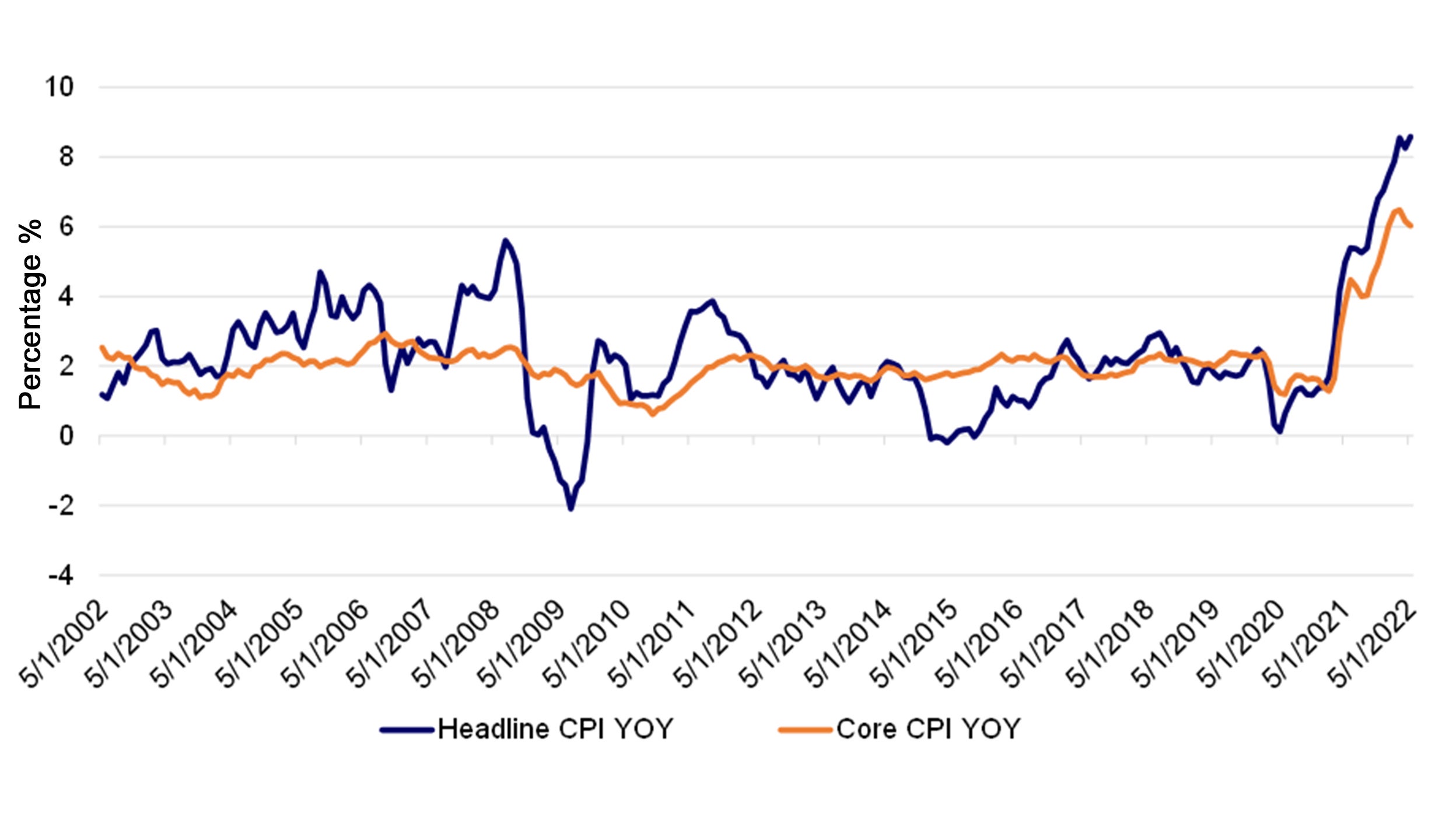

US May inflation heats up more than expected

US headline consumer price inflation in May climbed to +8.6% y/y (vs. cons. 8.3% and 8.3% in April), its highest rate in 40 years, driven by rising food and energy costs as well as higher shelter costs.

The higher-than-expected CPI reading puts pressure on the US Federal Reserve to further tighten policy to restore price stability. Core CPI, which excludes food and energy, appears to have peaked as the inflation rate on durable goods declined slightly to 6.0% y/y from 6.2% in the prior month.

Source: Bloomberg, as of June 10, 2022

Nonetheless, inflation inputs remain higher than expected as higher costs for commodities and services continue to rankle the markets and puts pressure on the Federal Reserve.1

Market sentiment appears to be deteriorating on Friday amid expectations of tighter monetary policy, driven by declines in the tech-heavy Nasdaq Composite Index 2 and Asian markets sold off on Monday morning.

- The market is now expecting between nine and ten interest rates hikes between now and early 2023 with 50 basis points hikes priced in at the next three FOMC meetings.3

- The US Treasury yield curve has flattened meaningfully as the 2-year rate climbed above 2.9% and the 10-year fell to 3.02%. A flattening yield curve should be viewed as a warning sign of future economic woes but is typically not a sign that a recession is imminent.4

- The US dollar is rallying as expectations of higher rates in the US and the potential for a deterioration in economic activity has investors allocating capital to the US greenback.5 This could portend to near-term volatility for EM local currencies and risk assets.

Implications

The risk to the current US business cycle is elevated. Cycles don’t end on their own volition but rather the demise is almost always the result of tighter policy. We would expect volatility to remain elevated as policy uncertainty persists and for financial conditions to tighten.

Our outlook calls for US inflation to moderate over the course of the year driven by base effects and slowing consumer demand but recognise that the risks to that call are elevated. We are comforted by the recent moderation in goods prices but recognise that service and commodity inflation remain stubbornly high.

The markets, since mid-March, have been signaling that the US economy is in more of an expansionary phase (stocks outperforming bonds, high yield credit outperforming Treasuries, value outperforming growth, interest rates and commodity rising higher). 6

Nonetheless, the US economy is likely to slow as the Fed tightens policy and as the consumer grapples with higher food prices and the higher cost of rent.

In the slowdown phase of the cycle, we still favor equities but recognise that volatility persists amid policy uncertainty, returns become more modest, and the range of outcomes within equity indices becomes more extreme. Higher quality businesses with pricing power and greater visibility of earnings will likely outperform as financial conditions tighten.

Bottom Line

Inflation and Fed tightening hasten the end of business cycles. We still believe our base-case scenario will come to fruition, in which inflationary pressures ease as consumer demand slows and supply-chain challenges recede as workers return to the factory floors.

However, we recognise that the probability of a “persistent inflation” scenario, in which central banks tighten too aggressively and choke off economic growth, remains very elevated.