Looking at equity markets during the Covid-19 crisis through a factor lens provides valuable insights into the drivers of market performance. It also allows a useful comparison with the Global Financial Crisis (GFC) to be made. Our paper looks at the behaviour in detail and, this article, summarises the main points.

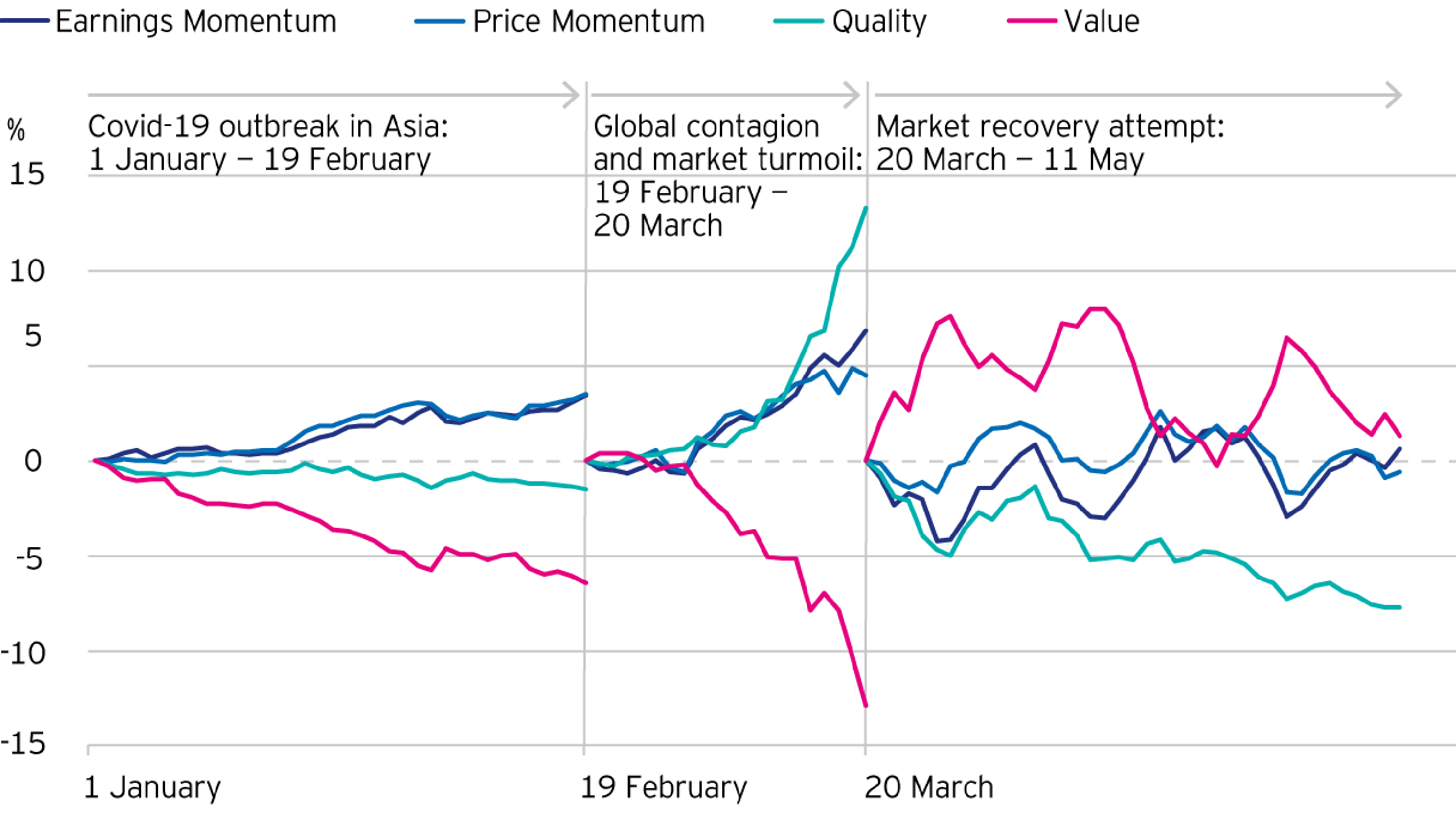

Three phases of the influence of Covid-19 on the global developed world equity market can be identified. These are shown, with the performance of four major factors (price momentum, earnings momentum, quality and value) in Figure 1.

Phase 1: Covid-19 mainly confined to Asia 1 January to 19 February

The first phase of the crisis, when Covid-19 was confined to Asia and was not a major concern in developed equity markets, saw a broad continuation of the factor performance seen in 2019. That is, momentum factors (price and earnings) produced superior performance (measured relative to overall global developed market performance); quality lagged; and the value factor delivered a negative premium. For value, this was a continuation of a longer-term trend of underperformance. This broad pattern of factor returns was similar to that seen in the run-up to the bankruptcy of Lehman Brothers on 15 September 2008 – Phase 1 of the GFC.

On 19 February global developed equity markets peaked, registering a total return of around 4% since the start of the year.1

The momentum factor can simply be described as ‘past winners tend to continue to win’. In that sense, it is often considered vulnerable to a prompt shift in the investment landscape, as happened in mid-February. By then Covid-19 had spread outside China.

Phase 2: Global pandemic, lockdown and market turmoil 19 February – 20 March

A sharp, short (one month long) sell-off formed Phase 2. However, both momentum factors continued to produce superior performance during this phase. Momentum did not prove vulnerable to this shift. This is not as counterintuitive as one may expect. Over most of 2019 and throughout Phase 1, the stocks that were trending upwards were often larger-sized companies with defensive or even bond-like characteristics. Consequently, the momentum factor had become quite defensive before the crisis. Its continuation in Phase 2, and indeed in Phase 3 is, in that light, explicable.

Quality was the strongest performing factor in Phase 2. Quality refers to the idea that well-governed and efficiently operated companies with particularly strong balance sheets and financials outperform their peers of lower quality. Such equities can be expected to provide downside protection during bear markets. That did indeed prove to be the case in the second phase of the GFC (from the bankruptcy of Lehman to the equity market trough in March 2009). So, in that sense the second phase of Covid-19 followed its predecessor.

Similarly, our value factor seeks exposure to stocks that are relatively cheap according to fundamental value measures. This factor is often deemed to be a “risk-on” factor that underperforms during economic downturns as market participants become more concerned about increasing bankruptcy risk. In turn, this is explained by the fact that such companies tend to have high levels of tangible assets and debt, making their business models less flexible. Value underperformed in the second Phase of the GFC so, one again, in this respect the performance during Covid-19 was similar to its predecessor.

Phase 3: COVID-19 containment, limited opening-up and volatile market recovery 20 March -11 May

The third phase began when the equity market bottomed on 20 March. The quality factor lagged during that recovery and momentum performed in line with equity markets. Surprisingly, value, usually the go-to factor in a market recovery, traded in a volatile fashion (there were periods when it did well, followed by setbacks). This provides an important contrast with the third phase of the GFC. Then, value performed strongly, and in many ways led the market recovery. However, our analysis of the GFC recovery period covered five months (March through to May 2009) whereas the current recovery period is much shorter. Time will tell whether value works if the current recovery continues.

Conclusion

Factor performance in the current crisis resembles the GFC in several aspects. By and large, factors performed as expected: Quality factors mitigated the drawdown but lagged in the recovery, while value suffered the most in the market drawdown. The largest difference so far has been the missing reversal of value’s performance during the market recovery from March.

Read here our more in-depth assessment.