Ideas that CLIC: Changing consumption trends support industrial demand

Key takeaways

How we consume goods and services has fundamentally shifted over time

COVID has fast-tracked this shift that was long in the making

The demand for industrial real estate has benefitted from this shift

“The pandemic has devastated retail real estate.” That storyline has been unavoidable over the last year and a half, perpetuated by economic lockdowns and the acceleration of e-commerce. But that’s not the whole story.

For one thing, the pressure on traditional retail has been going on for a decade or more, driven by changes in the way consumers consume goods and services — and there was a significant retail impact for at least 12 months before the pandemic. COVID simply accelerated a fundamental shift that was long in the making.

Importantly, the flip side of this story is industrial, which has benefitted from these existing trends and where we see continued promise in the years to come.

Four drivers of industrial demand

We see four main drivers of industrial demand over the next five years:

- The cyclical recovery. Job growth remains the primary driver of industrial demand.

- Expansion of e-commerce. The continuing shift to e-commerce remains a significant near- to mid-term demand driver.

- “Just in case” inventory. Supply-chain disruptions have prompted some companies to hold more inventory (a “just in case” versus “just in time” strategy).

- Onshoring/nearshoring. The need for a more resilient supply chain has led to a reshuffling of resources.

Driver 1: The cyclical recovery

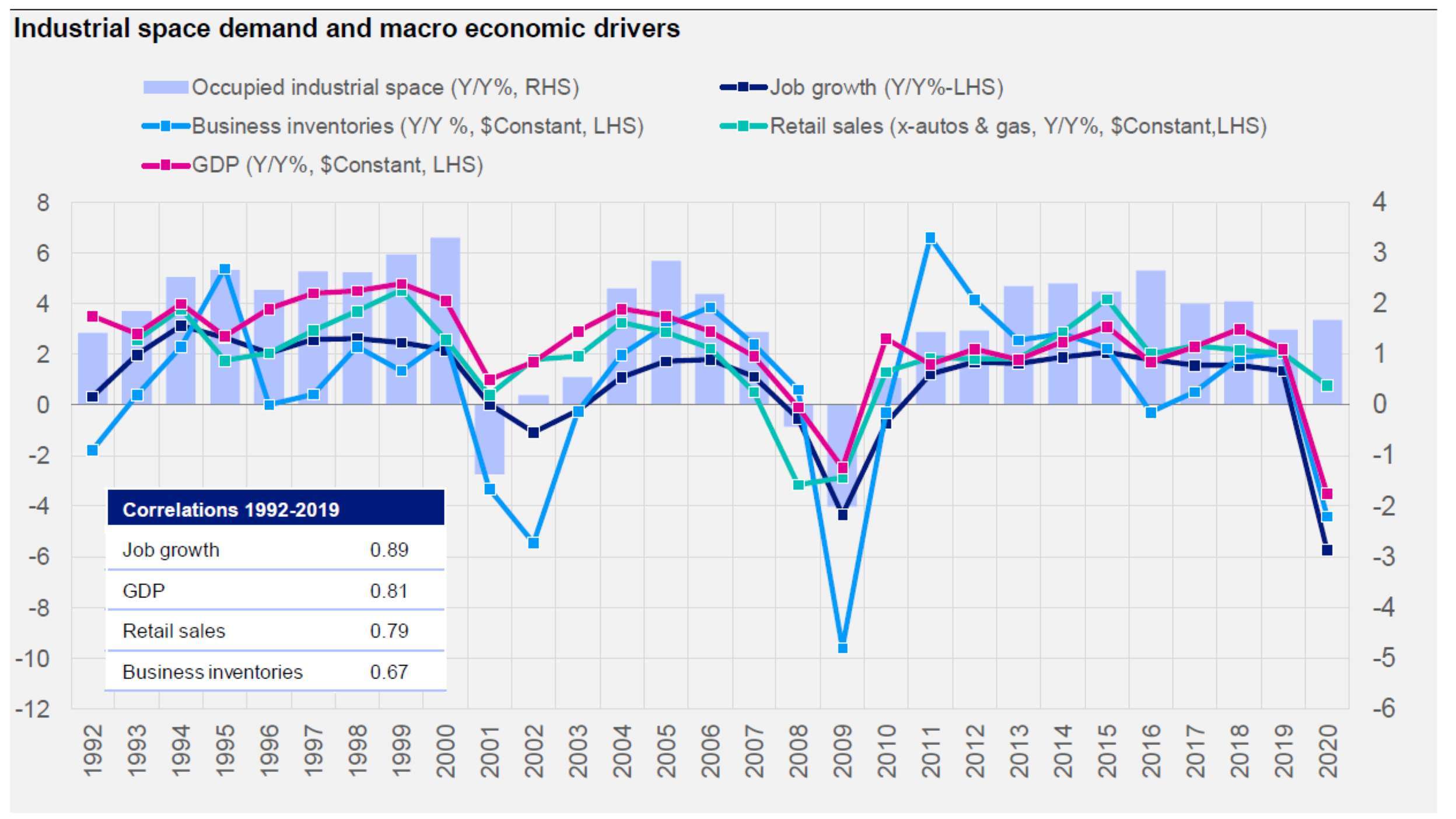

As the chart below shows, the demand for industrial space has a higher historical correlation with job growth than with other macroeconomic drivers such as gross domestic product (GDP)1, retail sales, or business inventories.

The obvious exception is 2020, when job growth plunged, but industrial demand grew year-over-year (Y/Y) from 2019. Does this represent a reset in what’s important to the industrial market going forward? No—we believe this is an outlier driven by strong e-commerce demand during the pandemic. We expect industrial demand to remain highly correlated to the business cycle.

Source: Invesco Real Estate using data from CBRE-EA and Moody’s Analytics as of April 2021

Driver 2: Expansion of e-commerce

The pandemic put e-commerce squarely in the spotlight, but this is a trend that was long in the making, and one that we expect to grow for years thanks to technological innovation and the younger generation’s comfort with online shopping.

Invesco Real Estate believes this should be a great benefit to industrial real estate demand — but how much runway remains? The answer to that depends on three key questions.

1. How much growth is possible?

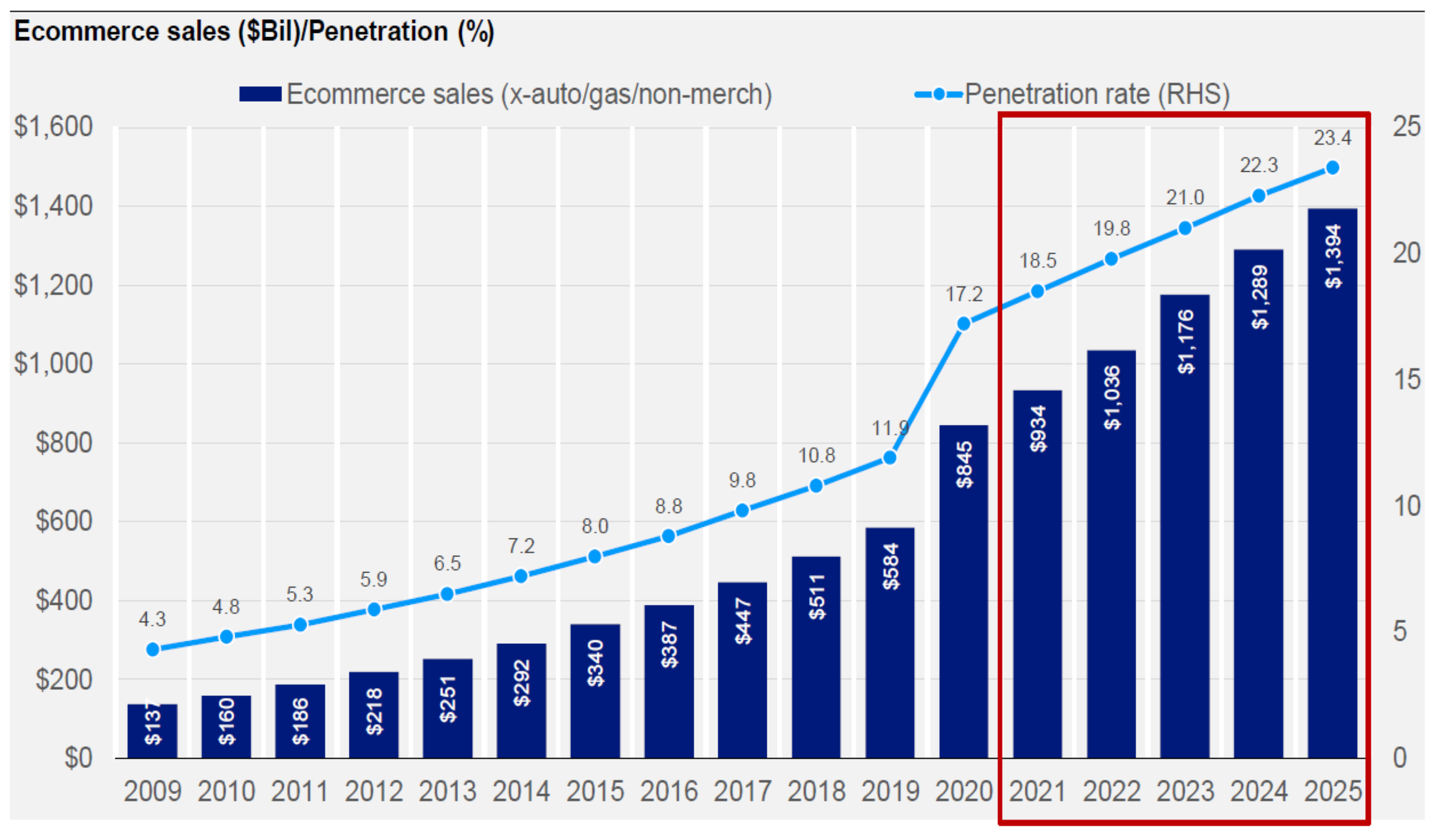

The current penetration rate of e-commerce is about 18% of adjusted retail sales. Forecasts vary, but most experts anticipate strong growth over the coming decade — Green Street and Cowen expect a penetration rate of about 25% by 2025, and Goldman Sachs forecasts about 30%. Cowen’s forecast is illustrated below.

$5.8 trillion: total e-commerce sales expected for 2021-2025.

50%: 50₵ of every $1 in new retail spending is expected to occur online

130 million: e-commerce demand should support about 130 million square feet of net new industrial demand annually over the next five years.

Source: Cowen research

Source: Invesco Real Estate using data from Cowen and Company as of April 2021; Cowen estimates ecommerce sales to include goods ordered online and shipped from a warehouse or direct from a store.

What could this mean for industrial demand? Cowen estimates that e-commerce demand should support about 120 million to 130 million square feet of net new industrial demand annually over the next five years. This will be impacted by company-specific fulfillment strategies and companies’ plans to build-out their fulfillment platforms. And that brings us to our next two questions.

2. When will Amazon finish building its fulfilment platform?

Amazon has about 38% share of US e-commerce sales and has been aggressively building out its fulfillment platform. In 2020, Amazon added about 100 million square feet of industrial space, accounting for about 45% of industrial net absorption, and it is on pace to add a similar amount in 2021.

What is unclear is whether Amazon is building for today, or for the future.

3. How will other retailers choose to fulfill online orders?

Amazon’s fulfillment platform is currently the exception, not the rule. National retailers such as Walmart, Target, Home Depot and Best Buy are largely using their existing store base for fulfillment. And others are outsourcing their fulfillment using third parties, or even Amazon’s platform.

How other retailers choose to fulfill orders in the future will impact industrial demand.

Driver 3: “Just in case” inventory

Recent supply-chain disruptions have prompted some companies to hold more inventory — a “just in case” versus “just in time” strategy. If this trend continues, it could have a notable one-time impact on industrial demand.

History suggests that a 1% increase in inventory levels has resulted in a 1.7% increase in occupied industrial space.5 That means that a modest 2% to 3% increase in current inventories could result in 400 million to 600 million square feet of aggregate net new demand—equivalent to two or three years of demand.

We expect this would be a one-time impact as companies reset their sales-to-inventory ratio to build a more resilient supply chain.

Driver 4: Onshoring/nearshoring

Recent supply-chain disruptions have also increased the desire to diversify supply chains, especially ones that are solely dependent on China, but that’s easier said than done. For example, Southeast Asian countries and Mexico may be cost-competitive, but their capabilities and capacity lag China.

In terms of onshoring, the Biden administration is focused on strengthening domestic US supply chains and has earmarked money in The American Jobs Plan to incentivise this. However, we expect the impact to industrial demand may be marginal, geographically focused, and not immediate.

Conclusion

Invesco Real Estate believes that the old ways of thinking about the real estate market fail to appreciate how the world is changing — and what that means for investors. When it comes to the evolving way we consume goods and services, we believe the trends point to greater opportunities in the industrial space over the next five years.

Finding those opportunities requires deep understanding of the various forces impacting industrial demand. The world may be changing, but the importance of experience and expertise remains.