Digital Currencies: The (Coming of) Age of Central Bank Digital Currencies

Key takeaways

Central Bank Digital Currencies (CBDCs) Are No Longer a Fringe Fascination

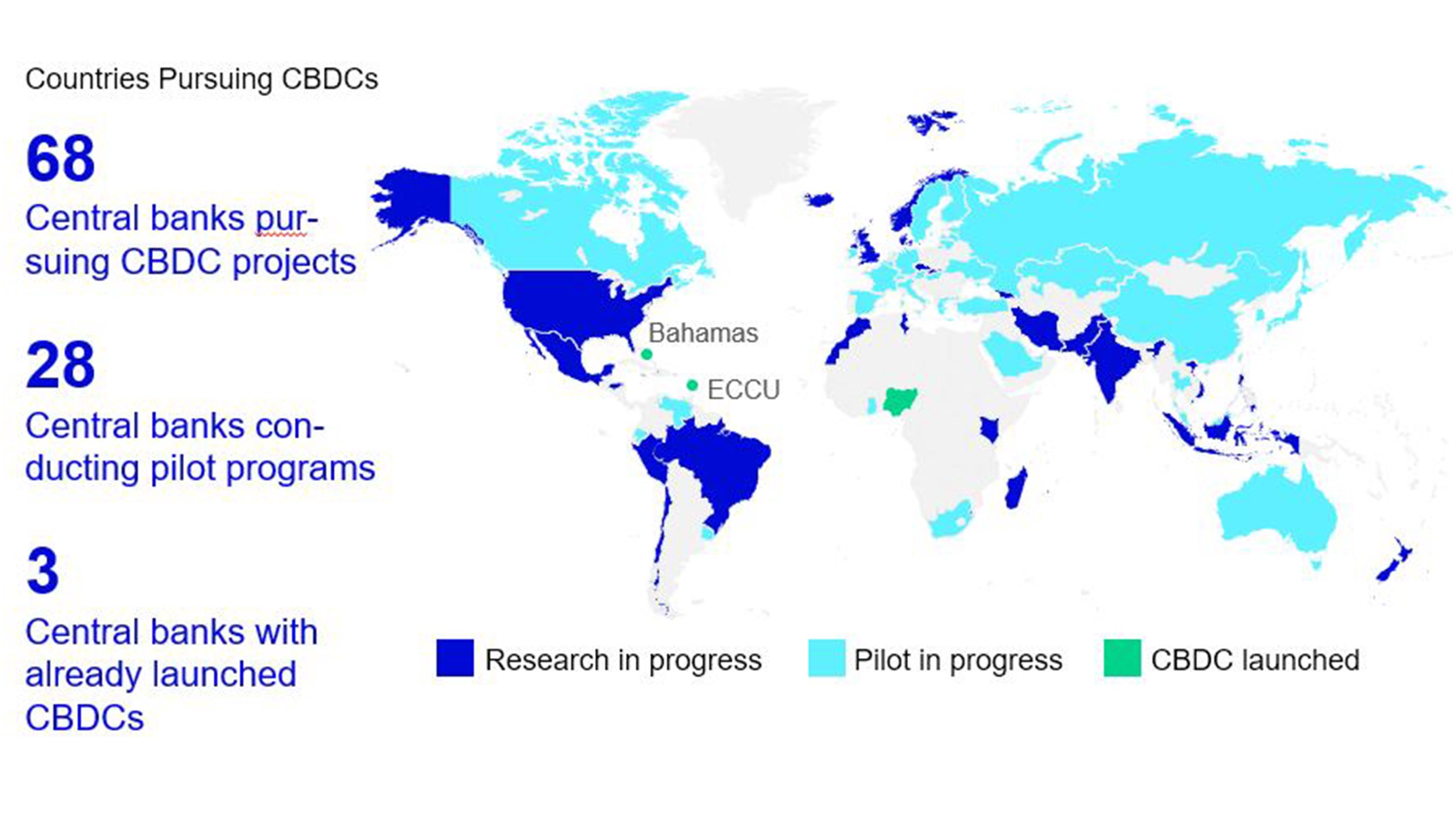

Many countries are actively exploring or have already launched CBDCs

Once a pipedream of the digitalization of finance, central bank digital currencies (CBDCs) have reached a critical moment. Small states in the Caribbean have pioneered the world’s first official digital currencies, while China has continued to expand its digital yuan’s pilot project to the masses. 38% of central banks are actively researching a CBDC of some kind encompassing 76% of the world’s population. Of those, 46% are currently conducting or have already completed a pilot program. It is our view that CBDCs are not a question of if, but when.

In this piece, we seek to define and explore CBDCs and assess their characteristics and their disruptive potential. We address the potential implications for monetary policy, financial markets, banking, and asset prices. We conclude with an overview of major CBDC projects, including China’s digital yuan and the case for a digital US dollar or euro.

ECCU = Eastern Caribbean Currency Union, comprising Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines.

Sources: Auer, R, G Cornelli and J Frost (2020), "Rise of the central bank digital currencies: drivers, approaches and technologies", BIS working paper, No 880, August, latest available data as of 31 January 2022.