Key Takeaways from December FOMC decision

The Fed decided to keep rates on hold. This continues a pattern of holding that has been in place since the last rate hike in July.

However, this time the Fed signaled a pivot away from further tightening and towards rate cuts at this meeting.

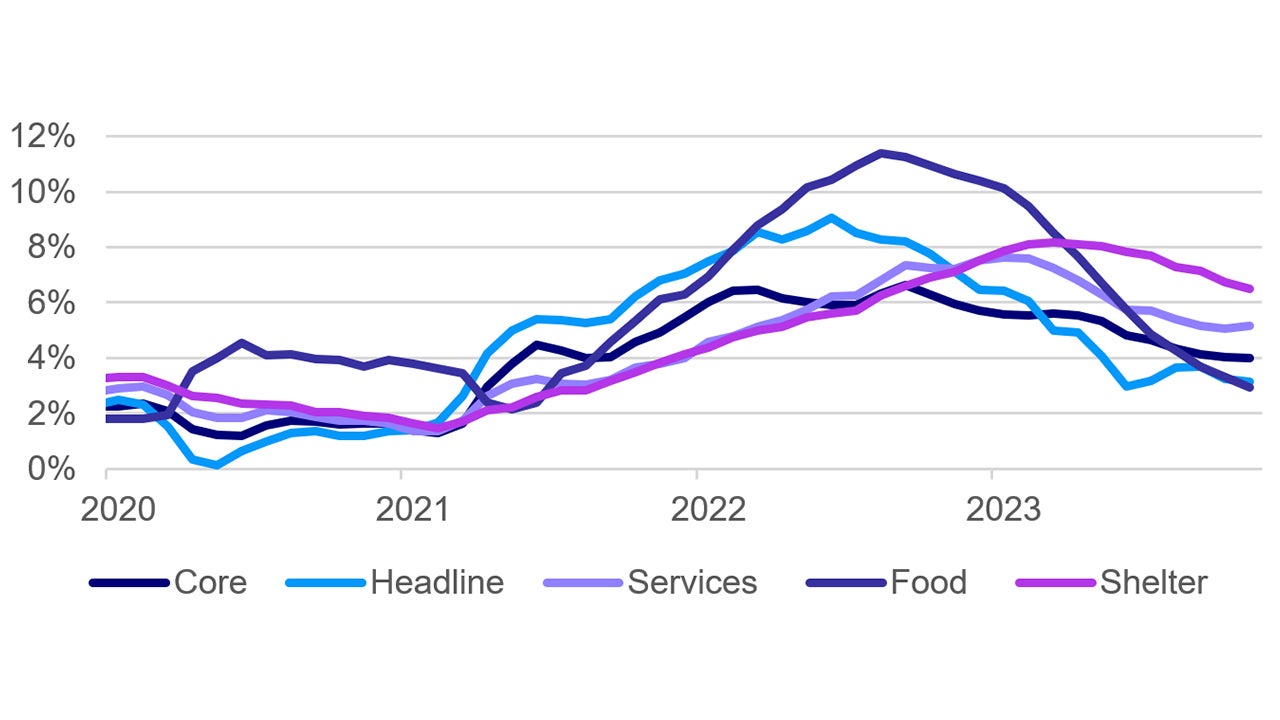

The Fed acknowledged growth has slowed and inflation has eased (but remains elevated) and that we are at or near peak rates for this cycle and that additional hikes are unlikely.

Source: U.S. Bureau of Labor Statistics (BLS). Monthly data as of November 2023.

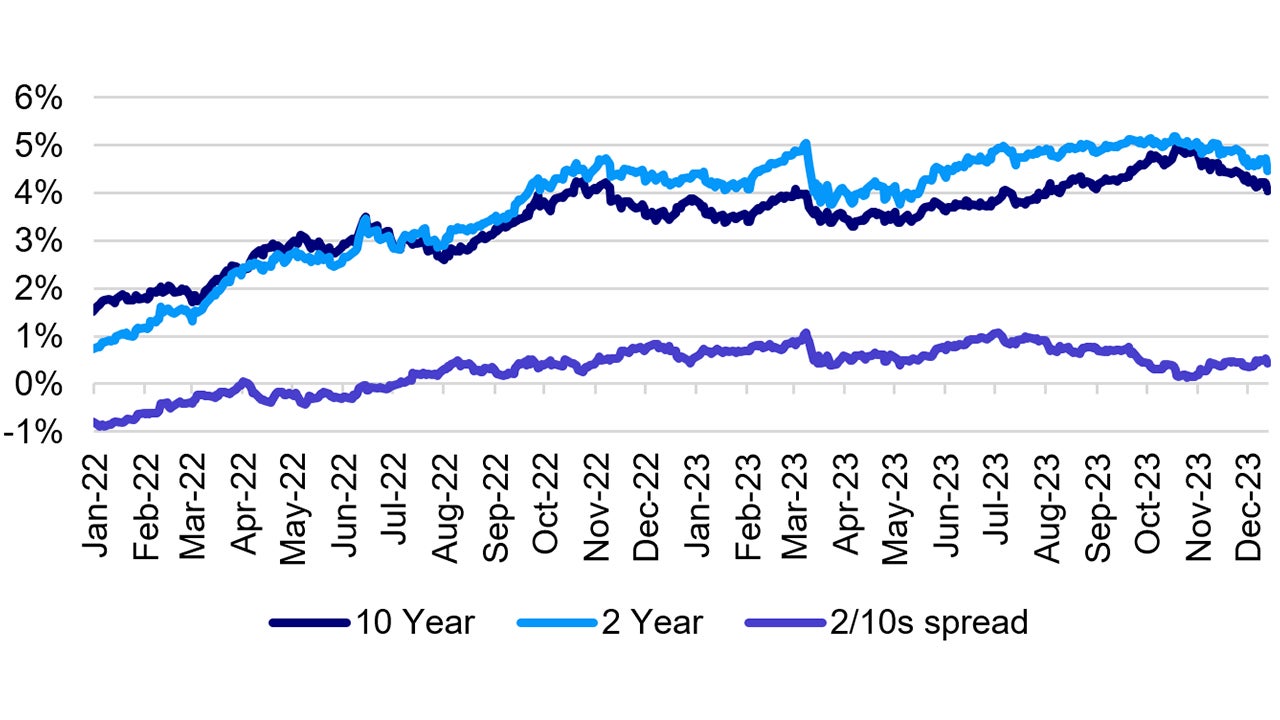

There was a very meaningful reaction in the bond market, with rates dropping significantly.

In the hour after the announcement was released, the 10-year US Treasury yield fell close to 4.0%.1 And there was a very meaningful reaction in the stock market, with stocks rising significantly.

Source: Macrobond and Federal Reserve. Daily data as of 13 December 2023.

Unless something extraordinary occurs, the Fed is done hiking rates and will now be focused on when to cut rates.

I do not believe there needs to be a substantial deterioration in economic growth in order to trigger rate cuts; all the Fed needs to see is continued satisfactory progress on disinflation.

This view was articulated by Fed Governor Chris Waller several weeks ago and in today’s press conference, Chair Powell affirmed this view.

I believe this was a bit of “tough talk” in order to keep markets guessing and keep a lid on easing financial conditions.

I would anticipate that the Fed will see enough progress on disinflation to begin cutting rates in Q2 2024.

Investment Implications

With today’s announcement and press conference, there is far more clarity on monetary policy.

Markets have come to assume that the rate hike cycle is over and that we are likely to see rate cuts start in 1H 2024.

Markets have started to discount an economic recovery to occur later in 2024 after a somewhat bumpy but brief landing.

In this environment, I would expect a growing global risk appetite.

I would anticipate smaller-cap stocks and cyclical stocks will outperform and would also anticipate strong performance from investment grade credit and high yield bonds.

I would also expect international assets, especially emerging markets, to begin to outperform US assets.

With contribution from Kristina Hooper