Navigating through uncharted waters

Seven weeks into lockdown, and the business has settled into a ‘new normal’ operating rhythm. This is testament not only to our excellent colleagues in technology, but also the extraordinary effort that has been put in across the firm across all the departments with the central aim of ensuring that our clients’ needs are being met in these astonishing times.

However, whilst individuals are showing huge adaptability and resilience, there is no doubt that this is a crisis unlike any other we have faced in our investment careers and there is no clear ‘playbook’ on how to navigate the financial markets. We are running out of superlatives to describe the nature of recent moves. Neville Pike, Product Director on the UK Equities team, turned to statistics to attempt to do so. He explains in detail in the piece, A Lunar Landing, but a table within it summarises the point nicely:

| Std Deviations | Actual Number of Days | Expected frequency (approximate) |

|---|---|---|

| >3 | 7 | Yearly |

| >4 | 4 | Every 43 Years |

| >7 | 1 | Every 1.07 billion years |

| >8 | 1 | |

| >10 | 1 |

Source: Bloomberg, as at 24 April 2020. Index: FTSE All-share Index since 24 April 1988.

In the 43 trading day period to the end of April 23rd this year, he shows the numbers of days with greater than 3 standard deviation moves (in other words moves that are more extreme than one would expect 99.7% of the time) and then translates that into how often one might expect to see moves of that magnitude. Not only have we seen a 7 standard deviation move, which might be expected once every 1.07bn years, but also an 8 standard deviation event, and even a 10 standard deviation event. His computer gave up the ghost trying to calculate those in terms of implied frequency.

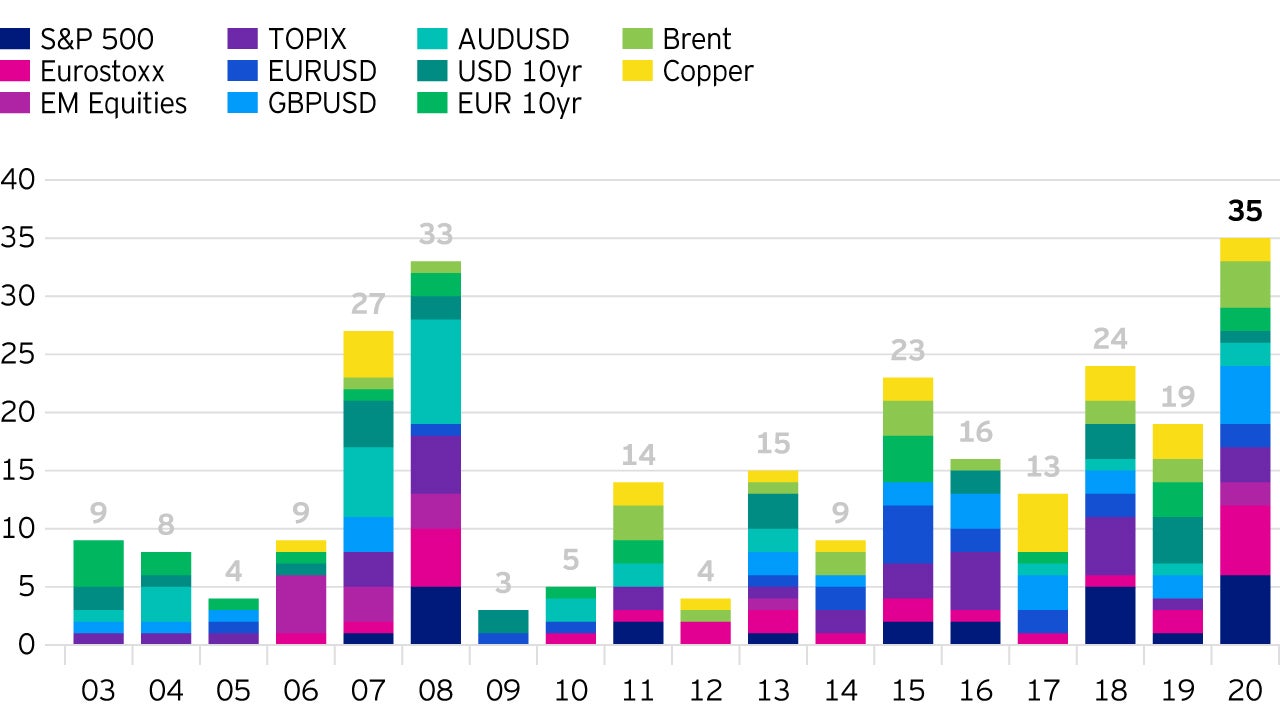

What is more these moves are not isolated to equity markets, but we are seeing them across asset classes.

Challenging as events like these are, they also create opportunities. Against this backdrop, our long-term orientated active Fund Managers and Analysts are well placed to safeguard our clients’ long-term interests. The Henley Investment Centre has many Fund Managers on the floor who have been running money for over 25 years, and in the process have navigated through several other crises.

Although no crisis is ever the same, the experiences and lessons learned from each one tends to transcend any single event and can often be applied universally. Crucially the emphasis is always on calm analysis, detailed discussions and a focus on managing the shorter-term variation but with an eye to the long view.

With that in mind, there is wide-ranging debate across the investment teams about the implications for societal and policy change long after the effects of the virus itself pass: working practices, the implications for the climate debate, fiscal policy, healthcare policy, supply chains and globalisation as just some examples.

What have our Fund Managers and Analysts been doing as these events unfolded?

One of the first things – and in our opinion the most important – is that they have been thoroughly assessing individual holdings one by one to determine whether the original investment thesis holds true in this new world. What does this mean in practice? Meetings with company management, brokers, external analysts and comprehensive in-house research and analysis to understand whether these businesses have the balance sheets and management teams to navigate through these uncertain times.

From a portfolio construction and risk basis, the Fund Managers have been working even more closely with the Henley based Investment Oversight Team. Given recent events, this is proving to be an invaluable tool as they look to understand how the risk in their portfolios is changing, and what is happening to factor risk models that help inform where risks are being taken.

The Investment Oversight Team have never been solely ‘quant-driven’: at times of stress the risk data needs deeper understanding and interpretation. Fund Managers working with the Investment Oversight Team together assess market dynamics and changing risk factors, which will be essential in helping the Fund Manager align their portfolio strategies for optimum outcomes as we come through this crisis.

Finally, they continue to adhere to the long-term fundamental valuation driven process while looking for new opportunities. Despite the short-term volatility, the focus on valuation, strong balance sheets and sustainable businesses is central, in our belief, to protecting our clients’ interests in the long run. It is apparent that markets are undergoing a significant dislocation, with inevitably good as well as bad companies impacted. Whilst this can be unsettling, looking at previous periods of significant market upheaval it has also created a fertile hunting ground for stock pickers.

Investment risks:

-

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

Important information:

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.