Global Monetary Policy Divergence Part Two: China’s economic headwinds are met with stronger policy support

With the Fed now accelerating its tapering of asset purchases and accelerating its rate rising cycle, the contrast with China couldn’t be any starker.

The Chinese National Bureau of Statistics recently reported headline CPI inflation for March +1.5% y/y. Even though consumer prices ticked up 0.8% m/m, CPI is well-below the 2.0% targeted level.1

This allows the PBOC (People’s Bank of China) much more wiggle room to deploy more stimulative monetary policy in order to stabilize and grow the economy for the next couple of quarters.

Potential RRR cut in Q2

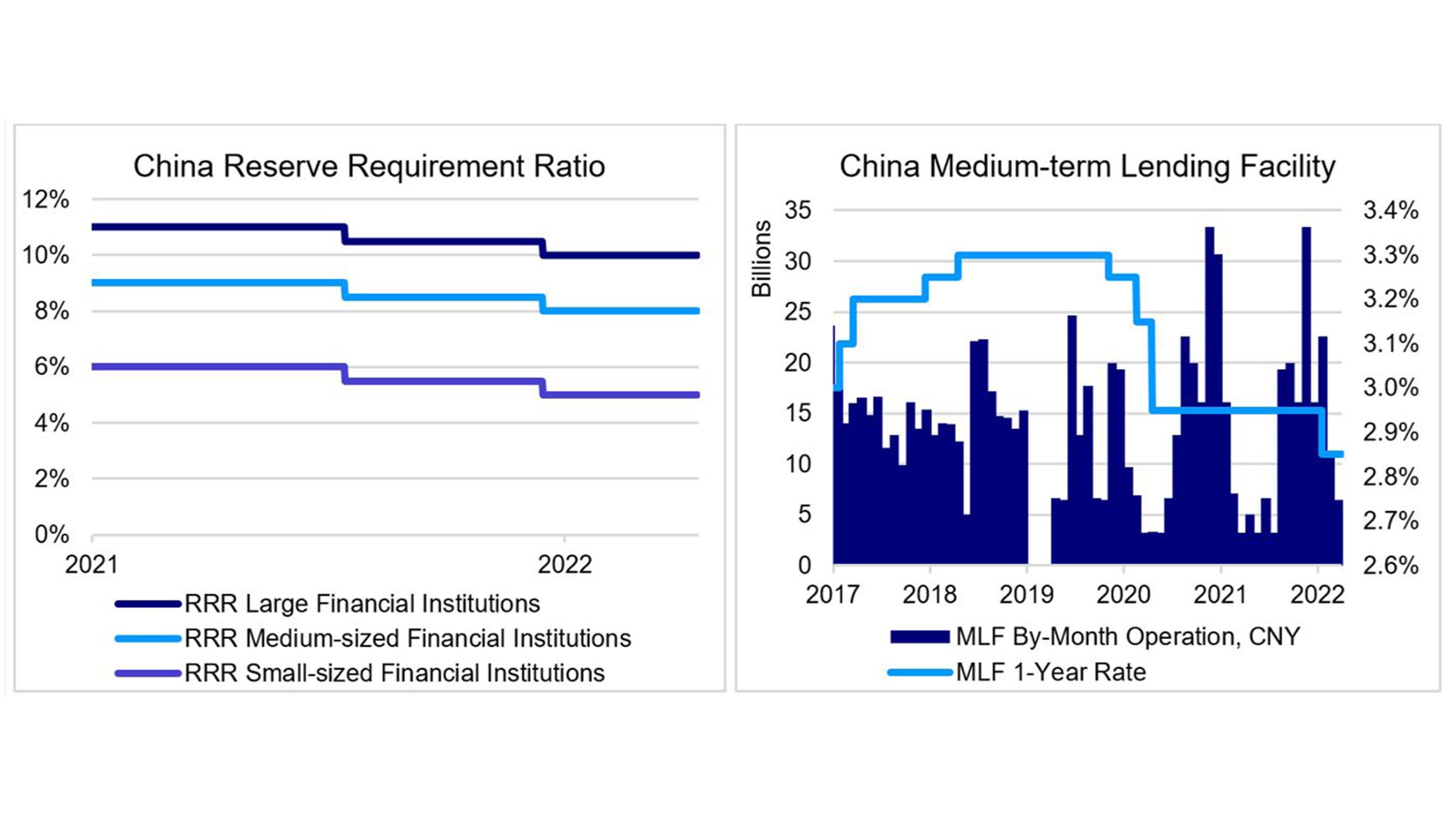

In Q2, I expect a 50bps cut to the reserve requirement ratio (RRR) as well as a 10bps cut to the medium-term lending facility rate (MLF) and one-year loan prime rate.

Source: People’s Bank of China. Data as of 14 Apr 2022.

The PBOC’s current approach probably isn’t sufficient to reach the government’s 2022 GDP target growth of 5.5%, as the challenges facing the Chinese economy are coming into clearer focus.

The relentless outbreak of the Omicron variant in Shanghai is likely to push Chinese authorities to double down on their Zero-COVID policy, especially as the proportion of unvaccinated seniors remains worryingly high.

In China - a supportive monetary backdrop alone isn’t enough to give the economy and Chinese stocks the boost they need - businesses will need to respond with increased credit appetite to fund real commercial activities.

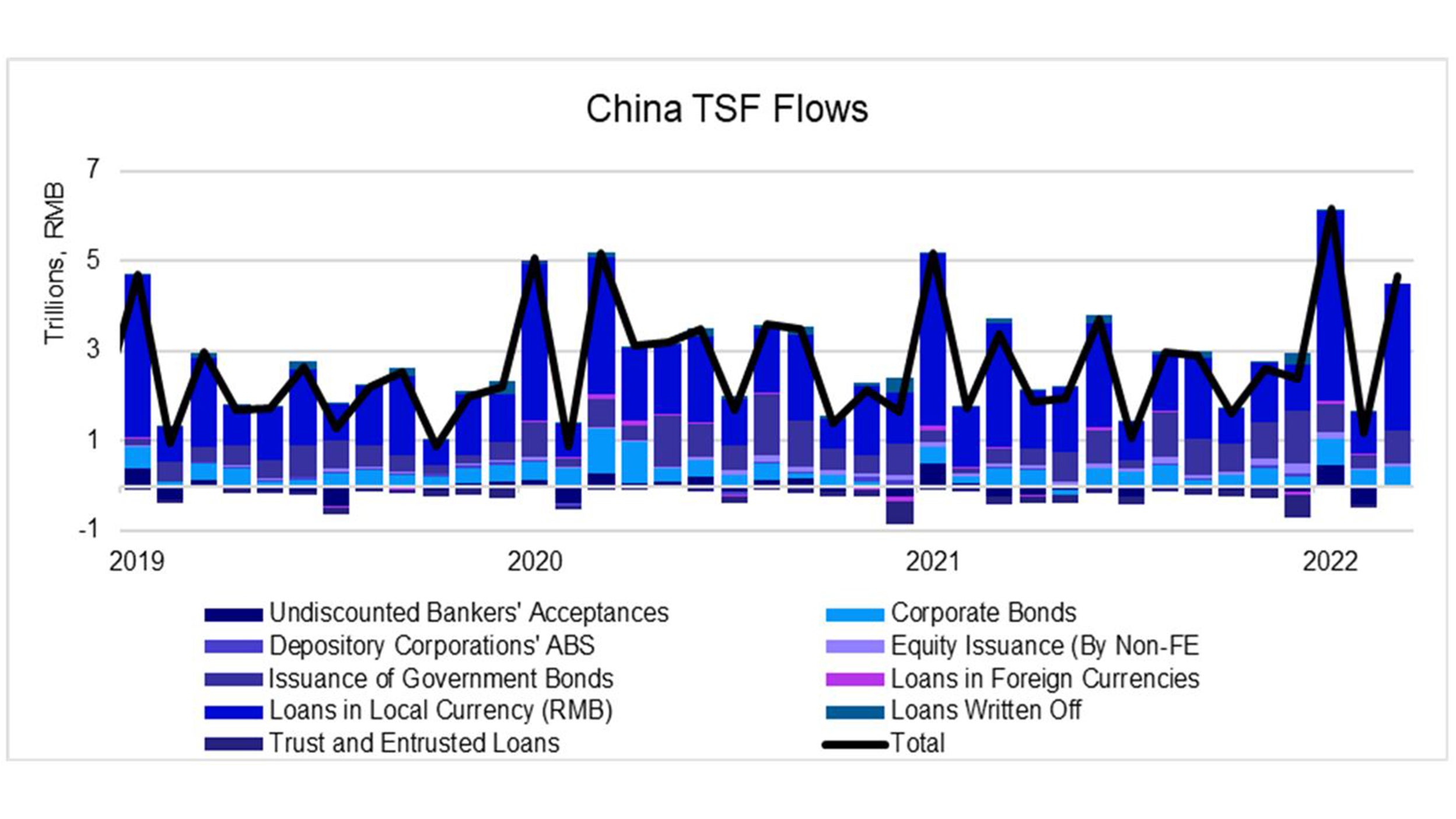

Credit growth over the past few months has been underwhelming despite more policy support after December’s Central Economic Work Conference.

That has started to change – China recently reported its March’s total social financing (TSF) – a broad measure of liquidity in the system – grew by 10.6% y/y, up from 10.2% in the prior month and money supply (M2) also accelerated to 9.7% y/y, up from 9.2% in the prior month.2

Both metrics beat consensus expectations, and is now closer in line with the much stronger than expected Jan-Feb monthly economic data.

Source: People’s Bank of China. Data as of March 2022.

I’ve argued that an upswing in money supply and credit growth could provide a floor for Chinese equities and signal that investor sentiment may soon start to improve, especially if COVID and geopolitical concerns start to wane.