China’s property and financial sector stress and the remediation outlook

After a strong start to the year, economic headwinds have gathered in China. Growth has slowed, property developers are on the edge of a precipice - financial markets are nervous because of recent shadow bank incidents.

Policymakers have already responded with pledges and piecemeal support, though more expedient and muscly policy support for the property market and financial services sector are needed in order to prevent a further slide.

The recent property and financial sector stress

Problems have recently surfaced in the property and financial services markets.

One of China’s largest property developers and one of China’s largest, private wealth managers (shadow bank / trust), have missed scheduled payments to investors1, triggering market concerns over the health of corporate and financial industry balance sheets.

While anxiety levels are high in Chinese markets these days, these incidents are unlikely to devolve into a liquidity crisis.

Policymakers have been closely monitoring the situation and already taken initial steps to ease the property market problems through policy rate cuts and increasing liquidity to developers.

On the shadow banking front, numerous regulatory guardrails and safeguards have been put in place over the past few years2.

Policymakers to date, have been parsimonious with their stimulus measures, avoiding any large-scale fiscal transfers or significant rollbacks to property market restrictions.

If push came to shove, and the economy appeared to barrel towards a downwards spiral, I believe policymakers would take out these stimulus bazookas.

A deep dive into China’s shadow banking

That said, the shadow bank problem couldn’t have come at a worse time, as liquidity concerns over China’s property developers and local government financing vehicles (LGFVs) start to pile up.

The halted payments on wealth products could further squeeze liquidity to troubled property developers and cash-strapped LGFVs as well as other financial institutions and corporates that have sold, borrowed or invested in related trusts and wealth products.

The trust company in question, manages over RMB 1trn of assets has faced liquidity constrains. Supposedly around RMB 230bn worth of investment products are at risk3 from both the trust company and its affiliates4.

Most of the wealth management products cater to wealthy individuals and deploy riskier strategies in order to target high returns. Assets are placed in alternative investments, such as trust loans and account receivables. Average returns on these wealth management products average close to 7% per annum since 2018, compared to bank lending returns of close to 4%5.

Trust companies often extend high interest loans to institutions that don’t have easy access to traditional bank loans, such as property developers and LGFVs. These institutions have seen their balance sheets deteriorate this year, causing some to miss interest rate payments which has triggered dividend payment problems at the respective trust company and its wealth management products.

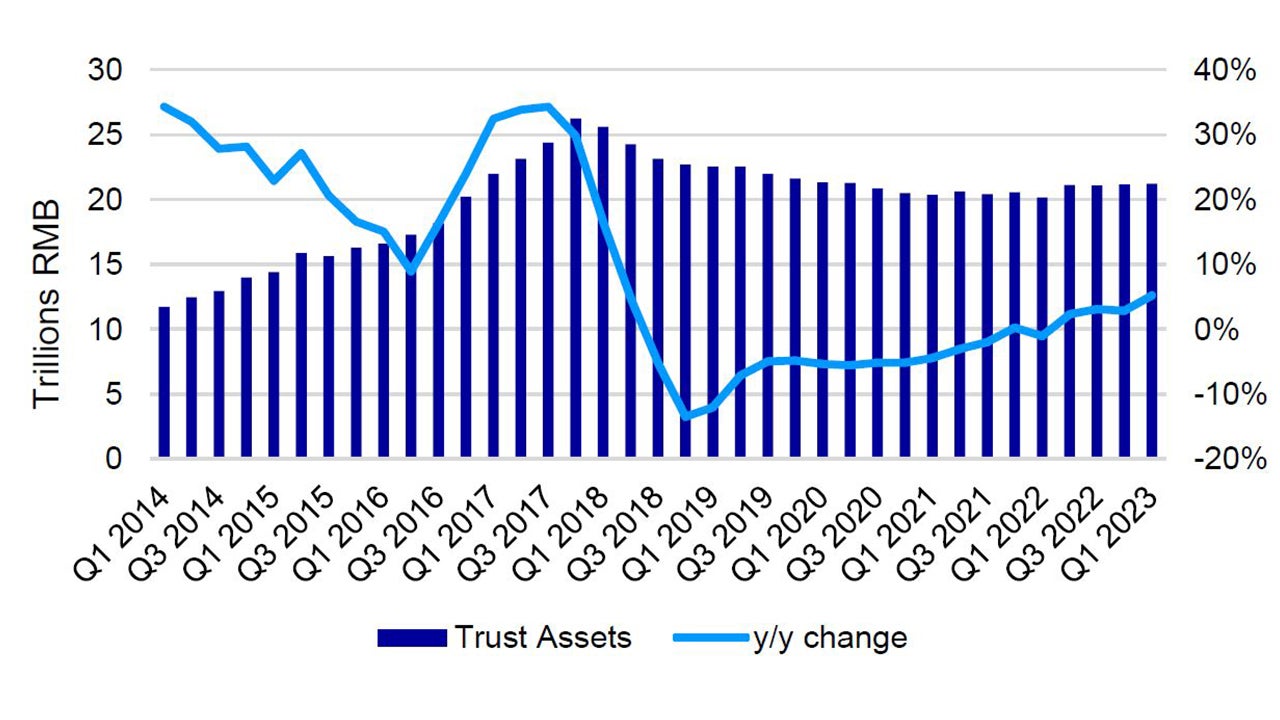

It’s difficult to say how big the trust problem could be. Assets managed by trusts in China total around 5% of the RMB 400trn financial system and around 1.1trn is invested in the property sector6, according to the China Trustee Association.

Regulators in recent years have cracked down on this type of shadow banking, most recently in 2021 constraining the ability of trust companies to lend to property developers and LGFVs.

Source: China Trustee Association. Data as of Q1 2023.

Outlook

I believe the net impact for both the property developer and shadow banking incidents could lead to further fiscal conservatism from Chinese households, which may sap near-term consumption spending and household sentiment.

Capital is likely to pivot ever more so to bank deposits and away from riskier assets, which could result in tighter financial conditions. Already, Chinese households are cautious, keeping an unusually high percentage of their savings in bank deposits7.

On a brighter note, the domestic wealth management business saw some pickup in product performance over the past month and demand as deposit rates continue to trudge downwards through policy rate cuts8.

While the trust problem is an issue to keep an eye on because of the possible strains it would place on developer and LGFV financing, ultimately, what really matters for China’s growth outlook and markets are two things 1) how quickly the property market can be stabilized 2) further policy stimulus.

So far, stimulus measures have underwhelmed – it’s likely that policymakers are trying to determine the least costly form of government support.

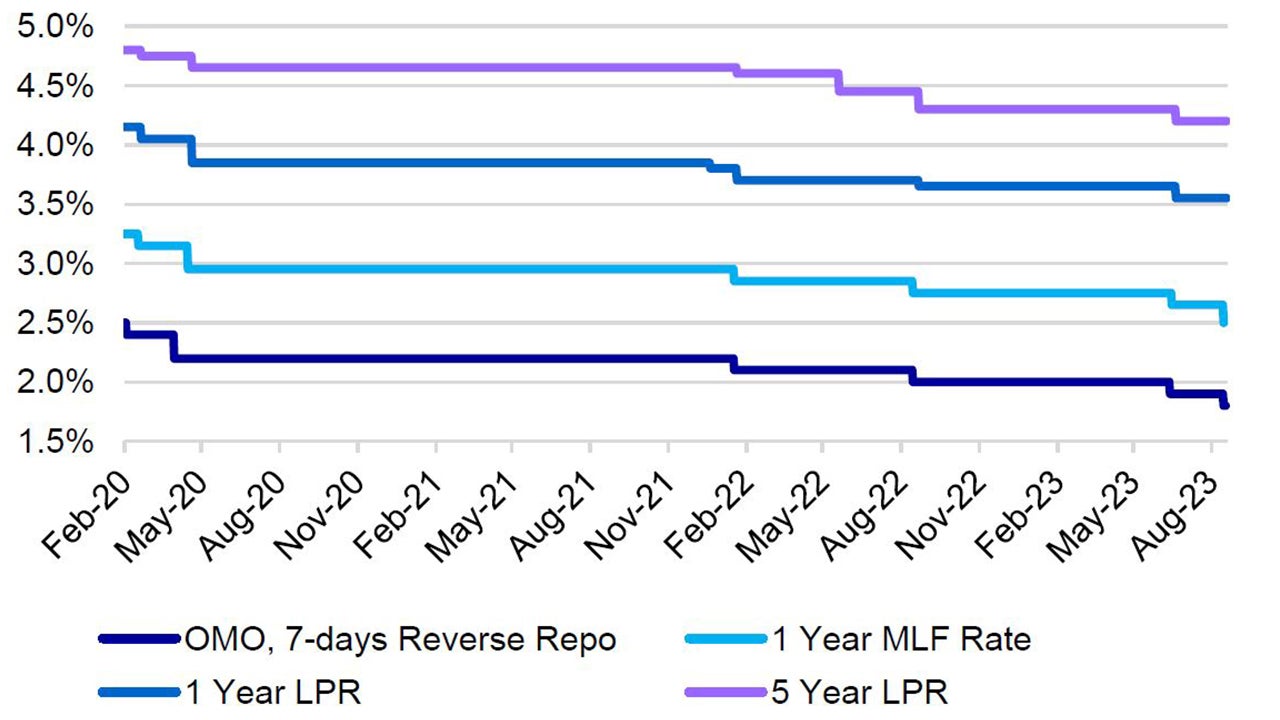

The recent Medium-term Lending Facility and repo rate cuts were quite modest. They are not effective enough on their own nor are they the right fundamental tools to address the key issues: the struggling property market and weak household demand.

Source: People’s Bank of China (PBoC). Data as of 8 August 2023.

Monetary policy may not be able to address the current situation; the recent rate cuts have served as an easing signal from policymakers, but property investment and housing sales have continued their downward trend. Note how the June rate cut did little to improve home sales.

Fiscal stimulus could be a better tool

Fiscal stimulus is better suited for the current economic environment, and I expect policymakers to turn to their classic stimulus playbook – infrastructure investment – to boost growth and sentiment.

Ultimately, it’s hard to see growth getting back on track without the property market stabilizing. Officials have so far been averse to broad-based policy and fiscal support, but I believe that when push comes to shove, they would prioritize domestic growth, even if it means some weakening of the currency.

Despite its limitations, I’m expecting monetary policy to nonetheless ease further into this year. This could result in a bit of currency fluctuation, though well worth the price if that means getting the domestic economy back on track.

Any further delay in stimulus measures could lead to more intense economic problems down the line.

While Q3’s growth is likely to remain flat on a sequential basis, I expect a pick-up in the final quarter of the year, as policymakers finally roll-out more broad-based and concrete stimulus measures to stabilize the property market and invigorate household demand.