Our hypothesis for a bull market in emerging market equities

Key takeaways

We believe that the decade ahead will be particularly good for emerging market (EM) equities.

While this may come across as contrarian, it essentially rests on a handful of considerations:

Weakness in the US dollar

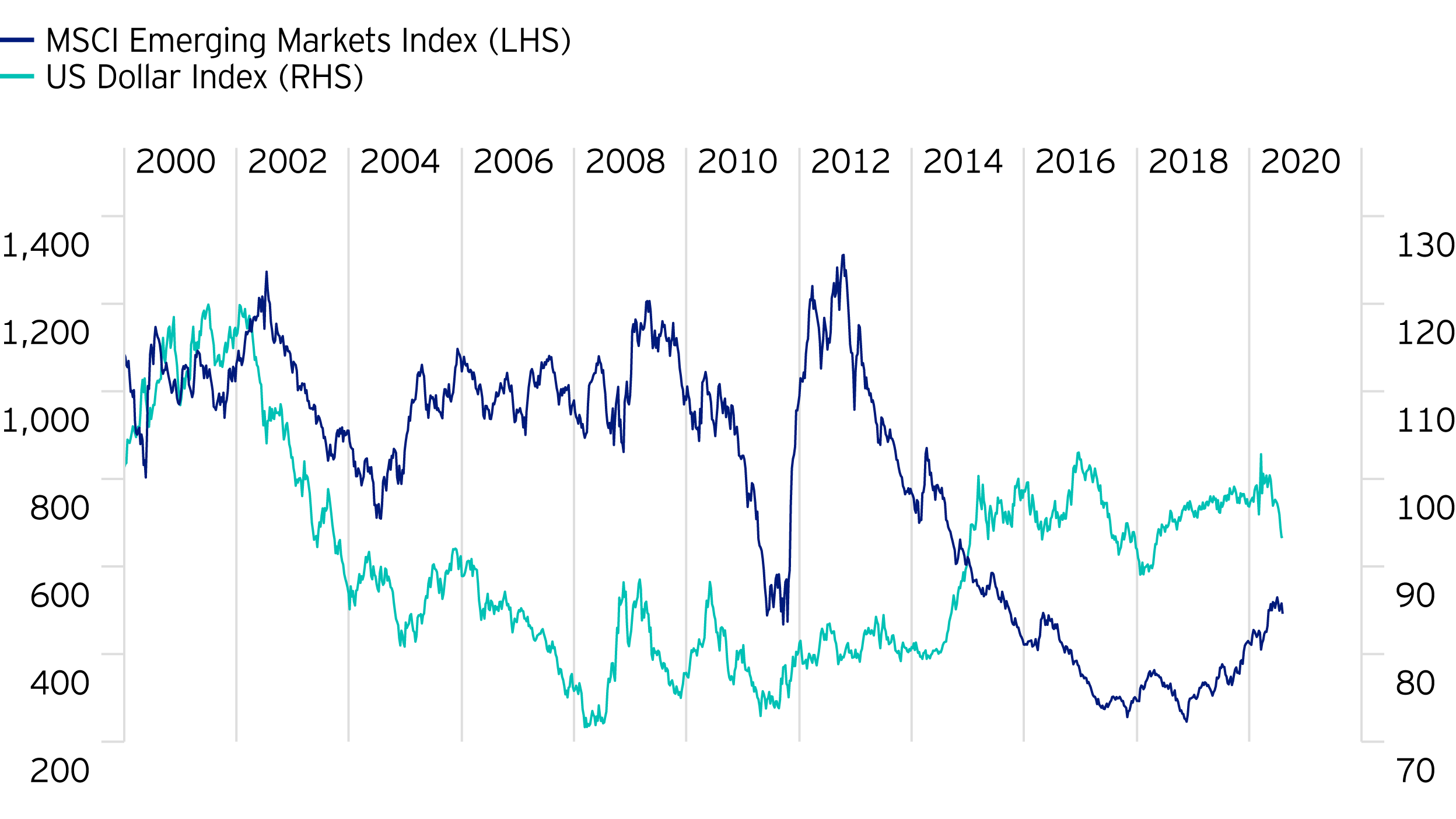

The big structural moves in (non-China) EM equities are nearly always against the backdrop of weakness in the US dollar.

And we see all the ingredients for significant US dollar weakness over the next few years, largely a reflection of considerable fiscal stress in the US.

We believe the federal debt stock will continue to expand at what can only be considered a highly unorthodox pace.

The US federal debt is estimated to have surged from nearly US$17 trillion in September 2019 to US$20 trillion in June 2020.1

We expect the federal deficit to significantly worsen over the next 2-3 years, even after the pandemic subsides, as the highly contested November presidential elections lead the winning administration to address longstanding grievances associated with socioeconomic inequalities.

The right cocktail

An environment where interest rates and energy prices are low, along with a pronounced trend against the US dollar, will likely create a situation where foreign capital flows and private investments will be directed towards non-US assets.

That bodes well for EM, which we think offer greater potential for growth as (non-China) developing countries by and large are constrained by insufficient domestic savings to fund investments necessary to lift structural growth.

This starts the flywheel witnessed in previous periods of significant EM outperformance - foreign capital inflows beget credit creation, which in turn causes capital formation, growth, (formal sector) employment, productivity and significant earnings momentum.

We see much of Latin America, Southeast Asia and parts of sub-Saharan Africa benefiting from this potential cocktail of a weak US dollar, low global interest rates, sustainably lower energy prices and a retreat from US dollar assets.

China

And then there is the other factor - the potential for a structural bull market in China.

We have written previously about the outsized influence of China (45% of EM GDP, 41% of EM market capitalisation²) and the fact that China’s economy could eventually dwarf all the other EM equities combined.

This has already started to happen.

China now accounts for more than 40% of the MSCI EM index, and we think it will continue to grow with the outstanding pipeline of Chinese unicorns going public in Hong Kong (and now also in the A-share markets).

We believe China is the only significant macro growth story in a very dismal climate for worldwide growth.

Having generated a plurality of worldwide growth over the past 10 years, China, we believe, will account for more than 50% of total worldwide growth over the next 2-3 years, in our view (and significantly all global growth in 2020!).

Closing the gap with the US

China's GDP is rapidly closing the gap with the US, and it is now larger than the GDP of Africa, India, Russia, and all Latin America combined.

For the decade ahead, we expect China will remain the engine of global growth and only accelerate in terms of its increasing contribution to worldwide GDP despite likely lower, but higher-quality growth.

We also anticipate that the China-US relationship will remain structurally challenged while likely causing high-quality Chinese companies to consider mainland China and Hong Kong as their preferred exchanges for company listings.

This is an important turn with wide-ranging consequences that we think will lead to improved quality of companies listed on the exchanges, better investment opportunities for domestic investors and will result in yet another flywheel effect that will boost the performance of Chinese equities.

We expect this effect to be very significant as China has among the highest household savings globally, estimated at 23% of the country's GDP (based on International Monetary Fund data as of 2018) and 15% higher than global average.

In the past, public savings were invested in real assets like infrastructure while private saving went into real estate.

Indeed, China’s enormous wealth creation is anomalous in its lack of diversity.

This historically has been a result of the dysfunctional domestic equity market, populated almost entirely with state-owned companies.

The highest quality Chinese equities were inaccessible to domestic investors, having been listed predominately overseas (US American Depository Receipts [ADRs] and more recently in Hong Kong).

Improving accessibility

Accessibility to these companies is changing rapidly.

- The Hong Kong Connect platform has opened a (south-bound) channel for domestic investors to invest in mainland companies listed in HK. Many of China’s finest companies have chosen to list in Hong Kong after changes to listing requirements, which permit dual-class shares (a staple of the ‘new economy’ governance globally). Meituan Dianping, Innovent Biologics, Wuxi Biologics among others have paved the way for even larger primary listings, including the rumoured forthcoming US$200 billion IPO of the Ant Group (the fintech arm of Alibaba). ³

- Growing US political pressure on Chinese ADR listings is encouraging a wave of parallel listings of companies like Alibaba and JD.com in Hong Kong, all of which become accessible for the first time to mainland investors through the HK Connect mechanism.

- The mainland exchanges are also evolving. In 2019, Shanghai's tech-focused STAR Market (Shanghai Stock Exchange Science and Technology Innovation Board) was launched, modelled on New York's Nasdaq. Meanwhile, the composition of the historic Shanghai and Shenzhen bourses has changed to reflect higher quality private sector listings, including such behemoths as Jiangsu Hengrui and Ping An Insurance.

With these massive changes in accessibility (and relatively pedestrian real estate prices), we anticipate a tidal wave shift in asset allocation towards equities, analogous to what we witnessed in the US in the 1980-90s when mutual funds democratised equity investing.

And remember China has the largest savings pool in the world.

An observation

Markets have become enormously concentrated over the past twelve months.

This is an anomaly we worry about.

While much is bantered around the phenomenal rise of US tech giants’ capitalisation and high valuations in pockets of emerging new technology companies, we see parallels in the EM landscape.

There is a clutch of companies, which have heralded enormous attention and large amounts of investment dollars that we believe are structurally overvalued.

These are often labelled with analogues (MercadoLibre, “the Amazon of Latin America”; Sea Group, “the Tencent of Southeast Asia”).

While we are envious at having missed these early on, we would caution that lofty valuations and an uncertain path to profitably may result in losses as the long-term gravitational pull of fundamentals develops.

Avoiding these, and other potential landmines requires an active manager that is focused on identifying high quality companies with strong competitive positions, balance sheets, cash flows and other factors that will allow them to thrive in the post-Covid-19 world.

We believe the challenging US and global circumstance make a very strong case for EM equities that offer a large investment opportunity set and several extraordinary companies with many real options that will manifest over time.

The EM flywheel effect along with the positive developments around Chinese equities certainly bode well for the EM equity asset class, which we believe will be among the most attractive investment opportunities over the next decade.

As of June 30, 2020, the Invesco Emerging Markets Strategy held positions in the following companies: Meituan Dianping, Innovent Biologics, Wuxi Biologics, Alibaba, Jiangsu Hengrui, Tencent and Ping An Insurance.

Footnotes

¹ Source: Brookings “Policy 2020: How worried should you be about the federal deficit and debt?” July 2020.

² Source: World Bank data, as at 31 July 2020.

³ Source: Reuters, “Exclusive: Alibaba's Ant plans Hong Kong IPO, targets valuation over US$200 billion” July 20

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. As a large portion of the strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the strategy. The strategy may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of a portfolio. The Manager, however, will ensure that the use of derivatives does not materially alter the overall risk profile of the strategy.

Past performance is not a guide to future returns.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.