Alternative opportunities quarterly update

Executive summary

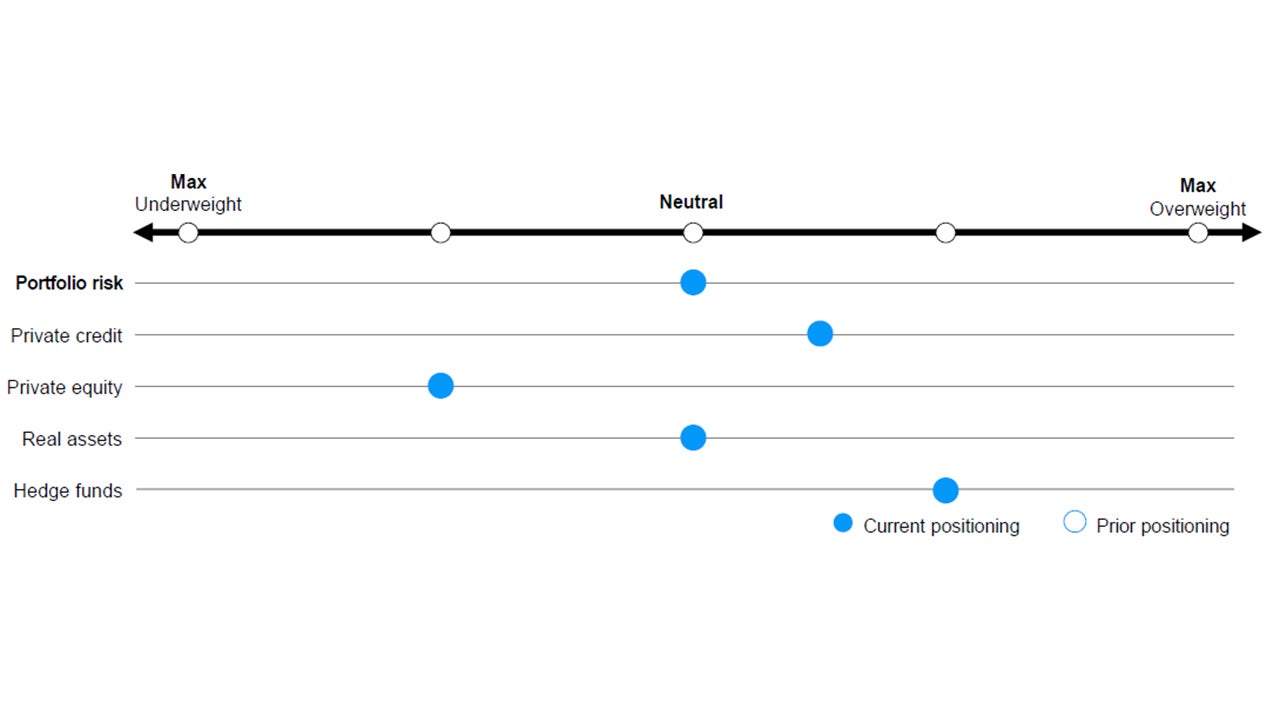

Portfolio risk: We remain neutral on how we’re allocating risk within our alternatives portfolio due to elevated downside growth risks, high equity valuations, and benign capital markets activity. In general, we’re more defensive, favoring private debt and hedged strategies versus private equity.

Private credit:

- Deal flow remains challenged, however, with recent activity well below its 2021 peak. A muted leveraged buyout (LBO) environment due to large valuation gaps keeps many PE deals on hold.

- With a surplus of real estate debt dry powder and a continued pullback by banks, alternative lenders are poised for a robust year of loan origination.

Private equity: Private equity (PE) faces headwinds in today’s environment. High interest rates are likely balanced by lower public market valuations post-sell-off. While uncertainty looms from tariffs, we believe a favorable regulatory environment for domestically oriented sectors within PE (such as those in the middle market) may provide some counterbalance.

Real assets: While cap rates remain muted relative to interest rate levels, we view real estate valuations as relatively attractive compared to public and private equity markets. After recent policy and sentiment volatility, expected Fed cuts should be supportive for lending costs and cap rates.

Hedge funds: As stock markets recently entered a technical correction, hedge funds with lower betas to market risk may be a valuable alternative within a portfolio. Spreads within event-driven strategies remain high due to the limited capital markets activity from mergers and acquisitions as private equity remains sidelined.

Source: Invesco Solutions, views as of May 12, 2025. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Alternative strategies may include investments in private equity, private credit, private real estate and infrastructure, which may involve additional risks such as lack of liquidity and concentrated ownership. These types of investments may result in greater fluctuation in the value of a portfolio. Private Market investments are exposed to risk, which is the risk that a counterpart is unable to deal with counterparty obligations. Changes in interest rates, rental yields and general economic conditions may result in fluctuations in the value of any underlying strategies. These types of strategies may carry a significant risk of capital loss and other market risks.