Tactical asset allocation views: A fine balance

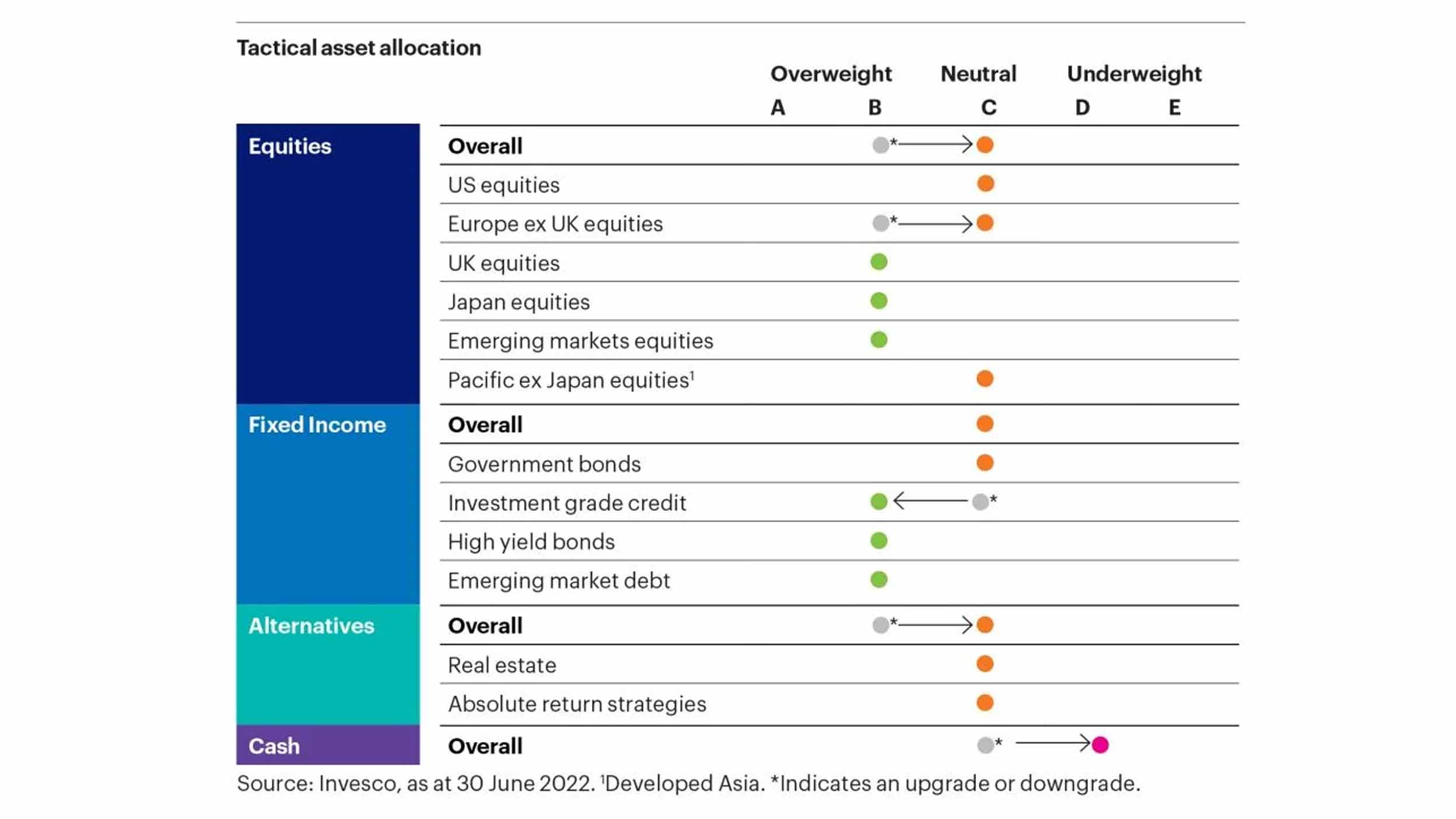

Each quarter, the Multi Asset Team shares its fundamental tactical asset allocation views, providing an A-E rating for each asset class over a 1–3-year investment horizon.

Read the team’s latest views below.

We upgrade investment grade credit to overweight and remain overweight high yield

Overall, our fixed income rating remains neutral, but we are increasingly positive on credit. We have upgraded investment grade credit to overweight, primarily on high absolute and relative yields.

The asset class offers potential value as it appears to be pricing in a default rate that is synonymous with an extremely negative economic environment – one of a magnitude that we do not see as a highly likely outcome.

That said, we are wary of the adage that the credit market often leads the way.

High yield credit remains an overweight and we note the improvement in value with absolute yields at very high single digit levels. The relatively short duration of the asset class means it may be a more susceptible to rate rises at the short end of the interest rate curve.

However, we feel that at these yields the asset class offers a potentially valuable ‘buy and hold’ option over our tactical timeframe.

We downgrade equities to neutral from overweight and downgrade cash from neutral to underweight

Our neutral view on equities reflects our concerns that corporate earnings risks have not been fully priced in and that further rate hikes could de-rate equities further.

On a more positive note, technical factors are supportive and some sentiment surveys suggesting that the appetite for equities is as low as in 2008 makes us mindful that equities are oversold in the short term.

Within equities we downgrade US, Europe ex UK and Emerging Markets ex China, instead preferring the UK, Japan, and China. We note that the sterling (and indeed the euro and yen) investor has benefitted from currency weakness versus a stronger dollar.

A reversal of this currency weakness would present a return headwind for unhedged equity investors.

Government bonds remain neutral overall, but only due to the yield available in the US

We remain neutral on government bonds, driven by the US Treasury market.

We are less positive on other government bonds markets such as the Eurozone, Japan and the UK given lower yields and a less advanced monetary policy profile.