Alternative opportunities: 2024 Outlook

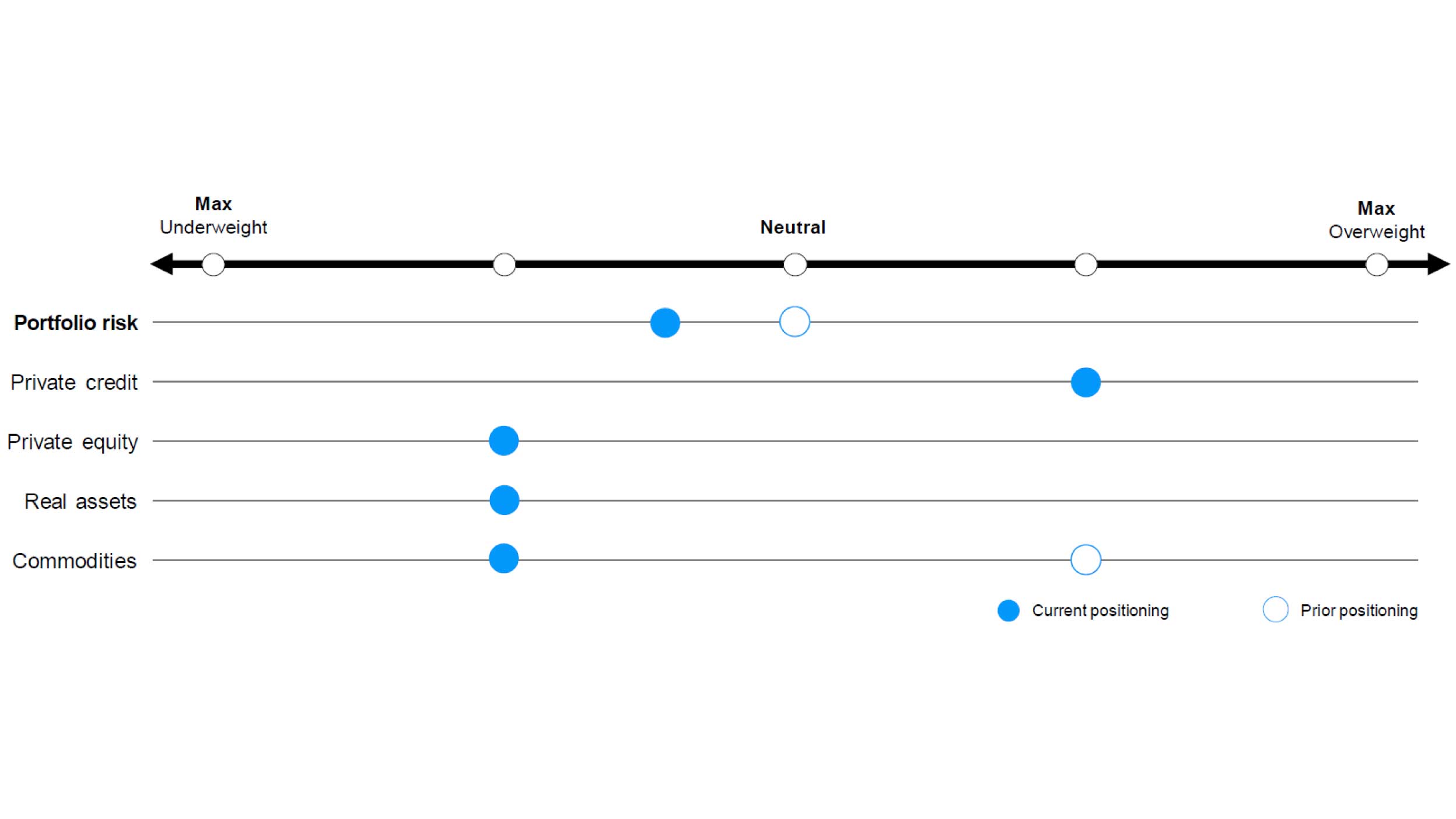

Read our analysis and take a look at our summary dashboard across key alternative asset classes.

Alternative Opportunities is a quarterly report from Invesco Solutions. In each new edition, we look at the outlook for private market assets. In particular, we focus on private credit, private equity, real estate, infrastructure and commodities.

As we look to 2024, our view for direct lending is that the backdrop supporting a more favourable transaction environment is firmly in place relative to 2023, including better visibility into the macro environment, softening inflationary pressures, potential rate reductions and heightened pressure from LPs for private equity firms to generate realizations and invest in new platform companies.

Within distressed debt and special situations, we are seeing a significant amount of liquidity-constrained small caps that are “good companies” with “bad balance sheets”, providing an expanded opportunity set for the asset class.

With record levels of dry powder now four years or older, depressed debt coverage ratios, and a looming refinancing wall, opportunities should present themselves for managers with turnaround experience in an environment where General Partners (GPs) are highly incentivized to ramp up purchase activity. While still at valuations that exceed pre-2021 levels, the correction in late-stage venture valuations should provide a continued opportunity for private equity firms with a flexible mandate.

Despite a subdued transaction environment, many real estate markets continue to see robust income fundamentals. We note that leasing has slowed broadly across property types in the US, where we expect the recovery in fundamentals to lag the capital markets recovery.

While dry powder remains elevated, and valuations, like those in real estate, have not backed up with base rates, near term fundamentals are strong and secular tailwinds are supportive.

Commodity prices remain volatile and rangebound across most sub-complexes. While our secular trend assessment is increasingly attractive, we caution it is subject to sudden change.

Source: Invesco Solutions, views as of Feb. 29, 2024.

Alternative opportunities: 2024 Outlook

Read our analysis and take a look at our summary dashboard across key alternative asset classes.