The importance of stringent risk management

Dr. Martin Kolrep Senior Portfolio Manager, Invesco Quantitative Strategies and Erhard Radatz Portfolio Manager, Invesco Quantitative Strategies

Invesco’s Global Balanced Solutions Strategy (GBS) successfully navigated the recent Corona crisis market sell-off, adhering to the risk limits set by our clients. Three salient features of the investment process contributed to this favourable outcome. First, a systematic process to adjust asset allocation to clients’ risk budgets. Second, a state-of-the-art risk forecast which allows for a quick reaction to changing market environments. And third, a focus on investing in liquid asset classes.

Market recap: The Corona crisis sell-off

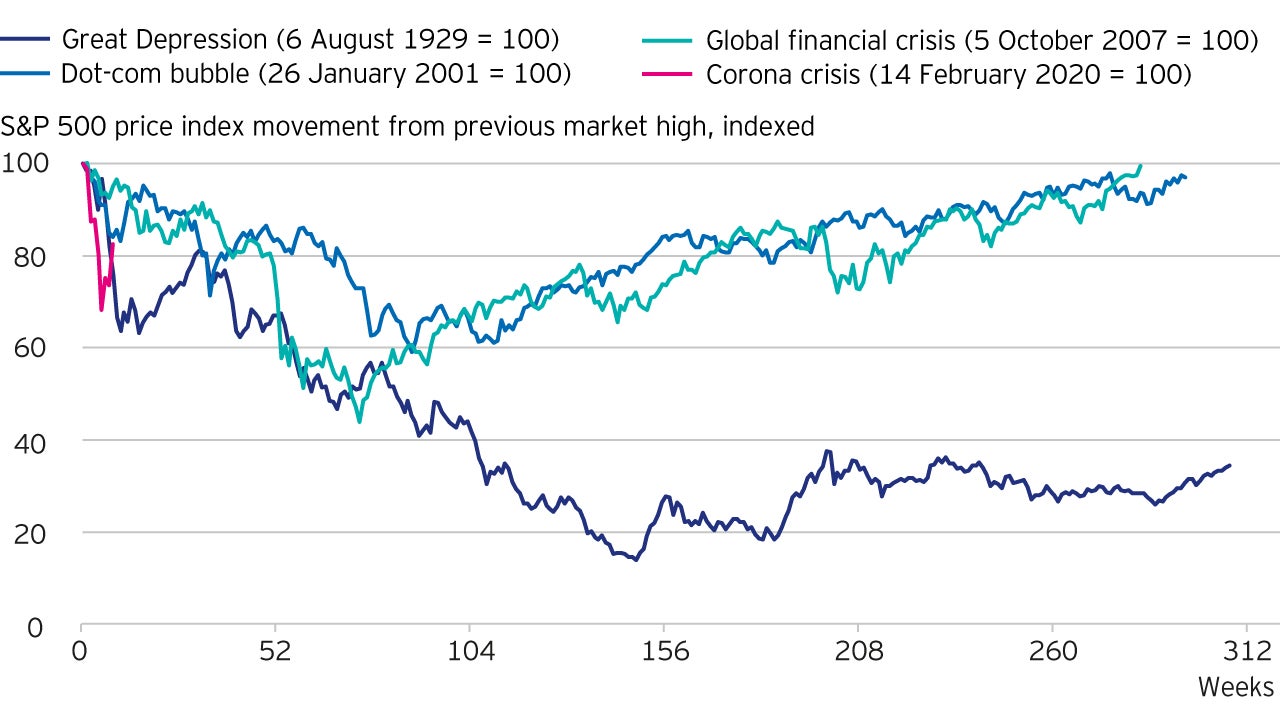

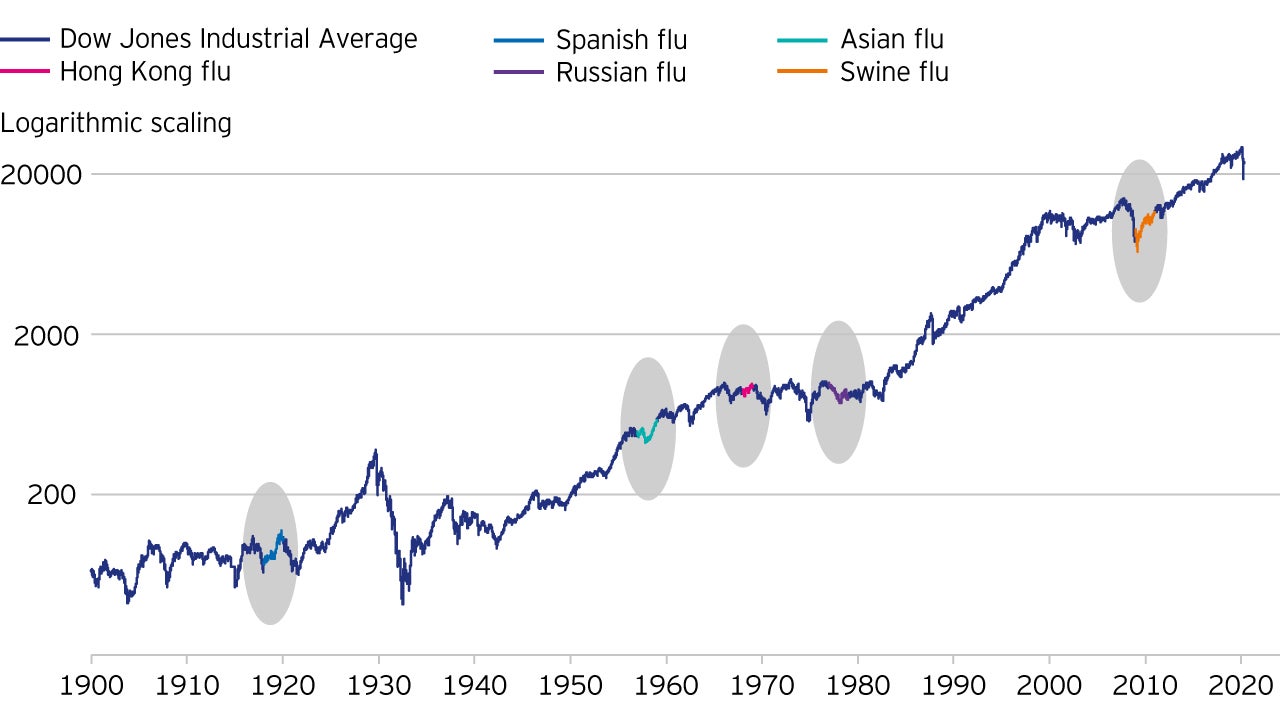

Any crisis in financial markets has both idiosyncratic, individual characteristics as well as ones that were seen in prior crises. One idiosyncratic feature of the Corona crisis was that it was the first global crisis driven by a pandemic. It also saw the sharpest fall in the US stock market exceeding the 1929 US stock market crash (see figure 1).

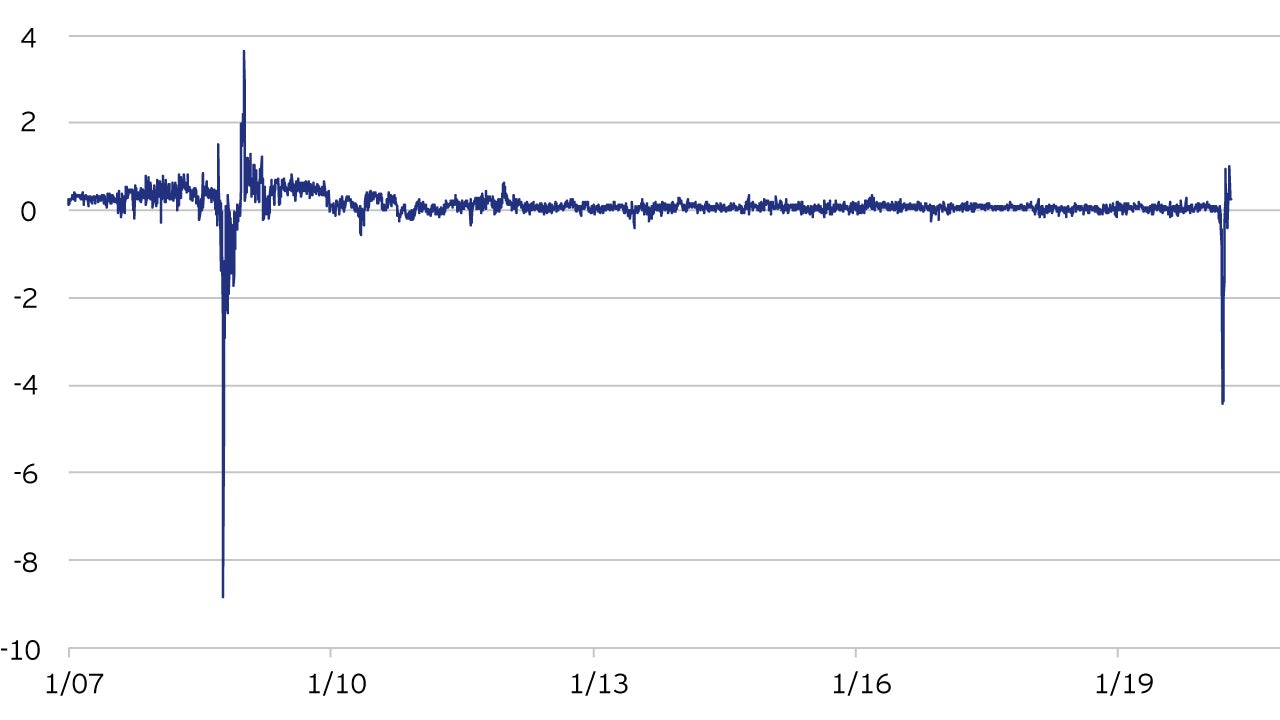

Yet the corona crisis was similar to previous market routs in other respects. Former correlation patterns between financial assets collapsed as shown in figure 2; and liquidity suddenly dried up in certain asset classes. For example, as shown in figure 3, a large discount opened up between the 5 most liquid US listed ETFs containing credit exposure, which are highly liquid and easy to sell in a crisis, and the underlying corresponding market index (the constituent securities of which are relatively illiquid). This illiquidity was also evident in ‘high carry’ markets such as emerging market corporate bonds; and a range of currencies, including the Norwegian krone and New Zealand dollar.

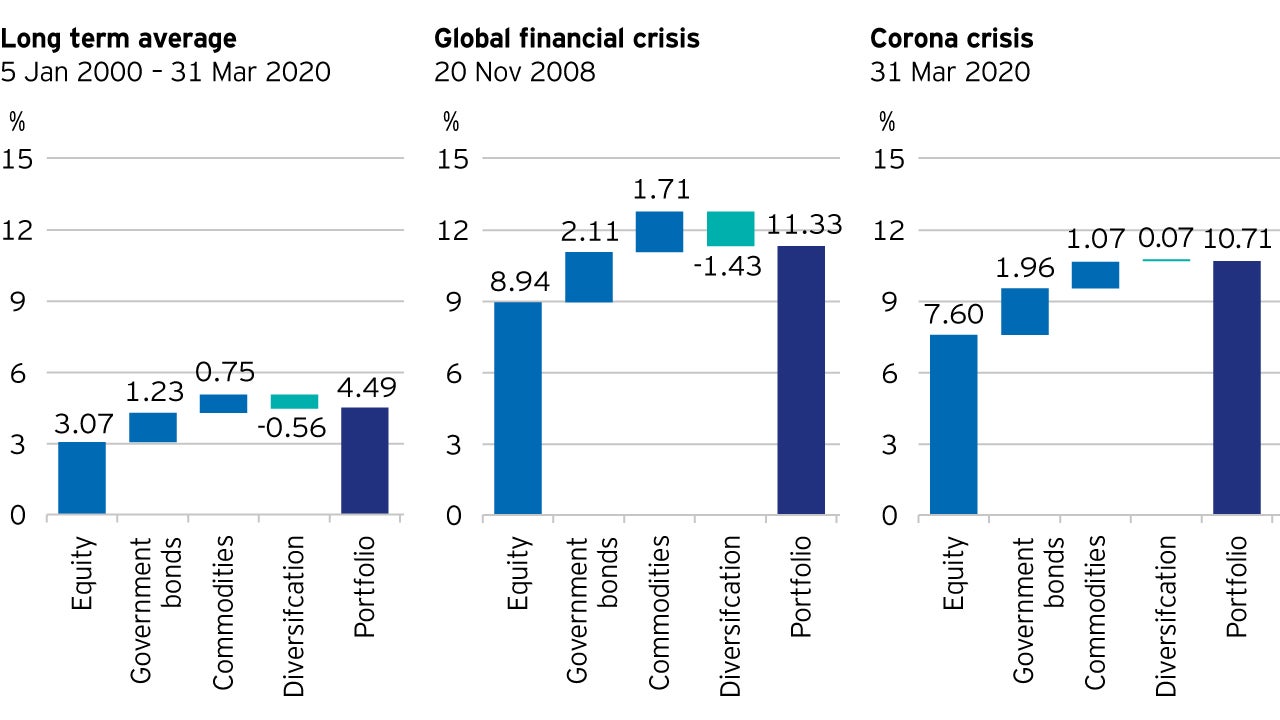

Multi asset strategies and diversification

Given that diversification across asset classes was missing when it was needed most, the Corona crisis was a challenging time for many multi-asset investors. At IQS (Invesco Quantitative Strategies team), we have been (and continue to be) firm believers in diversification, yet the investment process should be able to deal with situations in which asset class diversification fails.

To this end, IQS follows a systematic investment approach. At its heart, the strategic asset allocation is set to harvest a diversified set of asset class risk premia over the medium to long-term. Using a proprietary simulation tool, we review annually the interplay of asset allocation and the risk overlay. In 2019, such analysis lead to a reduction in the allocation to equities, industrial metals and energy commodities. This was not because we had a crystal ball in which we could accurately foresee market developments. Rather, it was because the simulated portfolio return distributions prompted us to target low risk in the context of our risk budgeting framework.

Additionally, recognizing the time-varying nature of asset class risk premia, the GBS strategies have two additional lines of defence. First, a tactical model (based on fundamental and technical indicators) is used to gauge the deviation from strategic asset allocations. Second, a risk overlay, which dynamically adjusts investment exposure based on pure risk considerations, is employed.

In the context of the current sell-off, the tactical model signals were mixed. For equities, the tactical model suggested an overweight position at the beginning of the crisis given that some of the indicators used were relatively slow in capturing what was a very fast-paced sell-off. The art of parametrizing such indicators resides in capturing meaningful signals whilst suppressing any form of noise. As financial markets exhibit a low signal to noise ratio, the endeavour is an intricate one. As for fixed income and commodity exposure, signals were more accurate. In particular, the signalled being short during the massive oil price decrease.

Therefore, the combination of strategic and tactical allocation was particularly exposed to equity risk as the crisis developed. As a result, portfolio risk estimates quickly spiked after the onset of the equity market sell-off. Consequently, the third line of defence, the risk overlay, took charge and led to a swift reduction of investment exposures. For the risk overlay to take such prompt action, it is important to use a risk model that pays justice to the salient characteristics of international financial markets: in particular, the time-varying nature of volatility and the interdependencies of major asset classes. Our tried and tested Copula-GARCH model, which shows the one-day expected shortfall (with 99% confidence) from various asset classes, quickly caught the spike in tail risk (see figure 4).

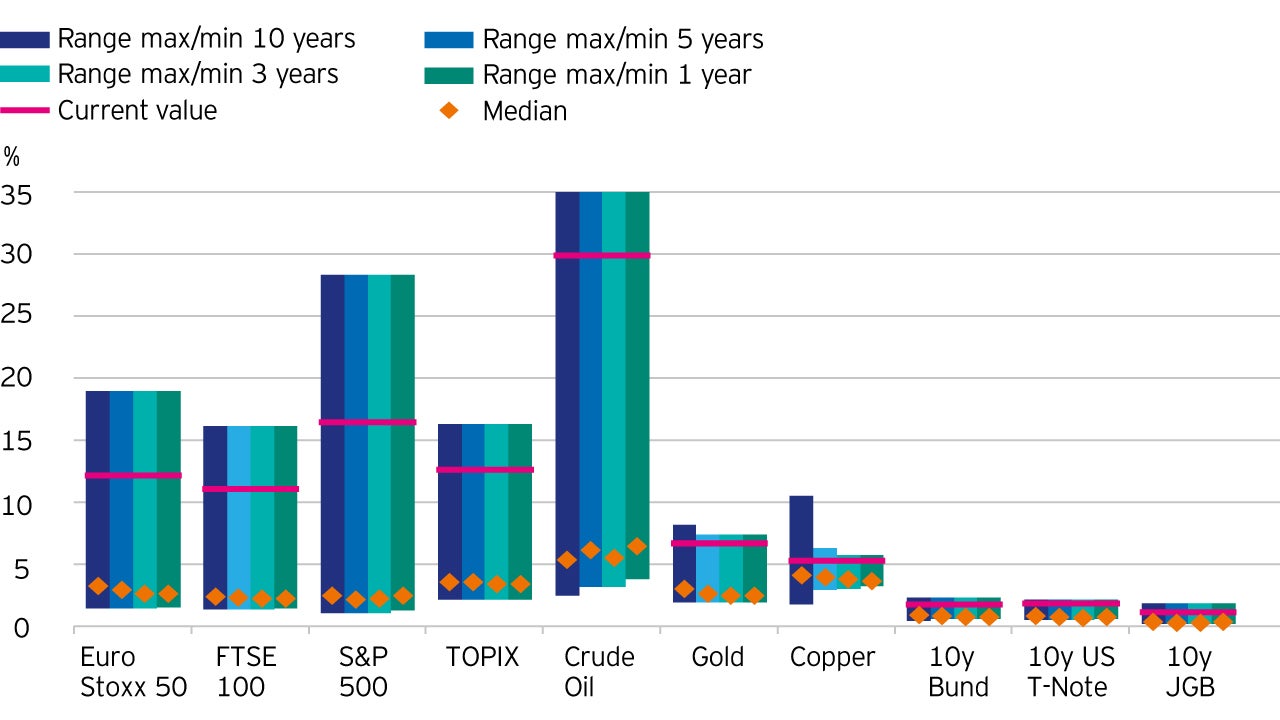

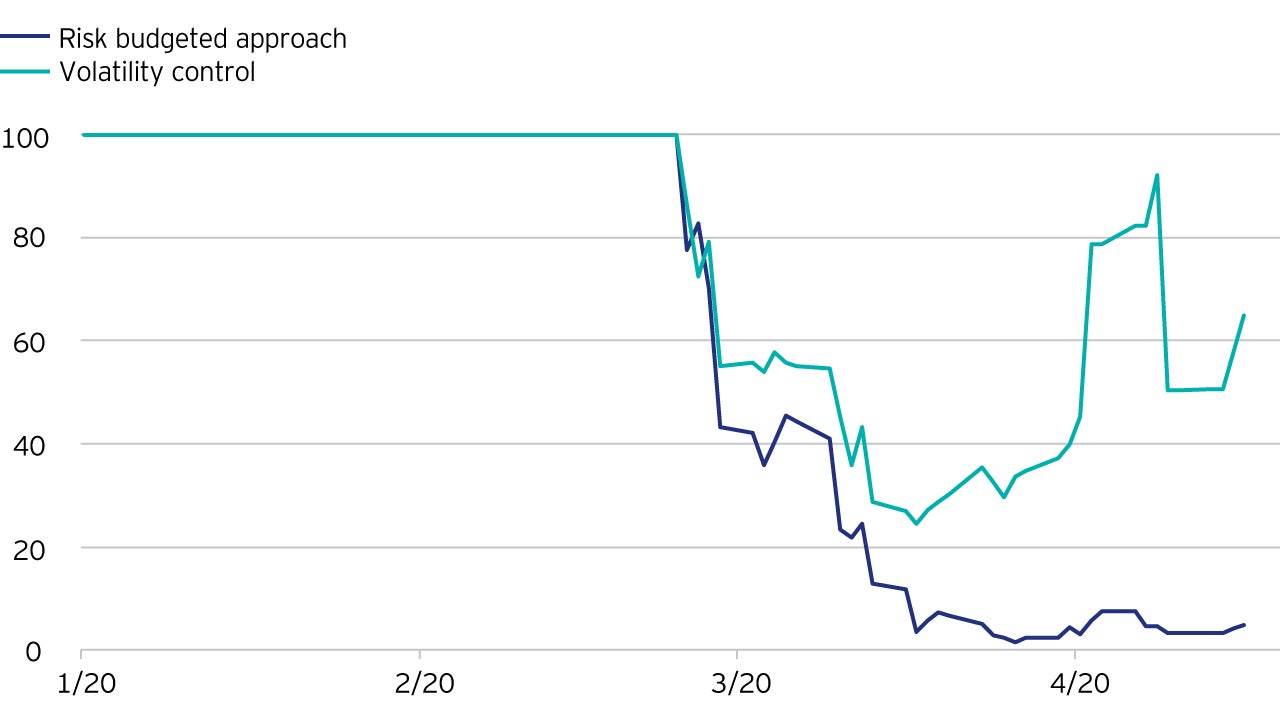

Based on this elevated risk, GBS mandates swiftly reduced investment exposure across all asset classes (see figure 5), moving these to a conservative standpoint. This risk reduction happened irrespective of the risk management framework employed. Volatility overlays as well as risk budgeting concepts have massively reduced their risky asset exposure, adhering to the pre-defined risk levels.

Where do we go from here?

Currently, most of our balanced mandates are in risk minimal positions consisting of a hedged equity and duration sleeve and a wide range of cash exposure, being actively managed to avoid an undue level of counterparty risk. Until market volatility calms down, we would not consider aggressively return to the capital market , resonating with the empirical finding that risk-adjusted returns are low during phases of high volatility. Furthermore, all risk budgeted concepts are long volatility – the convexity costs associated with this positioning are high during those nervous markets. Put differently: a premature release of additional risk budget might lead to its quick consumption given that high market volatility might lead to a fast approach of the floor. Nevertheless, it is advisable to be invested in the capital markets for the long-term, as the markets have historically always recovered from the type of sharp losses we have recently seen (see figure 6).

An interesting option for a conservative entry strategy might by a stepwise released volatility cap to benefit from the cost-averaging effect and reduce the dependency on the timing decision.

Please reach out to Invesco Quantitative Strategies’ Multi-Asset team for assistance and further analysis on timely market entry strategies.

Appendix

The Copula-GARCH framework: Invesco’s proprietary Copula-GARCH model helped to reduce risks at a fast pace enabling us to adhere to our clients’ risk budgets. It is not based on a normal distribution, but on a Student-t distribution which provides a more accurate way of modelling tail risk. The GARCH component allows the model to capture the notion that volatility tends to be clustered at certain times. As the probability of losses increases sharply during more volatile market phases, Invesco uses short-term volatility estimates which take into account such market considerations.

Rather than modelling the dependence structure of assets through simple linear correlations we estimate Copulas, which we think describe interrelationships better, particularly in tail events.

Choice of the risk management approach: Defending clients’ risk budgets is the number one priority in our fiduciary duties. Every stringent risk management naturally brings opportunity costs, especially if short-term volatility measures rise and do not materialize in severe market drawdowns. Furthermore, the necessity for liquidity limits the variety of asset classes especially within the Fixed Income space. Invesco invites investors to re-think their risk budgeting: is it a necessity to stick to the risk budget as the first priority? If yes, a hard threshold is certainly the right approach, if not, a volatility overlay parametrized using e.g. Invesco’s simulation engine might be more appropriate. This allows to set certain draw-down limits with a pre-defined probability and could also serve as an interesting market re-entry strategy.