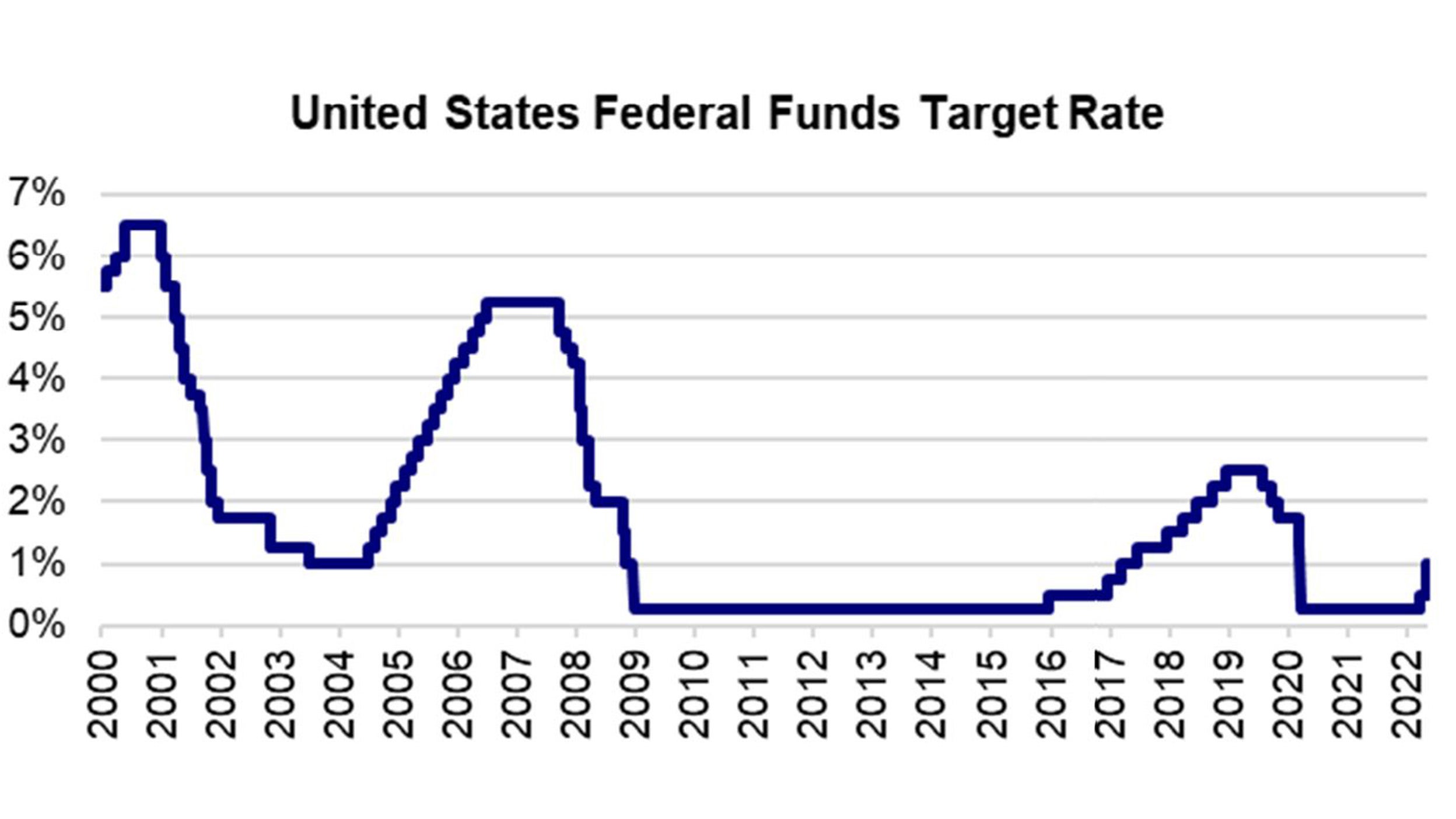

The Fed raises rates by 50 Basis Points as it tries to orchestrate a soft landing while tackling high levels of inflation

After weeks of speculation on how hawkish the Fed would pivot in its May FOMC decision, the Fed delivered a goldilocks rate hike of 50bps and announced that it would start its balance sheet runoff in June. Still, a 50bps hike is the largest hike we’ve seen in two decades.

US stocks soared while bond yields and the USD fell during the scheduled press conference as Chair Powell allayed fears that the central bank was barreling down a path of more aggressive monetary tightening.

Source: Federal Reserve. Data as of 5 May 2022.

Despite core prices and inflation remaining “much too high” and recent comments from FOMC members that larger hikes were needed, Powell guided to a more dovish tightening trajectory of 50bps hikes at “the next couple” of meetings and that the Fed was not “actively considering” a 75bps hike in June and July.

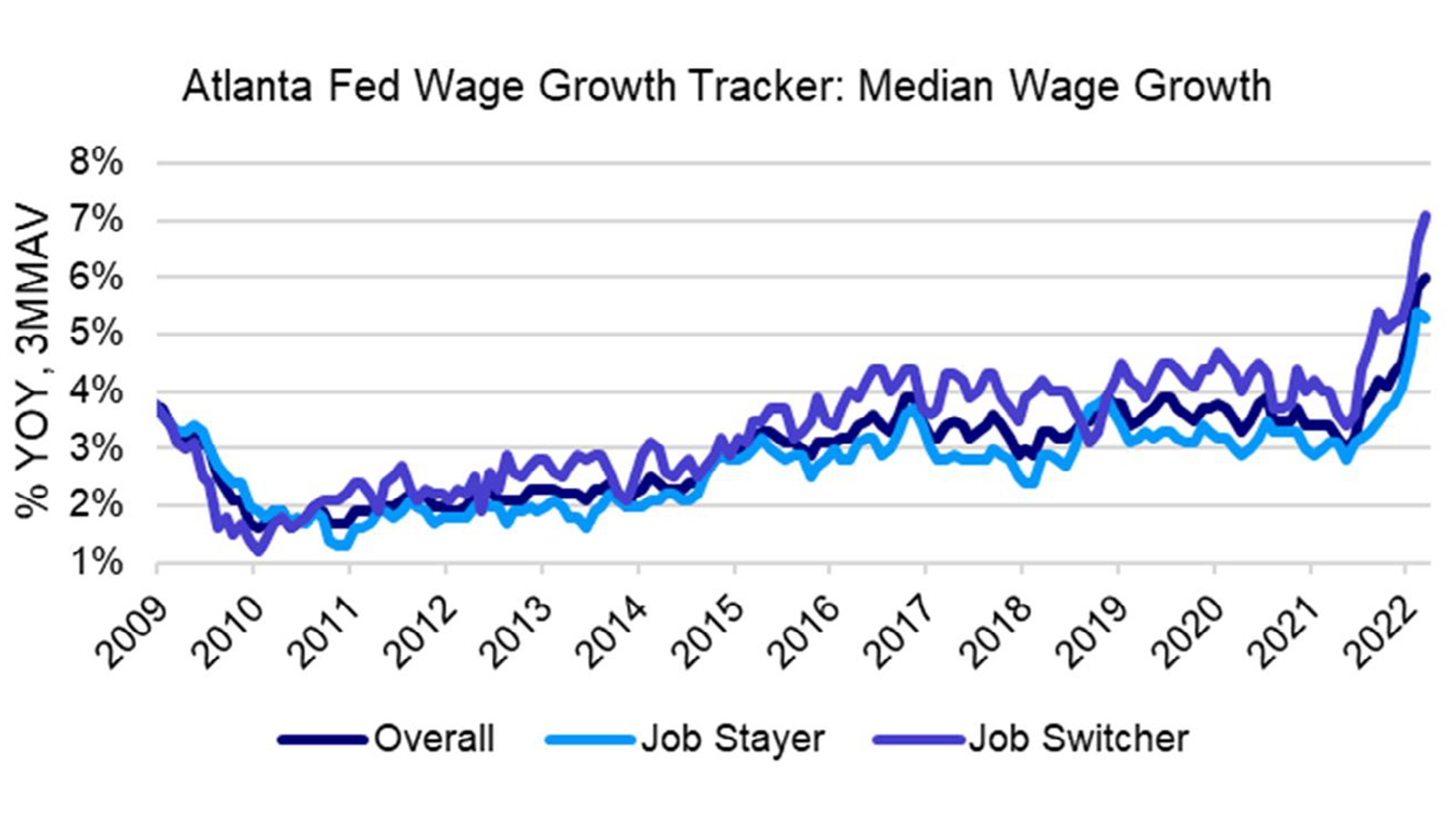

The move to guide concretely against higher rate hikes is somewhat surprising in light of the recent Q1 wage-price data which grew 5.8% q/q.1 Still, Powell stated that “we don’t see a wage-price spiral.” The average hourly earnings data this Friday should shed more light on whether or not the economy is experiencing a wage price spiral or not. I believe that wages in the US could continue to see upwards pressure though other segments of core inflation could start to cool in the 2H of this year.

Source: Federal Reserve Bank of Atlanta. Data as of March 2022.

Investment Implications

Even then, risks remain elevated for a policy mistake – either by not tightening quickly enough to combat inflation or being overly hawkish that results in the end of the current business cycle.

I expect continued momentum from post-Omicron reopening to help sustain growth in the US despite Fed policy normalization during 2022.

Real incomes in the US have suffered from higher inflation so far, but healthy household balance sheets have helped maintain consumer spending and I expect this dynamic to continue to help households weather the inflationary storm.

Overall, I believe today’s FOMC decision and Powell’s forward rate hike guidance demonstrate that the Fed continues to try and orchestrate a soft landing while tackling high levels of inflation.

The Fed may continue to aim towards a neutral policy rate as quickly as possible for the remainder of the year in line with current market expectations.

Risks are tilted to further upside in yields and US and APAC equities could continue to experience a bit of volatility given the tightening environment.

Global markets have so far taken this tightening largely in stride, with US bonds suffering the bulk of the turbulence to date.