The returns of a decade past, and other Dickensian lessons

As investors, we need to learn from the past, take note of the present, and watch out for what the future has in store. A bit like Scrooge.

Our Investment Solutions Team provides a clear line of sight into investor portfolios, uncovering potential blind spots. The team offers expert investment insight, advanced analytics, and strong advisory partnerships.

‘I will live in the Past, the Present, and the Future. The Spirits of all Three shall strive within me. I will not shut out the lessons that they teach’ – Charles Dickens, A Christmas Carol

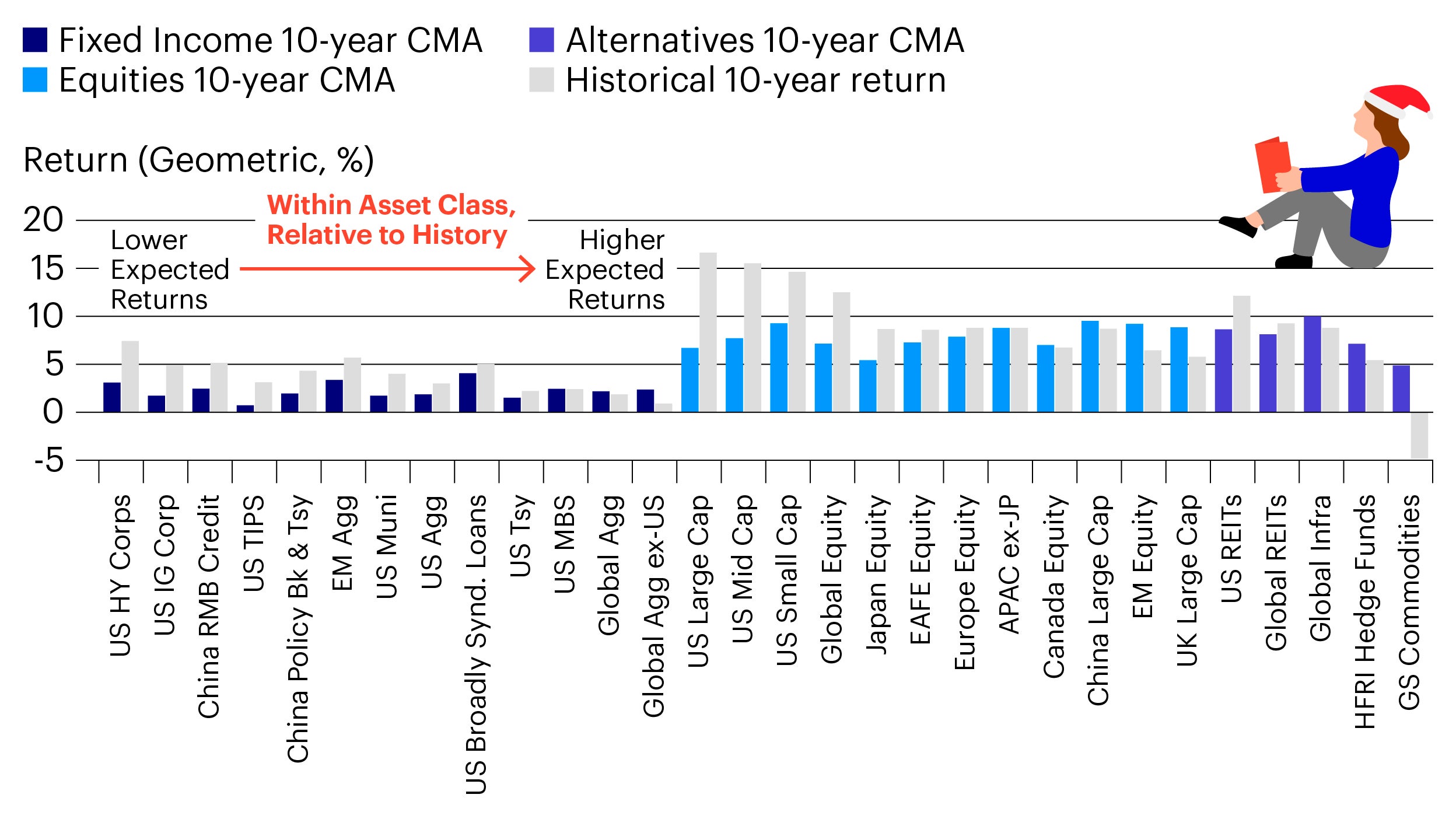

Source: Invesco as at 30 September 2021. Expectations relative to historical average (EUR). Proxies listed in the footnotes section. The estimates are forward-looking and are not guarantees. They involve risks, uncertainties and assumptions. Please see the footnotes section for information about our CMA methodology. These estimates reflect the views of Invesco Investment Solutions. The views of other investment teams at Invesco may differ from those presented here.

This is the economy of Christmas present

Many of the risks that existed before the pandemic are still relevant today:

- Elevated valuations in developed economies will likely detract from prices.

- Some of the largest bubbles exist outside of equities, in the fixed income market. These centre on duration and inflation risk.

- Rates are low and rising, with spreads on most credit assets back to pre-pandemic tights.

These are our views for Christmases yet to come

Over the next decade, we believe non-US equities (particularly those in emerging markets) and diversifying alternatives (like infrastructure and commodities) will perform well.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.