August 25, 2020 Our hypothesis for a bull market in emerging market equities

We believe that the decade ahead will be particularly good for emerging market (EM) equities.

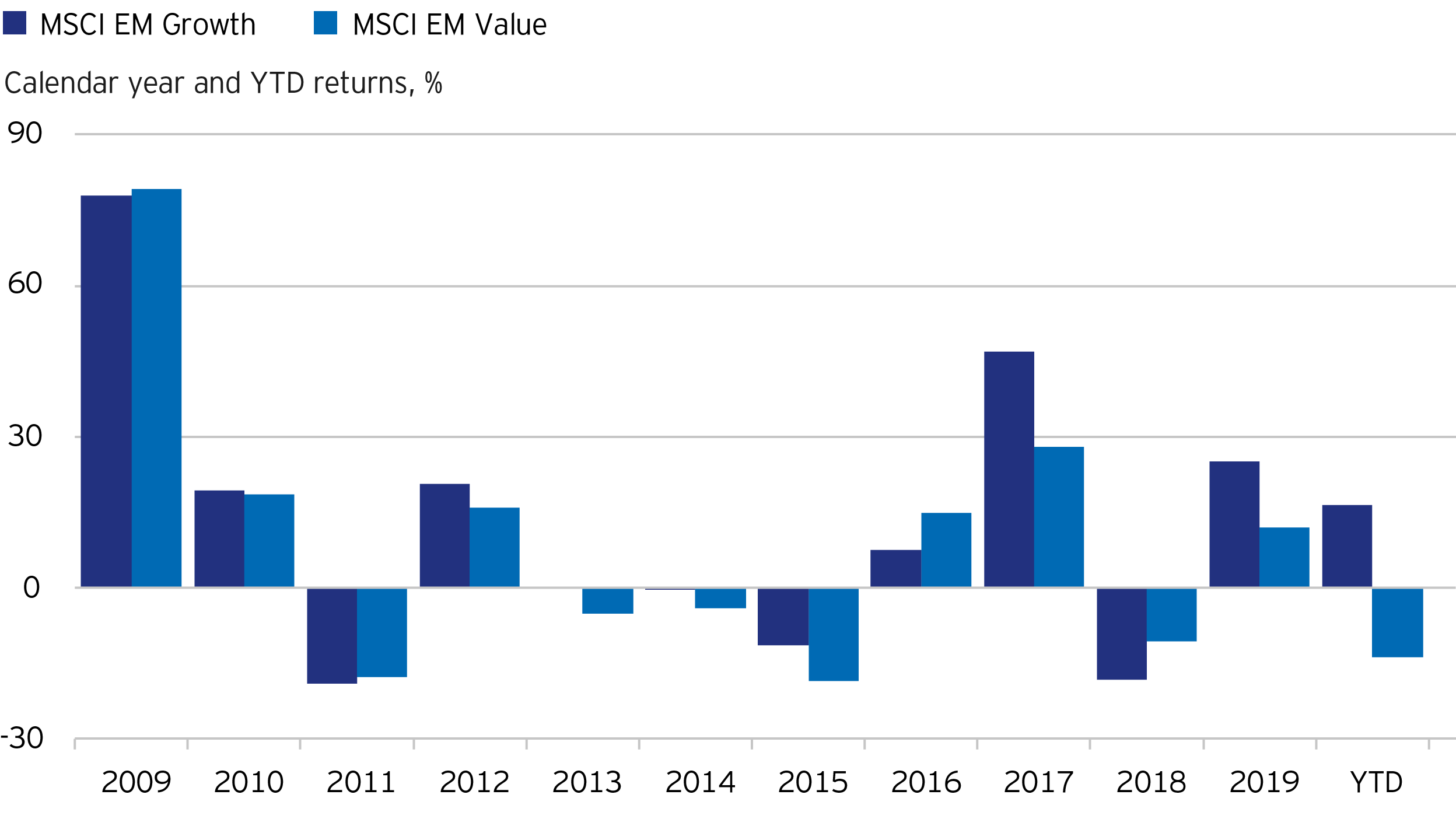

Emerging market growth stocks have had an unprecedented run versus value over the past decade. The pandemic has amplified the run of growth stocks and, in our view, led to pockets of excessive valuation. We believe the “certainty” of the COVID-19 trends may, in a number of spots, lead only to the certainty of significant loss at these valuation levels. Despite growth’s extraordinary bifurcation with value stocks, we recommend investors embrace greater nuance in thinking through the value versus growth debate.

Two trends that have boosted growth stocks

Growth stocks have been clear beneficiaries of the two big trends in financial markets under COVID-19 — negative real rates and great economic uncertainty. These twin forces have made extrapolation of the future incredibly challenging for investors, leading to a relentless search for certainty in obvious “digital” winners. Add to that a powerful case of FOMO (fear of missing out), and you have the ingredients for worrying levels of concentration and pockets of structurally overvalued companies. COVID-19 has essentially amplified trends that were already underway in EM and accelerated the prospects of e-commerce, fintech, food delivery, ride-hailing, gaming, cloud, and other similar digitally driven companies. In many cases, the assumptions of what these disruptive growth companies can deliver and the valuations they have reached have become untethered from reality, in our view. Imagination is a critical trait in creating differentiated portfolio results, but much of the hyperbolic gravitas is conventional wisdom, divorced from rigorous diligence. The herculean assumptions being made to justify current valuations often fail to appreciate fierce competitive structures across many of these industries and the long and grinding battle companies face in their pursuit of market dominance. In essence, FOMO has become the primary investment motivation for many.

FOMO is on full display in Chinese stocks

An additional twist unique to EM is the focus on countries that have successfully contained the virus and had the administrative capacity to deal with the economic fallout. China is a great example. Having generated the plurality of worldwide growth for the past 10 years, we believe China is poised to deliver over 50% of global GDP over the next couple years as the rest of the world slowly recovers from the economic impact of COVID-19. We have argued for a structural bull market in China in one of our recent posts (Our hypothesis for a bull market in emerging markets equities), in part due to an increasing number of high-quality companies that are listing on local exchanges and offering better investment opportunities for China’s significant, and largely undiversified, pool of savings — which we believe will result in a major asset allocation shift into equities. However, China’s resiliency and growth this year have put it on the radar of many equity managers on the hunt for “certainty,” and those with clear FOMO. We have observed a rapid increase in investor interest in China, most notably from those with little experience and no visible mandate investing there. This heightened attention has led to pockets of excess.

We believe the massive gap that has formed between growth and value will likely collapse, probably painfully, but this does not mean that traditional value stocks will be in ascendancy. The classic mean reversion approach to value investing will likely prove unsuccessful, in our view, as many traditional industries face considerable structural challenges:

A different perspective on the search for value in EM

In this context, relying on historical or normalized valuation multiples and an extrapolation mentality may not produce desired outcomes. Therefore, we embrace a different perspective on value — one that appreciates nuance and probabilistic thinking, and looks beyond the obvious. Nuanced value investing, in our view, is able to look beyond pandemic economic shock to companies and countries that are well-placed for rapid recovery, and to industries where consolidation may result in improved pricing, margins, and returns. These include companies such as hotels, restaurants, and airports, which we expect will more than mean revert under consolidation. This approach also looks to geographies dominated by informal economies like India, the Philippines, and Indonesia, which in our view will likely see V-shaped recoveries post-pandemic.

We believe this nuanced approach to value investing also works in companies that are suffering from heightened skepticism as a result of transient project delays or misplaced governance concerns, as well as in companies investing in adjacent, unproven business opportunities where uncertainty reigns. In all these, value investors must look beyond extrapolation of numbers and conduct differentiated research. Our approach to investing in EM equities maintains a long-term orientation and a focus on differentiated research.

We do not have a FOMO gene, which has resulted in an unwillingness to bend to fashion. And, alas, a year of reasonably middle-of-the-pack performance. However, we strongly believe that our continued focus on investing in high-quality companies with durable growth opportunities, sustainable competitive advantage, real options, and appropriate valuations will allow us to avoid common landmines and position us to generate compelling returns over time.

We believe that the decade ahead will be particularly good for emerging market (EM) equities.

William Lam, Co-Head of the Asia & Emerging Markets Equity team outlined his views on those Asian equity markets that have dealt with the virus well, and some of the associated Asian equities strategies.

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.