Given the continued restrictions related to Covid-19, many physical stores will be closed or operating at reduced capacity. What has already become the biggest sales weekend in eCommerce is now expected to bring even more shoppers online than ever before.

In our view, US retail sales have been incredibly strong despite the pandemic-induced recession. The consumer sector continues to recover, and there is evidence of pent-up demand. Amazon’s Prime Day 2020, for example, was a record-breaking event for small and medium businesses worldwide with US$3.5 billion in sales, a rate of 60% more than last year2.

Delivery services providers Fed-ex and UPS have signalled that they are operating at full capacity. Many retailers have also stated that shipping times will be longer this year. We believe that even those holiday shoppers that tend to wait to the last minute are more likely to participate in Black Friday weekend this year, and we expect more shopping will be done online than not.

In 2019, Amazon accounted for 54.9% of all sales on Black Friday3. The company is now expected to exceed US$100 billion in quarterly revenue for the first time ever in Q4 20204, which places it into rarefied air and underlines its market dominance.

Amazon is one of the prime holdings in the Invesco Global Consumer Trends strategy, which seeks to invest in global leaders benefitting from a change in consumer behaviour as a result of technology and increased internet connectivity. We believe Amazon has placed itself in an enviable position, as eCommerce continues to grow.

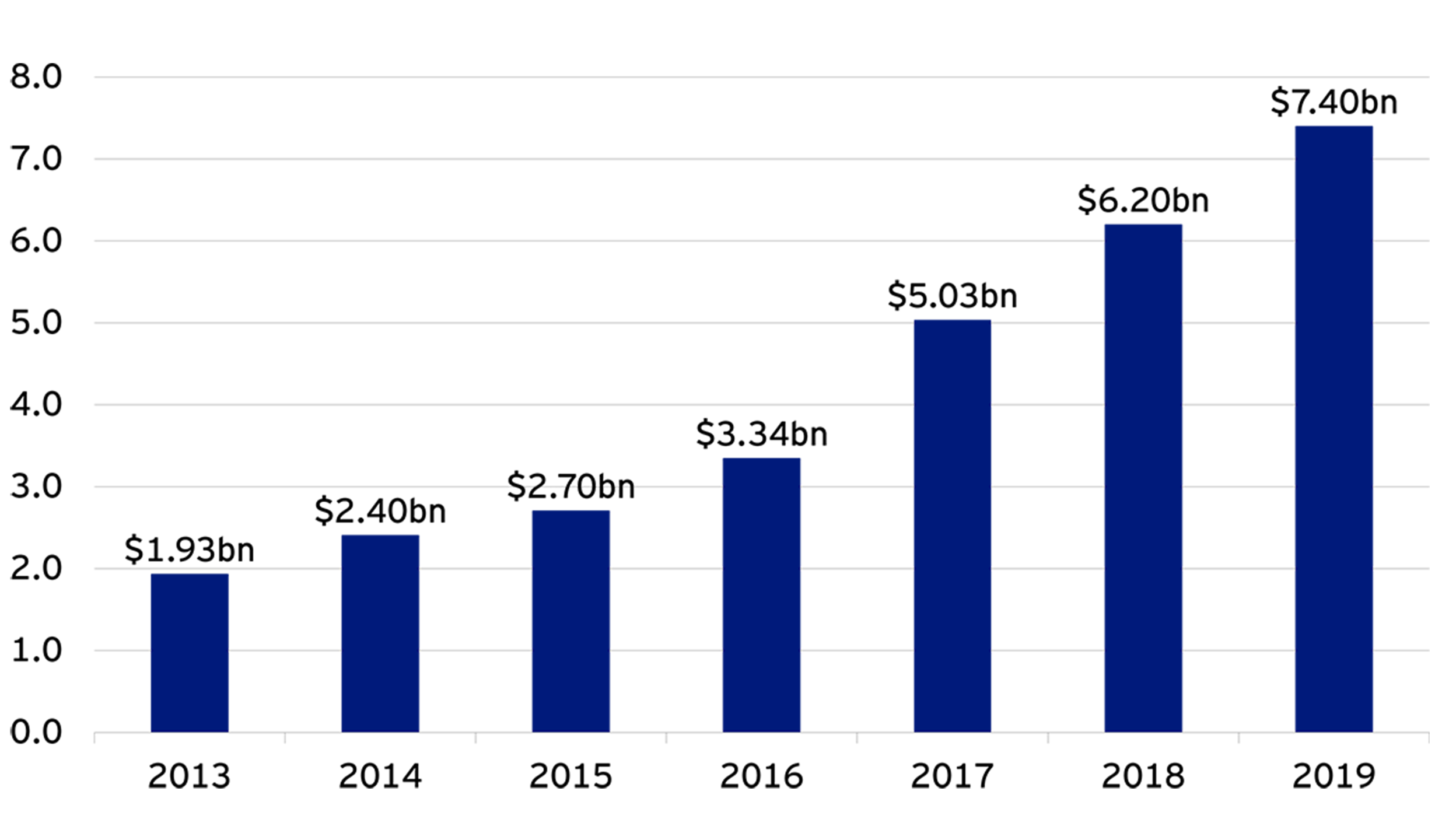

Many of our themes, including eCommerce, video games, social media, online dating and digital trends in music, are in the mist of multi-year trends of increasing adoption and engagement.

We believe, this Black Friday falls in the middle of a 20-year revolution in consumer behaviour, driven by increased connectivity. At the same time, the pandemic has accelerated the trend toward digital and has triggered changes in consumer behaviour that are likely going to have lasting effects. In our view, it therefore continues to be a compelling time to invest in the consumer sector to capture alpha.