Market Monthly Market Roundup

In our monthly market roundup for September, Invesco experts review a mixed month for global equity markets, alongside key updates in fixed income.

In our monthly market roundup for September, Invesco experts review a mixed month for global equity markets, alongside key updates in fixed income.

Welcome to our Tactical Asset Allocation hub. Here you’ll find a selection of the most recent research from Invesco Solutions. Read our latest analysis that covers market strategy and opportunities across various asset classes.

We speak with IFI portfolio managers about the factors driving US investment grade and how they are navigating the current fixed income environment. Read online.

Get an in-depth Q3 report from our alternatives experts, including their outlook, positioning, and insight on valuations, fundamentals, and trends.

With the Federal Reserve cutting rates and recent US economic data showing resiliency, the environment may be conducive to an end-of-year rally.

Paul Jackson, Global Head of Asset Allocation Research, discusses his insights on portfolio allocations and strategies for the Q4 2025 outlook.

Private real estate debt offers insurers a way to diversify their portfolios, generate stable income streams, and match their long-term liabilities.

In today’s environment, we believe properties with income growth that’s less tied to the business cycle are best positioned to outperform.

Federal Reserve Chair Jerome Powell’s dovish tone at Jackson Hole last week had ramifications for rate expectations, tech stocks, and the US dollar.

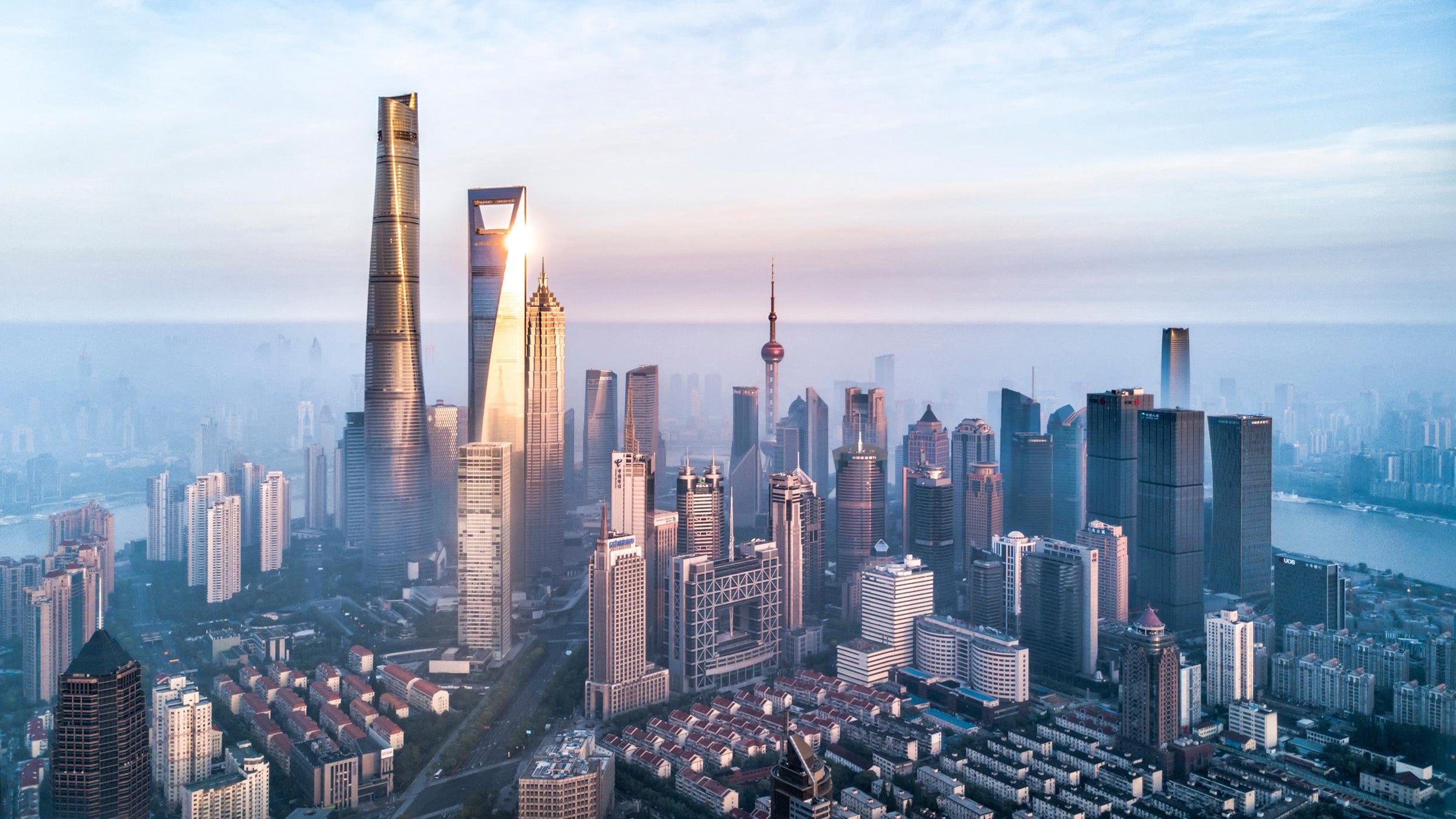

Why APAC real estate may offer growth, diversification, and value for institutional investors amid global market uncertainty in 2025.

Explore key macroeconomic themes and sector trends shaping global equities in 2025, as discussed by experienced fund managers in our recent webinar hosted by Ben Gutteridge.

Reduced cross-border investment in new US commercial real estate may impact US and global property sectors, markets, and assets differently.