Uncommon truths: The Aristotle List: 10 improbable but possible outcomes for 2023

It is time to forget central scenarios and think about improbable but possible outcomes. Markets remain volatile, so our list of surprises errs to the positive (these hypothetical predictions are our views of what could happen even if they do not necessarily form part of our central scenario).

Aristotle said that “probable impossibilities are to be preferred to improbable possibilities”, meaning that we find it easier to believe in interesting impossibilities (B52s on the moon, say) than in unlikely possibilities. The aim of this document is to seek those unlikely possibilities -- out-of-consensus ideas for 2023 that I believe have at least a 30% chance of occurring. The concept was unashamedly borrowed from erstwhile colleague Byron Wien, who recently published his 10 surprises for 2023.

I believe the biggest returns are earned (or the biggest losses avoided) by successfully taking out-of-consensus positions. A year ago, the mood was hopeful on the back of strong performance in 2021. Hence, my improbable but possible ideas were biased to the negative side (“S&P 500 finishes the year lower than it started”; “US 10-year treasury yield goes above 2.5%” and “Bitcoin falls below $30,000” were examples of ideas that worked). The mood is now confused (after a difficult 2022) but my list is more hopeful – don’t look for internal consistency, as there is none.

1. US core CPI inflation falls below 4.0%

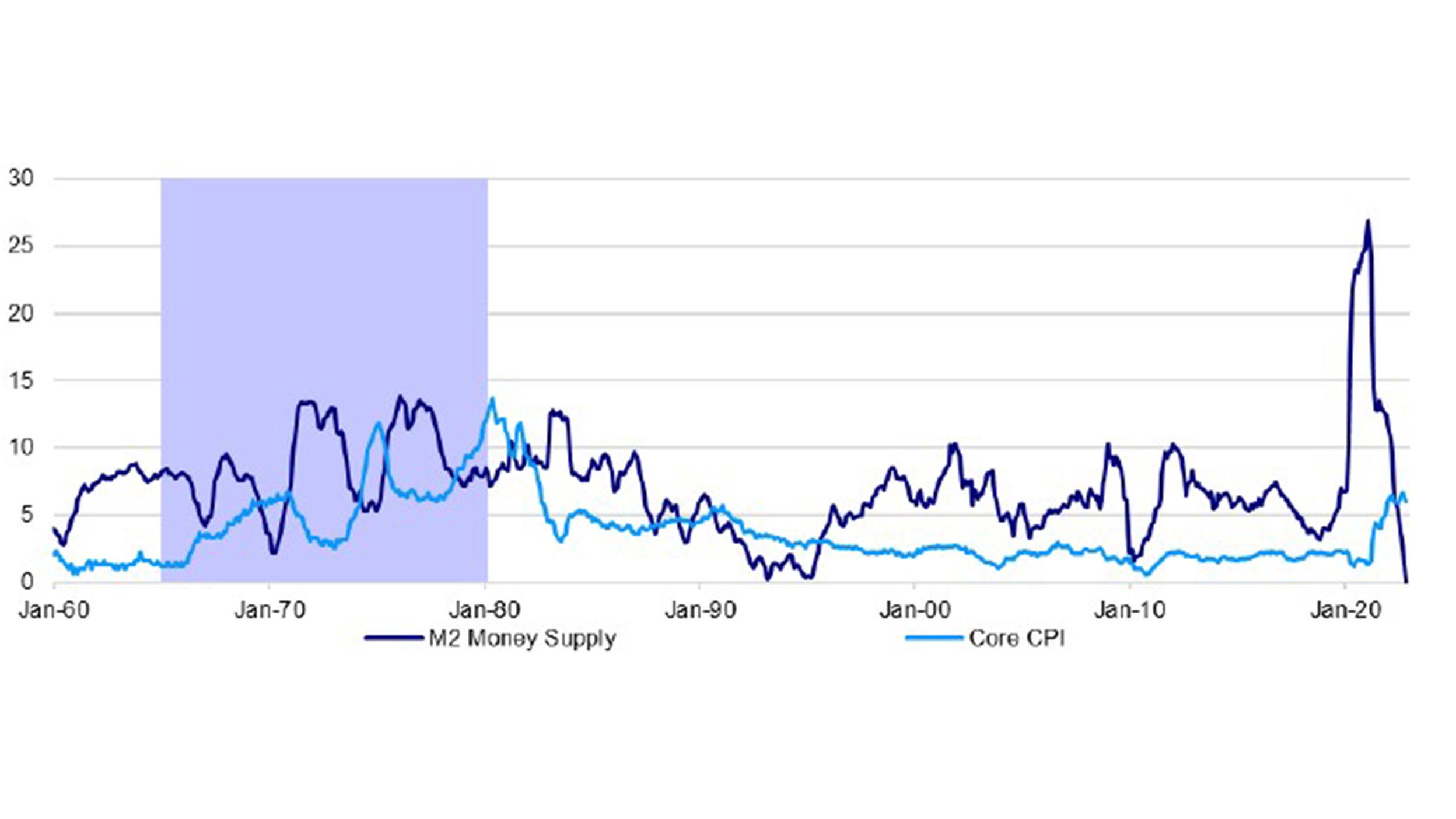

During presentations and meetings with investors in late-2022, one of the biggest push backs was about my conviction that core inflation will come down noticeably during 2023. Core CPI inflation in the US was 6.0% in November 2022, having peaked at 6.6% in September 2022. I believe that inflation is a cyclical phenomenon for the most part and that the recent bout had its roots in the monetary expansion that occurred during the Covid pandemic. Figure 1 shows the case of the US, where M2 money supply growth reached 27% year-on-year (yoy) in February 2021. The subsequent collapse to 0% by November 2022 (and possible dip into negative territory) will reduce inflationary pressures over the coming years, in my opinion. US headline CPI inflation peaked at 9.0% in June and had fallen to 7.1% by November. With commodity prices weakening and supply chain problems easing, I think headline inflation will fall below core inflation during the first half of 2023 and then drag core lower. Even better, the latest wage data from the US (for December) suggests that hourly earnings inflation continues to abate, falling to 5.0% yoy from the March peak of 6.8% (and this is before unemployment has risen). Adding in the weakening of the housing market, which should lower shelter inflation, I think that core CPI inflation could fall below 4.0% during 2023. That would be a big (and positive) surprise for many market participants.

2. The Fed panics and reduces rates in late 2023

Given the decline in inflation suggested above, I expect US economic weakness to persuade the Fed to reverse policy direction during the second half of 2023. This would follow the panic tightening of 2022 (after the Fed stayed way too loose for way too long) and could bring one or two rate reductions. This would not be a surprise for financial markets (based on evidence from Fed Funds futures) but is not what the Fed expects.

3. USDJPY falls below 115

Having peaked at around 150 in October 2022 (a 32 year high), USDJPY has since fallen to around 130. This rebound in the yen (fall in USDJPY) was recently aided by the BOJ’s widening of its 10-year bond yield target range (with an upper limit of 0.5%). With Governor Kuroda’s term ending on April 8, this could be the time for the BOJ to end its extremely loose stance (it still has a policy of quantitative easing). Even if CPI inflation falls back from the recent 3.8%, I believe the central bank should be trying to normalise its policy. If I am right, and with the Fed easing towards year end, the yen could strengthen and I wouldn’t be surprised to see USDJPY fall below 115 (which would still leave it well above historical norms in real terms).

Note: Based on monthly data from January 1960 to November 2022. The shaded area is from January 1965 to January 1980. Source: Refinitiv Datastream and Invesco

4. Boris Johnson makes a comeback as PM

The next UK general election must take place no later than 24 January 2025. Bookmakers’ odds currently suggest Keir Starmer (Labour) will be the next Prime-Minister (see oddschecker.com). They also suggest that 2024 is the most likely year for Rishi Sunak to exit 10 Downing Street. That exit could happen in two ways: by losing a general election or upon removal by his own party. Though opinion polls are now more favourable for the Conservatives than at the time of Liz Truss, Labour’s lead is still in excess of 20 percentage points (according to polls conducted in early 2023). If this were the result at the next general election, I believe Labour could have a majority of more than 300 seats, with the Conservatives having less than 100 parliamentary seats. If opinion polls do not improve (and Rishi Sunak’s performance is hardly encouraging), I doubt that the Conservative Party will wait to the end of this year to replace him. Bizarre as it sounds, were they to depose him, I suspect there is a good chance that Boris Johnson would be chosen by Conservative MPs and party members to be the PM to lead them into the next election (despite the ongoing Commons Privileges Committee investigation into his conduct).

5. Turkey chooses a new president

Recep Tayyip Erdogan has been president of Turkey since 2014 and prior to that was prime minister since 2003. The constitution was amended in 2017 to make Turkey a presidential system. With the abolition of the office of prime minister, the president became the most powerful person within the Turkish government. Were Erdogan to be re-elected in June/July 2023 (the first round of votes seems likely to be on 18 June, with a second round on 2 July, if needed), it would be for his final term as president (there is now a two-term limit of five years each). However, though his AK Party remains the most popular (according to opinion polls) and that Erdogan may receive the most votes in the first round of voting, there appears a possibility that he would lose the second round (based on opinion polls). His problems appear to include a lack of faith in the democratic system (with his machinations front and centre) and economic decline (inflation peaked at 86% in October 2022). Though it is dangerous to count him out, I suspect Erdogan will lose over two rounds, heralding a fundamental change in Turkish politics.

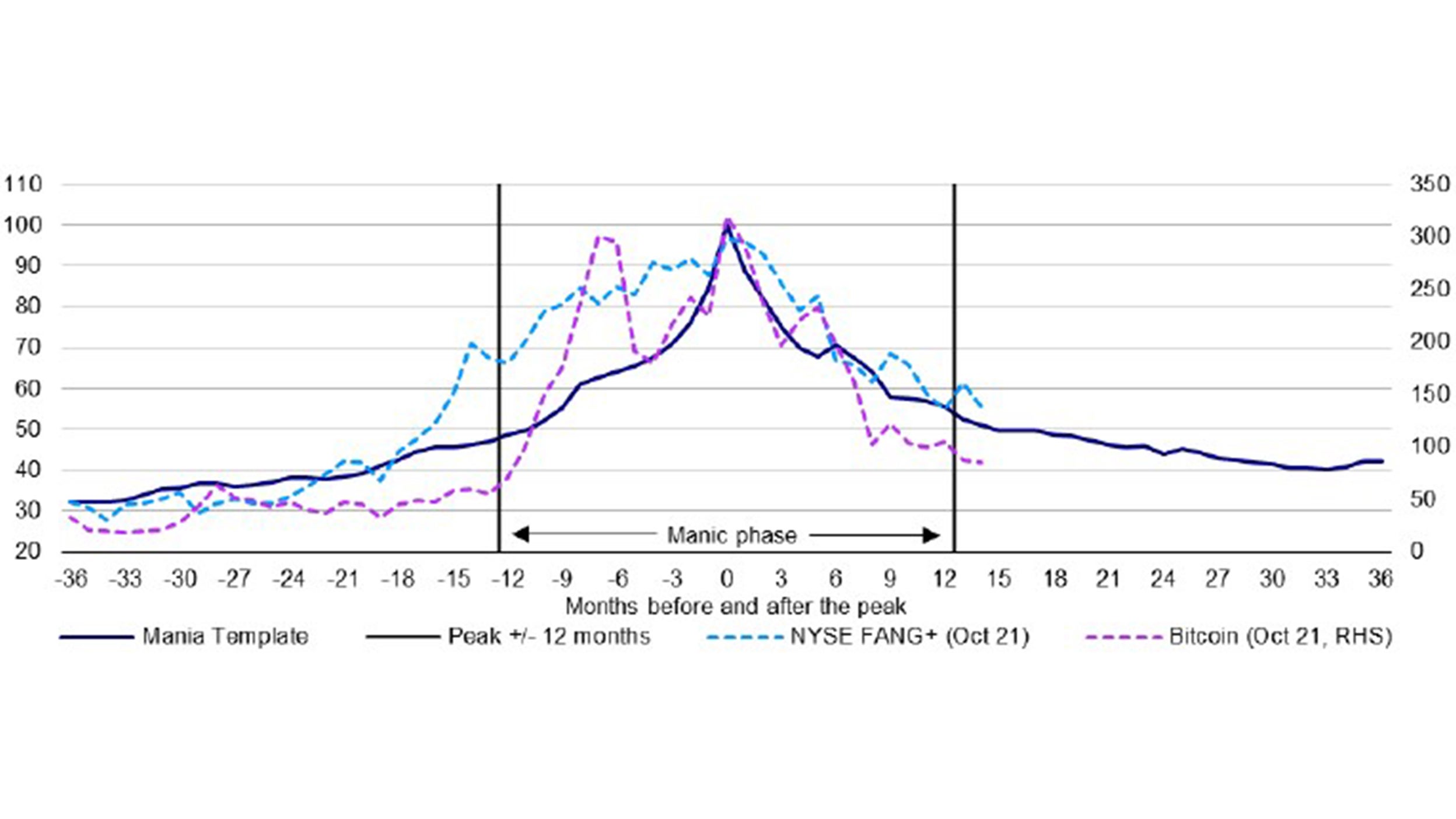

6. NYSE FANG+ falls again during 2023

Last year I spoke of Bitcoin falling below $30,000 during 2022, having peaked at around $68,000 in 2021. Another asset that had broadly followed our mania template was the set of 10 growth stocks that make up the NYSE FANG+ index (see Figure 2). That mania template suggests a 45% loss is typical in the 12 months after the peak of a typical financial bubble. The monthly data used in Figure 2 suggests the NYSE FANG+ decline has broadly followed that template (Bitcoin’s decline was more dramatic, as had been its ascent, thus necessitating the use of a different scale). The template also suggests that bubbles typically deflate for a further two years, with a further decline of 20%-30%. Expecting the NYSE FANG+ index to register another year of losses may seem brave, especially if bond yields decline during 2023 (as we expect). However, given that bubbles are usually associated with an abundant supply of credit (and that was certainly the case in 2021), the fact that US money supply growth is now virtually zero, suggests to me that bubbles may continue deflating.

Note: Past performance is not a guide to future returns. Based on monthly data. See appendix for construction methodology of “Mania template”. “Bitcoin” and “NYSE FANG+” are constructed using the hypothesis that the 31 October 2021 level was the peak (month zero) and the final datapoint is for December 2022 (as of 30 December 2022). NYSE FANG+ is an equally weighted index designed to represent a segment of the US technology and consumer discretionary sectors. Source: Refinitiv Datastream and Invesco.

7. Ukraine government debt outperforms

After a number of years at the bottom of the return league tables, Turkish government bonds came out top in 2022. The yield on 10-year USD denominated Turkish Government bonds is currently 8.9% (as of 5 January), compared to 3.7% for the US, 6.1% for Brazil and 5.9% for Mexico. That is a high yield but not as high as the 19.9% available in Argentina (on bonds subject to New York law). Even that pales in comparison with the 33.9% yield available on 10-year USD denominated Ukrainian government bonds. The risks are obvious but I doubt that other countries would allow Ukraine to default and suspect that these bonds may generate high (if risky) returns.

8. Pakistan stocks to outperform major indices

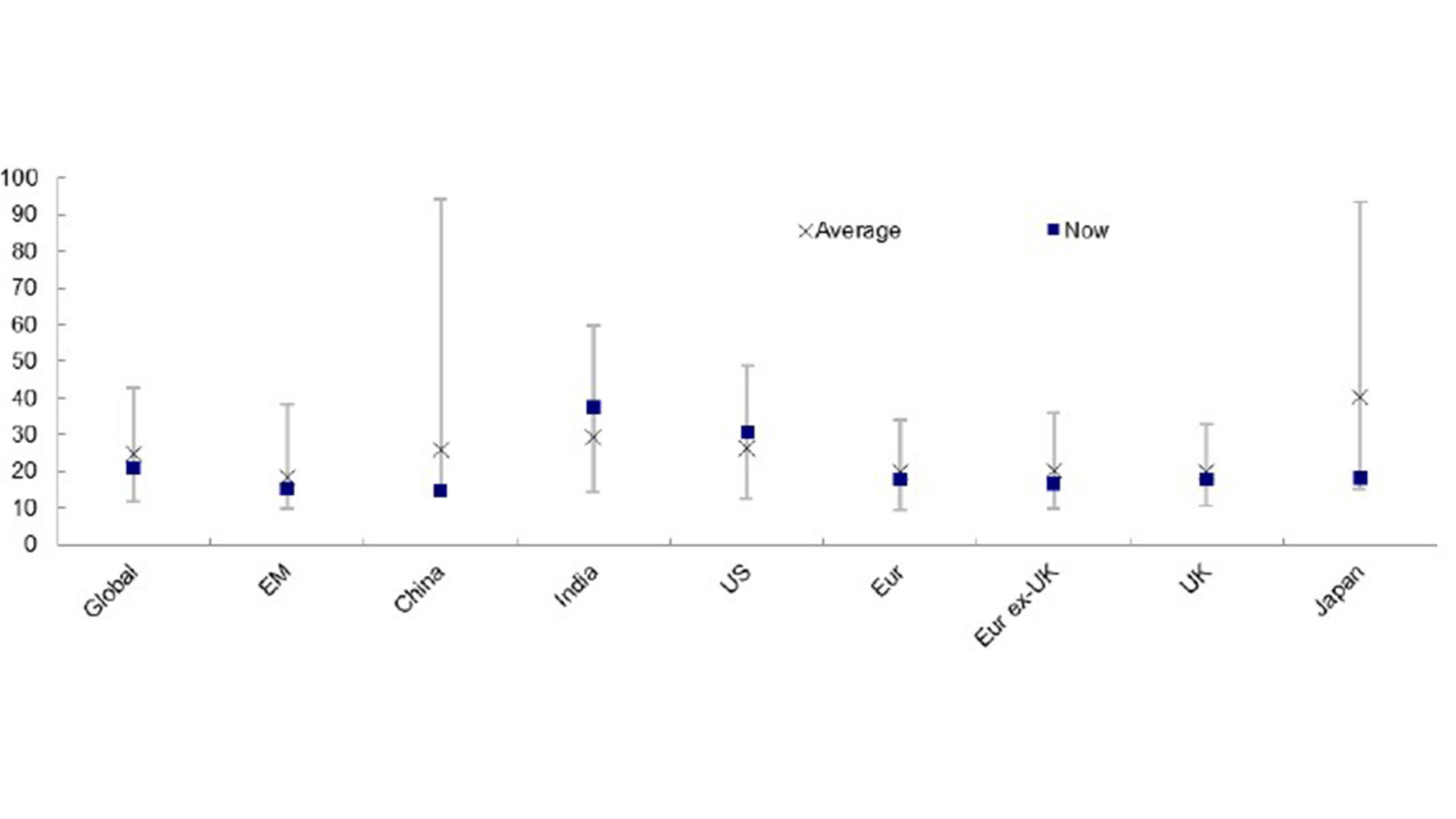

In our search for exotic stock market opportunities, we usually look for the holy grail of a dividend yield that exceeds the price/earnings ratio. Current examples include Brazil, Chile, Colombia, Hungary, Ghana, Kenya and Romania. Another example is Pakistan, where, after a 9% index decline in 2022, the current KSE-100 price/earnings ratio is 4.3 and the dividend yield is 10.2% (changing to 3.3 and 10.7%, respectively, based on consensus 2023 forecasts, according to Bloomberg, as of 5 January 2023). Usually, whenever valuation metrics are at such levels it is because earnings and dividends are expected to decline. However, those consensus estimates suggest the opposite, which is even more encouraging, especially compared to the more elevated valuation ratios applied to neighbouring Indian stocks (Figure 3 shows how expensive Indian stocks have become).

9. Chinese stocks outperform despite Covid woes

Having moved away from its zero-Covid policy China may suffer as other countries did during the early stages of the pandemic, with the difference that China is partially vaccinated and that therapeutic treatments now exist for those who fall ill. I suspect this will lead to pressure on hospitals (as it did elsewhere) and will require periodic lockdowns (as was the case elsewhere). Painful as it may be at times, these steps had to be taken at some stage and, as seen in other countries, something like normality beckons over the next year or so. Despite concerns about Covid, Chinese stocks have performed well in recent months and I suspect that will continue throughout 2023. For one thing, Chinese stocks have lower valuation ratios than elsewhere, with a cyclically adjusted PE ratio of 14.7 at end-2022 compared to 30.8 in the US and 37.6 in India and its own historical average of 25.9 (see Figure 3). For another, China effectively had a recession in early 2022 and its central bank is easing, suggesting economic momentum could be better than in the US and Europe. I think broad Chinese stock indices could outperform global indices during 2023.

10. Ireland wins Rugby World Cup 2023

This year’s Rugby World Cup is being played in September/October in France. Bookmakers seem to favour hosts France and perennial favourites New Zealand (see oddschecker.com). Looking at the pools and potential pathways through the competition, I suspect the final will be between France and Ireland, with the latter having the edge as the weight of expectation proves too much for the home team.

As a gift for the new year, we offer Figures 4, 5 and 6 which show long term performance data across assets, sectors and factors.

Unless stated otherwise, all data as of 30 December 2022

Note: Cyclically adjusted price/earnings ratio uses a 10-year moving average of earnings. Based on daily data from 3 January 1983 (except for China from 1 April 2004, India from 31 December 1999 and EM from 3 January 2005), using Datastream indices. As of 30 December 2022. Source: Refinitiv Datastream and Invesco