We believe the uncertainty could open up attractive real-estate opportunities in Asia Pacific related to long-term themes.

The spread of the novel coronavirus Covid-19 has picked up globally, upending everyday life and placing significant downside stress on financial markets. In times of great uncertainty like the one the world is experiencing right now, Invesco Real Estate reiterates the need for a long-term strategic view.

Our view

We have been clear of our strategic positioning before entering this uncertain landscape. This means that we have been:

- Focusing on opportunities where returns are generated from active asset management;

- Recognizing the importance of pro-active asset management, especially in the current period of uncertainty;

- Zooming in on markets or sectors that are supported by a large domestic demand base, as any potential rebound could be domestic led amidst tighter border control and government support policies;

- Identifying specific sectors with structural tailwinds, such as:

- Online retailing as reduced mobility is further accelerating the adoption of online sales;

- Technology solutions to business activities (such as automation of processes, transactions, etc.) and traditional office functions due to stronger demand;

- Various living options supported by market specific demographic trends.

These long-term themes have either been unchanged or reinforced by the current uncertainty, and the current market weakness may suggest we could pursue investment opportunities with more attractive entry prices.

Situation in Asia Pacific is still fluid

As of April 1, 2020, over 111,000 cases have been reported in the Asia Pacific region (including the entire Western Pacific and Southeast Asia regions as defined by World Health Organization), with China, Korea and Australia most affected. Even though China and Korea’s experience in reducing the number of new cases following strict control measures could illustrate how other countries could affect how infection patterns develop, a rising number of new cases in Hong Kong and Singapore raised concerns of a second wave of infections.

Clearly, we are not yet out of the woods, but the pandemic appears, at least for now, a little more under control in the Asia Pacific region. As such, Asia Pacific may point the way for Europe and North America in the months ahead.

Real-estate opportunities may emerge with growing market weakness

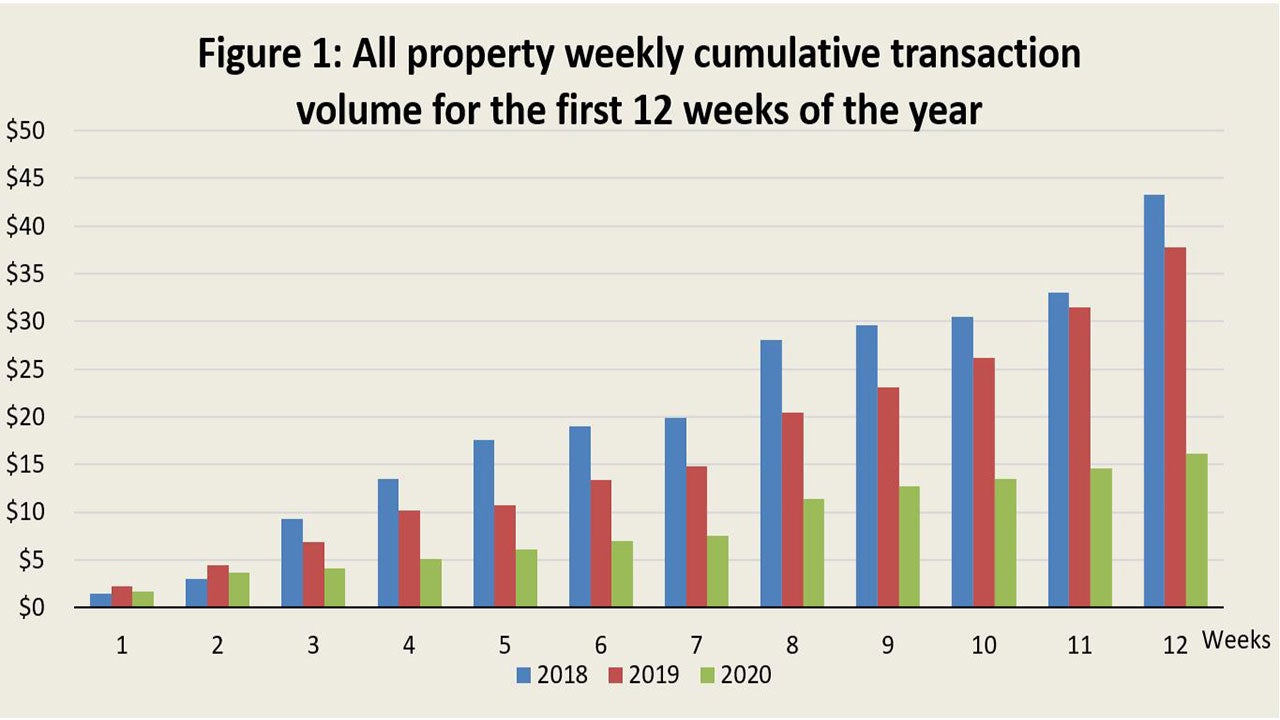

According to Real Capital Analytics, real-estate transaction volumes in Asia Pacific in the first 12 weeks of 2020 was 57% below the same period in 2019 (figure 1). While we have yet to see strong evidence of properties being traded at substantial discount due to the outbreak of Covid-19, we expect pressure on values to emerge due to an expectation of falling rental income.

Meanwhile, lower REIT prices and a potential denominator effect1 in multi-asset portfolios could weigh on investment demand for real estate in the near term. While base rates are low, banks have raised spreads in some cases and are reluctant to lend to the more vulnerable hotel and retail sectors .

Invesco Real EstateOur expectations for Asia Pacific occupier demand in the short term has dimmed due to halted social and economic activities.

Turning to property-market fundamentals, our expectations for Asia Pacific occupier demand in the short term has dimmed due to halted social and economic activities. We elaborate our near-term outlook for each property sector is below:

Logistics

- Relatively more resilient as this sector is supported by B2C e-commerce;

- Full impact from disrupted supply chain (due to halted manufacturing activities, and sharp reduction of road, rail and air traffic) remains to be seen;

- Technology such as automation and IoT (Internet of Things) could be more widely adopted.

Office

- Weaker occupier demand due to weaker corporate profits;

- Delayed real-estate decisions due to uncertainty;

- Flexible work arrangements (e.g. work from home) may speed up office-space transformation.

Residential

- Households delay real-estate decisions;

- Strata-titled sales sector and high-end for lease segment are likely to be affected;

- Mortgage delinquency may rise should unemployment rise and valuations drop significantly.

Retail

- Sharp decline in retail and F&B (food and beverage) sales is likely;

- Footfall and spending in prime streets of key cities in the region could plummet due to a sharp drop in Chinese tourist arrivals.

Strategy implications

We return to our theme of having the right positioning in entering this new and uncertain market landscape. We believe that most of the long-term themes, driven by secular trends, are likely to re-emerge after the pandemic, potentially at more attractive entry pricing.

For now, in the current environment, we intend to focus on opportunities stemming from market stress, distress or dislocation as a result of deteriorating income streams and balance sheets. Structurally, we continue to believe that distribution centers, driven by e-commerce, could do well. Submarkets within the office segment that are driven by technology-related occupier demand, in addition to medical offices, could also outperform. Strategies to provide appropriate living solutions in metropolitans with rising populations should be feasible as well.