Applied philosophy - Factors in the fog of war

Hopes for a quick resolution to the Russia-Ukraine conflict were dashed again this week. We believe that in the short term the war will continue to drive financial markets and commodity prices. We envisage three scenarios on how the situation may develop (resolution, prolonged war, war plus energy crisis), which in turn imply different outcomes for global economic growth and inflation. We believe that markets will remain in flux until the situation clears and we analyse how these scenarios may impact our equity factor indices.

The conflict in Ukraine seems to be nearing a stalemate with no end in sight. However, most risk assets have returned to pre-invasion levels perhaps in the hope that the two sides may be able to reach a peace agreement. There may also be relief that the US Federal Reserve (Fed) raised its target rate by only 25 basis points, although the general rhetoric has been more hawkish since. Importantly, commodity markets have remained tight and driven by concerns around ongoing supply disruptions.

Higher commodity prices keep worries about inflation in the forefront of investors’ minds. Moderating economic growth partly driven by falling real incomes casts a shadow over consumer spending raising the prospect of a period akin to stagflation. Nevertheless, we think that remains a tail risk alongside recession triggered by overly aggressive Fed tightening.

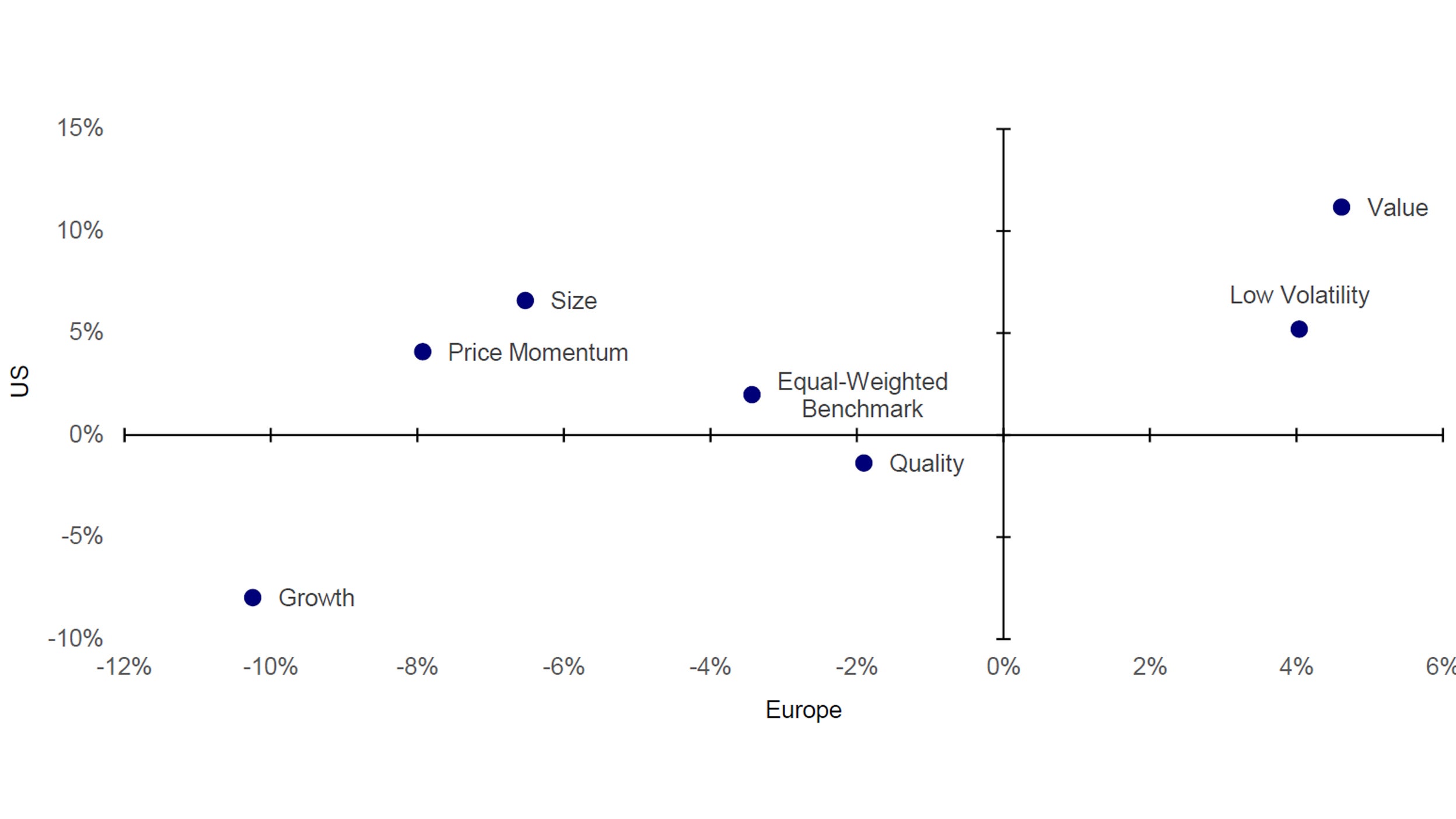

Still, rising inflation and lower growth is a difficult environment for financial assets. All global asset classes declined in the first quarter of 2022, apart from commodities, a real asset. This is consistent with our analysis of asset classes in periods of high and accelerating inflation (see here for the full report). Similarly, assets that have outperformed within each asset class are either relatively defensive, such as Japanese stocks or real estate, or have exposure to rising commodity prices, for example UK equities or Emerging Market (EM) real estate. We have observed a similar pattern in equity sector returns with resource-related sectors (energy, basic materials and utilities), non-healthcare-related defensives (food products, tobacco and telecommunications) and financials (boosted by rising rates) outperforming. We would expect these sectors to provide exposure to the value factor and low volatility, which have been the only two outperformers in both the US and Europe year-to-date (Figure 1). Can these two factors continue to outperform?

We think that in the short term, what happens in Ukraine will drive risk assets, and therefore equity factors. The impact of the conflict on commodity prices will also affect inflation rates and monetary policy. We outlined three scenarios for the war in the latest The Big Picture. In our view, markets have most probably priced in a war of attrition with elevated commodity prices and lower global GDP growth. Thus, we expect a resolution (either through Russian withdrawal or occupation of Ukraine) to be bullish for risk assets.

Notes: Data as of 31st March 2022. Showing total returns of factor indices and the equal-weighted regional benchmark relative to the S&P 500 index in the US and the Stoxx 600 index in Europe since 31st December 2021. See appendix for factor index definitions. Past performance is no guarantee of future results. Source: Refinitiv Datastream and Invesco

On the other hand, we would view an escalation and an energy crisis as bearish. We think that how our US and European factor indices may respond to these scenarios depends on their sector exposures and we compare how they have changed compared to their pre-pandemic situation.

Growth is the most concentrated factor index both in the US and Europe with their four largest sectors accounting for 73% and 63% of their constituents respectively. Unsurprisingly they are both dominated by technology, healthcare and industrial goods & services (mainly payment processors, professional services, specialist manufacturing and transportation). The main difference is the high exposure to retailers in the US, while the European index is more exposed to real estate.

Low volatility is the second most concentrated index in the US and the third in Europe with 64% and 50% in the top four sectors. Utilities, food, beverage & tobacco and insurance dominate in both regions. The main differences are that the US has a high exposure to industrial goods & services and it is most exposed to utilities, while real estate is the biggest sector in Europe. Also, sector exposures have become more concentrated in both regions since February 2020.

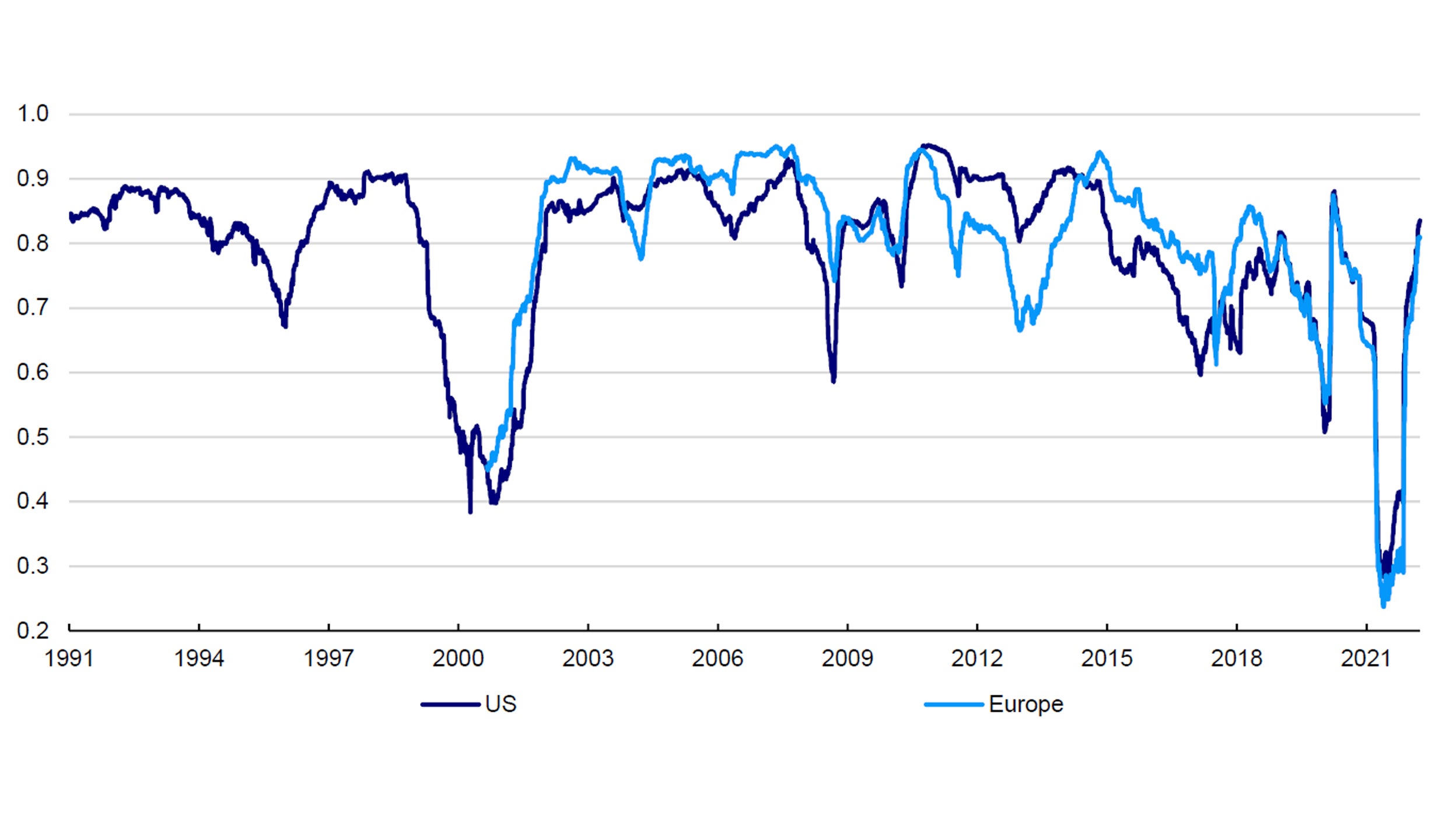

Price momentum has gone through perhaps the biggest reshuffle compared to February 2020. It is not only less concentrated in both regions, but the leading sectors have changed, and it is tilted more towards the value factor than growth (Figure 2). In the US, gone are the days of technology dominance. It remains in the top four, but has ceded its crown to energy, followed by healthcare and industrial goods & services. In Europe, the pre-pandemic top three of industrial goods & services, healthcare and real estate have all lost ground mainly to banks and energy. Our indices in both regions are more diversified than two years ago overlapping with both value and growth.

We have viewed quality as the steadier cousin of growth, which applies in the US, where our factor index is dominated by sectors which also feature heavily in the growth index, such as industrial goods & services, healthcare, technology and consumer products & services. However, our European index is less concentrated and its top four exposures include basic resources and financial services alongside industrial goods & services and consumer products & services.

In both the US and Europe, our size index is relatively well-diversified with their top four sectors accounting for less than 45% of constituents. Both of them are perhaps slightly more tilted more towards what we consider growth sectors with healthcare, consumer products & services and technology featuring prominently although our European index has a significant exposure to real estate.

Finally, value is still dominated by financials (banks, financial services and insurance) and utilities in the US, while real estate completes the top four in Europe. Its exposure to energy is much lower than in pre-pandemic times, so it may be a less useful hedge against rising inflation than before.

Notes: Data as of 31st March 2022. Showing the one-year correlation of daily total returns between our price momentum and value factor indices. The data starts on 1st January 1991 for the US and 1st September 2000 for Europe. See appendix for factor index definitions. Past performance is no guarantee of future results. Source: Refinitiv Datastream and Invesco