Why we are positive on Contingent Convertible Bonds during these Covid times.

Our positive view on banks’ Contingent Convertible Bonds (CoCos) is driven primarily by our assessment of the sound underlying creditworthiness of the issuing bank, as well as our general confidence in the European banking sector as a whole.

We believe that while banks’ profitability is often challenged by the low interest rate environment and, recently, by the need to boost Covid-related provisions, this has a silver lining in that it is promoting greater cost control.

In fact, even during this Covid uncertainty, banks have continued to demonstrate financial balance sheet strength by calling their bonds to highlight the bondholder friendly approach, whilst suspending dividends (albeit regulatory induced, which is negative for shareholders) which is a positive story for bond investors (i.e. more proceeds to pay bond investors).

More importantly, we are of the opinion that European banks’ balance sheets remain strong: doubtful loans are under control and well provided for and liquidity and capitalisation are extremely robust and additionally benefit from strong regulatory support and forbearance in this time of crisis.

When it comes to investing in riskier subordinated and junior subordinated instruments, we naturally focus on the stronger entities within the banking sector.

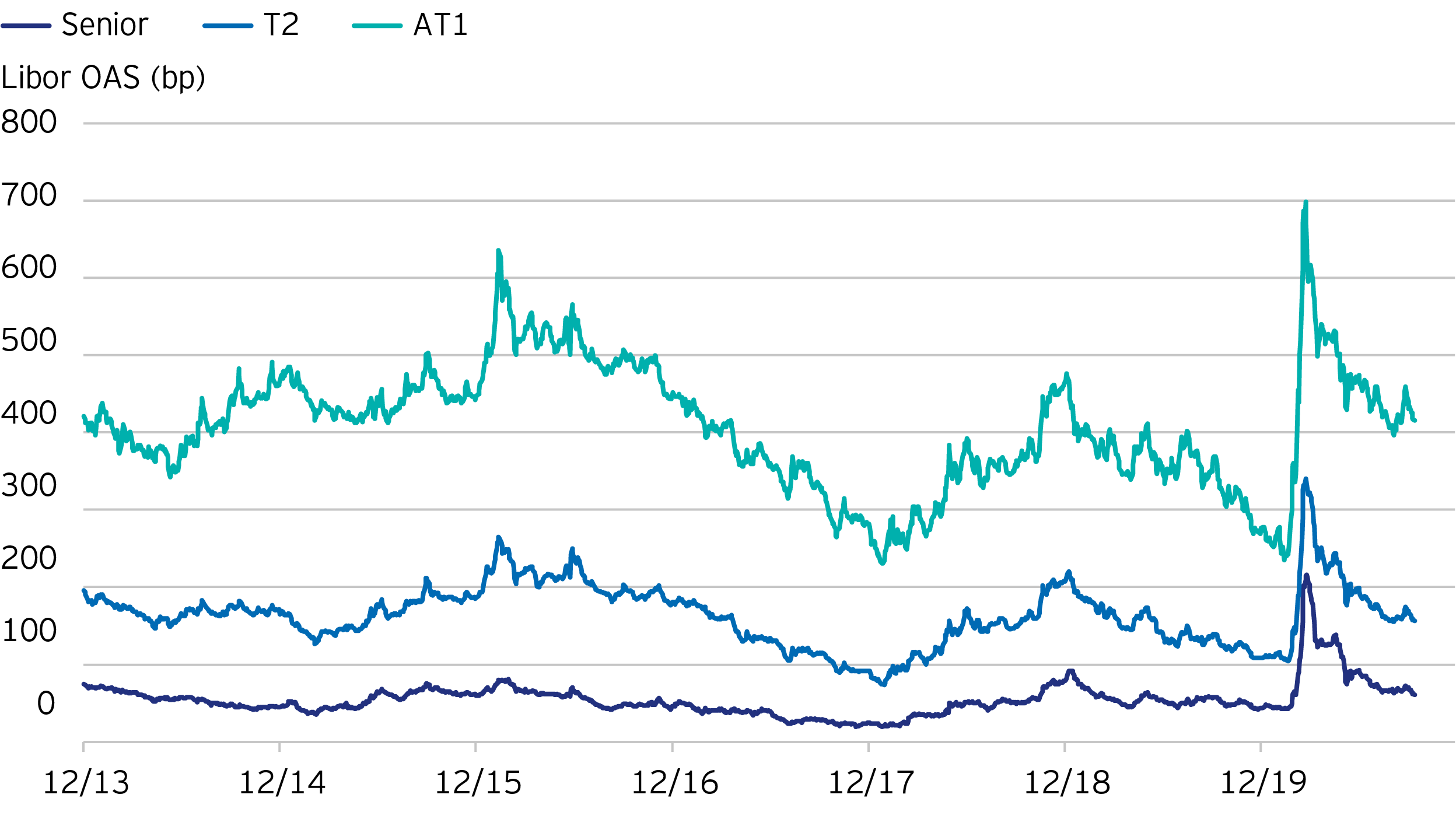

So, we believe that the credit quality of the issuers is high, and believe that valuations in this low yield environment (even in light of all factors, see below) e.g. looking at the ICE BofA indices, as of 05/10/20 their CoCo AT1 index yielded 5%, their tier 2 index yielded 1.3% and their senior banking index yielded 0.25%.

Even though our view on the asset class is positive, we are very selective in what issuers and issues to invest in. Within our credit research process, we not only evaluate the fundamental qualities of the issuer, but analyse in detail the language and various valuation considerations of the issue as well

Our subordinated and junior subordinated holdings tend to be focused on very creditworthy and highly rated Swedish, Belgian, French and Swiss banks’ AT1s which either have high coupons and back-ends or solid investor-friendly reputations.

Risk Factors we analyse in CoCos before investment

The biggest risk that AT1s are known for is write-off or equity conversion risk. That means that, depending on the specific terms & conditions, the security will either be written off altogether or converted into equity at a generally very unfavourable ratio either mechanically or at the request of the regulator (should the latter believe a “Point of Non Viability” has been reached) if the issuing bank’s capital ratio falls to or close to 5.125% or 7% (depending on the bank’s home country).

Note that banks tend to have capital ratio in excess of 12% (the average is probably well above 13%), so in practice a bank needs to be facing losses so catastrophic that half its capital base would be lost.

For virtually all banks these would be amounts far greater than the losses incurred after 2008, both in absolute terms and as a share of earning assets. We find such a scenario improbable in the extreme and can comfortably dismiss it.

A less improbable but still remote risk is coupon suspension for a time. The rules require a bank whose capital ratio falls below a minimum set individually by the regulator for each bank to reduce total distributions (including dividends, AT1 coupons and staff bonuses) by a degree commensurate with the size of the shortfall until such a time as the capital ratio recovers to this minimum individual level.

However, even there, banks tend to have a buffer before they hit this minimum of at least 2% (it has recently risen further), and moreover management (with the encouragement of regulator) is much more likely to cut back on dividends than coupons, as the former are much more sizeable.

Finally, a risk that we have seen occur in very few cases (very low single digit occurrences) is extension risk, where an issuer may choose to leave an AT1 outstanding past the first call date because it is cheaper than calling it and issuing a new one.

On the very few occasions that this has happened, the market price adjustment proved to be small, reversed over a matter of weeks, and the bond was eventually called on a subsequent call date within a few months.

Going forward, the risk of extension has reduced as banks tend to pre-finance a maturing security well ahead of the first call date. In any case, we look to minimise this risk by focusing on issuers that have behaved in an investor-friendly way in the past and on securities that were issued with a high coupon and therefore would enjoy a high variable coupon if left outstanding past the first call date, which would limit price variations and indeed discourage the issuer from not calling the security in the first place.

Turning to tier 2 CoCo subordinated securities, it is important to note that they only have one of the above risks: the possibility that it is written off if capitalisation hits the write-off trigger or a regulator decides to write them off when it invokes a “point of non-viability” for an issuer. As we have discussed, that is highly improbable in our view.

Another possible but remote risk for callable T2 CoCos is that they are extended, but note that these securities are not perpetual and have a final maturity date generally no later than five years after the first call, during which time they lose regulatory capital value and therefore become increasingly uneconomical for the issuer to keep outstanding.

Again, note that only few T2s are “CoCo”, i.e. they don’t have a mechanical and clearly defined write-off trigger. Nevertheless, they would still be subject to possible write-off by the regulator if the “point of non-viability” is invoked.

To conclude, tier 2 subordinated securities do not have a mechanical write-off trigger, they cannot suspend coupon unless written off, and extension risk for those that are callable and not bullet is limited by the existence of a final maturity as well as the declining regulatory value of the security in the final five years of its life.