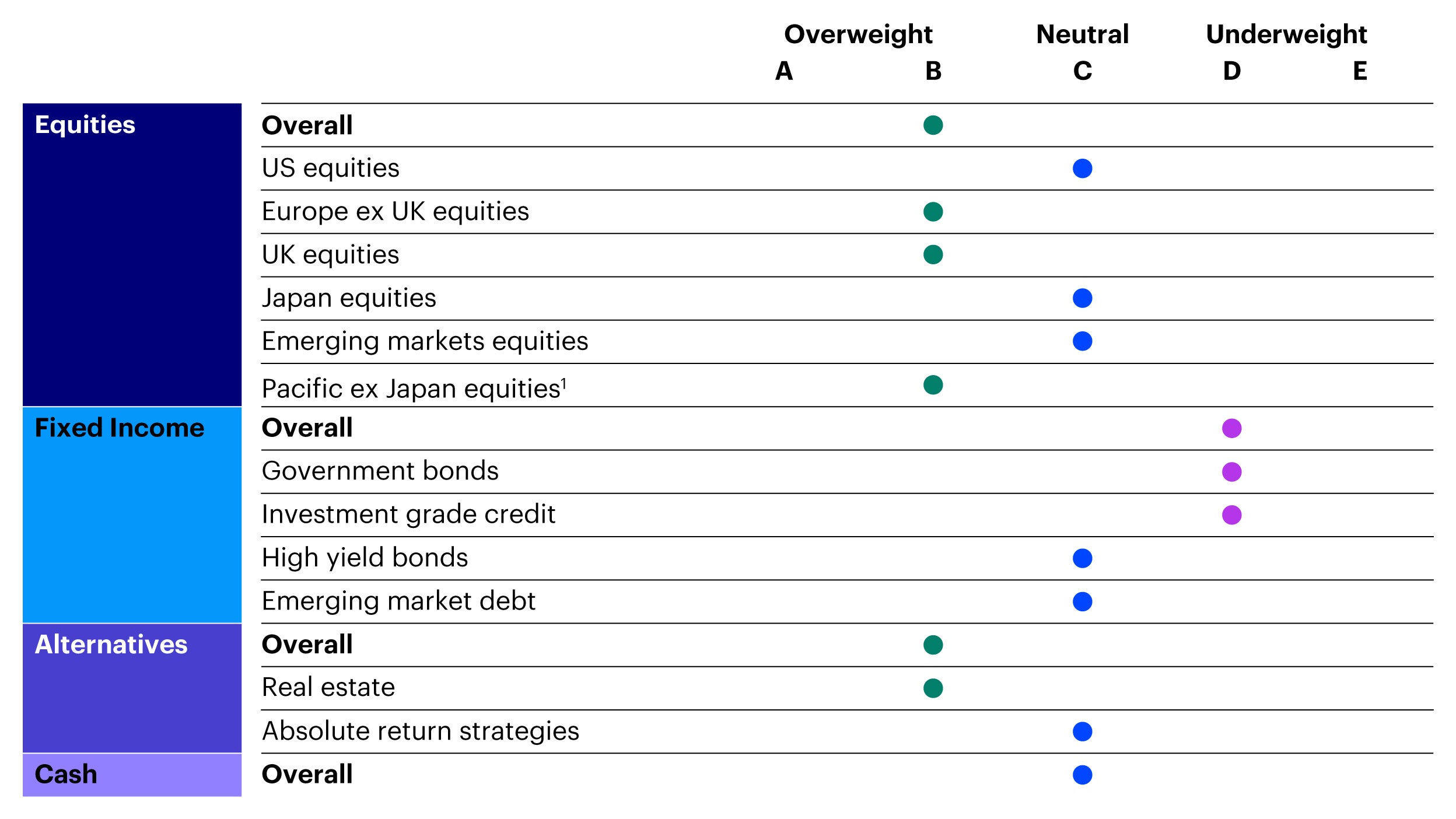

Multi Asset Team : Tactical asset allocation views

Each quarter, the Multi Asset Team shares its fundamental tactical asset allocation views, providing an A-E rating for each asset class over a 1–3-year investment horizon. Read their latest views below.

Key Takeaways

- Our asset allocation is unchanged, maintaining a preference for equities over bonds and cash.

- We still consider equity markets expensive in absolute terms, particularly US equities, but we believe they are supported by relative valuations (versus fixed income) and recent market weakness.

- Having tempered our bullishness in the last quarter of 2021, we are now a little more optimistic given current equity market levels.

- That said, we are mindful of the risks, including geo-political developments in Russia.

Source: Invesco as of 31 January 2022. 1Developed Asia.