2026 Investment Outlook - Asia Equities

Asia equities delivered a resilient performance in 2025, supported by policy measures, robust domestic demand, and AI-driven innovation across key markets. Looking ahead, we expect the U.S. dollar to remain on a weakening trajectory, a trend that has historically benefited Asia equities. The global monetary environment is likely to continue its rate-cut cycle, prompting investors to rotate away from U.S. markets toward more attractively valued Asian economies.

We maintain a constructive outlook for Asia equities in 2026, underpinned by improving earnings prospects, supportive liquidity conditions, and structural reform momentum. In this environment, Asian markets are well-positioned to capture both cyclical tailwinds and long-term secular growth trends, offering compelling investment opportunities for global investors.

Source: Bloomberg, data as of November 20, 2025.

Asia’s markets exhibit diverse drivers and investment opportunities:

China

We maintain a constructive outlook on China, supported by structural growth drivers and clear policy priorities. Domestic consumption remains a key pillar, contributing around 60% to economic growth from 2021 to 2024, a trend expected to strengthen as incomes rise and service sectors such as healthcare, education, and elderly care expand.

Industry consolidation is reducing oversupply in manufacturing, allowing leading firms to capitalize on advanced technology and resources for sustained growth. Looking ahead, the 15th Five-Year Plan reinforces China’s commitment to breakthroughs in core technologies, advanced manufacturing, and emerging industries, such as semiconductors, green energy, and quantum computing, to reduce reliance on foreign supply chains. Accelerated industrial upgrading and an evolving consumer market, driven by high-level opening-up, are set to create significant new opportunities for investors.

India

India’s equity market did not rise as much as broader Asia and global peers in 2025, but we expect a potential turnaround in 2026. Domestic economic indicators are improving, supported by steady consumption and investment trends, though we continue to monitor external uncertainties such as H1B visa policies and trade dynamics.

The recent rationalization of the Goods and Services Tax (GST) and earlier personal income tax cuts are expected to ease household tax burdens and stimulate consumption. We anticipate these measures will gain traction in the coming year as household spending patterns adjust, driving growth across key consumer sectors. We see investment opportunities in consumer discretionary sectors, including automobiles, travel, and jewelry, which stand to benefit from policy tailwinds and rising incomes.

Korea and Taiwan

Korea and Taiwan have both benefited from the ongoing technology cycle, particularly in high-bandwidth memory (HBM) and semiconductors, driving market re-ratings. We expect these markets to continue gaining from rising demand for AI applications, poised for multi-year capacity growth.

Furthermore, Korea is accelerating governance reforms to strengthen shareholder value. The previous Value-Up Program has heightened corporate focus on capital management, shareholder returns, and stock valuations. Looking ahead in 2026, proposed amendments to the Commercial Code aim to enhance governance through expanded fiduciary duties for directors, cumulative voting to improve board independence, and adjustments to dividend taxation. These changes could support higher dividend payouts, attract long-term investors, reinforcing Korea’s position as a more competitive and investor-friendly market.

ASEAN

Investment opportunities and valuations across ASEAN markets remain attractive, though investors should monitor political uncertainties in select countries.

Singapore stands out as a bright spot, supported by ample liquidity and proactive government initiatives aimed at unlocking value in undervalued sectors and asset classes. We expect Singapore’s economy to maintain a stable outlook underpinned by favorable policy measures.

We are also constructive on Malaysia and the Philippines. Malaysia continues to attract global semiconductor and tech hardware companies, complemented by young demographics, rising incomes, and structural export growth in electronics. Meanwhile, the Philippines is poised to benefit from supportive financial conditions and resilient private consumption, driven by urbanization, a young population, and overseas remittances, providing a solid foundation for long-term economic expansion.

Investment themes in Asia: Artificial Intelligence (AI)

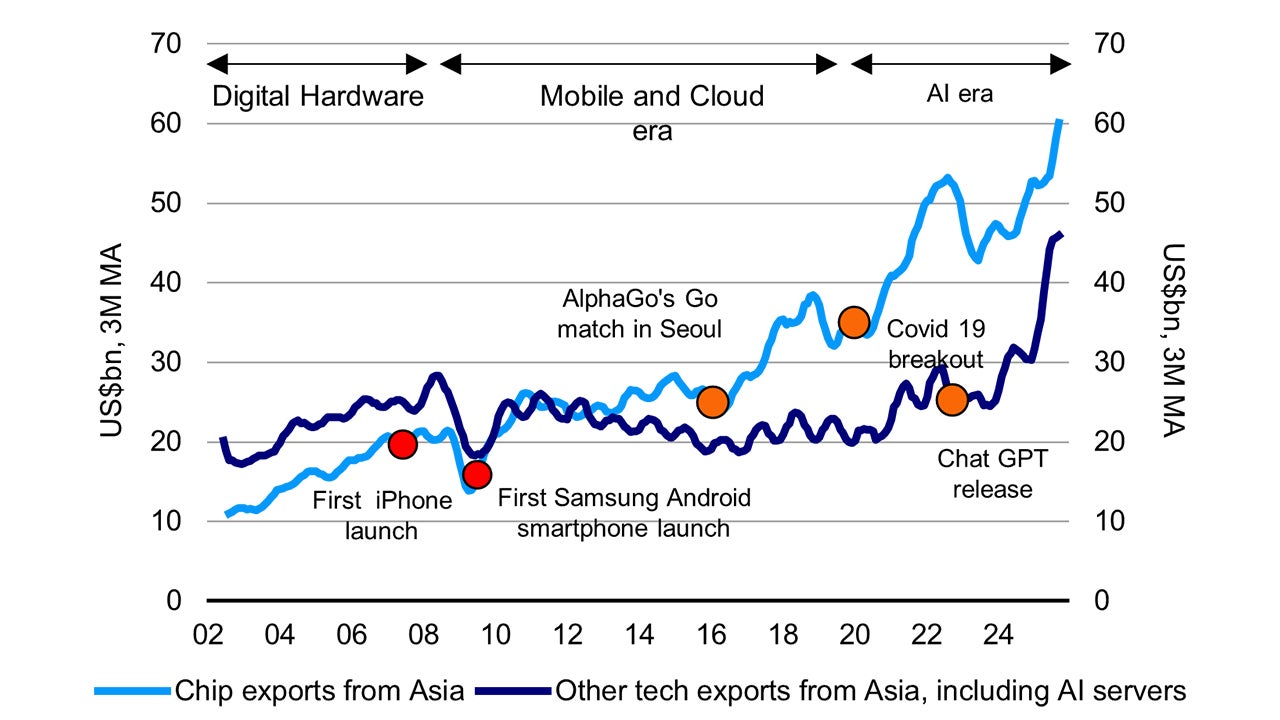

Looking forward, we believe Artificial Intelligence (AI) will be a structural growth theme across Asia, despite near-term volatility and a mini-cycle in valuations. Recent re-ratings in software, hardware, and infrastructure segments reflect strong investor interest, but the full benefits have yet to materialize at the application layer.

We believe the next growth phase will be driven by real-world AI applications, where adoption accelerates across industries such as healthcare, finance, manufacturing, and e-commerce, unlocking revenue streams and productivity gains. Asia’s competitive advantage lies in its large data ecosystems, cost-efficient talent pools, and government-backed digital strategies, which create fertile ground for scalable AI solutions.

As the investment universe evolves, selectivity will be critical: we favor companies with clear monetization pathways, proprietary technology, and integration capabilities that enable AI to move into enterprise-wide deployment. We expect AI adoption could become a key driver of earnings growth and valuation re-rating across Asia.

Source: Haver Analytics, Goldman Sachs Global Investment Research, as of September 2025.

Navigating external trade dynamics

Asia equity markets remain exposed to volatility driven by unpredictable global tariff developments and trade tensions, and we believe these risks may persist. Encouragingly, recent constructive dialogues between Asian economies and the U.S. have resulted in trade agreements that lowered tariffs, easing some pressure on the region.

Looking beyond short-term uncertainties, Asia’s large domestic markets and expanding innovation ecosystems provide a strong foundation for sustainable growth. Structural drivers—such as robust domestic demand, reform momentum, and technological transformation—continue to underpin Asia’s resilience. In this environment, Asia equities are well-positioned to capture both cyclical tailwinds and long-term secular trends, even amid ongoing global trade challenges.

Overall, Asia equities are trading at attractive valuations with robust earnings growth, and Asia ex-Japan equities continues to trade at a discount to developed markets. The Asia region offers compelling opportunities supported by reform, innovation, and resilient domestic demand. Investors should remain selective, focusing on markets and sectors with clear policy support, reform momentum, and long-term growth potential.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.