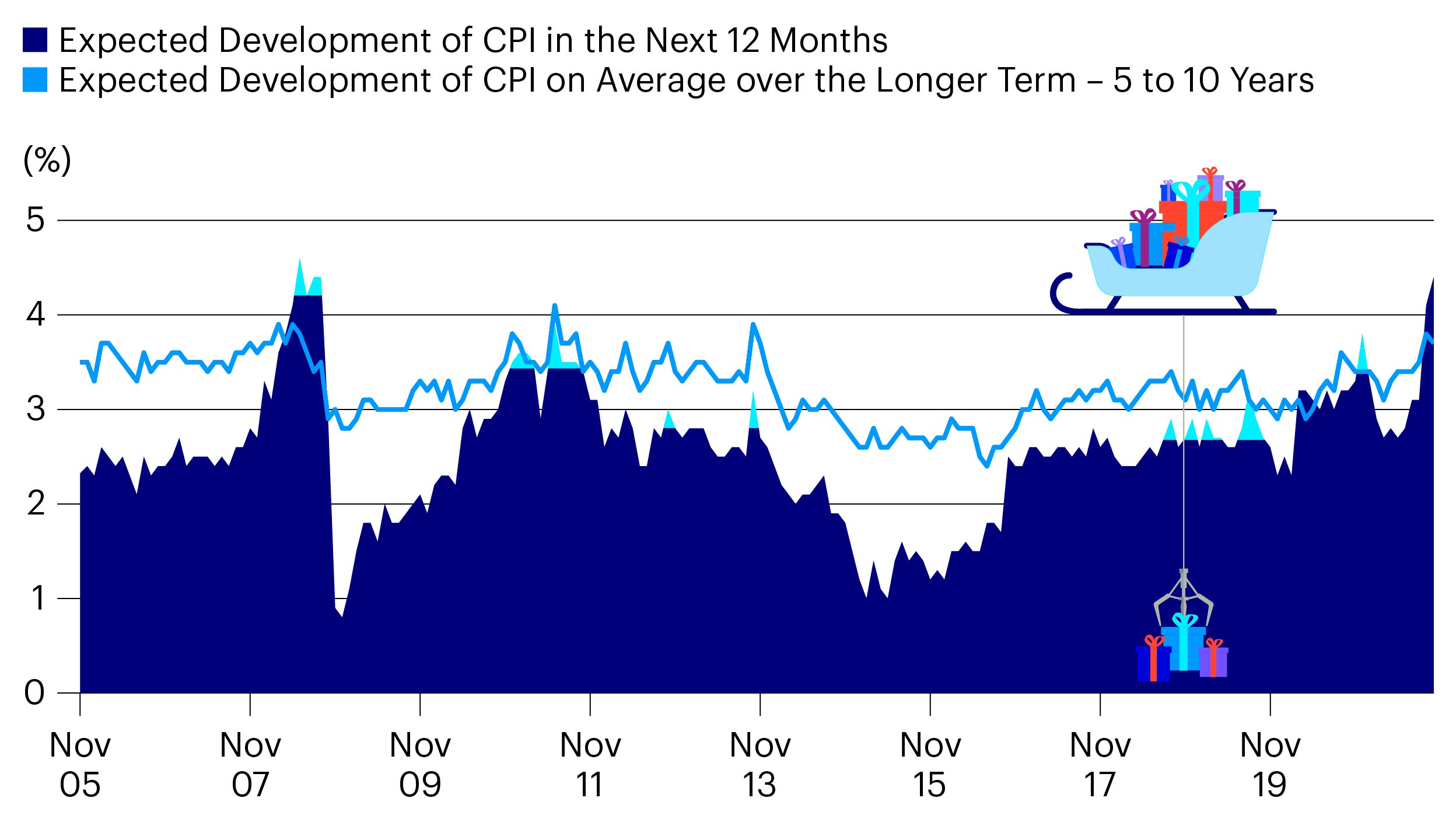

On the first day of Christmas, my true love said to me… this inflation’s not transitory

The UK has experienced a sharp increase in the headline inflation rate this year.

Government bond yields have risen somewhat as this data has come through, but there is potential for yields to rise further if a higher level of inflation persists. As well as depressing gilt prices, this would put upward pressure on other yields.

Government bond markets may be able to adjust slowly to higher inflation without too much disruption (the Goldilocks scenario), but we know that markets don’t always evolve so smoothly.

We believe there is the prospect of a sharper upward move in yields that could easily unsettle credit and equity markets.

While none of this is set in stone, the risk is clearly there. Yields in all fixed income markets are still very low and, against this backdrop, it feels as though a defensive and patient approach is prudent.

In our portfolios, we are defensive in duration and credit.

Source: YouGov and Citi inflation survey, 1 Oct 2021.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.