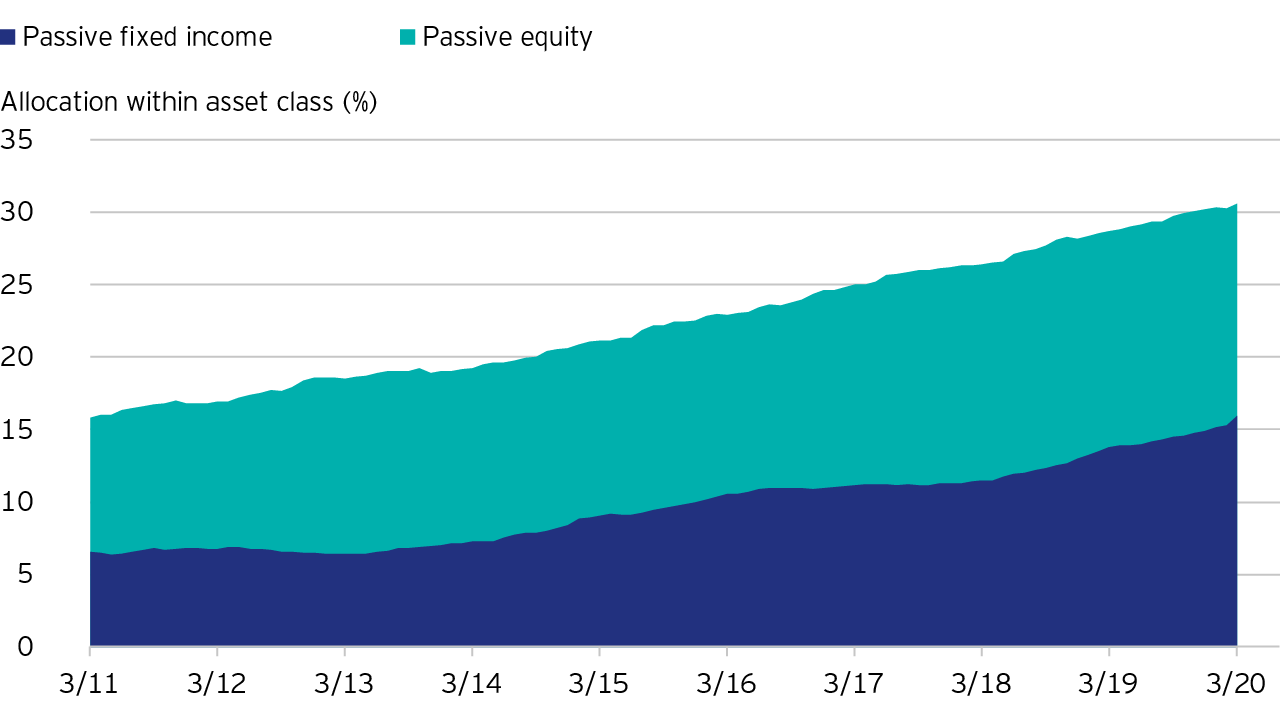

Although most investors now acknowledge the benefits that a passive approach may be able to provide for equity exposure, industry flow data would suggest less conviction in the merits of using passive management in fixed income.

This article will look at the investment environment for fixed income:

Bond yields

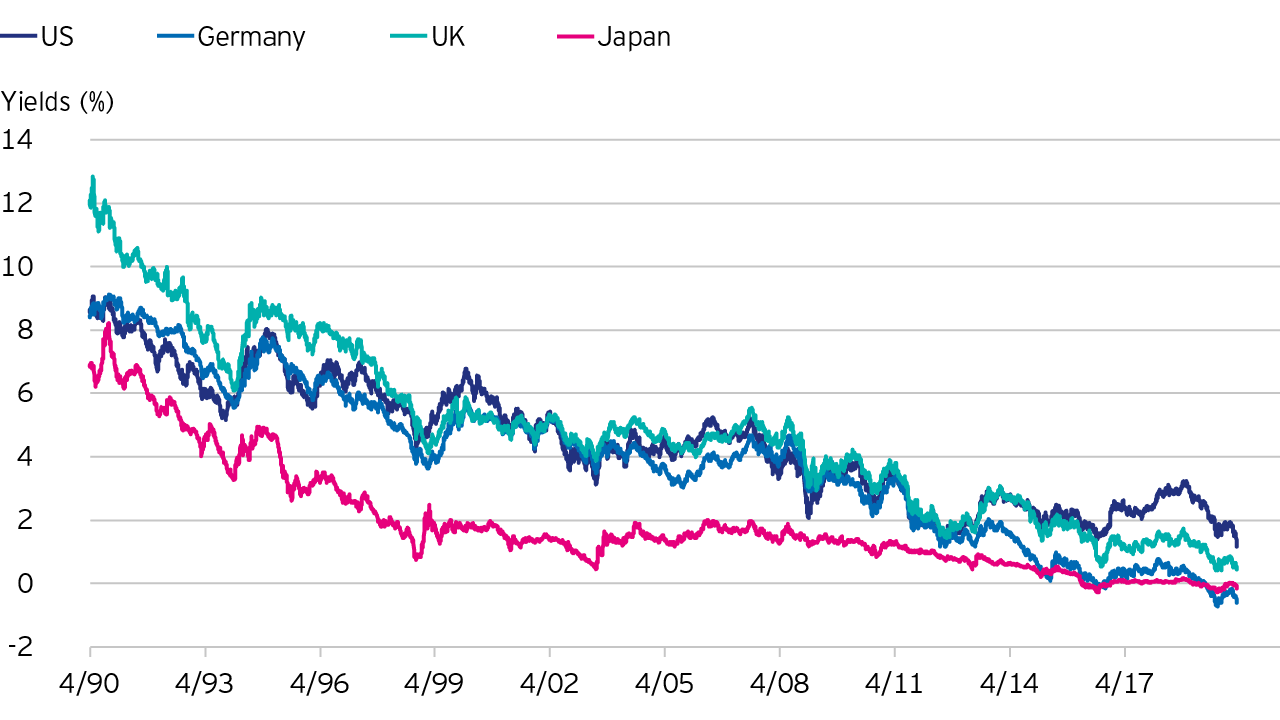

Record low government bond yields means every basis point of additional risk-adjusted performance can make a material difference to portfolio returns

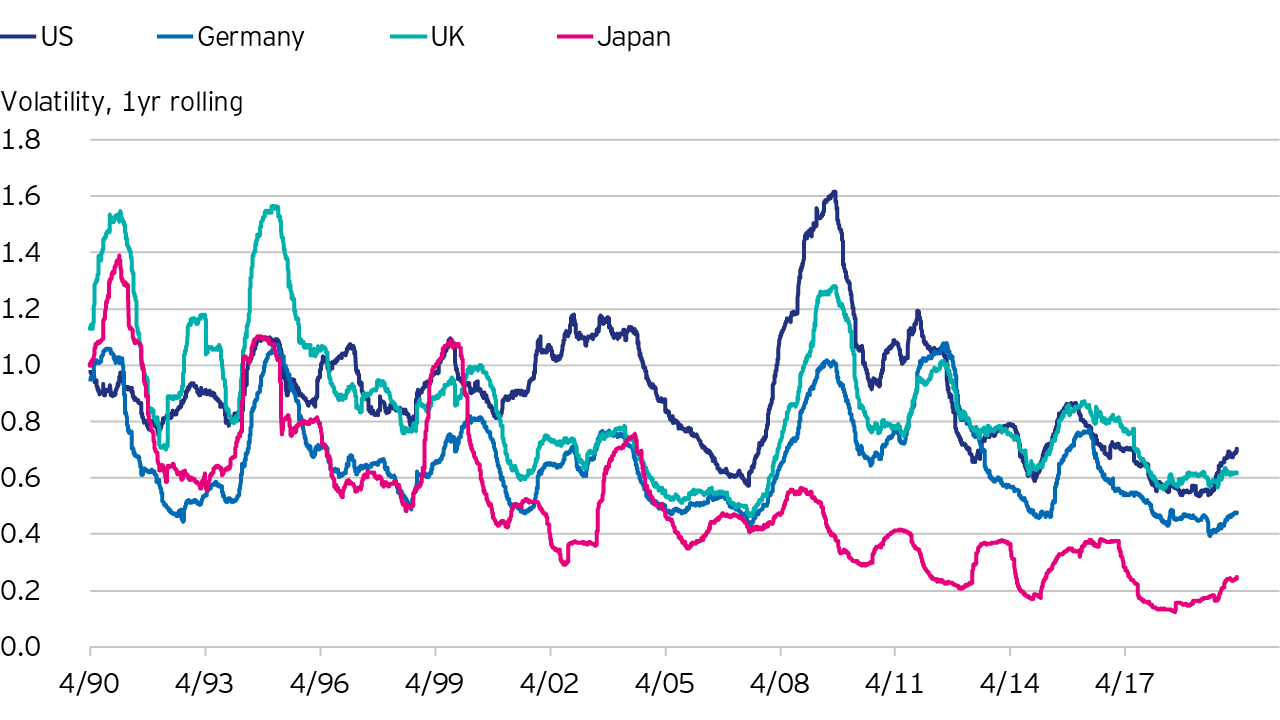

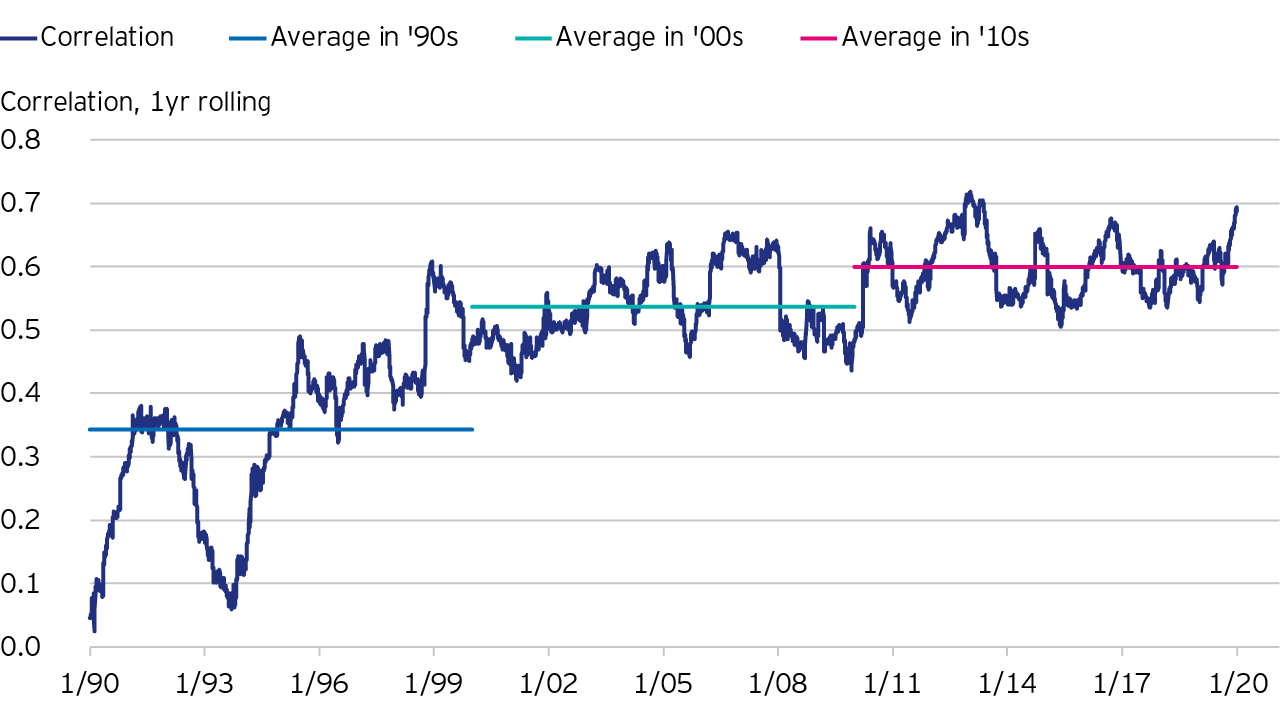

Correlation and volatiliy

The volatility of yields has fallen, and credit and government bonds are now more closely correlated, thereby reducing some of the traditional benefits of diversification.

Passive or active?

In the same way many investors now address equity allocation, the solution in fixed income is rarely between just active or passive but knowing when to use each one.

Established in equities; not yet in fixed income

Although most investors now acknowledge the benefits that a passive approach may be able to provide for equity exposure, industry flow data would suggest less conviction in the merits of using passive management in fixed income.

Arguments are generally around the size and complexity of bond benchmarks. Ongoing issuance and redemptions mean benchmarks are constantly changing, resulting in high turnover, and the over-the-counter nature of bond trading can lead to higher transaction costs than for equities.

While some active portfolio managers may have been able to use the continuous changes to benchmarks to help generate alpha, the market environment may have shifted for the benefit of passive ETFs.

Why consider passive management for fixed income

Simplifying the complexity

Any passive ETF, irrespective of the asset class, needs to be able to replicate its reference index. How efficiently it manages this is likely to make a material impact on performance and, as a result, should be one of the main factors to consider when selecting an ETF.

If a fixed income benchmark has a particularly large number of constituents, especially if some of them are small or illiquid, a passive ETF can use the same sampling techniques employed by many passive equity ETFs. This is possibly even more useful in fixed income as it means the portfolio manager is not forced into buying (or selling) every issue whenever there is a creation (or redemption) or when rebalancing. Instead, they can select a smaller basket that represents the profile of the whole index.

Going one step further, the ETF issuer can customise a fixed income index to make it more efficient for the portfolio manager to track, assuming that the modifications either do not materially alter the overall risk profile of the index or enhance desired characteristics. Applying liquidity filters can eliminate very small or otherwise difficult-to-trade issues. Using sampling and/or a customised benchmark should result in lower turnover and lower transaction costs compared to an ETF that tries to fully replicate the broader index.

Of course, the proof is in the eating, and the transparency of the ETF structure enables you to see just how well the ETF tracks the performance of its reference index. With any asset class, there will be some ETFs that deliver better results than others. The same goes for active management, where it has become more difficult to deliver alpha to cover the fees in some segments of the bond market.

Fixed income investing, from alpha to zero

The way in which the global economy and central bank policies have evolved over the last three decades means there may now be a stronger argument for passive management, particularly for broad, liquid fixed income asset classes. The current environment of low volatility in yields and high correlations between bond markets may not be offering the dispersion that would usually be most desirable for an active manager.

Not only have yields fallen, but so too has the volatility of those yields. The chart below shows that, with the exception of periods of economic crisis, yield volatility has declined as central banks have become more transparent and added “forward guidance” as a policy tool. The impact of ongoing zero or negative interest rate policies and quantitative easing is particularly visible for Japanese Government Bonds (JGBs).

In addition to falling volatility, Government bond markets have become more correlated over time. This has become particularly noticeable in the last decade following the global financial crisis, which caused the global economy and central bank policy to become more synchronised. Central banks reacted to the aftermath of the crisis by reducing base rates to record low levels, with some even breaching the zero lower bound for base rates and have tried to spur growth with unconventional quantitative easing policies and forward guidance aimed, amongst other things, at keeping Government bond yields low. The charts below show that correlations have increased from the relatively low levels in the early ‘90s to much higher levels today.

Why is this important?

Lower volatility and higher correlations mean it is much more difficult for an active fund manager to achieve their alpha target, particularly after fees are taken into consideration. The main tools available to an active fixed income manager to generate alpha are:

Duration – interest rate risk that is taken relative to a benchmark and is effectively a directional bet on which way yields will move. However, the current low rate environment, along with QE and forward guidance, makes this a less valuable tool for alpha generation than in the past.

Curve – how a portfolio is positioned along the yield curve. Historically, when base rates were higher, the yield curve tended to pivot in middle maturities (the belly of the curve), as rising base rates would push yields on short-dated bonds higher while being perceived as reducing future inflation, which benefitted longer-dated bonds. More recently, with short yields pegged to base rates, which are unlikely to rise anytime soon, the curve is pivoting at the very front end. This means generating alpha from taking curve risk can now only be achieved in longer-dated maturities.

Relative value – a way of taking a cross-market position that is not directional or curve-related. For example, a portfolio manager could express an interest rate view by selling US Treasuries and buying German Bunds. However, as the global economy has become more synchronised and bond market correlations are elevated, a portfolio manager would have to take a much larger position to create the same amount of alpha as they would have done in the past. While potentially still a valuable tool, larger positions could mean larger underperformance if the decision or timing is wrong.

Consequences for active management

Active portfolio managers typically take active positions relative to a benchmark, with some degree of the portfolio passive as determined by the benchmark constituents. You would expect more opportunities for active positioning when volatility is higher and correlations lower than they are now. In low-volatility, high-correlation markets, an active manager may need to place more on each active position to maintain similar alpha potential or accept the possibility of lower alpha. The question is how much alpha a portfolio manager can generate for a given level of risk.

The choice between active and passive

The choice between active versus passive management for fixed income should be determined by a combination of factors but one of the most important should be whether an active manager can regularly outperform a passive manager after fees. Given how broad fixed income is as an asset class, it is difficult to provide a conclusive answer across the board.

The breadth of the benchmark and the liquidity of the underlying bonds will influence the opportunity an active manager may have for generating alpha. For example, a US Treasury benchmark may have around 250 highly liquid, US dollar-denominated government bonds, which is likely to limit the opportunity set. On average, an actively managed US Treasury fund domiciled in Europe would have to generate 0.75% in alpha just to break even with the average US Treasury ETF.

Contrast that with a global aggregate bond benchmark with nearly 25,000 constituents across 24 currencies and spanning AAA Government bonds through to BBB corporate bonds. Such a broad and diverse universe should present more opportunities for an active manager to generate alpha.

Conclusion

Historically, there have been many arguments favouring active over passive management for fixed income. However, while some of these continue to make sense, in the current low yield, low volatility environment, it may be worth reviewing how much you are paying for your fixed income exposure and if you are getting value for money. Certain fixed income allocations and benchmarks may still lend themselves to being actively managed but for others, it may be more efficient to choose a low-cost, passively managed ETF.

Indeed, using these passive ETFs to reduce risk in your core fixed income allocation may allow a higher risk budget for certain niche, satellite-type allocations that could generate alpha. We will explore this topic more fully in our next article