Federation of Logistics and Purchasing. Data as of May 2022.

Services PMI – the brightest spot

On a brighter note, the producer price indices fell to their lowest level since December and overall new orders and export orders indices rose sequentially. This could indicate signs of a domestic demand pickup and that business sentiment in China isn’t getting worse - though no sharp U-turn can be expected.

The brightest spot from the official reading came in the services PMI, which saw a significant rebound to 47.1 from 40.0 as social distancing restrictions eased in the month.1 I expect a continued recovery in consumer activity due to declining new infections and easing restrictions across the country.

Although one months’ data doesn’t call for a trend, it’s becoming clear to me that the Omicron-induced economic bottom may have already been reached.

The government’s recent monetary and fiscal support measures should also stabilize growth and add fuel to economy’s main propellers. It’s possible that we’re seeing early signs of the economy slowly clawing its way towards a rebound in the 2H though the journey could be bumpy in light of a complicated global macro backdrop.

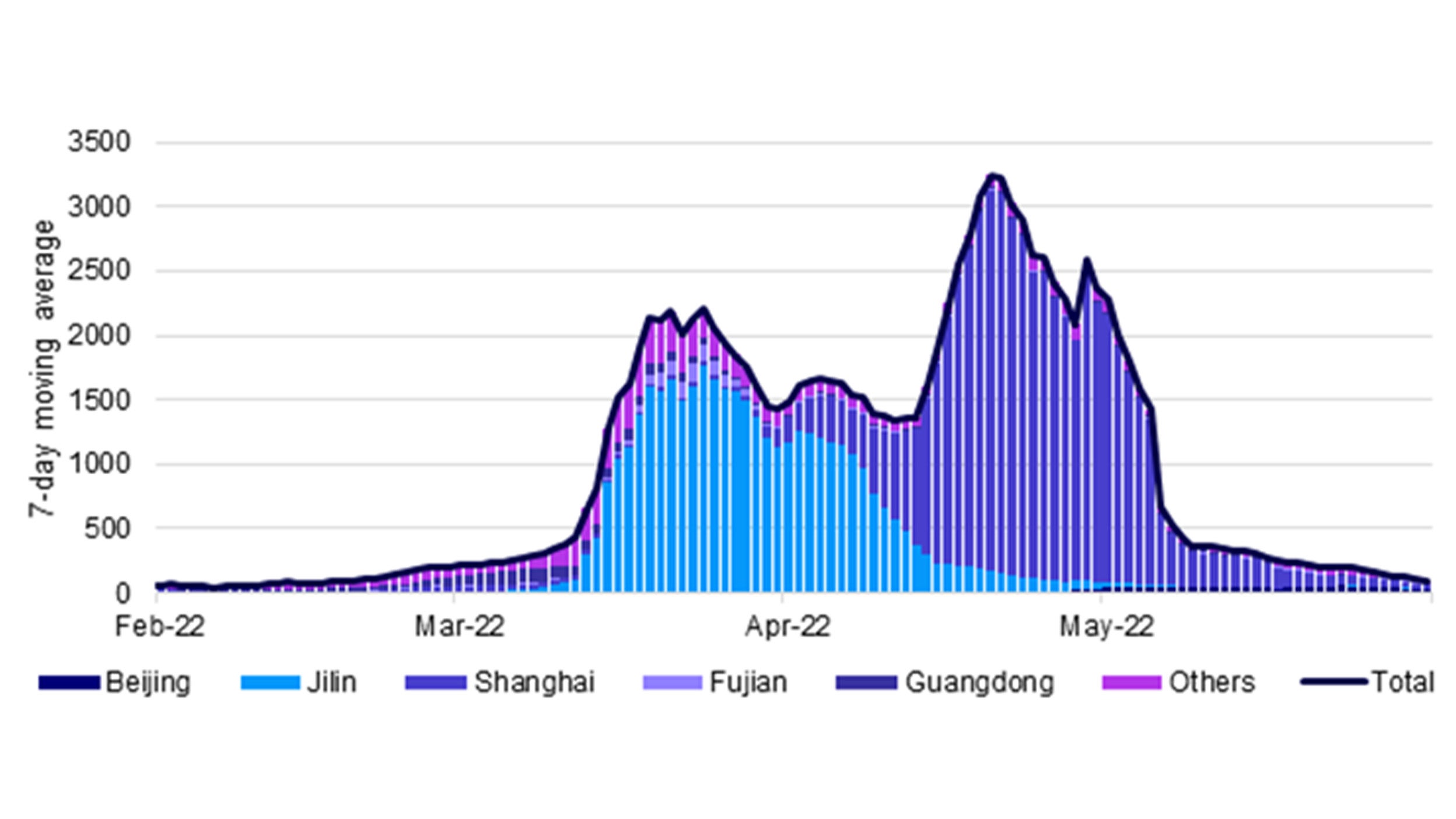

China’s COVID-Update

New COVID infections have been falling steadily in China and restrictions have been eased in Shanghai though a full reopening could take some time. Shanghai has already accomplished its society-wide zero cases since early May though mobility hasn’t rebounded much.

Beijing on the other hand, hasn’t achieved society-wide zero cases though the city is not under full lockdown but mobility measures have declined significantly. It’s clear that policymakers want to spare the capital city from a Shanghai-style lockdown that has cost the economy dearly.

Still, most cities in China are reopening though some large cities have also tightened - the overall national lockdown intensity barometer has stabilized since mid-March. It’s possible that investors could soon look through the Omicron wave as it approaches an end.

Source: China National Health Commission and DXY (Lilac Garden Family Clinics). Data as of 31 May 2022.

Even though policymakers remain steadfast towards pursuing a zero-COVID policy, they have recently announced a raft of growth stabilizing measures to support SMEs and the labor market.

I expect China to undertake a gradual reopening stance rather than quickly ending lockdowns.

If the majority of cities in China can continue to gradually ease restrictions, it’s possible to imagine a “new normal” in China – one that consists of a reopening in stages that could first lead to the manufacturing and the services sectors staging a meaningful recovery followed later by consumption spending.