Aldi’s business model is simple; smaller stores, fewer staff and lower costs. Unlike their rivals they have pushed back against home delivery and click and collect – despite its increasing popularity. Then came the pandemic. Everything changed. Last month, Aldi finally caved in and offered customers the option to shop for groceries online. The moral of the story is simple: when a company or institution – that has typically resisted an idea – finally succumbs to pressure, it’s a sign that a new structural trend is firmly underway.

Similar structural trends are happening in macroeconomics. In this case, however, Aldi is the International Monetary Fund and online grocery shopping is fiscal policy. For a long time, the fund has been regarded as the bastion of fiscal conservatism. If we take the great financial crisis, for example; after the collapse of Lehman Brothers, the fund welcomed (the then) president Obama’s stimulus but warned that the costs of the “financial crisis—while sizable—are dwarfed by the impending increases in government spending on social security and health care.” Similar thought processes were going on in national treasuries too. Policymakers generally believed that the role of fiscal policy should be limited to ‘automatic stabilisers’ – in other words the loosening of fiscal policy caused by higher benefit spending and lower taxes. The bulk of stimulus, it was thought, should be provided by monetary policy.

Fast forward to today and the thinking has changed immeasurably. At their October World Economic Outlook, the IMF said the priority was to avoid the “premature withdrawal of fiscal policy.” The IMF’s chief economist, Gita Gopinath, went one step further and appealed for more fiscal spending in a Financial Times article. She boldly asserted that “the world is in a global liquidity trap where monetary policy has limited effect” and “it is time for a global synchronised fiscal push to lift up prospects for all.”

Given this large shift in thinking what should investors make of this move to fiscal activism? Albert Einstein famously said, “If you want to know the future, look at the past.” Fortunately, history really does provide a precedent. The good news is such economic thinking (often thought of as Keynesian policy) has been very effective at times. There is no doubt that higher public spending helped drive growth as the world economy rebuilt following the second world war. Moreover, whether it be climate change or transport there is no shortage of productivity-enhancing investment out there. The bad news is twofold; firstly, fiscal policy is controlled by politicians – not economists, and politician’s main objective is re-election – not productivity-enhancing investment. Secondly, although fiscal policy can be useful to get an economy out of a slump, politicians will also find it difficult to dial down stimulus when the economy has recovered – and it’s no longer needed.

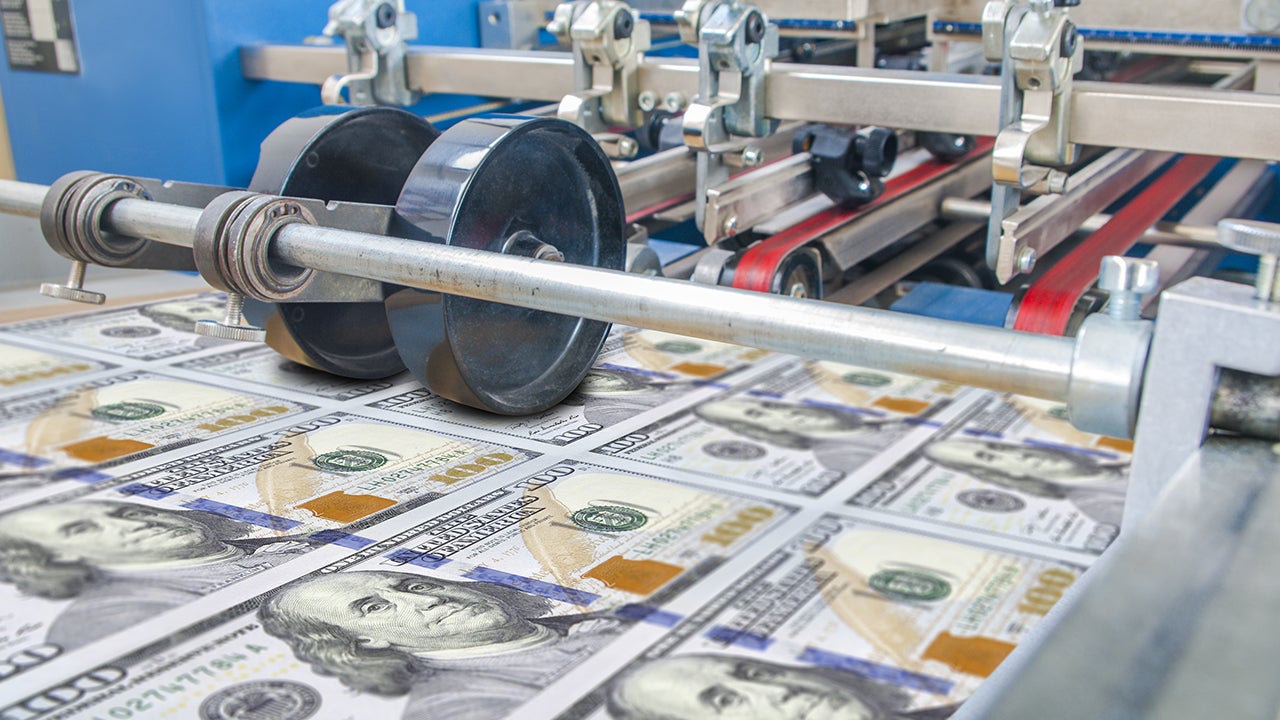

In summary, the short-run benefits of fiscal activism should be positive for growth. Given the unprecedented nature of the shock – and rising unemployment – government’s newly-found appreciation for fiscal activism should be welcomed. Over a longer period, however, risks do increase. Its very possible, for example, that resources are misallocated – and policy is kept too loose for too long. This raises the spectre of inflation. Similarly, if resources are misallocated and debt levels continue to rise government’s may look to finance their deficits through money printing. After all, Keynes did famously say that “in the long run we are all dead!”