Global Monetary Policy Divergence Part One: High Inflation & US Monetary Policy

We have already seen substantial monetary policy divergence between China and the US since the start of the pandemic, but we can expect this to go into overdrive over the rest of the year.

Beijing policymakers shower the economy with stimulus to meet its ambitious growth forecast, all while the Fed tightens monetary policy to tackle high inflation.

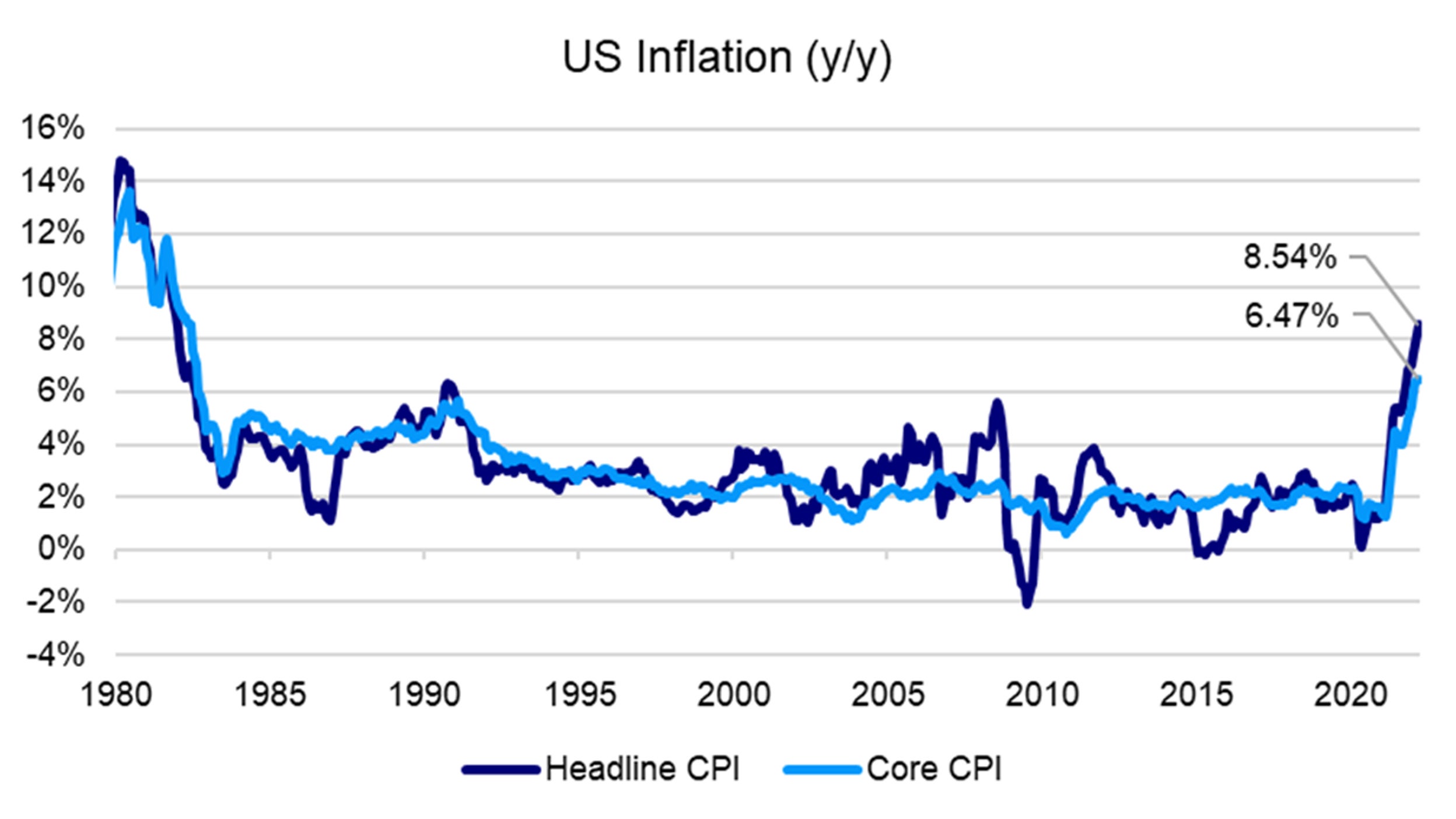

The US recently reported March CPI +8.54% y/y, the highest since 1981, mostly due to a jump in gas prices.1 A post-Omicron reopening also boosted airfares, car rental and hotel prices.

Aside from the eye-catching headline print, core prices (which excludes volatile items such as food and energy) moderated from +0.5% m/m in February to +0.3% m/m in March due to an easing in goods supply shortages.1

Source: U.S. Bureau of Labor Statistics (BLS). Data as of March 2022.

This could mean that inflation pressures may start to abate soon in the US due to energy prices coming off from their highs, easing supply chain bottlenecks and more favorable base effects going forward.

The Fed to continue normalizing monetary policy

Since one month’s data doesn’t make a trend, I believe the Fed will continue with its full steam ahead commitment towards normalizing monetary policy.

I believe that the Fed will lift its benchmark rate by 50bps and start to shrink its securities portfolio during the next FOMC meeting in May, with a goal of achieving a neutral policy rate by the end of the year.

While 2022 growth is unlikely to be substantially affected by tightening monetary policy, the path ahead is contingent on any further hawkishness from the Fed.

In the near-term, continued momentum from post-Omicron reopening should help propel growth higher. Real incomes in the US have suffered from higher inflation so far, but elevated savings levels and healthy household balance sheets have helped maintain consumer spending and I expect this dynamic to continue to help weather households through the inflationary storm.

Investment Implications

While the Fed’s inaction last year has led to record-levels of inflation, I’m also a bit concerned about recent, increasingly hawkish statements from Fed officials that could be too pessimistic about taming inflation.

I believe that the Fed should be able to thread the needle as long as they normalize monetary policy slowly and is data-dependent. There is also a possibility that inflation could cool more quickly than anticipated this year which could then provide some more room for Fed tightening.

If the Fed is successful in taming inflation without overly tightening financial conditions – then US stocks could tread upwards and the pivot towards value and cyclical sectors could continue.

While economic risks have recently become elevated, I believe that US bond investors have become overly bearish and so I’ve become more positive on US government debt and Investment Grade credit.