The announcement on Monday 9 November that an effective vaccine for COVID-19 could be imminent drove a recovery in some of the so called ‘Value sectors’ in the market.

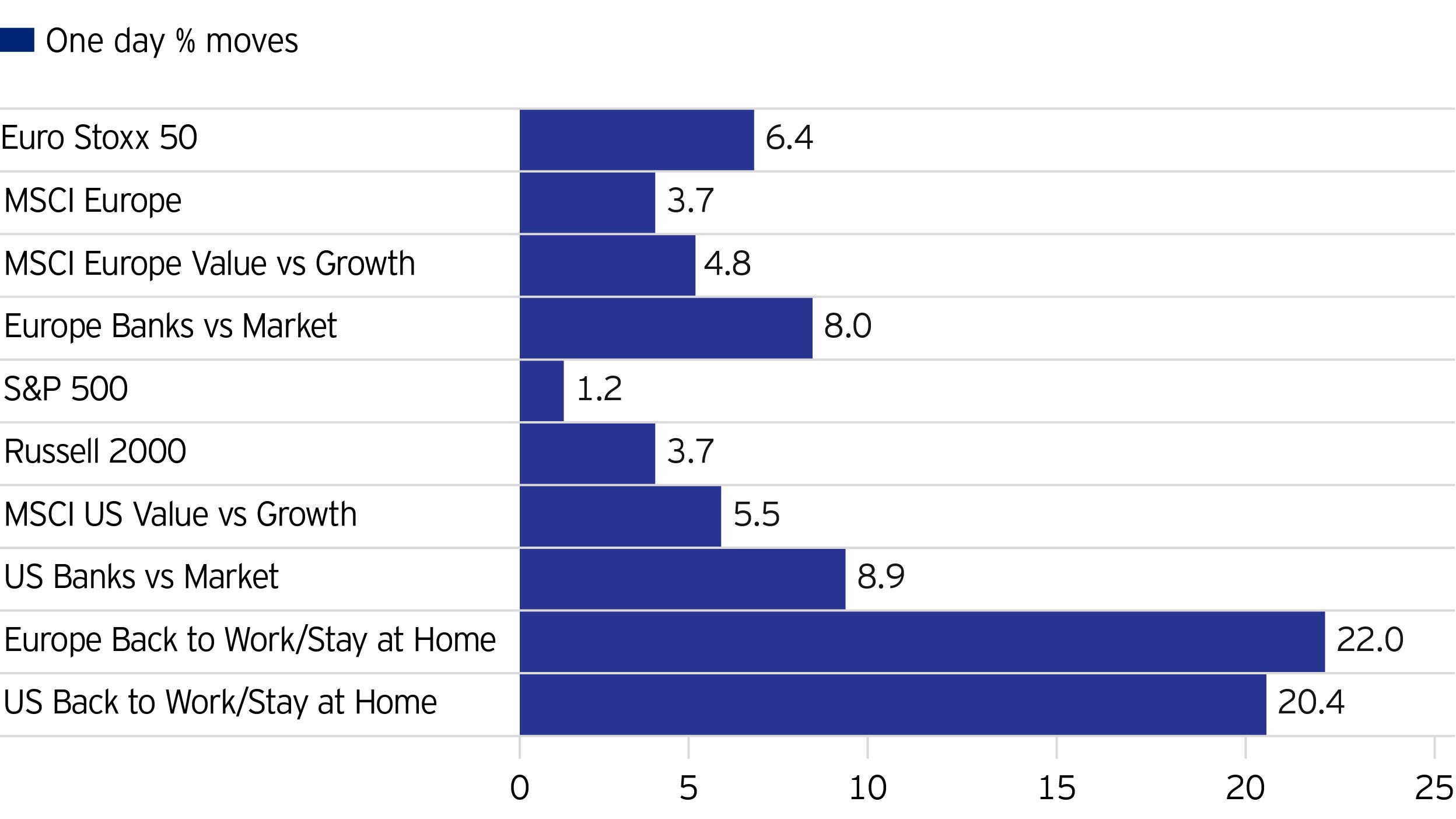

In fact, it was one of the biggest rotations we have ever witnessed. The key question now is, can this be sustained? To our mind, there are 3 strong drivers why it can:

1.

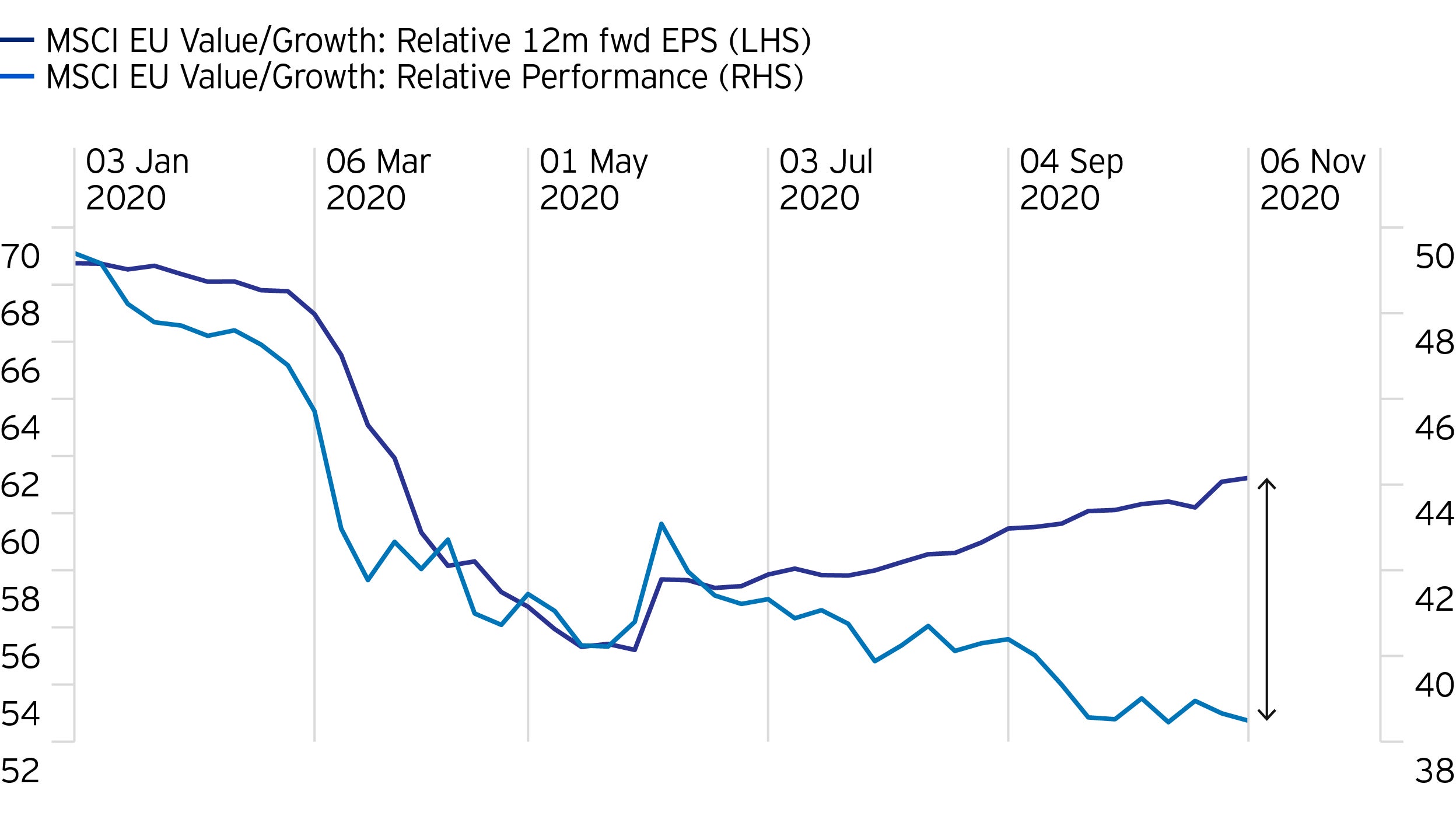

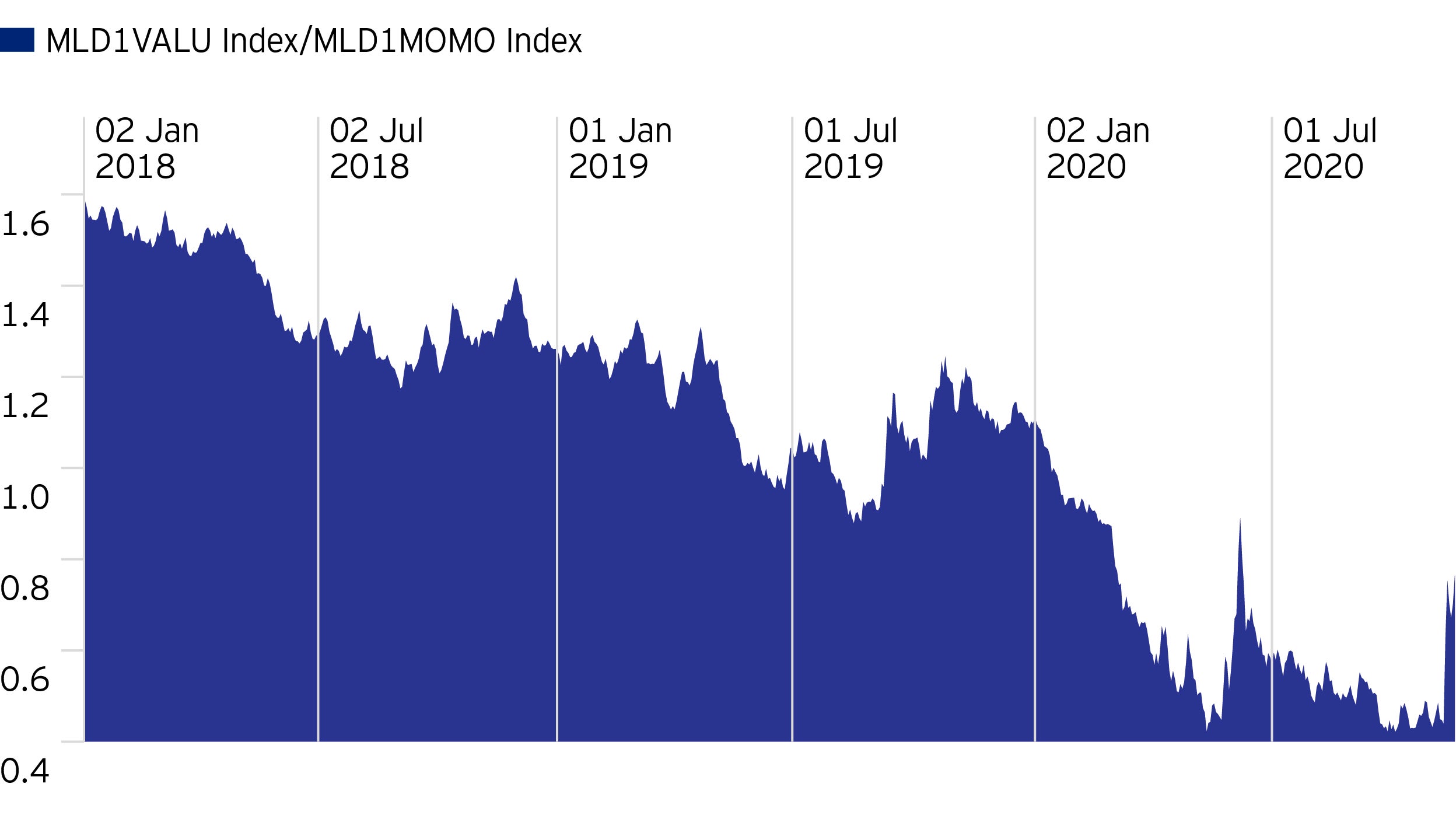

As equity investors, we expect earnings to lead share prices. What has struck us as peculiar this year is the stubbornness of outperformance of ‘Growth’ vs ‘Value’. There is growing evidence that things for ‘Value’ stocks are not anywhere near as bad as they might seem, particularly on a relative basis where we have seen a more encouraging picture on the earnings outlook. Anecdotally, coming out of 3Q earnings season, we have continued to see reassuring signs of economic momentum, particularly in sectors like Autos. From here, we could argue that the earnings outlook for ‘Value’ sectors has taken a significant movement higher once again. In the short-term, despite the fears, it is unlikely that this second lockdown will have the same economic implications. Firstly, because lockdown measures are not as draconian.