The first quarter of 2020 has provided a number of unwelcome records relating to the severity of movements within financial markets.

Driven by the rapid global spread of Covid-19 and the oil price shock, the two largely unforeseen events combined to create such disruption that investors’ primary goal instantly switched to capital preservation. This in turn resulted in a mass exodus from risk assets.

Global credit markets during January and February were broadly uneventful as participants assessed the opportunities for the year ahead after an extremely rewarding 2019. This relative calm abruptly ended as March arrived.

However, in our opinion, these market moves have created very attractive valuations within investment grade corporate bonds.

Coupled with a macro environment which reinforces our secular stagnation view – low growth and benign inflation – that will result in global central banks continuing to support high quality assets. This has cemented our positive view of the asset class.

Performance

The Invesco Global Investment Grade Corporate Bond Strategy underperformed its benchmark over the first quarter.

Despite the underperformance, the strategy was well positioned going into the volatility, with a more conservative stance primarily due to tighter valuations and several tail risk events not fully resolved in our opinion (Brexit, US-China trade and also the US Presidential Election).

This resulted in increased levels of cash within the strategy, a defensive allocation to European Government bonds and historically low active risk versus the benchmark.

This worked well for the strategy up until mid-March given:

- Our credit cycle differentiation theme. Here we are underweight US corporates (around 25%) versus Europe; during this period the US underperformed due to leverage concerns and lack of central bank support. In addition, the US market is made up of more energy companies impacted by the negative moves in oil, here we were also underweight, thus benefitting relative performance

- Our China rebalancing theme. Here we continue to overweight Asia (namely Chinese corporates); this helped the strategy to outperform relative to the benchmark given Covid-19 concerns moved from China, as the source of pandemic was contained and moved to the rest of world

However, during the third week of March, the US Federal Reserve (Fed) announced it would begin purchasing corporate bonds for the first time. This led to US credit aggressively outperforming which, due to our underweight, weighed on the strategies relative performance into month-end.

Whilst we have been reducing the underweight to US credit in light of this positive technical, we retain our long-term credit cycle differentiation theme given that we expect the late cycle nature of the US will result in increased rating agency downgrade risk.

Strategy

Throughout March our primary goals have been to reduce the volatility of the strategy through the use of macro overlays (hedges using derivatives) and at the same time ensuring the strategy continues to hold good levels of liquidity, such that we are not forced to sell bonds into a weak market. These two objectives were met.

With regard to macro overlays, we use liquid instruments to dampen the volatility of the strategy. During recent events, we have opted to primarily use duration to achieve this.

Specifically, we increased our exposure to duration (focused on the 5-year part of the US treasury yield curve) using interest rate futures. In addition, we maintained an existing position in the form of interest rate curve flatteners in Europe (due to our Japanification of Europe Theme). Both worked well during the risk-off environment.

In terms of liquidity, it has been challenged throughout the month of March, exacerbated by the requirement that most dealers and traders must work from home. Initially credit markets were not functioning and there was next to no liquidity across the entire investment grade corporate bond rating spectrum.

Additionally, we saw outflows from the broad bond asset class (led by ETF outflows) which created forced sellers in a market when there were no buyers as the banks were unwilling, or unable, to warehouse additional risk. Together with USD funding stress, these combined to cause the extreme widening in credit spreads we have witnessed.

However, as the month progressed the situation for high quality assets (including investment grade rated bonds) improved somewhat, primarily driven by central banks (ECB, Fed and BOE) providing unpresented levels of support to markets.

As liquidity returned, so did the investment grade primary markets across the US and Europe. In recent weeks we have seen record issuance which has been impressively taken down by the market, albeit with the help of the Fed and ECB respectively. Importantly, open primary markets provide cash to companies which helps to reduce cash flow related stresses.

Managing idiosyncratic risk within the strategy

COVID-19 has caused a sharp collapse in both trade and service sectors (especially the latter) which will result in a material hit to companies’ liquidity in the short term. We expect corporate fundamentals to deteriorate as a result, with greatest pressure on industrial and cyclical firms alongside the leisure and travel industries.

Bank regulation has been temporarily relaxed and balance sheets are much stronger versus 2008/09, albeit loan loss provisioning will increase as the SME market feels the greatest pressure on funding lines. At current valuations, this credit deterioration is being priced in.

Therefore, it's clear that the aggressive nature of the growth contraction due to the measures taken by governments to stem the spread of Covid-19 will lead to a rise in downgrade and fallen angel risk for this asset class.

With regards to default risk, it is extremely rare that companies default whilst they are investment grade rated and as such the strategy is much less exposed to such risks. As a result, we believe it is downgrade risk and not default risk that the strategy is exposed to.

The market is currently pricing in an annual default rate of around 4% across the Global Investment Grade Universe (based on current spreads and a recovery rate of 40% in the event of a default occurring).

Despite this, we would like to highlight that based on the Moody’s annual default study (end Jan 2020) the average number of Global Investment Grade defaults over the past decade has been 1.7/year and 2.1/year over the past 100 years i.e. extremely rare. As alluded to, companies typically go through a cycle of downgrades prior to reaching the point of default. Therefore, our focus remains on managing downgrade risk.

To mitigate the risk of a downgrades occurring within the strategy, our team of Global Credit Research analysts continue to work around the clock to update their ‘Downgrade Candidate Monitor’ as the situation evolves. This is in place to give portfolio manager’s advanced warning of potentially weaker names held within the portfolios which drives single name selection and overall positioning. It also helps to ensure that such names are not purchased in the first place.

We continue to look to pare down more idiosyncratic risk exposure in strategy i.e. those names highlighted to us by the credit research team as downgrade candidates. It is also worth reemphasising that prior to this volatility the strategy was (and continues to be) underweight a lot of cyclical sectors (such as Autos, Real Estate & Retail) due to our bearish growth view, hence it has benefitted from being u/w Autos (which saw extensive downgrades across the sector, including Ford (which was d/g to junk)).

Looking ahead we believe the current environment presents a compelling opportunity to invest in global investment grade corporate bonds. Below we consider this within our Fundamentals, Valuations and Technicals framework.

Valuations

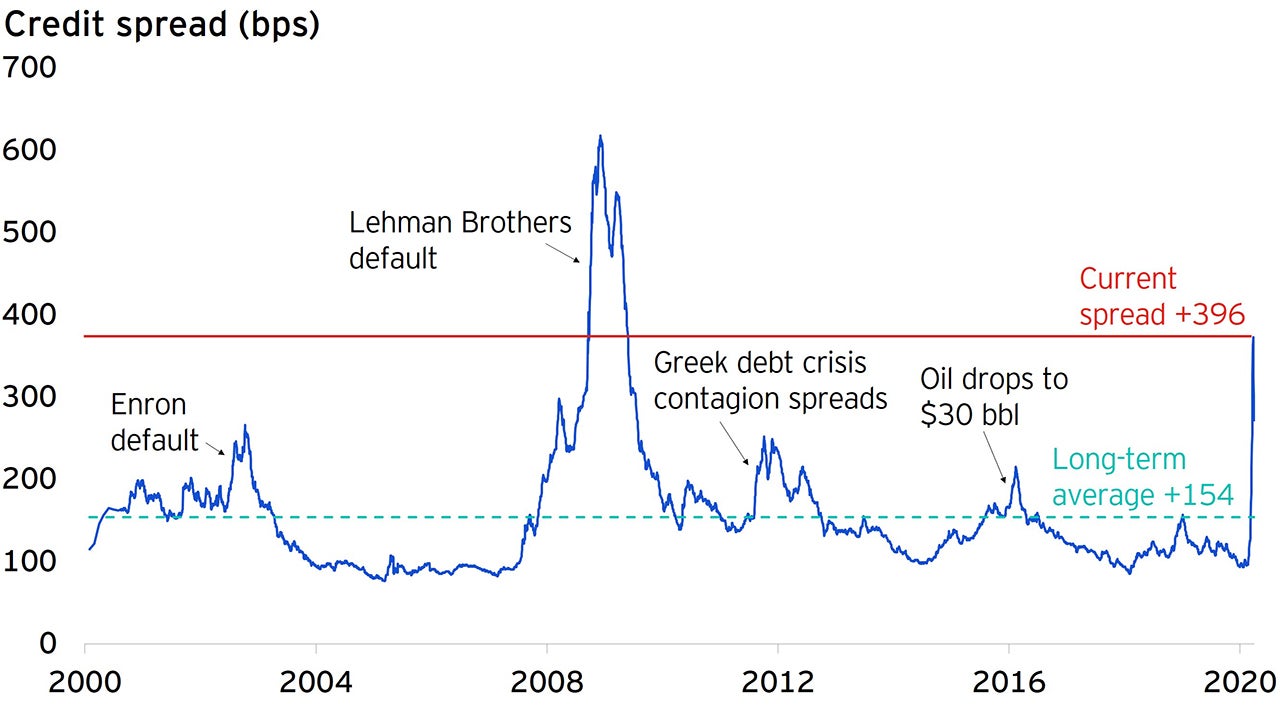

The negative sentiment and the anticipated deterioration in credit fundamentals has resulted in a sharp move wider in credit spreads year to date.

These moves, which can be likened to those experienced during the Global Financial Crisis (Fig 1), have resulted in valuations across investment grade corporate bond markets becoming very attractive. There is no doubt that this is a crisis at the highest level.

However, this is not a financial crisis like that witnessed during the GFC, where the risk of bank failures would cause systematic and significant contagion risk to the economy on a structural as well as a cyclical basis.

Therefore, whilst parallels can be made in terms of the magnitude of market moves with the GFC, comparisons to the impact on the financial system (especially when banks are in a significantly healthier position combined with the vast liquidity support) should not be seen in similar manner.

Technicals

The technical backdrop (supply and demand) turned extremely negative during March. However, we have seen strong signs of improvement since as net asset class flows have turned positive once again. We see strong support from investors who will effectively now be competing with the largest asset purchases globally, the Fed and ECB.

Specifically, investment Grade corporate bonds in the US, UK and Europe are key to implementing the respective Central Bank’s stimulus packages and are best placed to benefit going forward.

As a result of this extremely strong market technical, we believe investment grade corporate bonds should remain extremely well supported into year end. In the US alone, it is expected that the Fed will purchase half of all new Investment Grade Corporate Bond issuance in 2020. Whilst they add that there is no limit to this stimulus.

In Europe, the ECB has ‘thrown out its rule book’ by abandoning its capital key to ensure it has the flexibility to deploy the over EUR 1 trillion in Quantitative Easing to the areas of the market in most need of support.

We have experienced this playbook numerous times before and the impact on asset prices due to central bank intervention should not be underestimated in the fight against the negative economic impact of Covid-19.

That is, the immediate support will be for the area of the market being purchased by the central banks, followed by the broader market as spill over into other sectors, regions and asset classes drives spreads tighter. However, given increased idiosyncratic risks against due to growth challenges, security selection will be key.

Fundamentals

The current crises will continue to create large contractions in terms of activity which will no doubt manifest themselves in a global growth recession. However, once the pandemic risk stabilises, we believe the low growth, subdued inflation and a vast amount of extra-ordinary stimulus implemented to prevent the global economy from collapsing will create a strong positive for fixed income.

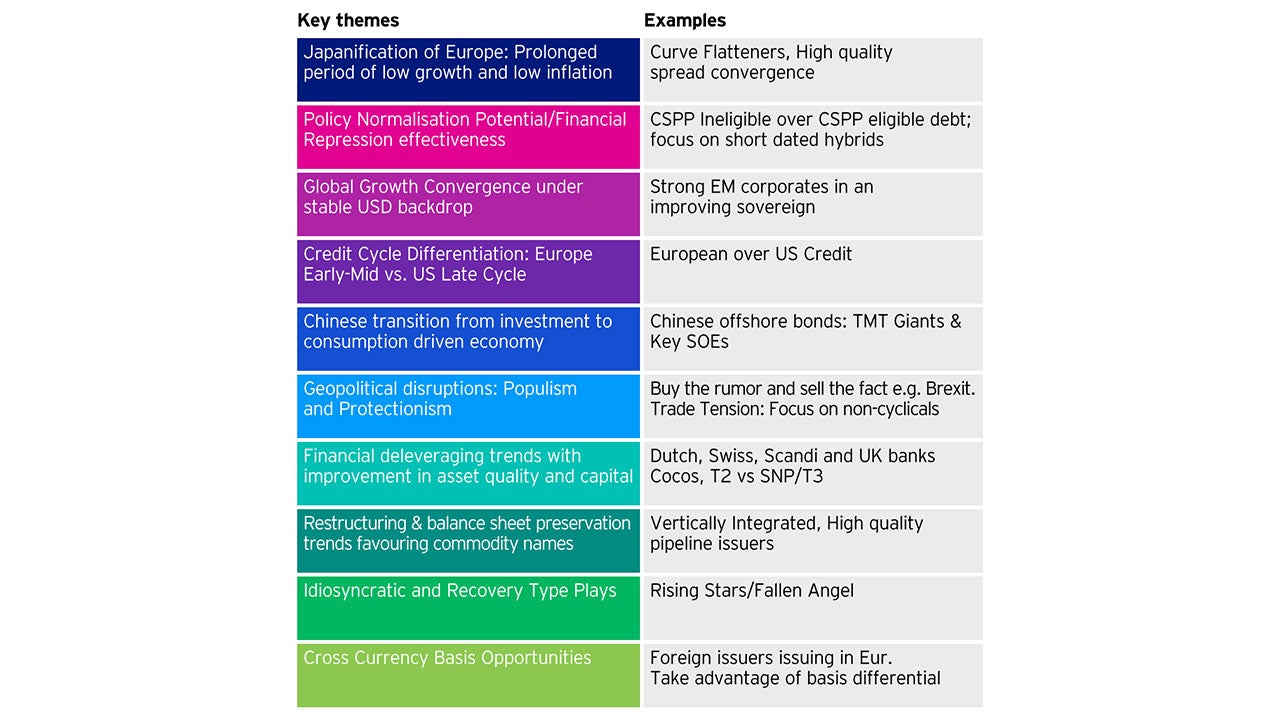

This is our Secular Stagnation Theme (Theme 1 in Fig. 2). Here, we believe the focus needs to be on the high-quality parts of the market, particularly those that trade with a spread i.e. investment grade corporates.

Of course, we will see downgrades rise and defaults impacting lower quality assets. There is also no doubt that reduced corporate profitability and a renewed focus on surviving (being bond holder friendly) rather than thriving (being shareholder friendly) will negatively impact equities, but this behaviour will be supportive for investment grade corporates.

However, we believe the strategy is well placed to benefit from improved valuations whilst being able to mitigate the negative impact on fundamentals as noted within the section on managing idiosyncratic risk within the strategy.

Positioning for the opportunity

We continue to focus on ensuring the strategy has excess liquidity and have been using the new issue market to not only add value but add liquidity to the strategy in the form of highly rated senior bonds, primarily in the US market given the strong Fed support. Examples include Nike, Berkshire Hathaway & CVS.

This will act to reduce our underweight to the US market, though we will remain underweight to achieve greater diversification across the portfolio. In addition, we expect a greater proportion of upcoming downgrades to occur in the US versus Europe given our Credit Cycle Differentiation Theme (Theme 4 in Fig. 2).

We retain our Financial deleveraging theme (Theme 2 in Fig. 2) and are comfortable to invest in the subordinated parts of the capital stack in specific banks.

Whilst there were concerns of coupon suspension risk for the AT1 part of the market as a result of ECB effectively telling Eurozone banks not to pay equity dividends, we view a suspension of dividends as positive for AT1s given:

- (1) this improves the Core Equity Tier 1 ratio of banks

- (2) this reduces the risk of coupon cancellation of AT1s given effectivity the prioritisation to suspend dividends over coupons

As a result, we are overweight bank subordinated financial bonds and continue to hold AT1s in core European banks that we consider to be national champions.

banks must be strongly capitalised to lower the risk that these bonds are converted to equity as well as having distributable reserves to reduce the risk of coupon suspension.

Elsewhere, we have reduced our overweight on some Euro sovereign spreads risk in Spain and Portugal which has benefitted from ECB’s abandonment of the capital key.

That being said, in light of limited inflation pressures and a very challenging growth backdrop (even in the absence of the current pandemic), the additional fiscal measures implemented will unlikely result in higher rates. In fact, the ECB and the Eurogroup will want to ensure rates remain low to ensure that debt sustainability will not be challenged, otherwise this will render their measures effectively redundant.

Therefore, we remain positive in peripheral countries like Spain and Portugal from a sovereign risk perspective and prefer yield curve flatteners as part of the Japanification of Europe theme (Theme 6 in Fig. 2).

With regards to Energy, the recent agreement between oil producers to cut production is only likely to at best offset the demand side destruction caused by the pandemic and help to stabilise inventories. For oil prices to rise materially, it’s likely we will need to see further cuts.

However, given the extremely negative impact on oil related assets seen since OPEC+ initiated this price war, the fact that discussions are taking place (amidst a more favourable risk backdrop), will no doubt help support energy corporates.

Within the strategy, we have been adding energy bonds from high quality sovereigns which include the new issues that Qatar and Abu Dhabi recently brought to the market as well as high quality corporates in vertically integrated corporates. Here names include Total, Shell & BP. This is a more defensive play the energy recovery story (Theme 3 in Fig. 2)

As we move through this crisis, we will remain active in using macro overlays to try and dampen down the volatility of the strategy.

Given this, we maintain our overweight to duration at this juncture as it offers a hedge to the credit exposure in the strategy whilst duration should remain supported given our secular stagnation view (low growth, low inflation, easy financial conditions).

In turn, this backdrop should provide strong support to high quality spread assets, namely the investment grade corporate bond universe, and combined with current attractive valuations lead us to have a positive outlook from here. As such, we have been adding credit beta risk to the strategy, which increases the strategies sensitivity to broad market moves.