The outlook for global banking sector following the recent banking “mini-crisis”

The dust from the recent banking crisis in the US and Europe has started to settle, though it’s too early to declare this period over. A few conclusions can be drawn so far:

- There is little global banking contagion risk since the broader sector is well capitalised.

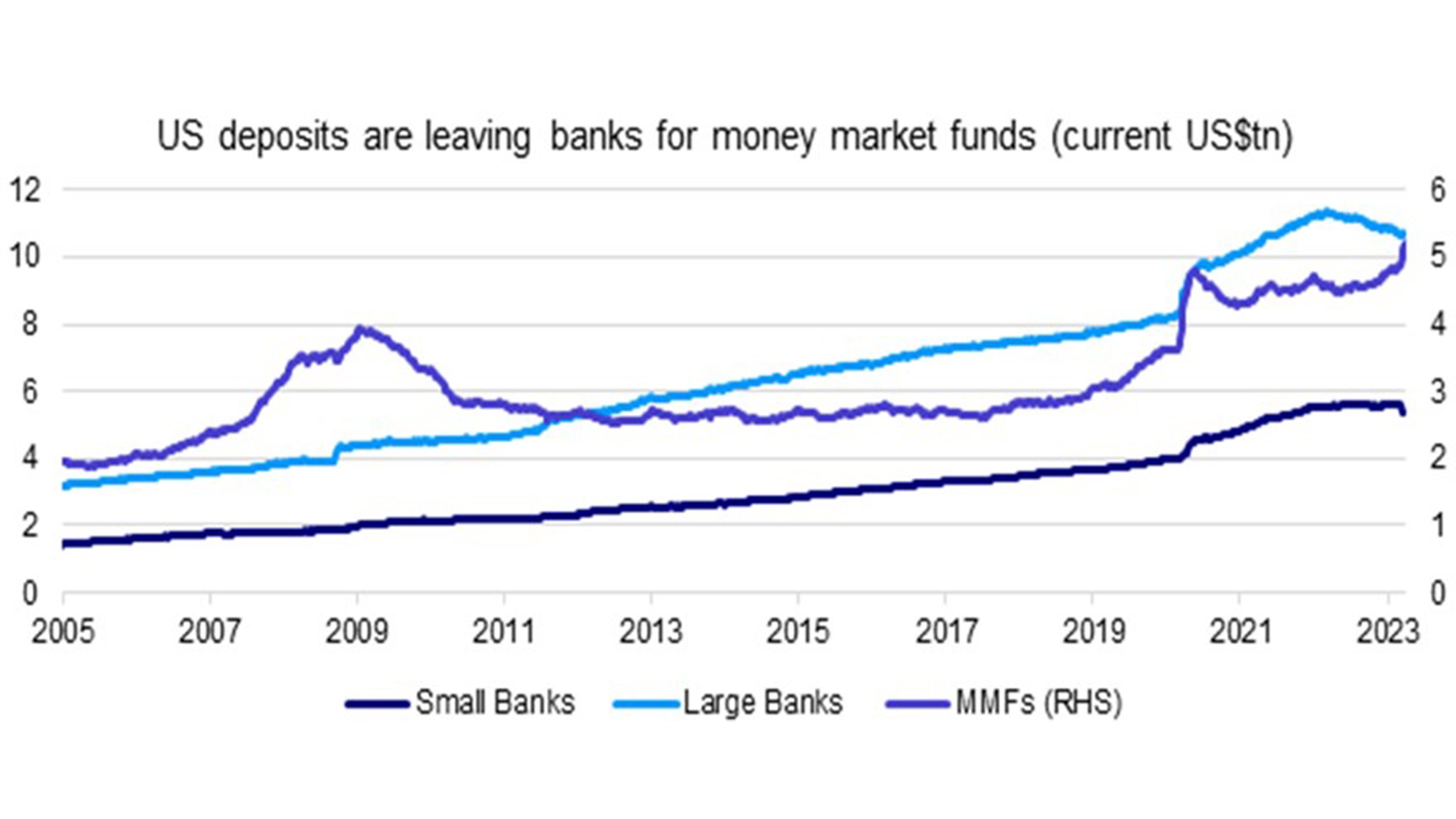

- US banks’ margins could compress as deposits flow to higher yielding products and the yield curve remains deeply inverted.

- European banks face declining profitability from a weaker economy.

- Emerging Market banks – particularly Chinese banks – are the most resilient.

Commercial banks around the world are in a far better capital position now compared to 2008 due to the stringent regulatory requirements put in place after the Global Financial Crisis (GFC).

Global banks are well above the minimum capital adequacy ratios which means they are far better prepared to withstand any asset impairments than in the past.1

The level of bad loans held recently is much lower than in 2008 and global bank credit quality has notably improved over the past decade.2

Banks around the world are also much less interconnected now when compared to the period leading up to the GFC,3 which lowers the overall contagion risks.

US banks

US banks are in the most precarious shape, as they continue to face a crisis of confidence due to depositor flight risk which could force banks to sell assets and recognise investment mark-to-market losses on the income statement.

When measured against 18 other major economies, the US yield curve is the most inverted and US banks have the biggest gap between policy rates and deposit rates.4

Banks must choose whether to meaningfully raise their deposit rates or risk deposit outflows to higher yielding alternatives. Both scenarios result in a compression in profit margins.

Source: FDIC, Macrobond, Invesco. Data to 20 March 2023 for bank deposits; MMFs to 27 March 2023.

European banks

European banks on the other hand, have low risk of deposit outflows because the European Central Bank has raised rates less than the Fed and the gap between the policy rate and the deposit rate is much narrower than the US spread.5

But the shot-gun wedding between Switzerland’s two largest banks and wipeout of AT1 bondholders are likely to raise the cost of funding for EZ banks and therefore compress future profit margins.

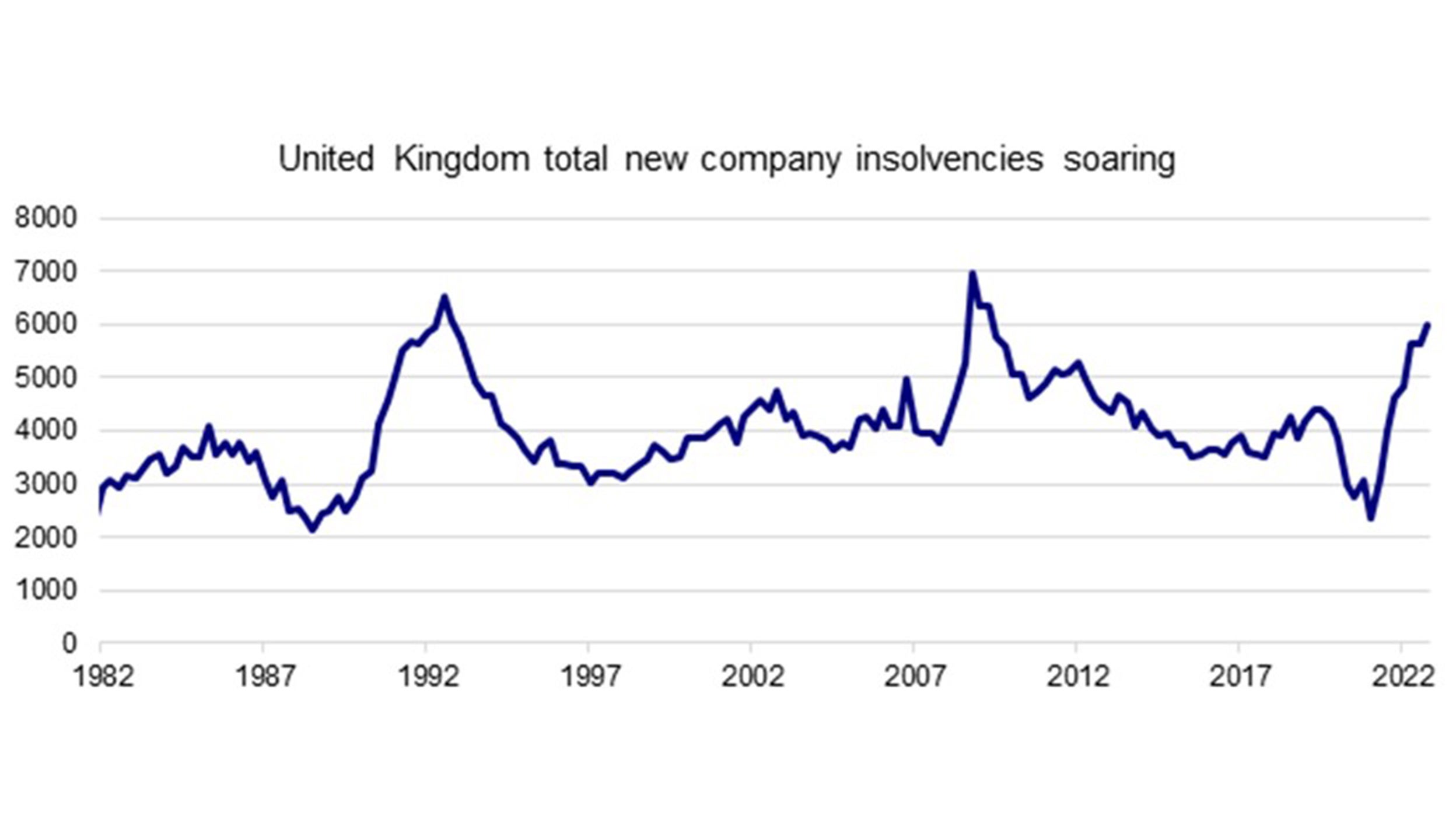

The more pressing concern is the European economy, which appears more vulnerable to macro shocks and recession.

Deteriorating credit quality is concerning in Europe - for example, in the UK – which started hiking rates 7 months ahead of the ECB, bankruptcies have soared in the most recently available quarterly data to levels not seen since 2009.6

Source: U.K. Insolvency Service. Data as of Q4 2022. Seasonally Adjusted.

Emerging market / Chinese banks

Emerging market banks – and particularly Chinese banks – face few of the problems seen in the US and EU.

This is largely because most banks in economically important EM countries appear resilient because most commercial banks have raised their deposit rates to match policy rates and government bond yields.7 Thus, depositors haven’t pulled their funds from banks in hunt for higher yielding products.

Secondly, major EM yield curves are much flatter and not inverted as is the case in the US. Inverted yield curves are anathema to banks since they all borrow short to lend long which means that EM banking profits have more leeway since their respective yield curves are upwards-sloping.8

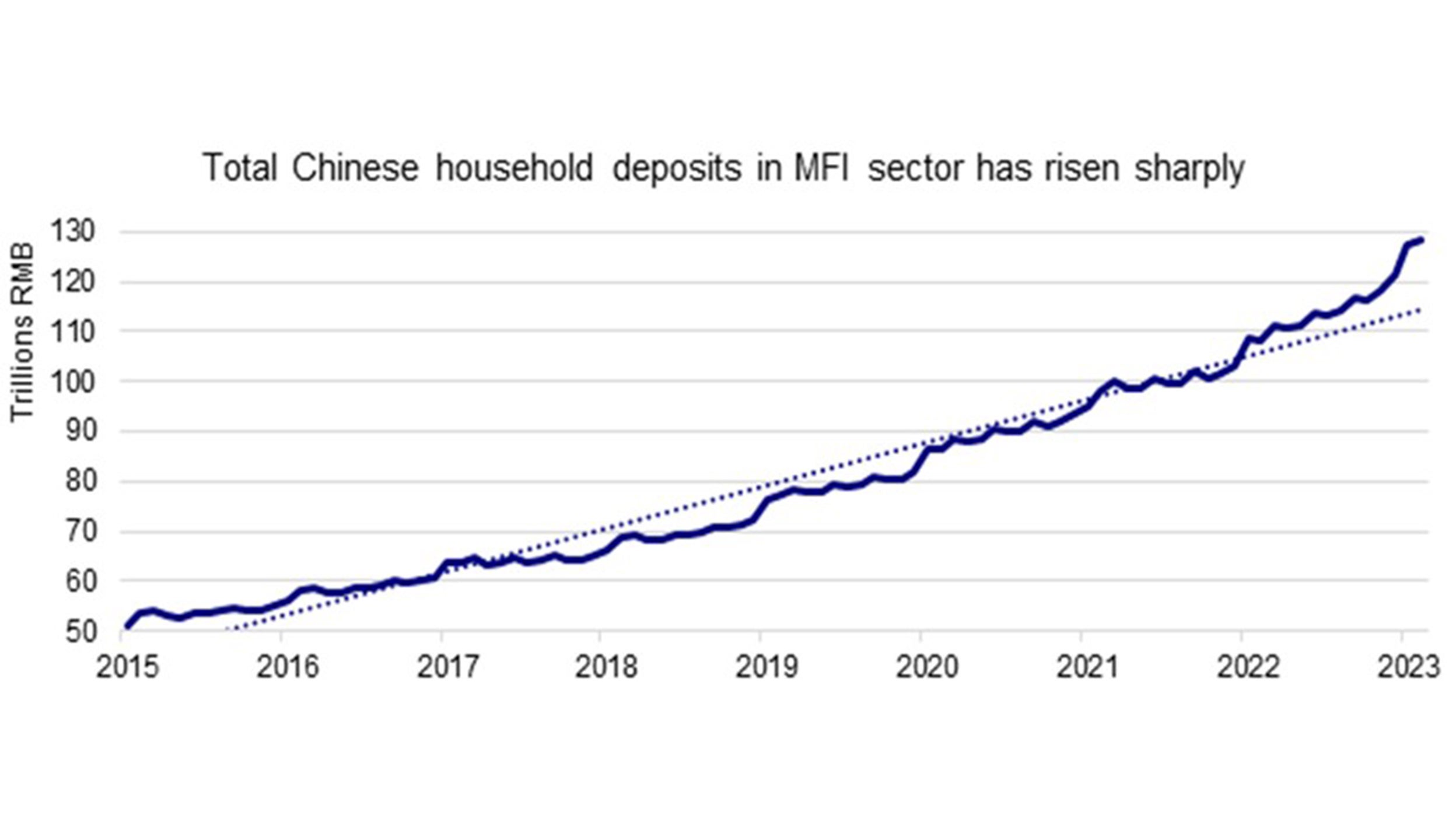

Chinese banks are the most insulated from the banking mini-crisis since the PBOC has not hiked interest rates9 so banks aren’t facing outflows.

On the contrary, Chinese banks recorded a significant rise in deposits10 over the past year as households parked their excess savings11 in banks due to economic uncertainties from COVID.12

As the economy normalises, I expect households to drawdown their excess savings and increase consumption spending consumption and investments in other assets, it’s still likely to cause financial stress at banks.

Source: People’s Bank of China (PBoC). Data as of February 2023.

The world’s second largest economy is also in better shape as it gathers steam from the recent reopening. Inflationary pressures have been kept in check and the 1y government bond yield has trudged up only 50bps when compared to the 300bps of the 1y US treasury yields.13

It’s clear that policymakers in China are focused on supporting the economy this year and likely to keep monetary conditions loose and ample.

The near-term banking sector outlook can be boiled down to two components: 1) deposit outflows can be expected when the deposit rate doesn’t track the respective government bond yield and 2) the state of the yield curve. The Fed and ECB are not finished with their hiking cycle which means banking headwinds remain in their respective countries.

Since SVB’s failure a month ago, EU and US banking stocks have underperformed relative to their respective country indexes whereas EM banking stocks have performed inline with their markets.14

In this environment, I believe it continues to make sense to have a barbell investment allocation.

On the one end, I prefer more defensive assets such as short-term US government bonds as well as European investment-grade credit while on the other end overweight EM equities, particularly China A-shares.