The recent surge in US Treasury yields and its investment implications

While the financial media has been focused on China’s economic slowdown narrative this summer, little has been written about the meltdown in the US treasury market.

Long-dated US treasuries (UST), which have historically been regarded as a risk-free safety asset, have in fact intensified portfolio volatility over the past few months.

UST, the biggest, deepest asset class in the world, has sold-off to levels not seen since 2007; in the past month, a major ETF tracking returns of UST has fallen -9% as the UST 10-year yield breached 4.2%1.

It’s important to note that the recent rise in yields is primarily an American phenomenon although very little news has developed.

The Fed hasn’t issued new policy guidance nor have there been super hawkish comments. All eyes will be on Fed Chair Powell during his press conference this Friday at the conclusion of the annual Jackson Hole symposium.

Possible reasons behind the move of UST yields

What has caused long-dated US treasuries to fall almost double digits on very little news?

The bulk of the move in US treasury yields has been due to the rise in real rates and little to do with inflation2.

Recession fears have faded as inflation continues to trudge downwards, raising the chance of an economic soft landing.

While Japanese rates have recently been rising due to modest shifts in their ultra-loose monetary policy, this isn’t the catalyst that’s driving US rates. It appears that US yields are leading Japanese yields.

The strong YTD rally in all things tech, especially the “magnificent 7” US stocks due to the generative AI euphoria could have also pivoted capital away from US treasuries.

The conclusion of the debt ceiling debacle has allowed the US treasury to issue around USD 1trn in new bonds in Q3 alone. This will add pressure to the fiscal indebtedness of the US and has been a core reason for the US government debt downgrade.

If the US economy remains resilient and inflation still has a way to go, US monetary policy could be higher for longer. Even if the Fed doesn’t hike more, it could institute more quantitative tightening.

Investment Implication

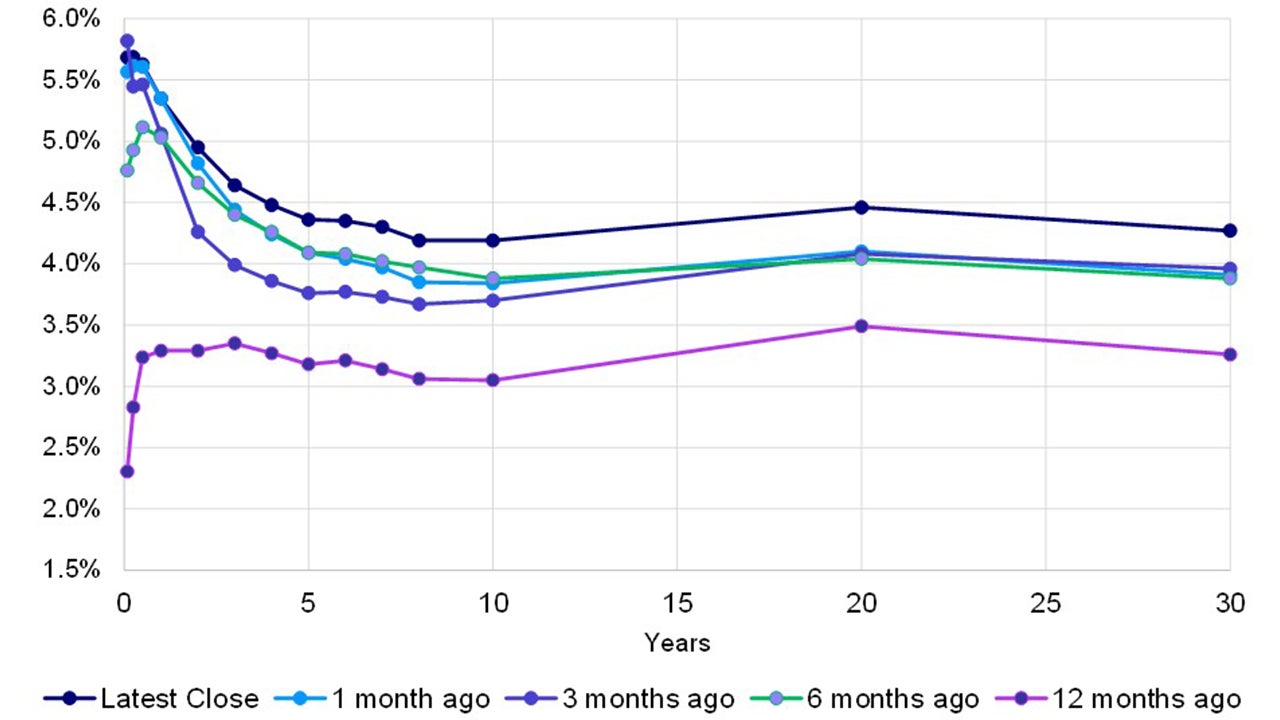

Even though I believe the recent-sell off in the UST 10-year is overdone, I still prefer to be on the shorter end of the curve since these securities have higher yields.

Source: U.S. Department of Treasury, Macrobond and Invesco. Data as of 23 Aug 2023.

The inverted yield curve continues to suggest that holding short-dated, fixed income securities makes sense.

Holding long-duration does not offer a sufficiently attractive risk/reward unless one assumes that the inverted yield curve implies an impending recession but I would argue this looks less and less likely.

With contributions from Kristina Hooper.