2021: Growth and its implications for emerging market debt

Global macro conditions and a shift in central bank frameworks are setting the stage for a possible sustained outperformance of emerging markets (EM) assets over the next three to five years in our view. Global growth is likely to be higher in the coming years, aided by significant fiscal policy response from across the globe.

The changing policy framework at the US Federal Reserve (Fed) should also ensure that financial conditions in the US remain favourable for a self-sustaining EM cycle.

We believe that US versus non-US growth differentials will matter less for aggregate EM performance as the market will not reprice the Fed’s path with growth.

This is the most significant change for the ensuing cycle when compared to both the 2013 taper tantrum and the 2018 tax and budget deal. In the current environment, we expect that improving global growth, whether coming from developed markets or EM, will all be a net positive for EM assets and flows. While the primary change is in the Fed’s framework, policies from all major DM central banks will remain favourable for the foreseeable future.

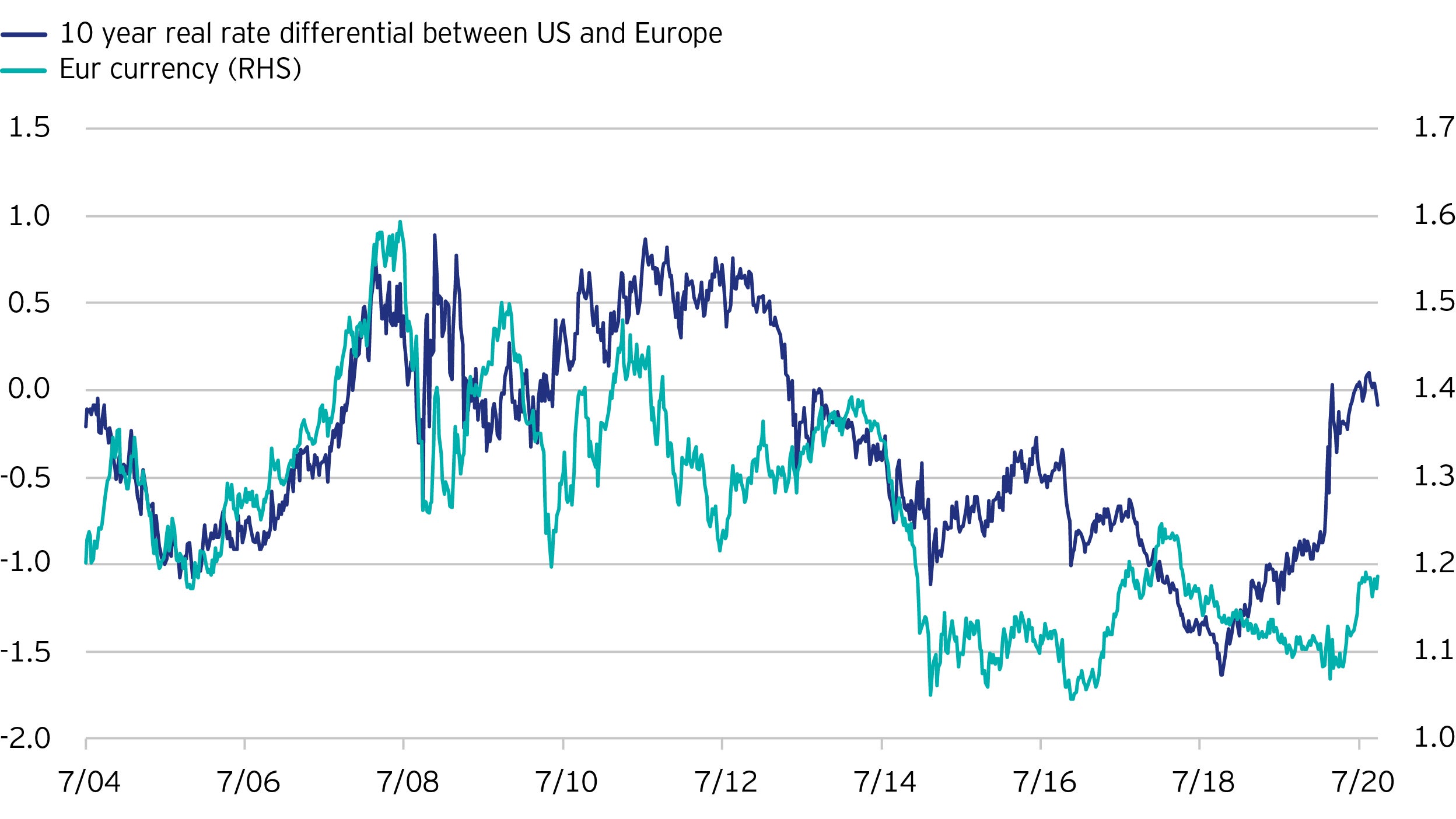

Real rate differentials will trigger USD weakness

In an environment where short- and medium-term nominal US interest rates cannot rise to reprice the Fed’s path, the likely outcome is for the US dollar to weaken. Without the ability to reprice nominal rates, it is likely that real rates could fall to accommodate increasing inflation expectations which would take US real rates further into negative territory. In such an environment, growth differentials between US, Europe, China and other EMs should matter less for aggregate EM performance but still matter significantly for relative EM performance and alpha generation.

Figure 1 shows the real interest rate differential versus Europe and its correlation to the level of the Euro. The real interest rate differential is currently hovering around zero and with growth we would expect that US real rates will be lower than European real rates, creating the conditions for broad based US dollar weakness. A similar dynamic exists vis-à-vis Japan. With broad based US dollar weakness, we would expect EM currencies to first stabilise and then appreciate.

US dollar weakness could trigger a virtuous circle in EM

The weakening of the US dollar has two beneficial impacts on EM assets.

1. It becomes materially easier to finance EM deficits, both fiscal and external.

2. It improves the balance sheet for those countries with negative net international investment positions.

EM countries in aggregate have been improving the management of their external liabilities (as seen by a narrowing in current account deficits), requiring less of the needed capital inflow to be unhedged. In our view, a stable to weaker US dollar will create a positive feedback loop where the embedded foreign exchange (FX) premia should not need to rise as economic activity picks up.

These global conditions when combined with attractive valuations in most EM countries create the conditions for cyclical outperformance in our opinion.

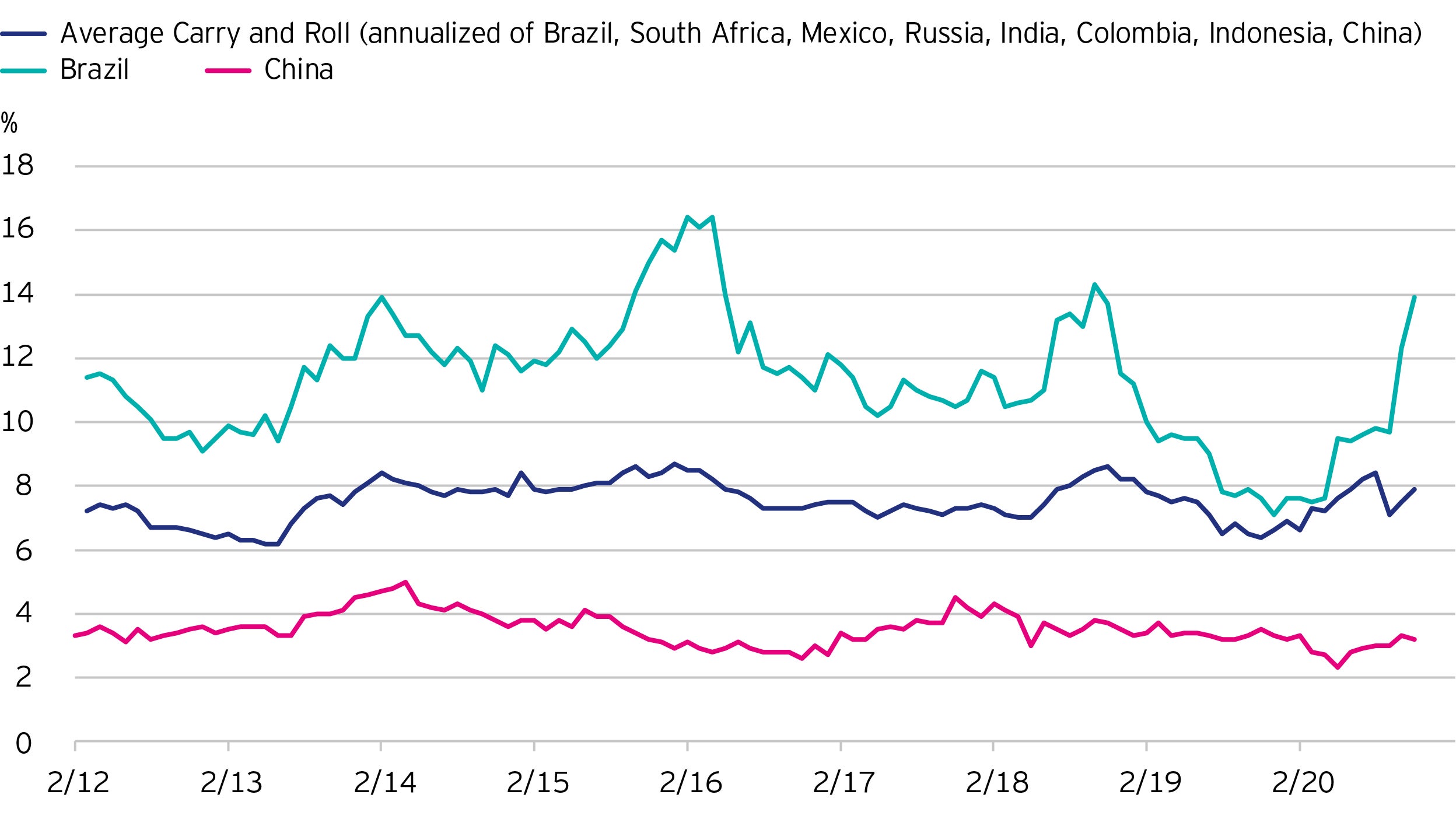

Attractive yield curves to support total return opportunities

Yield curves in most emerging countries have steepened materially as interest rates have been cut as central banks took advantage of the monetary policy room that opened with the Fed reducing rates to zero. The following graph shows the term premia in select countries.

As a result, the expected static return comprising of carry and roll has not declined much in most countries, if at all, including both higher and lower yielding emerging countries. The static expected rate of return has stayed near or above pre-Covid levels in several places.

FX hedged duration is attractive

Given the well-behaved external accounts of most emerging countries, the FX premia embedded in EM currencies has fallen in recent years. The need for unhedged capital flows has declined as current account deficits have generally been under control, even in countries that have historically had savings deficits. The counter side to the lower FX premia is that the cost of hedging EM bonds for those investors who do not want to take the FX risk due to high capital requirements or volatility, has declined significantly.

For the first time the term premia in EM assets is more than compensating for the cost of hedging FX, making it an attractive asset class to own, in our view.

The FX premia is now at a decade low. However, in a global environment where interest rates in the developed market are close to zero and likely to remain at these levels, even this lower FX premia is still quite substantial at 2% annualised. Given the high static expected rate of return in many countries, for investors who prefer little or no FX risk, the hedged return is likely to be an attractive alternative to developed market rates.

Conclusion

Improving global growth conditions and a weaker US dollar increases the attractiveness of this asset class, especially for investors in developed markets who are facing a decade of close to zero nominal returns. While most EM boats will be lifted, the dispersion in returns is likely to be significant. The alpha component, in our view, should provide even more of an opportunity than the passive, but solid, beta expectation.