The Pitfalls of the Small Cap Index

Smaller companies (Small Caps) offer investors the potential for higher returns as these businesses are typically more dynamic, with higher growth and have greater operating leverage than their larger counterparts. However, in Australian equities simply allocating to a smaller companies index has provided investors with mixed results.

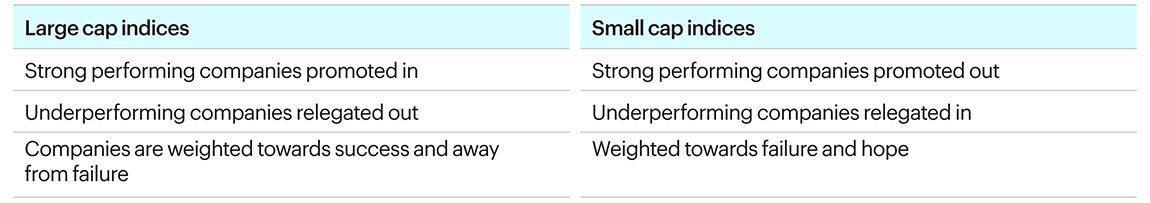

To understand why passively investing in smaller companies might not be the best approach we have taken a closer look at some of the structural design concepts of traditional capitalisation weighted indices and why they may work better for exposure to larger companies than smaller companies.

Capitalisation-weighted indices are designed to give more weight to companies with larger market capitalisations. While this approach works well for large-cap indices, it presents unique challenges for small-cap indices.

Due to capitalisation weighting of Small Cap indices, it is the largest Small Caps that get the majority of the exposure. There are typically two types of companies that feature as being large in Small Cap indices, they are either companies that were previously large but are now small (Fallen Angels) or companies that are trading on very high valuations based on extremely high growth expectations (Glamours).

So, where Large Capitalisation indices are weighted towards success, Small Cap indices tend to be weighted towards failure (Fallen Angels) and hope (Glamours). In addition, Small Cap indices have a greater representation to companies that barely earn enough revenue to meet their current interest payments, these companies are typically referred to as Zombies

20% of the S&P/ASX Small Ordinaries Index weight is made up of companies that were formerly in the S&P/ASX 100 Index

Challenges of Passive Investing in Small Caps: Given the high exposure to Fallen Angels, Zombies and Glamours within Small Cap indices, a passive approach in this asset class can be particularly challenging. Strategies that track these indices may inadvertently include a significant proportion of underperforming companies, leading to suboptimal returns - as we explored in Australian Smaller Companies: Fallen Angels, and Zombies and Glamours....oh my!

By employing a systematic approach that targets proven return drivers, investors can harness the true growth potential of smaller companies while avoiding the traps associated with traditional index investing. Importantly, investors can access these return drivers at a fraction of the cost of traditional active strategies.